Work Locations

In Zoho Payroll, a work location refers to the physical address from which an employee operates.

Accurately setting up work locations is essential for the correct calculation of employer and employee contributions toward state and local taxes. Whether employees work from a company office or remotely, you must record their work locations to ensure proper tax withholding.

The following scenarios will help you better understand work locations and their tax implications:

SCENARIO 1 Zylker has three offices within California—Fresno, Danville, and Blythe. You must add each of these offices as separate work locations in Zoho Payroll.

SCENARIO 2 Zylker Corp is registered in Minnesota and has two offices within the state: Minneapolis and Lakeville. Pat, a web developer, resides in Woodbury, Minnesota, and works remotely. Although you do not have an office in Woodbury, you must add Pat’s home address as a work location. Since Pat works from a location within Minnesota, he’ll be subject to Minnesota state and local taxes.

SCENARIO 3 Christie, a designer, lives in Bainbridge, Georgia, and commutes 40 minutes to work in Zylker Inc’s office in Tallahassee, Florida. Although she lives in Georgia, she must be associated with the Florida work location and will be subject to Florida’s tax regulations.

If an employee lives and works in different states (as in Scenario 3), state reciprocity agreements may come into play to prevent double taxation.

Add a Work Location

NOTE The ability to add work locations for different states (multi-state support) is available only for certain plans of Zoho Payroll. Visit our pricing page to check if it’s available in your current plan.

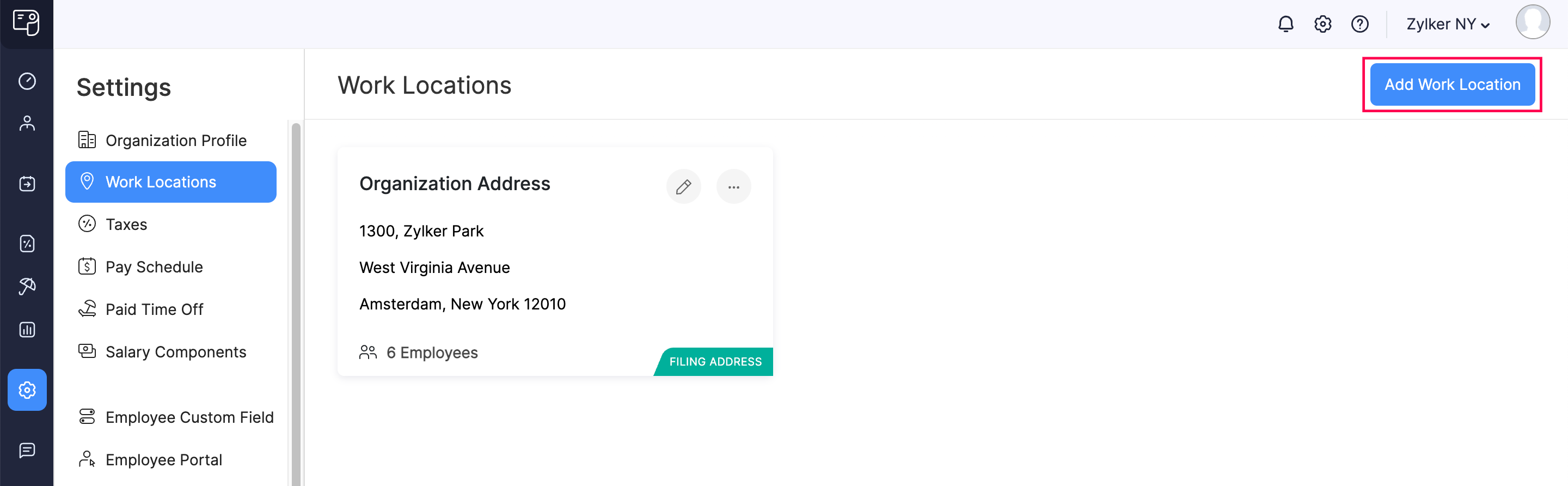

To add a new work location:

- Go to Settings and click Work Locations.

- Click + Add Work Location.

- Enter the following details:

- Work Location Name

- Address

- State

- City

- ZIP Code

- Click Save.

Once added, you can assign this work location to employees when setting up or editing their profile.

