Mileage reimbursement calculator for USA

Easily calculate your business mileage reimbursements based on IRS rates and find your eligible IRS refund with our mileage calculator.

RESULT

Total miles driven 0 Miles

Total estimated mileage deduction $0.00

- $0.00 (0%) of business miles reimbursement

- $0.00 (0%) of medical/moving miles reimbursement

- $0.00 (0%) of charitable miles reimbursement

IRS mileage rates 2025

The table below represents the official IRS standard mileage reimbursement rates, as published for the preceding five years.

| Tax year | Business Mileage Rate ( $ / mile) | Medical / Moving Mileage Rate ( $ / mile) | Charitable Mileage Rate ( $ / mile) |

|---|

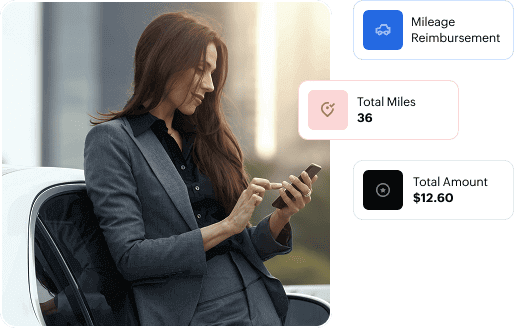

Track and manage mileage expenses automatically with Zoho Expense

Swipe right on automatically tracked rides in your mobile app to make on-the-go mileage claims. Generate regulatory compliant reports to support your IRS reimbursement claims.

Automatically track and classify your drives.

Process reimbursements swiftly and hassle-free.

Easily manage multiple vehicles with different mileage rates.

Convert your mileage logs into reimbursable expenses with just a swipe.

Set custom/regulatory-compliant mileage rates.

Generate and export mileage reports to support your IRS reimbursement claims.

Suggested reading

An IRS calculator helps you calculate the estimated mileage deduction you are eligible for as per the IRS mileage reimbursement regulations.

Any employee, independent contractor, or business owner can determine their estimated IRS mileage reimbursements quickly and accurately with an IRS mileage calculator.

The Internal Revenue Service (IRS) enforces and administers federal tax laws in the US. Every year, the IRS publishes new government regulatory rates for standard mileage reimbursements.

Each year, the IRS sets up a standard mileage reimbursement rate separately classified for business, charitable, and medical/moving travel. These rates can be used to calculate deductible travel expenses under federal tax law by eligible taxpayers.

The IRS sets a standard mileage rate annually for business use of personal vehicles. Reimbursements at or below this rate are generally not taxable, as long as they follow an accountable plan.

The IRS reimbursement rates for 2025 are as follows:

- Business: 70 cents per mile

- Medical/moving (for active-duty military): 21 cents per mile

- Charitable: 14 cents per mile

The 2024 IRS mileage reimbursement rates are as follows:

- 67 cents per mile for business use and self-employed individuals

- 14 cents per mile for charitable purposes

- 21 cents per mile for medical and moving purposes for qualified active-duty military personnel

Every business, big or small, incurs expenses to build and run their operations. These expenses are completely or partially eligible for tax deductions based on the rules set by local regulatory authorities. In the US, the Internal Revenue Service (the IRS) is the regulatory authority tasked with determining these business expense deductions. Check out our blog post A complete guide to business expense tax deductions to maximize write-offs for US businesses to learn more about business expense tax deductions.

Mileage reimbursement refers to the amount paid by employers to employees for the costs associated with use of their personal vehicle(s) for business purposes. Employees are reimbursed based on a rate set by official bodies, like the IRS (in the US) and the HMRC (in the UK). Check out our blog post to learn more about mileage reimbursement.

Yes, gas expenses are included in mileage reimbursement when your company uses the IRS standard rate method. There is no need to submit a separate expense for gas, as it's already accounted for in the reimbursement rate.

According to the IRS, employees must maintain a record of the trip's date, total miles traveled, destination, and the purpose of the trip to qualify for mileage reimbursement. Zoho Expense simplifies this process by allowing you to track and store these records within the app, and even export the details as a report for easy submission.

Business mileage includes trips directly related to work, such as meeting clients, making sales calls, picking up inventory, or attending business meetings. For mixed-use vehicles, only the mileage driven for business purposes is deductible. To track this accurately, you can use a mileage log or applications like Zoho Expense and apply either the actual cost or standard mileage rate method. Personal detours during business trips are not eligible for reimbursement.