VAT Payments

Note: This help guide is for the UK edition of Zoho Books only.

In Zoho Books, we offer you two methods to generate and file your VAT returns. You can generate VAT returns and:

If you’ve chosen to submit your VAT returns offline, you should know how to record your VAT payment and VAT reclaims.

On the other hand, if you’ve chosen to submit your VAT returns directly through Zoho Books, you should match the VAT payments details from HMRC.

Note: The option to submit VAT returns directly from Zoho Books is applicable only for businesses that have signed up for MTD.

Recording VAT Payment and VAT Reclaim

The complete VAT return report generated from VAT return module under Reports > Taxes will be helpful during your VAT return filing. The report will be in accordance with your VAT accounting period and the transactions recorded in Zoho Books. Once you file your VAT return to HMRC, you can mark the generated VAT return report as filed. After you’ve paid the VAT amount to the HMRC, record the VAT paid in Zoho Books. Also record the VAT amount reclaimed from HMRC.

- Go to VAT tab.

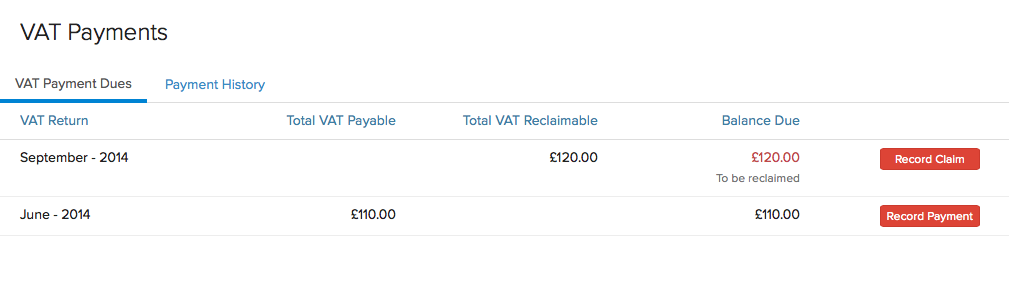

- Select VAT Payments and a list of VAT payments and reclaims if any will be shown according to your VAT return period under the VAT Payment Dues tab.

- This list will be generated as soon as you record filing of your VAT return in the VAT Returns module under Reports.

To Record VAT Payment

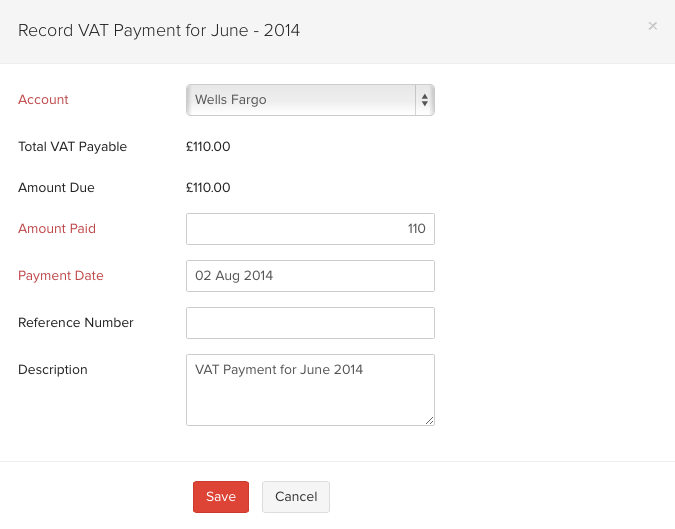

Click on the Record Payment button placed next to a payment which has to be recorded.

In the next window,

* **Account:** Select the bank account configured in Zoho Books from the drop down through which you have paid the VAT amount. * **Amount Paid:** Enter the total amount that you have to paid to HMRC. If you are settling your VAT due by partial payments, record the amount that you have paid partially. Remaining amount can be recorded when you pay them. * Enter the **Payment Date** and enter a reference number and description if necessary. * Click on **Save**.

To Record VAT Reclaim

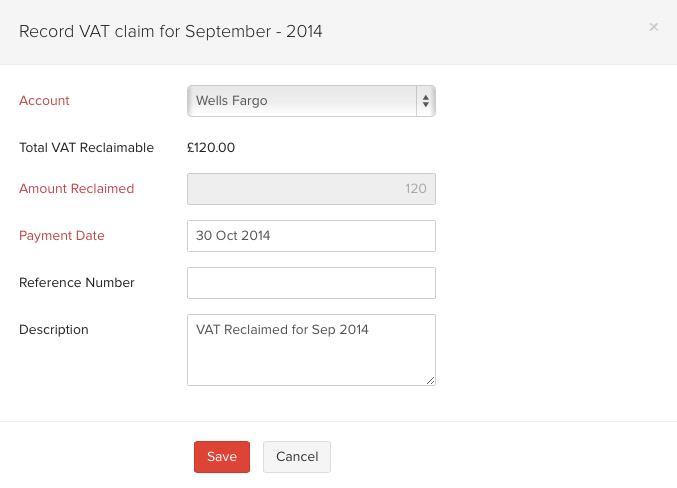

Click on Record Claim button placed next to a claim which has to be recorded.

