- HOME

- Payment collection and compliance

- What is revenue recognition | Zoho Billing

What is revenue recognition | Zoho Billing

Do you remember the moment you made your first sale, received the cash, perhaps even made a little happy dance, and marveled how all your hard work had finally paid off?

Earning cash as a business is exciting. When you ask yourself how much revenue your business earned this month, the answer might come easy if it is a retail business. But if you are running a subscription business, recognizing revenue is not as straightforward.

As a subscription business, you charge customers a fee in advance for the products or services that you will deliver over a certain period. When a business charges a fee for a product or service it intends to deliver in the future, certain revenue reporting rules must be followed for proper accounting.

In practice, revenue recognition can be quite challenging as finance regulatory agencies have established complex rules and their guidelines are constantly evolving with the continued growth of the subscription industry.

This guide looks to demystify the concept of revenue recognition and help you understand what revenue recognition means for your subscription business.

What is revenue recognition?

Revenue recognition is an accounting method that defines how and when businesses should record and recognize their revenue. This principle requires businesses to recognize revenue when it's earned (accrual basis accounting) rather than when the payment is received (cash basis accounting).

It is typically followed by subscription businesses where the customer pays in full before actually receiving the whole service. For instance, a SaaS business might have customers who pay upfront for an annual subscription and receive the services on a monthly basis throughout the year. That is, the business gets the money before earning it or, according to accounting language, "before fulfilling the performance obligations."

Revenue recognition asserts that although you received the full payment in one chunk, you can earn it only in pieces. You recognize the revenue as you continue to provide the service and fulfill the obligations agreed in the contract.

