- HOME

- Accounting Principles

- Introduction to GAAP: Principles and purpose

Introduction to GAAP: Principles and purpose

If you’ve ever wondered why financial statements look so structured and uniform, the reason is GAAP, Generally Accepted Accounting Principles. These are the standard rules and guidelines US companies follow when recording and reporting their financial information. GAAP makes financial statements easier to understand, more reliable, and comparable across businesses and time periods.

This article breaks down GAAP in a simple, practical way: what it is, why it exists, the principles behind it, and how it appears in everyday accounting.

What is GAAP?

GAAP is a recognized framework of accounting standards that ensures companies prepare financial statements using consistent methods and definitions. According to experts, GAAP exists to promote clarity, consistency, and comparabilityin financial reporting. Without GAAP, every business could present its finances differently, making comparisons confusing or misleading.

Although GAAP is used primarily in the United States, the idea of standardized accounting is global. Many other countries follow IFRS (International Financial Reporting Standards), which share similar goals but differ in certain rules.

Who creates GAAP?

GAAP isn’t a loose collection of best practices; it is formally defined and updated by key bodies.

FASB (Financial Accounting Standards Board): The main organization responsible for writing GAAP standards.

SEC (Securities and Exchange Commission): Requires publicly-traded companies to follow GAAP.

GASB: Sets GAAP standards for state and local governments.

Together, these bodies ensure that financial reporting remains transparent and consistent across industries.

What's the purpose of GAAP?

GAAP plays a crucial role in financial reporting for several key reasons.

Builds trust: Investors, lenders, auditors, and regulators rely on GAAP-based statements to judge financial health reliably.

Enables fair comparison: If every business uses the same reporting rules, users can compare results across companies and industries.

Supports better decisions: Consistent revenue and expense recognition helps businesses analyze performance without distortions from inconsistent methods.

Ensures transparency: GAAP requires clear disclosures, helping readers understand how numbers were calculated and what assumptions were made.

10 Core GAAP principles explained

Principle of regularity

Financial reports should follow the official GAAP rules—no shortcuts, no mixing in personal methods.Principle of consistency

Once you choose an accounting method, you stick with it. If you ever change it, you must explain what changed and why.Principle of sincerity

The numbers in financial statements should be honest and reflect what’s really happening in the business—no exaggeration or hiding.Principle of permanence of methods

Keep the way you record and report things the same over time. This helps people compare one period to another easily.Principle of non-compensation

Don’t “net off” amounts to make things look cleaner. Report assets, liabilities, income, and expenses separately so nothing is hidden.Principle of prudence (conservatism)

When you’re unsure, choose the safer option—don’t overstate profits or assets. Record possible losses early, but record gains only when they’re certain.Principle of continuity (going concern)

Assume the business will continue operating. This affects how you value assets and record long-term items.Principle of periodicity

Record financial activities in regular time frames—like months, quarters, or years—so you can track performance consistently.Principle of materiality

Focus on information that actually matters. Small, insignificant amounts don’t need detailed reporting.- Principle of utmost good faith

Be honest and transparent in all financial reporting. Everyone—investors, lenders, auditors—should be able to trust the information.

GAAP vs. IFRS: A comparison

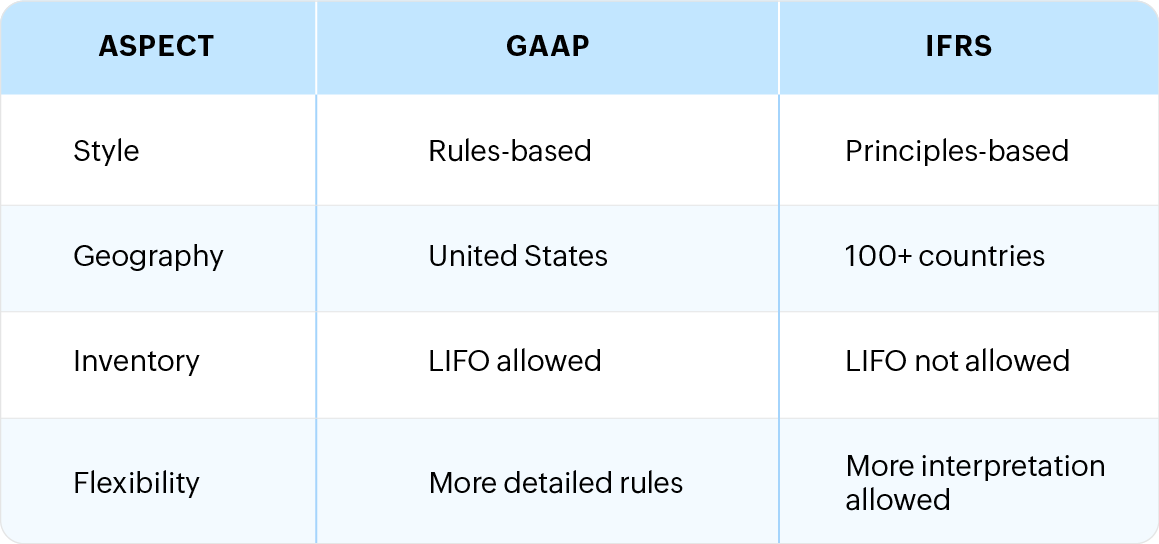

While GAAP is the standard framework used in the United States, most other countries follow International Financial Reporting Standards (IFRS). Both sets of rules aim to create clear, consistent, and comparable financial information, but they take different approaches to achieving it.

Understanding the differences is helpful for businesses that operate globally, plan to expand outside the US, work with international investors, or simply want a broader accounting perspective. GAAP tends to be more detailed and prescriptive, while IFRS focuses on broader principles that give companies more flexibility in interpretation.

Here’s a simple breakdown of how the two frameworks compare:

Although both systems aim for transparency and comparability, businesses may report different numbers depending on which framework they follow. For example, using LIFO under GAAP could reduce taxable income in times of rising prices, whereas IFRS does not allow it. Similarly, IFRS may allow more judgment in valuing assets, while GAAP often requires stricter documentation and evidence. For companies that operate internationally or plan to scale, understanding these differences helps with compliance, investor communication, and preparing financial statements that make sense across borders.

How software helps you stay GAAP-aligned

You don’t need to memorize GAAP to follow it correctly. The right accounting software supports GAAP by:

Applying double-entry rules in every transaction

Making accrual accounting easy (prepayments, deferred revenue, accruals)

Automating depreciation and recurring journal entries

Maintaining consistency in inventory and valuation methods

Generating standard GAAP-style financial statements

Keeping detailed audit trails

Zoho Books, for example, is built around these fundamentals so businesses can stay compliant while focusing on their day-to-day financial operations.