Manage Work Locations

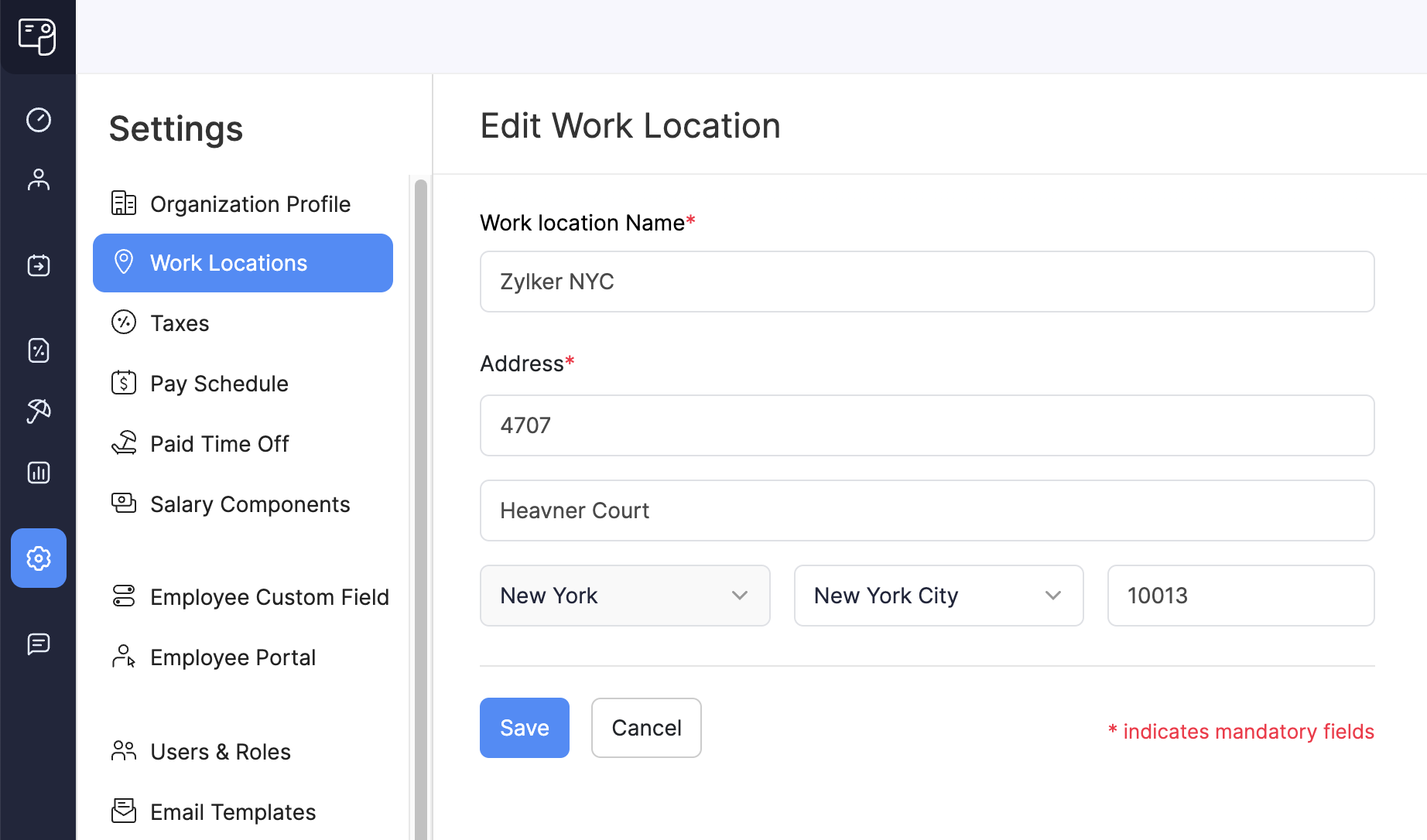

Edit a Work Location

If you misspelled the work location’s name or entered an incorrect address, you can update it easily.

To edit a work location:

- Go to Settings and click Work Locations.

- Click the Edit icon next to the location you want to update.

![]()

- Make the necessary changes.

- Click Save.

