Getting Started With Zoho Payroll

Setting up your organization in Zoho Payroll is a breeze. All you need to get started is some basic information about your company, your business address, and your tax rates. You’ll have most of these details already but if something is missing, don’t worry- we’ll tell you where to find it.

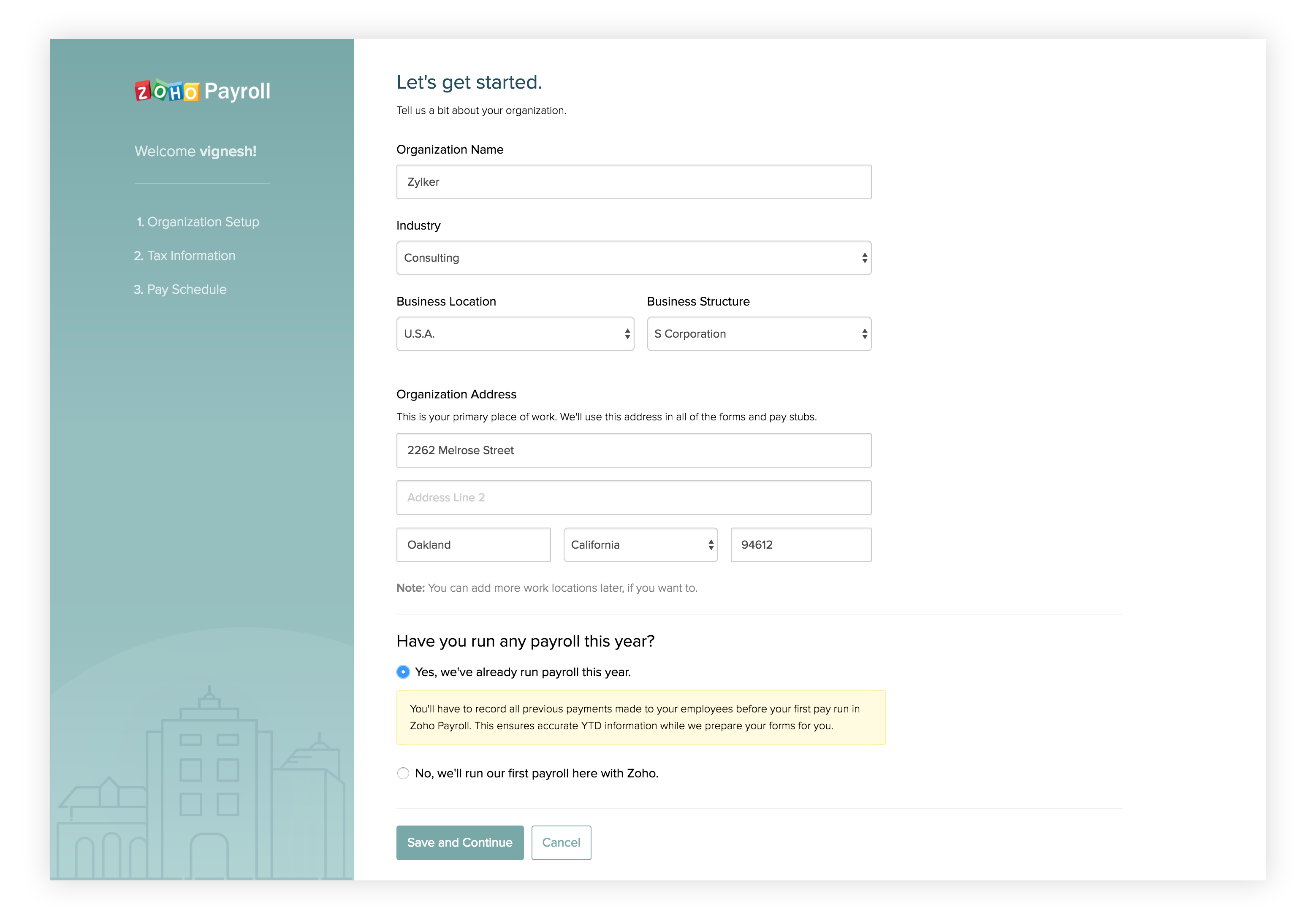

Basic Information

To start enter the basic details about your business like the name of your company, what legal business structure you follow, and the type of industry you fall under.