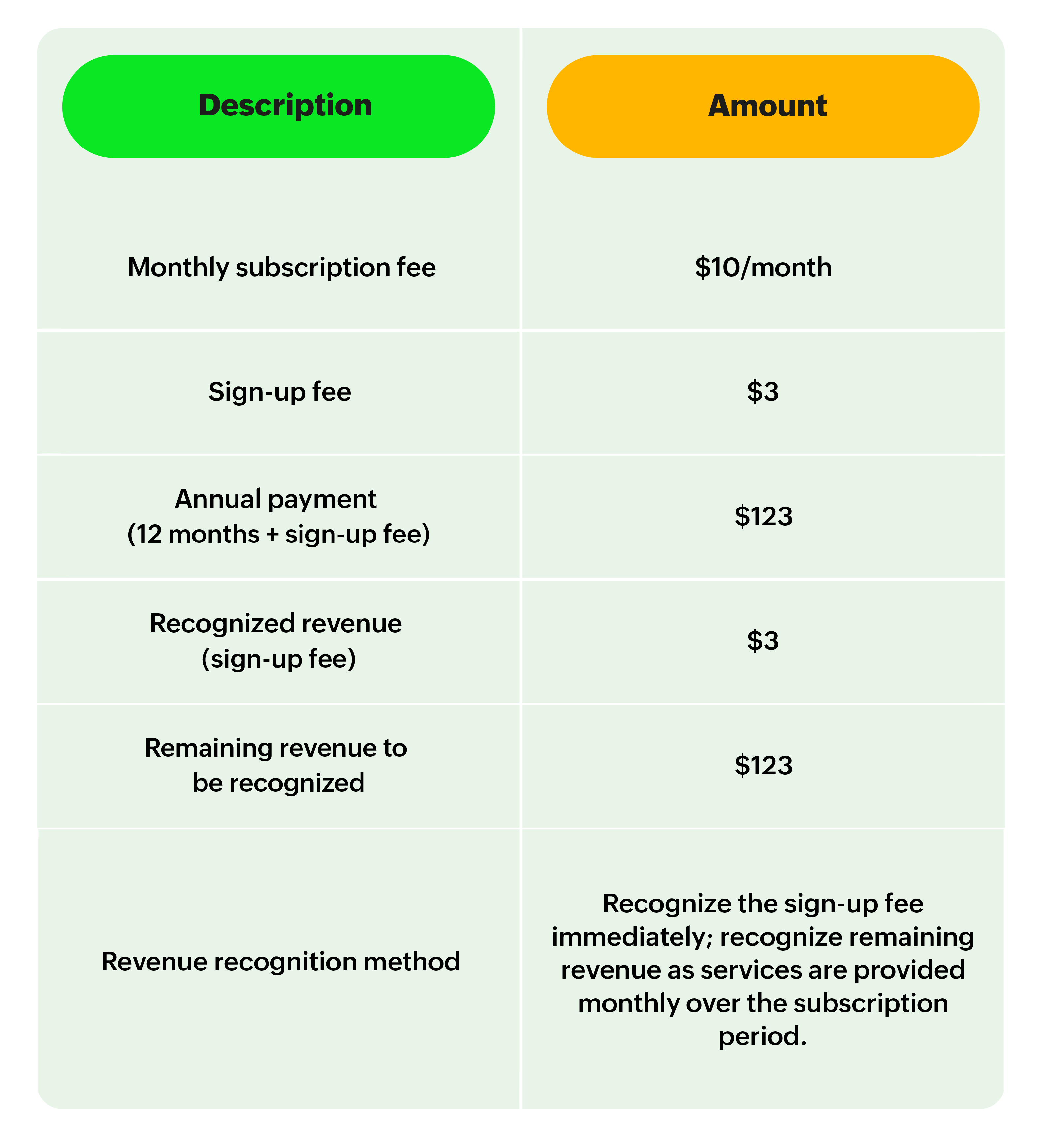

For instance, suppose you provide a monthly boxed subscription service to customers at $10/month, paid annually in advance along with a small sign-up fee of $3. You receive the payment of $123 for the year. However, you can't recognize the entire $123 as revenue because you are yet to deliver the 12 boxes from their annual subscription. According to revenue recognition standards laid by IFRS, during signup, you can only recognize the $3 sign-up fee, even though you have received the full year's subscription payment upfront ($123).

Adhering to revenue recognition guidelines ensures businesses' transparency and predictability in their accounting practices, helping them assess their financial position fairly and report on it to investors, stakeholders, and government agencies.

Why is revenue recognition important for subscription billing?

The importance of revenue recognition goes beyond compliance with international financial standards. There are several circumstances where accurate revenue recognition can help a subscription business operate more efficiently.

Make informed business decisions

Imagine if your company immediately recognized revenue when the customer made an upfront payment; then, the financial payments will show more profits than you actually earned in that specific period. The revenue you previously recorded too early will now be missing from future periods, causing your reports to show lower profits.

For instance, consider one of the customers in your SaaS business pays $240,000 upfront for the annual subscription in January. If the business simply records this as revenue all at once, you will see an overstated cash position. Encouraged by your cash position, you decide to use this cash to hire 10 new people and build new product features. The company exposes itself to risk if something negative happens to the existing subscriber base, like customers canceling early and requesting a refund. That's why it's important to distinguish between deferred revenue and track it separately from your earned revenue. In this way, the business has an accurate picture of its actual revenue now and expected revenue for each month over the year as those services are delivered and contractual obligations are fulfilled, so you can make informed business decisions.

Visibility to external parties

Deflecting from the rules of revenue recognition is often a reason for inaccurate financials. This is especially true for subscription companies where even if you have received payment, that amount still may not be counted as revenue because of ongoing contractual obligations, including the customer's right to return damaged or unwanted goods. The payment received still may need to be returned if the product or service is not delivered as per the contract and, hence, may not count as revenue for the purposes of valuing your business. This is categorized under deferred revenue as a liability.

This is why it's crucial to execute revenue recognition correctly. Any reasonable investor will want to see accurate financial records showing actual profits and see all your liabilities marked clearly. Adhering to revenue recognition standards helps your business present an honest picture of your finances to investors.

Useful for companies expanding publicly

If you are strategizing for your subscription business to go public one day, ensure your financial statements continue to track deferred and recognized revenue properly so prospective investors can accurately compare your company's year-over-year finances. If the company's early years did not follow revenue recognition practices, then ultimately, the financial position between years that do not and years that do track revenue according to these practices will look confusingly distinct. Especially, for the companies that start adopting revenue recognition practices late in the game, it will appear that revenue took a bad hit for a full subscription cycle.

For instance, suppose your subscription business provides services for an annual subscription of $900. If your business does not adhere to revenue recognition principles and adds 100 customers per month for the first year (2019), it would appear you have earned $90,000 per month or $1,080,000 per year—a flat revenue growth in 2019.

If you decide to follow revenue recognition practices in the following year, 2020, you would still collect the same amount of money over the year. However, you would only recognize one-twelfth of the fee obtained from all your customers every month. So, at the end of month one, you would recognize one-twelfth of the first month's total subscriber base: $750. At the end of the second month, when you have 200 customers, you would recognize one-twelfth of the 200 subscription fees, or $1,500. This trend would continue throughout the year such that in the twelfth month, your company would recognize the revenue of $90,000 per month.

