Take your payroll to the cloud

Handle your entire payroll process online, from approvals to pay runs, with cloud-based access from anywhere, at any time.

Run multi-state payroll across the USA

Support your multi-state business operations by paying employees in a single payroll, and automatically staying compliant with each state’s tax laws

Centralize employee data

Track and manage information related to all your payroll events like onboarding, benefits, salary revisions, and overtime using one centralized source of data.

Built-in flexibility for your every payroll need

Get payroll up and running in minutes

Set up payroll quickly without installation, hardware, or manual updates, and start paying your team securely and on time with easy-to-use cloud software.

Tailor work-based hourly wages

Set distinct pay rates based on the type of work, so you can fairly and accurately compensate every employee.

Give back for the time they showed up

Reward your employees for their consistent presence and commitment by offering payouts for their unused time off.

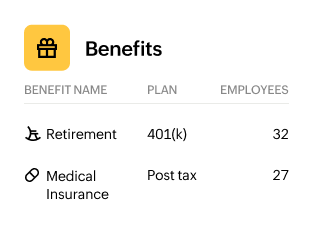

Shape better workplaces with the right benefits

Show your employees you care and manage benefits like healthcare plans, retirement savings options, flexible spending accounts, and other allowances built right into one software.

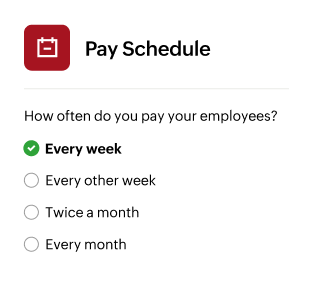

Choose flexible pay cycles for dynamic teams

Whether it's weekly, bi-weekly, semi-monthly, monthly, or quarterly define pay cycles that align with your business operation in the USA.

Run payroll that scales with you

Easily onboard more employees and evolve your pay structures without the hassle of manual setup or infrastructure changes.

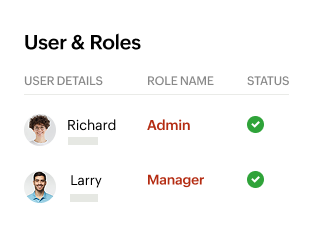

Grant role-based access

Assign roles to control who can view, edit, or approve different payroll tasks while protecting employee data and ensuring accountability.

See the full payroll picture

View and download password-protected payroll reports ranging from monthly summaries to year-end filings whenever you need them.

Compliance you can count on always

Zoho Payroll’s cloud-based payroll software adapts to the latest IRS updates automatically, keeping your USA business compliant with audit-ready reports.

Handle federal, state, and local tax calculations.

Manage every essential tax form including W4, W2, 940, 941 and 944 effortlessly in one place.

Stay up to date on payroll laws across all 50 states.

Automate tax payments and filings to reduce manual work and stay audit-ready.