Then you enter the address at which your business is located. This will be your primary work location. If you operate from more than one location, you can create them later. As of now, we support only businesses that are located in California.

If you are switching from another payroll provider, or a manual system in the middle of the year, then you need to enter some year-to-date (YTD) information about your employees' wages and their taxes.

If you paid employees during the current calendar year, select yes. This will ensure accurate taxes and W-2s at the end of the year.

Select No if:

- You’re a new business, and paying your employees for the first time.

- You’re an existing business, and running your first payroll of the calendar year.

- You’ve recently changed your business entity, and are running the first payroll for the new entity.

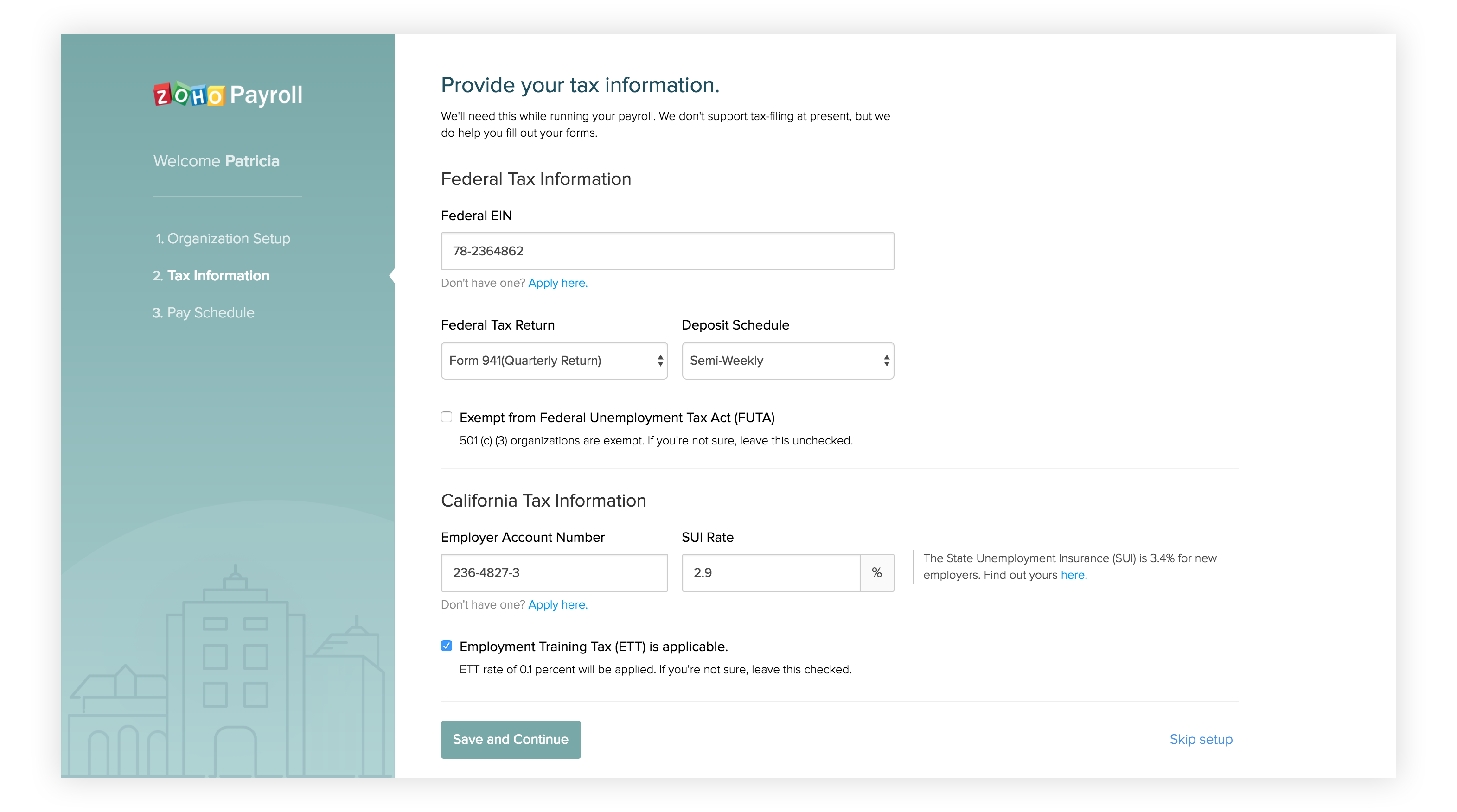

We need your federal and state tax details while running your payroll and filling out your forms.