At this point, your business went through one full year of a subscription cycle, and by now, you would have caught up to the monthly amount you would be recognizing on a cash basis. However, the month-to-date comparison between 2019 and 2020 would be very different based on a cash basis accounting method.

Take this up a notch: Imagine this for two to three-year subscription terms. You will see how long it would take for the new financial statements to become equivalent to the old financial statements, where revenue recognition practices are not adapted from the start.

How does revenue recognition work?

Let's say you run a SaaS business where you offer a range of software products under monthly and yearly plans. Your business charges a monthly subscription fee of $50 for access to the service under the basic plan. The customer pays the first month's fee of $50 as part of the signup process, and they get access to the service immediately after payment.

At the start of every month after that, you charge the customer $50. As long as the customer continues to make the subscription fee every month, you continue to provide access to your product.

Now coming to the task at hand, you collected $50 on the first day the customer signed up. The payment is in your hands, but it can't be recognized as revenue because you are yet to deliver the services to that customer. If you are forced to stop providing access to your product at any point during the month due to any technical or legal issue, the customer will have paid the full amount upfront for 30 days of access to your product but received service for a lesser period. To account for this discrepancy between the payment the customer has made and the services your company has provided, revenue recognition accounting rules require your business to defer the revenue and then recognize the revenue as the service is provided. Therefore, the accounting statement would look something like this:

Account Debit Credit

Account receivable: $50

Deferred revenue: $50

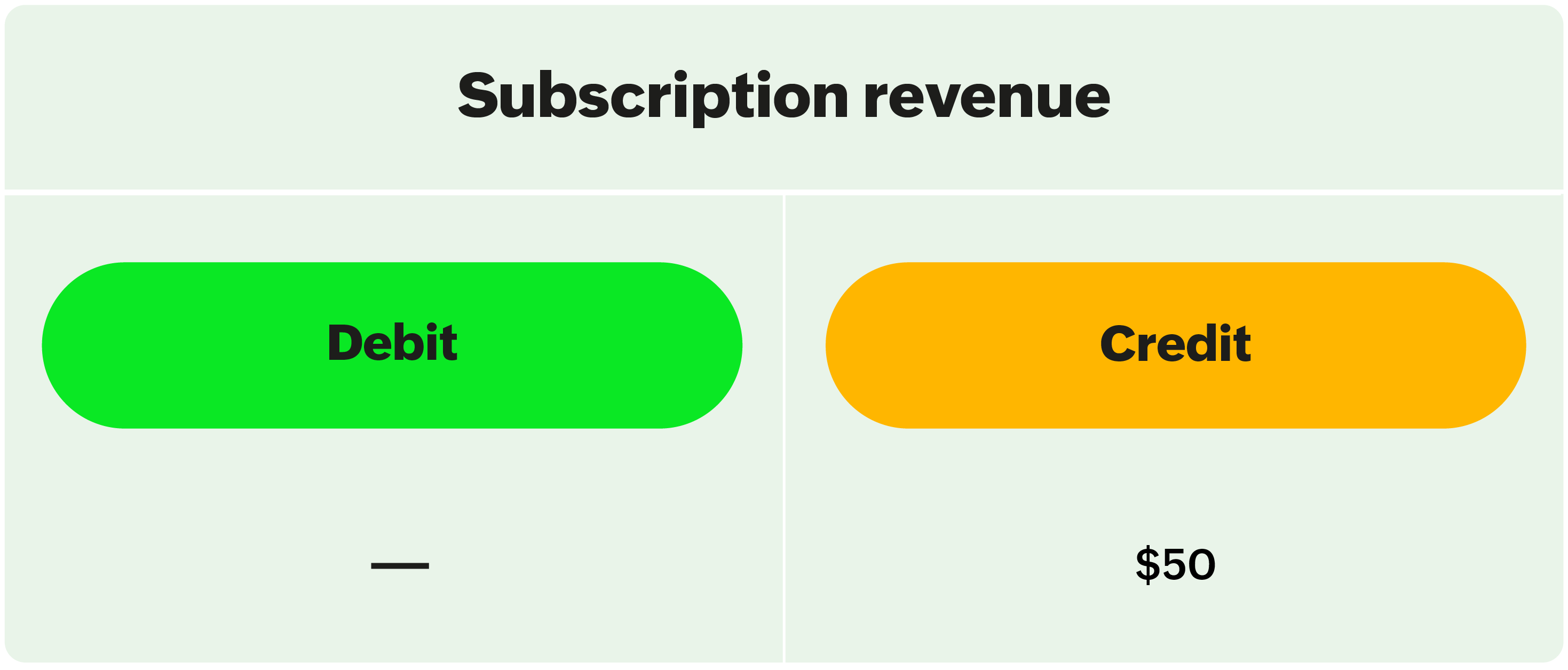

Once the month has passed and the service for that month has been completely delivered, fulfilling all the contractual obligations, you can finally claim that you have fully delivered the service for the money the customer paid, and you can recognize the full amount of the sale as revenue. As a result, the accounting statement would look something like this:

Account Debit Credit

Deferred revenue: $50

Revenue: $50

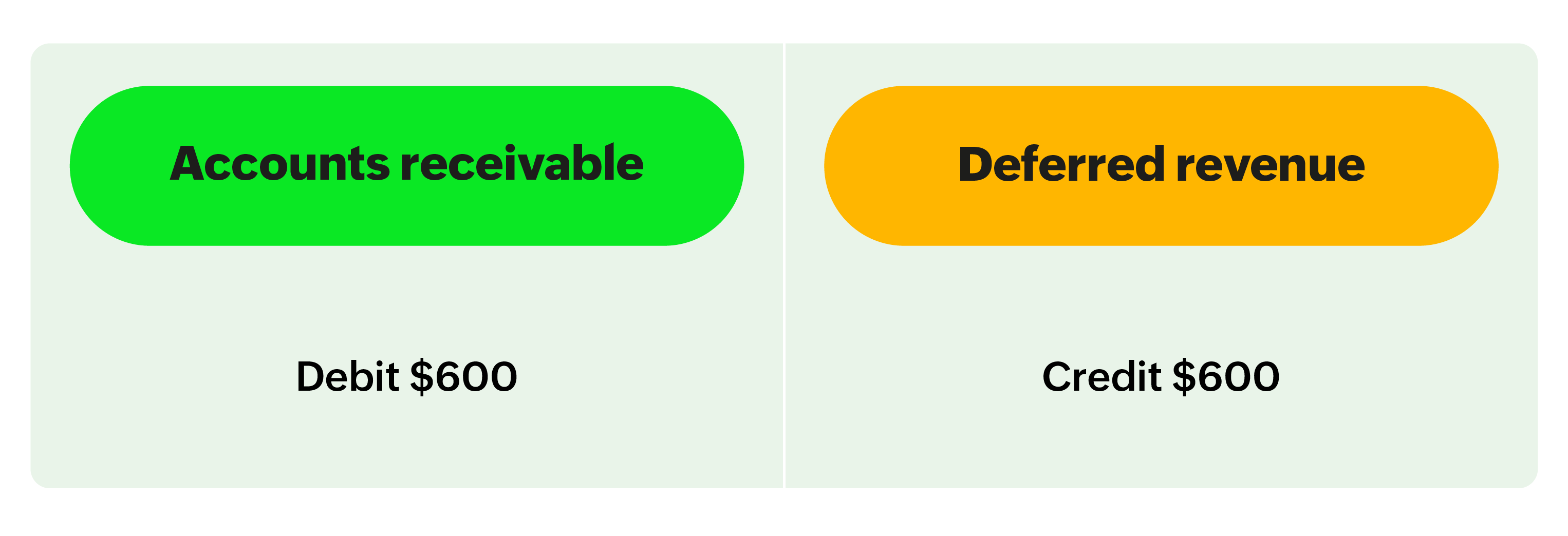

The same procedure is applied to annual subscriptions. If another customer signed up for a one-year subscription of $600 and paid upfront on January 1, the customer has access to the product from January 1 to December 31, the day when the subscription expires.

You bill the customer for $600, which debits accounts receivable and credits deferred revenue as shown below:

