Sales Tax Automation

Sales tax is a consumption tax collected from your customers at the point of sale and paid to the state or local tax authorities. In the U.S., each state and local jurisdiction has its own tax rates. The tax you collect depends on where your business operates, where your customers are located, the goods or services you sell, the states where you’re registered for tax, and whether your customers qualify for exemptions, such as resellers, non-profit organizations, or government entities.

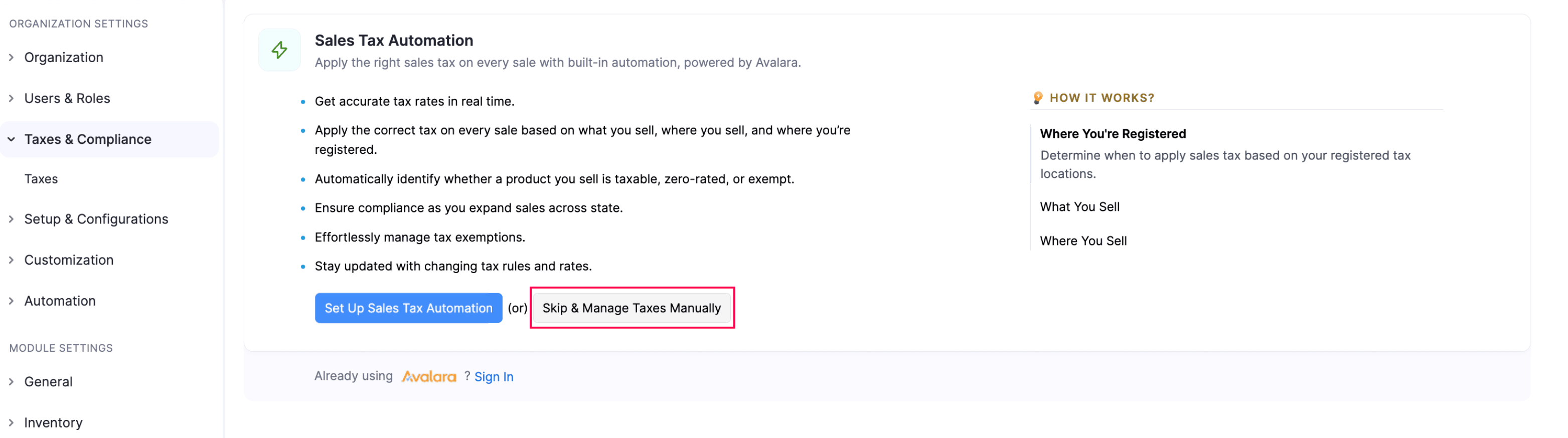

Sales tax is complex because tax rates often vary across states, counties, cities, and special tax districts. Some goods and services are taxable, while others are exempt or partially-taxable. To make tax calculation easier, you can use Sales Tax Automation, which automatically determines and applies the right sales tax for your transactions.

When you enable Sales Tax Automation in Zoho Books and enter all the required details, the system automatically calculates the correct sales tax and identifies valid tax exemptions for your transactions. This ensures that you comply with sales tax regulations effortlessly.

Choose the Right Sales Tax Approach

Choose how you want to handle sales tax for your transactions in Zoho Books. You can automate it or do it manually, based on your business requirements. To do this:

- Log into your Zoho Books organization.

- Go to Settings.

- Select Taxes under Taxes & Compliance.

On the Taxes page, choose one of the following approaches:

Enable Sales Tax Automation

If you want to automate tax calculation for every sale in Zoho Books instead of applying taxes manually, you can choose to enable Sales Tax Automation. This works best when:

- You sell in multiple jurisdictions (even within the same state or zip code), where tax rates vary.

- You sell goods or services which are taxed differently, such as some goods are taxable, some are exempt, and some are partially taxable.

- You want Zoho Books to automatically update tax rates when laws or regulations change.

- You work with tax- exempt customer (like, resellers, non-profit organizations, and more), and want these exemptions to be applied correctly to your transactions.

If the above suits your business needs, you can enable and use Sales Tax Automation in Zoho Books.

Note:

If you already have an Avalara account, you can integrate it with Zoho Books and use it for automated tax calculations. Learn more about Avalara AvaTax Integration.

Calculate Tax Manually

If you know which tax is applied to every sales transaction, you can choose to apply taxes manually. To do this, you need to add the required tax rates in the Taxes module, and then apply them to your transactions. This works best when:

- You sell limited goods or services in a few jurisdictions where the tax rate is the same for all of them.

- You rarely handle tax-exempt customers.

- You prefer to update tax rates yourself whenever the law or regulations change.

If you choose to manage taxes yourself, click Skip & Manage Taxes Manually at the bottom of the Taxes page.

How Sales Tax Automation Works

Zoho Books uses Avalara’s tax engine to automatically calculate the right sales tax for each transaction based on:

- Where your business operates, and where your business is registered for tax and is liable to collect sales tax.

- Your customers’ billing or shipping addresses.

- The tax category of the goods or services you sell.

- Any applicable customer exemptions, such as resellers, non-profit organizations, or government entities.

Note:

If you create a transaction for a customer in a state where your business is not registered to collect tax, sales tax will not be applied to the customer’s transactions.

Next >

Yes

Yes