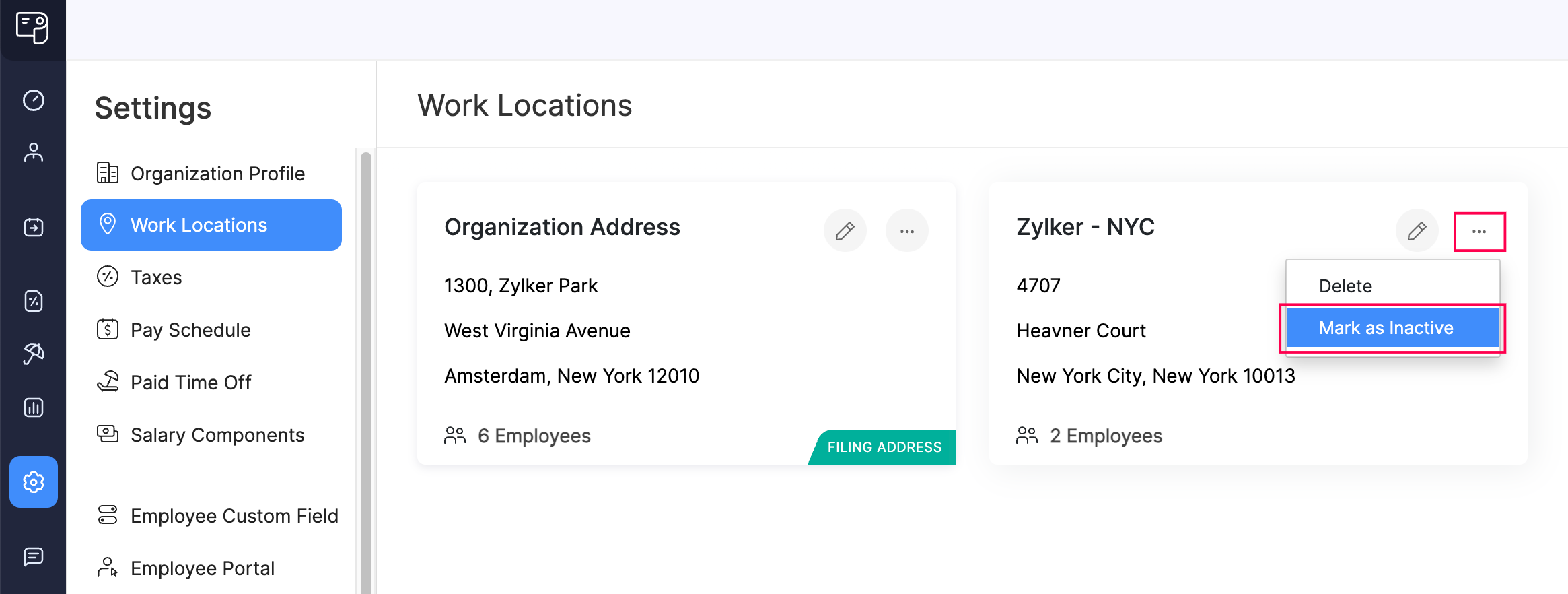

Mark a Work Location as Inactive

If a work location is no longer in use but may be needed later, you can mark it as inactive instead of deleting it permanently.

To mark a location as inactive:

- Go to Settings and click Work Locations.

- Click the More icon next to the work location.

- Select Mark as Inactive.

Once marked inactive, the location can no longer be assigned to employees. You can reactivate it at any time.

Delete a Work Location

Work locations, once added, cannot be deleted in Zoho Payroll. If you need help removing a work location, contact support.usa@zohopayroll.com.

State Reciprocity Agreements

NOTE State reciprocity agreements apply only when employees work across multiple states. Hence, this section is applicable only for certain plans of Zoho Payroll that support multi-state features. Visit our pricing page to check if it’s available in your current plan.

Some U.S. states have reciprocity agreements, which allow employees to work across state lines without being taxed by both states. Under these agreements, employees pay state income taxes only in their state of residence—even if they physically work in another state.

KEY POINTS

- Employers must withhold taxes based on the employee’s state of residence (not the work location) if a reciprocity agreement exists.

- Non-resident employees’ wages are not taxed in the state where the income is earned. For example, if an employee lives in Illinois and works in Kentucky, employers should withhold Illinois state income tax (as per the reciprocity agreement).

- Employees must submit a non-residency certificate (specific to the work state) to claim this benefit.

Example Scenarios

SCENARIO 1 An employee lives in State A and works in State B. States A and B have a reciprocity agreement. The employee submits the exemption form. The employer should withhold state income tax for State A only.

SCENARIO 2 An employee lives in State C and works in State D. No reciprocity agreement exists. The employer must withhold state income tax for State D, and the employee may need to file tax returns in both states.

States With Reciprocal Agreements

The following table outlines the states that have active reciprocity agreements:

| State of Work | Home State | Non-Residency Certificate |

|---|---|---|

| Arizona | * California * Indiana * Oregon * Virginia | WEC |

| District of Columbia | * Maryland * Virginia | D-4A |

| Illinois | * Iowa * Kentucky * Michigan * Wisconsin | IL-W-5-NR |

| Indiana | * Kentucky * Michigan * Ohio * Pennsylvania * Wisconsin | WH-47 |

| Iowa | * Illinois | 44-014 |

| Kentucky | * Illinois * Indiana * Michigan * Ohio * Virginia * West Virginia * Wisconsin | 42A809 |

| Maryland | * District of Columbia * Pennsylvania * Virginia * West Virginia | MW 507 |

| Michigan | * Illinois * Indiana * Kentucky * Minnesota * Ohio * Wisconsin | MI-W4 |

| Minnesota | * Michigan * North Dakota | MWR |

| Montana | * North Dakota | MT-R |

| New Jersey | * Pennsylvania | NJ-165 |

| North Dakota | * Minnesota * Montana | NDW-R |

| Ohio | * Indiana * Kentucky * Michigan * Pennsylvania * West Virginia | IT-4NR |

| Pennsylvania | * Indiana * Maryland * New Jersey * Ohio * Virginia * West Virginia | REV-419 |

| Virginia | * District of Columbia * Kentucky * Maryland * Pennsylvania * West Virginia | VA-4 |

| West Virginia | * Kentucky * Maryland * Ohio * Pennsylvania * Virginia | WV/IT-104 R |

| Wisconsin | * Illinois * Indiana * Kentucky * Michigan | W-220 |

By accurately setting up work locations and understanding reciprocity rules, you can ensure tax compliance and help your employees avoid unnecessary tax burdens.