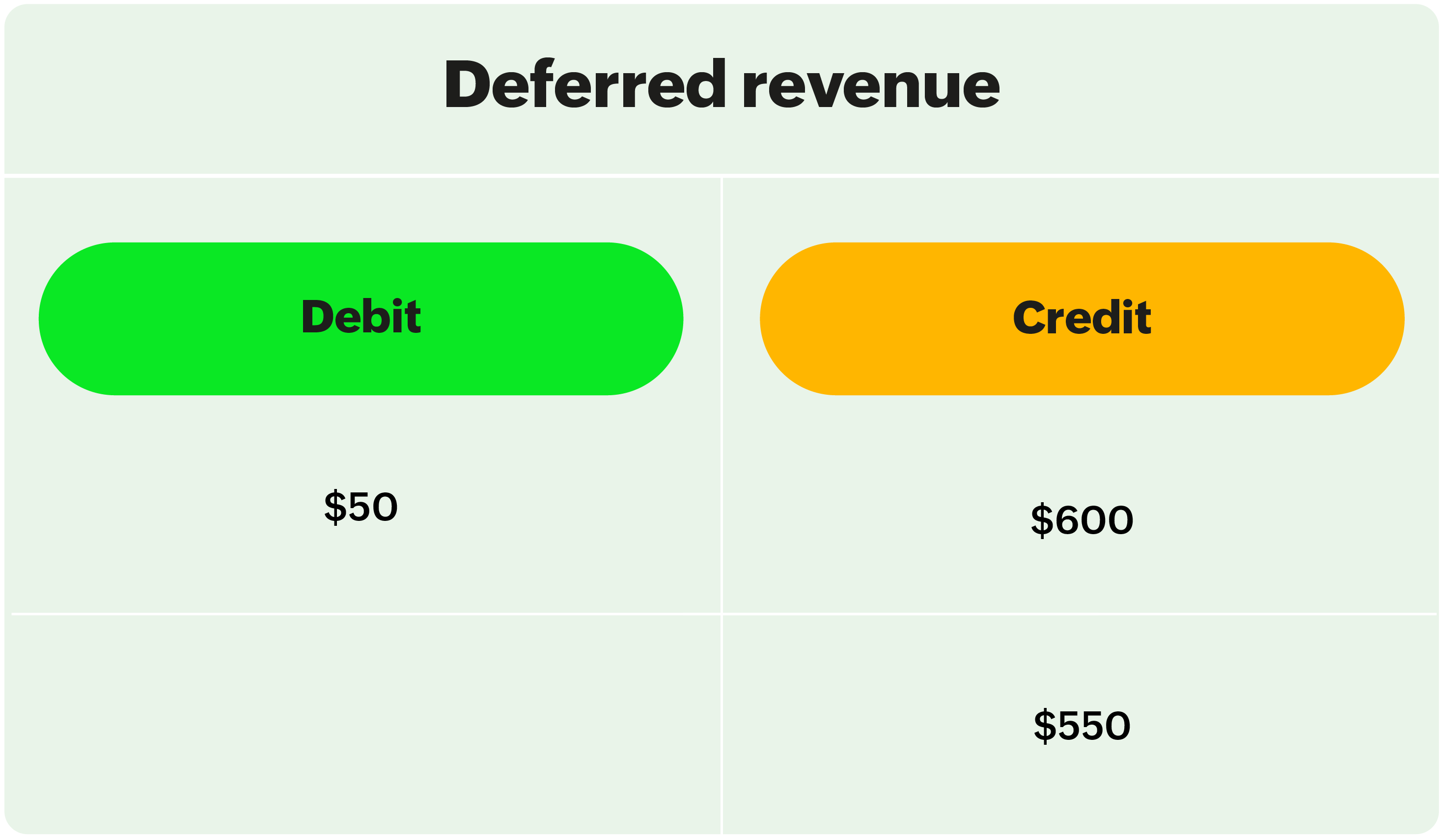

Now, it's February 1, and you close the January books. Then, you debit the deferred revenue ($600/12 = $50) and credit subscription revenue for $50. This reduces the liability of deferred revenue from $600 to $550 and your income statement will have $50 as your subscription revenue.

You continue this process every month until your deferred revenue for this customer becomes zero.

From a financial reporting standpoint, at any given period, your subscription business should be able to answer:

How much money have you collected from customers as part of your subscription services?

How much of that money is still in a deferred revenue account?

How much of that money has been recognized and recorded as actual revenue since the service or product has been fully delivered to the customer?

Key takeaway

Revenue recognition is an integral element that separates your subscription accounting process from your subscription revenue. You might update your monthly or annual revenue as soon as a new customer signs up and you get the payment upfront, but you can't update your recognized revenue until you have delivered the product or service.

Failing to acknowledge this distinction that a new account increasing your annual recurring revenue by $30,000 does not immediately equal $30,000 in revenue.

The ability to recognize revenue accurately at any point in time puts you in a better position to plan your business expansion, be compliant with international standards, and earn investors' and stakeholders' trust with your financial transparency.