Please Note: We don’t support tax filing right now.

Tax Details

Start with your Federal Tax Information.

Enter your Employer Identification Number (FEIN). It’s a nine digit number in the format: XX-XXXXXXX. You can find the EIN in the letter that states your business’s Internal Revenue Service recognition and tax status. If you don’t have an EIN, you can apply for it here.

Select your Federal Tax Return form. This form is used to report the wages you pay your employees and your payroll taxes. If you file your returns every quarter, select Form 941; if you file annually, then select Form 944. If you are not sure which one to select, select Form 941.

The IRS reviews previously filed returns to identify small businesses with $1,000 or less in employment tax (income tax withheld, employee and employer Social Security, and Medicare tax) liability (approximately $4,000 in gross payroll). These employers will be notified by letter that they are now 944 filers and must file Form 944 instead of 941.

Now select your Deposit Schedule. This is how often you deposit the taxes you withhold from your employees' paychecks. Most new employers choose the monthly deposit period. This is critical as selecting the wrong schedule can invite penalties.

The total amount of employment taxes you reported in the twelve-month period ending the preceding June 30 (called the look-back period) determines your deposit schedule.

-

If your payroll tax obligation is less than $2500 in a quarter, you can deposit these taxes with the quarterly return (assuming a Form 941).

-

If your total payroll taxes for the “look-back period” were $50,000 or less, you are a monthly depositor.

Note: Deposits must be made by the 15th of the following month.

-

If your total payroll taxes for the “look-back period” were more than $50,000, you make deposits on the semi-weekly schedule.

**Note:**

- Deposits must be made by the following Friday when pay day is on a Saturday, Sunday, Monday, or Tuesday.

- Deposits must be made by the following Wednesday when pay day is on a Wednesday, Thursday, or Friday.

You must use electronic funds transfer (EFTPS) to make all federal tax deposits.

If you are a 501(c)(3) organization i.e. a non-profit, then you are exempt from paying FUTA taxes and you can check this box. If you’re unsure, leave this unchecked.

Now, enter your State Tax Information.

Enter your State **Employer Account Number**. It's an eight digit number in the format: X-XXXX-XXX. If you don't have one, you can apply for it [here](http://www.edd.ca.gov/Payroll_Taxes/Am_I_Required_to_Register_as_an_Employer.htm).

Enter the State Unemployment Insurance (SUI) rate. It’s usually 3.4% for new employers. You can find out the rate that applies to you here.

The taxable wage limit for the Employment Training Tax is $7,000 per employee.

ETT is applied at a rate of 0.1%. If this doesn’t apply to you, uncheck this box.

