Off-Cycle Payroll

NOTE This feature is available only for certain plans of Zoho Payroll. Visit our pricing page to check if it’s available in your current plan.

Off-cycle payroll allows you to issue payments to employees outside your regular pay schedule, such as one-time payments for corrections or non-regular earnings that require immediate attention. This type of payroll ensures employees receive prompt and accurate compensation for scenarios that fall outside the regular payroll process. One important detail to note is that specifying a pay period is mandatory for off-cycle payrolls, and it must follow your a pay frequency.

Zoho Payroll lets you create off-cycle payrolls based on the following pay schedules:

- Weekly

- Bi-weekly

- Semi-monthly

- Monthly

- Quarterly

Run an Off-Cycle Payroll

PREREQUISITE Before you can start running payrolls for your organization, make sure you have completed the following:

Running an off-cycle payroll in Zoho Payroll involves four main steps:

- Creating an off-cycle payroll

- Adding employees to an off-cycle payroll

- Submitting and approving the off-cycle payroll

- Recording payment for the off-cycle payroll

Step 1: Create an Off-Cycle Payroll

To create an off-cycle payroll:

- Go to the Pay Runs module.

- Click Create Pay Run on the top-right

- Select Off-Cycle Payroll from the drop-down.

- Select the pay period, Pay Period Start Date, and pay date.

- Configure the Benefit and Deduction Preferences. This allows you to include or exclude employee benefits and deductions for the off-cycle payroll.

- Click Save.

The off-cycle payroll will be created. In the next screen, you must add employees to the off-cycle payroll.

Step 2: Add Employees to the Off-Cycle Payroll

To add employees to the off-cycle payroll:

- Click Add Employees in the Add Off-Cycle Details page.

- Click Select an Employee and select an employee. If the employee is paid by hour:

- Enter the Earning Hours (such as the number of Regular, Overtime, and Double Time hours) for their primary job role.

- If the employee had worked on any other additional job roles:

- Click + Add Additional Job Hours.

- Choose the additional job role.

- Enter the number of Regular, Overtime, and Double Time hours worked for that role.

- Enter the Earning Hours if the employee is paid by hour. If the employee is salaried, skip to the next step.

- Under the Earnings section, click Add Earning and enter the Bonus and/or Commission amounts for the employee.

- Click Save. The employee will be added to the off-cycle payroll.

- Click Continue to Payroll.

Review the payroll details, make any necessary changes, and proceed to approval.

Step 3: Approve the Off-Cycle Payroll

PREREQUISITE

- Ensure that no employees have negative net pay in the off-cycle payroll.

- Ensure you have sufficient funds in your bank account to cover both employee salaries and applicable taxes.

WARNING Once an off-cycle payroll payroll is approved, it cannot be edited or deleted.