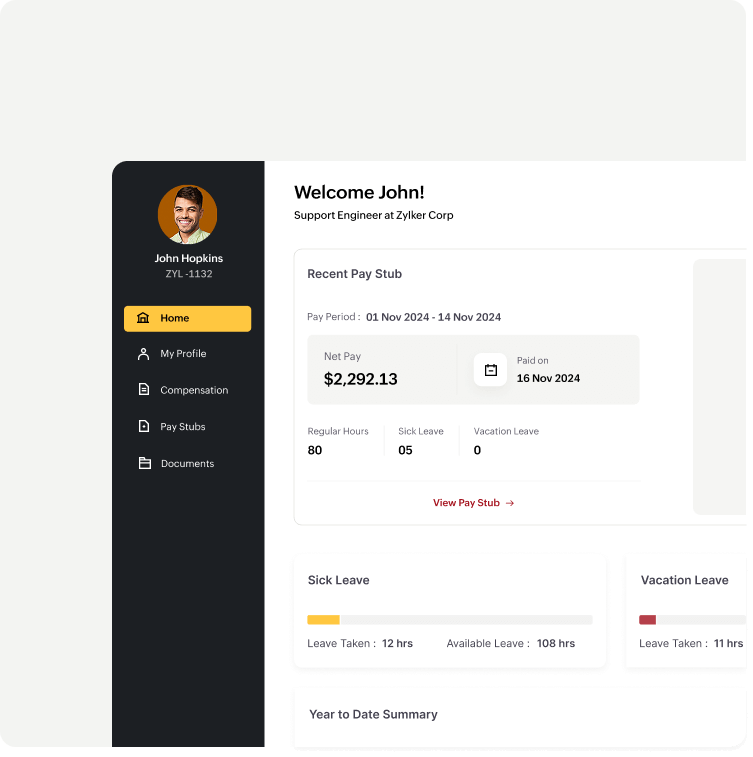

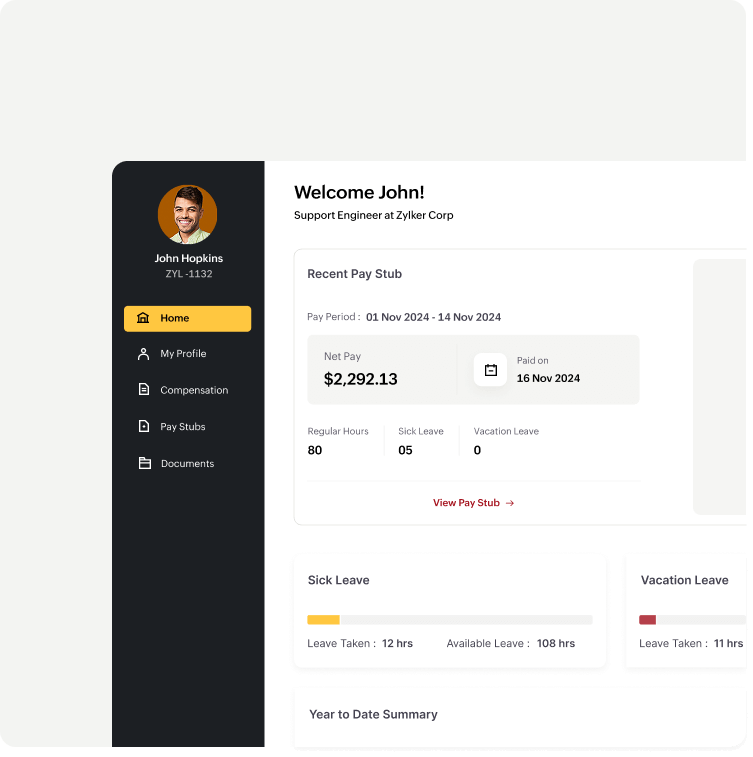

Provide a self-service experience your employees will love

With the cloud-based payroll software, empower employees to submit, track, and access their payroll information through both the web and mobile app.

Access their updated payslips instantly.

Manage payroll tasks effortlessly using the mobile self-service portal.

Log in and out securely from any device.

Get payroll updates quickly with auto-sync.

View and download payroll documents on their own.

Submit proofs and declarations digitally from where ever they are.

Affordable plans packed with all the essential features

Access all the essential features your business needs to run payroll with ease, starting at $29 per month + $5 per employee.

Explore plansGet support from experts

Payroll doesn’t have to be chaotic. We’re here whenever you need a hand.

We're just a call away

Have questions? Reach out to our expert support team by phone or email for quick, reliable help.

US +1-844-557-1787

Monday to Friday (9:00 AM to 7:00 PM)

support.usa@zohopayroll.com

Get answers to all your payroll questions

Access a full range of resources, including guides, articles, and videos that resolve all your payroll-related questions and help you navigate Zoho Payroll with ease.

Everything you need to know before signing up

- What is cloud-based payroll software and how is it different from traditional payroll?

- Cloud-based payroll runs entirely online, allowing access anytime, anywhere, without software installation or update worries. It's described as automated, secure, and scalable, unlike traditional payroll.

- Is cloud payroll software secure for sensitive employee data?

- Yes. Zoho Payroll uses bank-grade encryption, secure servers, and role-based access to protect data. It is compliant with AICPA SOC 2 and GDPR, with regular backups for added protection.

- How does pricing work for Zoho Payroll, a cloud-based payroll software?

- Zoho Payroll offers a simple, transparent pricing model: a fixed monthly base fee plus a small per-employee charge. Users can choose between flexible monthly plans or save more with annual plans, always with no hidden fees. See detailed pricing here >

- How easy is it to switch from my current payroll provider to a cloud-based payroll software?

- Switching to Zoho payroll, a cloud-based payroll software, is described as simple enough. It offers dedicated support, handles data migration, verifies accuracy, and guides users step by step, ensuring a confident switch without losing valuable time.