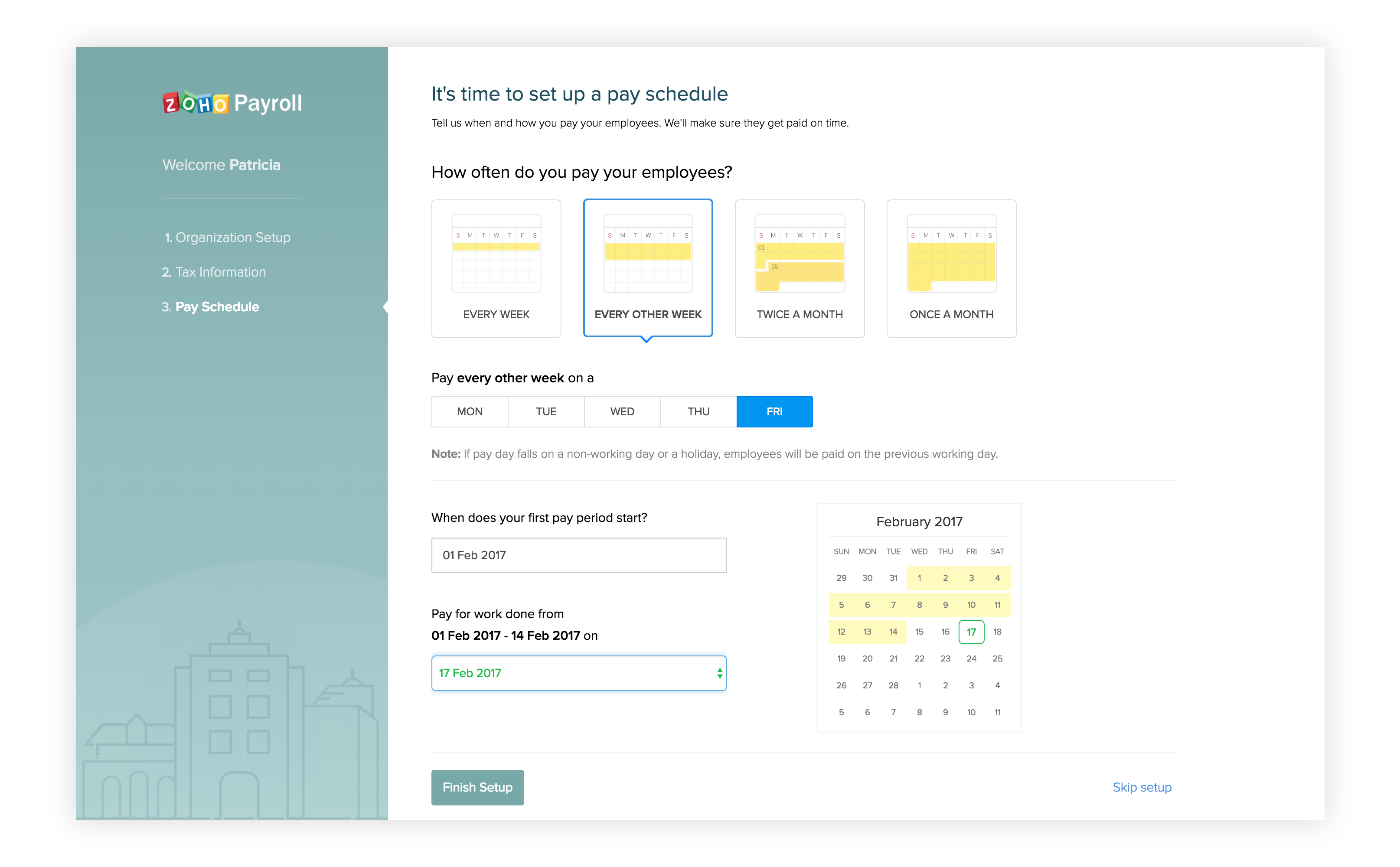

### Select how often you pay your employees.

This will help us determine the withholding taxes and let you know when a payment is due. Zoho Payroll currently supports four types of pay schedules:

| Type | No. of paychecks a year | Description |

|---|---|---|

| Every Week (Weekly) | 52 | You pay your employees on a specific day every single week. For instance, every Friday. |

| Every other week (Bi-weekly) | 26 | You pay your employees on a specific day every other week. For instance, every other Friday. |

| Twice a month (Semi-monthly) | 24 | You pay your employees twice a month, on two specific dates. For instance, on the 15th and the 30th every month. |

| Every month (Monthly) | 12 | You pay your employees on a specific day every month. For instance, on the 30th of every month. |

Once you’ve selected your pay schedule and the pay day, select when your first work period starts. This is when we’ll start processing payroll for you.

- If you opt for a monthly pay schedule, you can select a start date between 1 and 28.

- If you opt for a bi-weekly pay schedule, you can choose either 1 or 16 as the start date.

Select the Pay Day. This is the day on which you pay your employees.

You can choose to pay your employees either on the last day of the pay period or up to 10 days after the pay period ends.