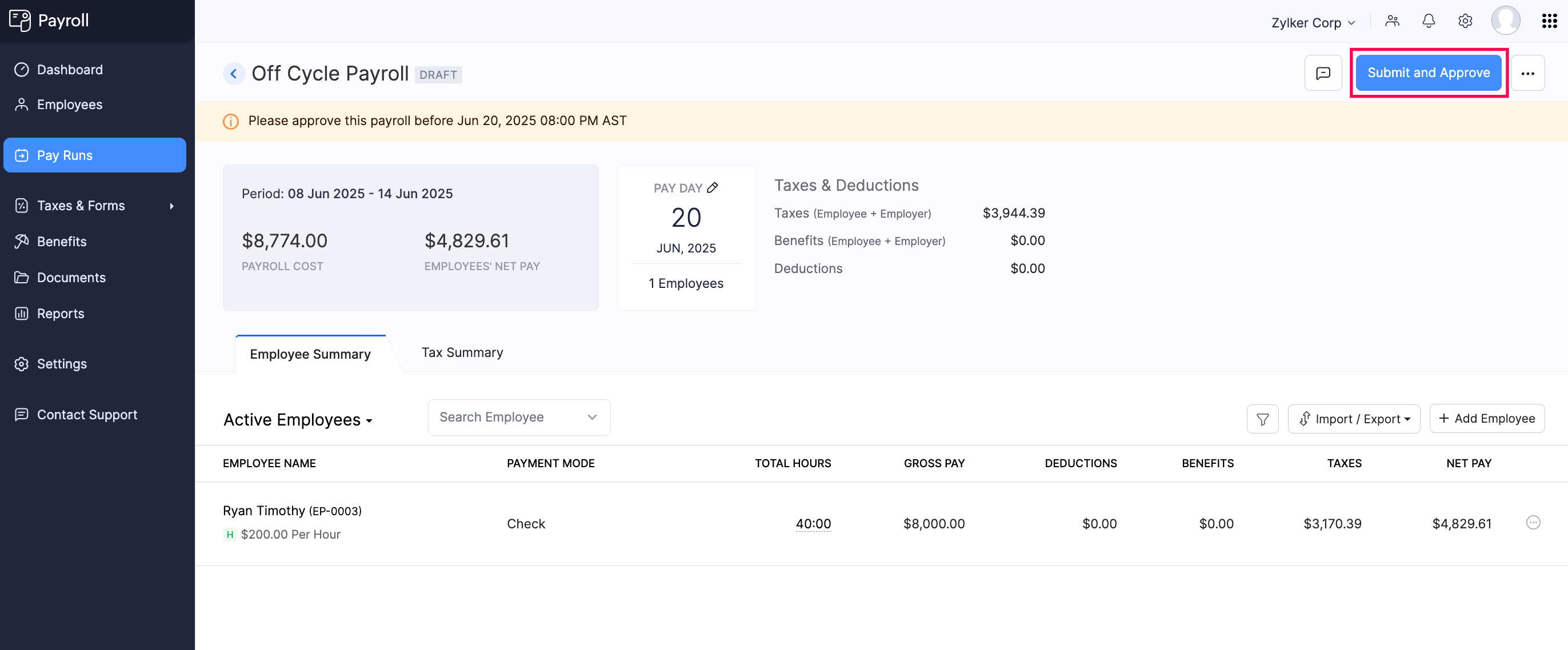

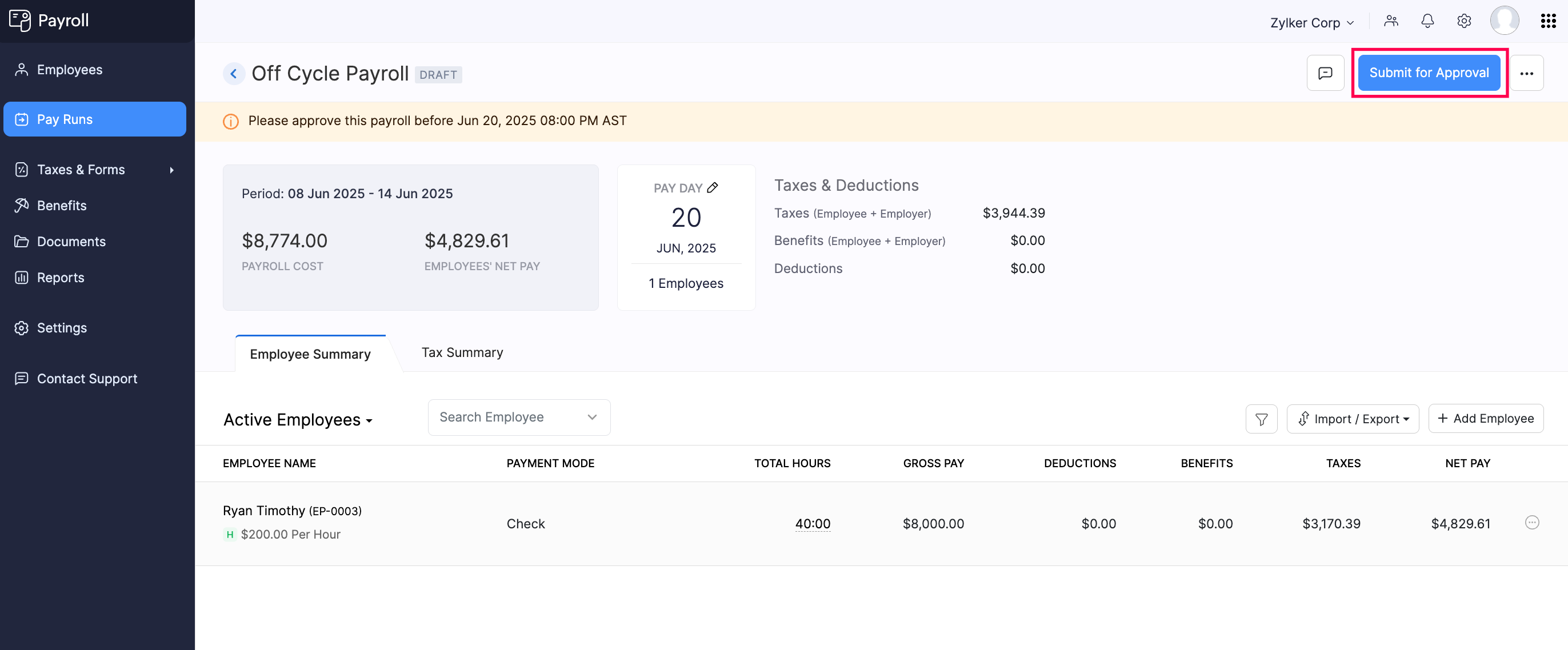

To submit or approve a payroll:

- Go to the Pay Runs module.

- Click Process Pay Run.

- Depending on your role and permissions, follow one of these paths:

If you have approval permissions (such as an admin or finance head), click Submit and Approve on the top right.

If you don’t have approval permissions, click Submit for Approval on the top right. An authorized user will then review and approve the payroll.

INSIGHT If you have enabled Zoho Books integration, you can choose to post the journal entry for the payroll transaction in Zoho Books. The transaction will be recorded under the account configured during the integration setup.

Once your off-cycle payroll is approved, Zoho Payroll will automatically deposit salaries into employees’ bank accounts on the scheduled pay date if you’ve set up Direct Deposit for your organization and employees. The applicable taxes will also be debited from your bank account and paid to the respective agencies.

Step 4: Record Payment for the Off-Cycle Payroll

If you’re paying employees manually via check, cash, or other methods, you can mark the payment as recorded on the payday.

To record payment for a regular payroll:

- Go to the Pay Runs module and open a payroll in the Payment Due status.

- Click Mark as Paid on the top right.

PRO TIP To record payment for individual employees instead of recording for the payroll as a whole, click Mark as Paid next to the corresponding employee.

- In the pop-up that appears, select the Paid Through Account and Payment Mode.

- Enable Send pay stub notification email to all employees if you want to email the pay stub to your employees. Otherwise, leave it disabled.

- Click Save.

The payroll will now be marked as Paid, and the applicable federal, state, and local taxes will be generated under the Taxes module.