Back

What does “Include the transactions in VAT return” mean and for what type of accounts can it be used?

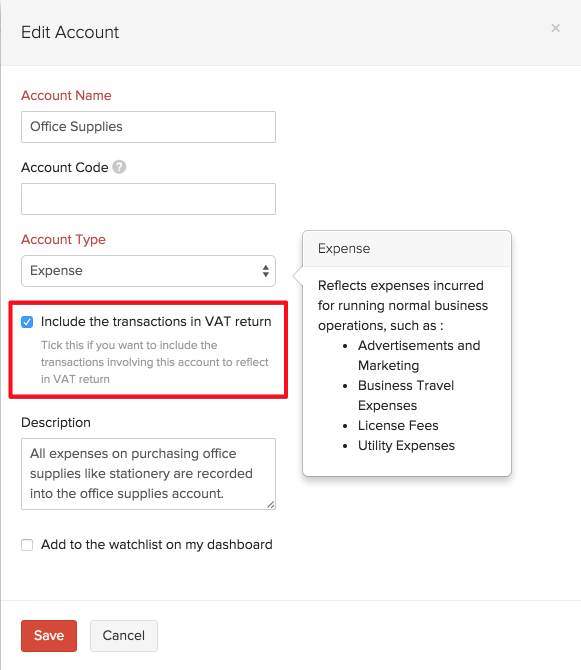

In the Chart of Accounts section under the Accountant tab, when you select a particular account, an Edit Account comes up. You will see a checkbox against Include the transactions in VAT return.

If the checkbox is selected, any transaction you create for this account will be included in the VAT return that will be generated at the end of the reporting period.

This option will be available for all the Income, Expense and Fixed Asset accounts.

Yes

Yes