**Note:** If pay day falls on a holiday, employees will be paid on the previous working day.

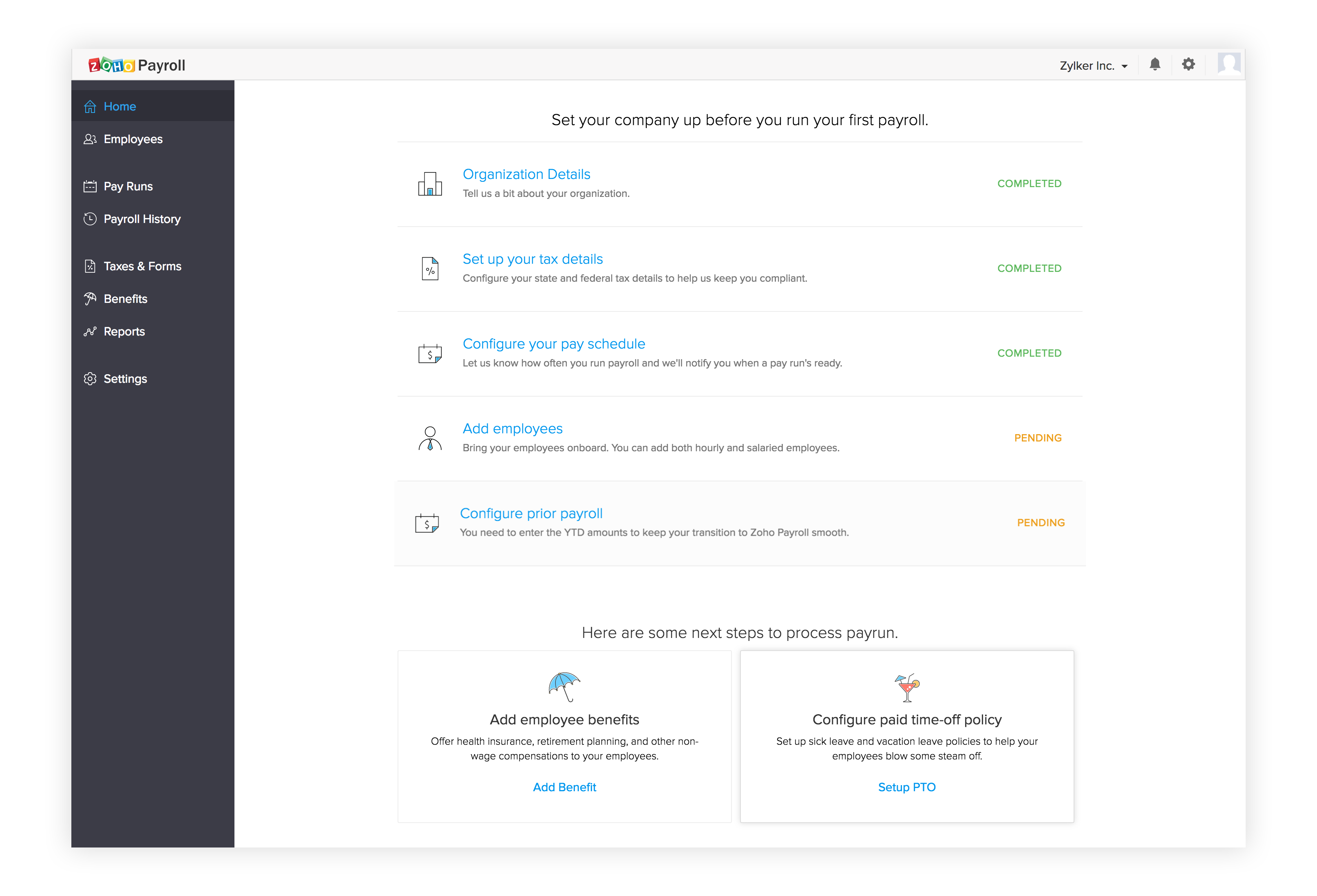

Now you’ll be taken to the dashboard. You can add your employees, set up benefit plans and time off policies from this page.

If you had paid your employees during the current calendar year, you need to enter the past payroll data to ensure a smooth transition.