Full-featured payroll at a fraction of the cost

The fastest way to a worry-free payday

Whether you’re paying hourly staff, salaried employees, or bonuses, you’ll get it right the first time with Zoho Payroll. Less admin work, fewer worries, and more time for your business.

- Handle multi-state payroll and multiple pay rates

- Process bonus and off-cycle pay runs whenever you need to

- Deposit salaries straight into your employees' bank accounts

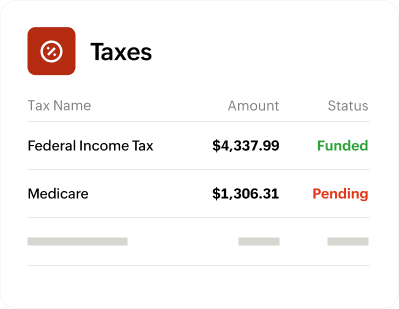

Compliance built right in

Filing your taxes and keeping your business compliant shouldn't come with a surprise bill. Your plan includes automated payroll tax filing, so you're always covered at no extra cost.

- File federal, state, and local taxes automatically

- Generate IRS-compliant forms

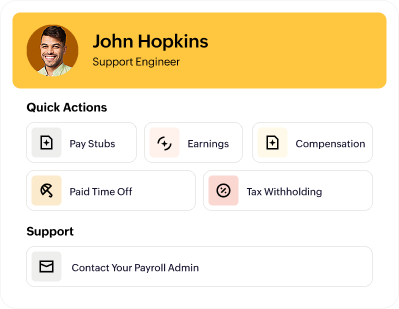

Everything they need, within easy reach

Give your employees instant access to their payroll information through a self-service portal. They can view details, download documents, and manage their payroll needs independently.

- View salary details.

- Download pay stubs.

- Digitally submit W-4s.

- Download W-2s.

- Track leave balances.

- Connect with the payroll team.

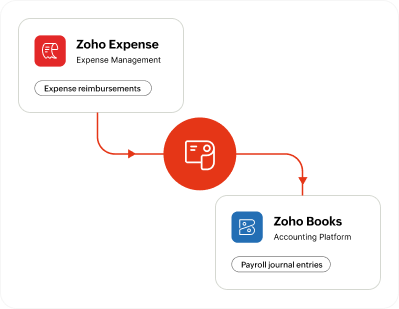

One place for payroll, books, and beyond

Enjoy the full power of the Zoho ecosystem with in-house integrations that just work.

- Connect with Zoho Books to automate payroll journal entries

- Connect with Zoho Expense to process reimbursements with payroll

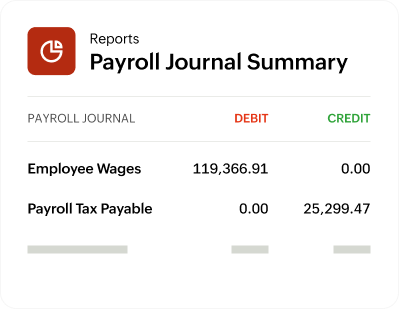

Stay one step ahead with payroll data

Make informed business decisions with comprehensive payroll insights. Access real-time dashboards, detailed reports, and smart reminders to keep your payroll operations running smoothly.

- View and download clear payroll reports whenever you need them.

- Access a real-time dashboard with key metrics.

- Get smart reminders to keep every pay run on track.

Easy on your pocket,

No forced up sells

You get everything you need to run payroll smoothly from day one. No tricks or nudges to make you pay more.

Practically priced

Every dollar delivers real value from payroll automation to built-in tax filing—no bloated features that drive up your costs.

Clear billing for extras

Need to add more users or make a wire transfer? You'll see exactly what it costs before you commit.

Caring for your business

Readily available resources

From setup guides to best practices, get the knowledge you need to manage payroll the right way with our vast collection of help resources.

Community and learning

Exchange ideas, share payroll tips, and learn from your peers through our exclusive community forums built for business owners who do it all.

Dedicated support team

We believe payroll should feel easy, and getting help should be too. Just drop us an email at support.usa@zohopayroll.com to get in touch with us.

Everything you need to know before signing up

- What is Zoho Payroll?

- Zoho Payroll is affordable payroll software from Zoho, packed with all the features you need at a price you'll love. No up sells or hidden fees. Just honest payroll, done right.

- How much does Zoho Payroll cost per month?

- Our Standard plan is $39 per month, plus $6 per employee. That's all you pay. Straightforward pricing with no hidden charges.

- Is there a setup fee or contract lock-in?

- No setup fees, and no long-term contracts. Zoho Payroll is subscription-based, so you pay month to month or year to year and can cancel anytime you want.

- Does Zoho Payroll include tax filing?

- Yes, every plan includes federal, state, and local tax calculations, payments, and filings. We also generate the forms you need like W-4 and update them automatically when laws change.

- Can Zoho Payroll handle both salaried and hourly employees?

- Absolutely. Whether your team is on fixed salaries, hourly wages, or a mix of both, we've got you covered. You can track overtime, add multiple pay rates, and even run off-cycle payrolls when needed. It's flexible enough to fit how you actually pay people.

- Do I need payroll experience to use this?

- No, you don't need any prior payroll experience. Zoho Payroll is designed to be intuitive and user-friendly, with step-by-step guidance and helpful resources to get you started.

- Do you offer a free trial or demo before I commit?

- Yes, you can try our payroll software free for 14 days and explore all the features before you decide. Sign up for the free trial here.