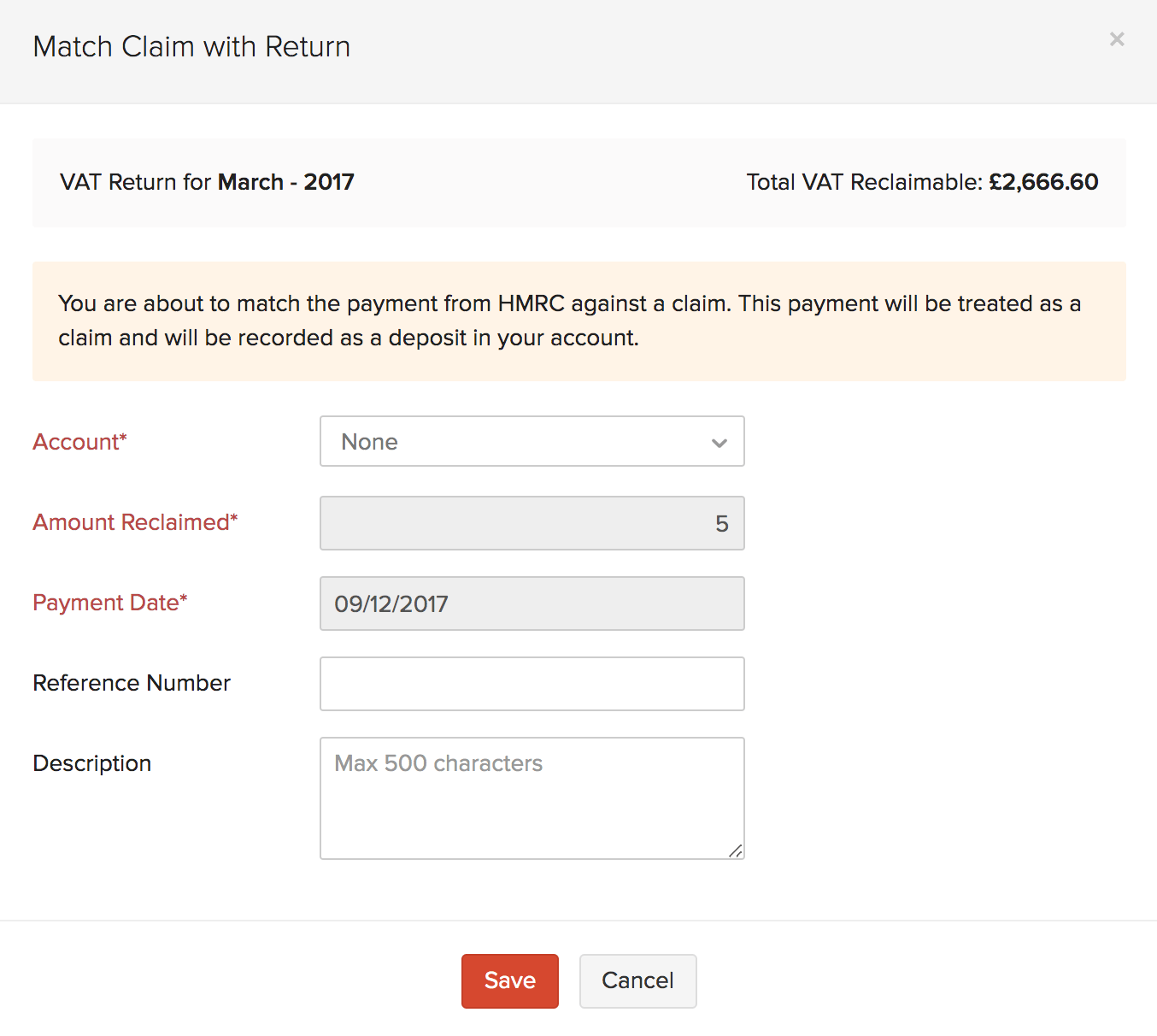

In the next window,

* **Account:** Select the bank account configured in Zoho Books from the drop down. * The **Amount Reclaimed** tab here shows the amount you have reclaimed from HMRC. The reclaim amount is a one time payment made by HMRC. * Enter the **Payment Date** on which the money was transferred to you by the HMRC. Also enter a reference number and description if necessary. * Click on **Save**.

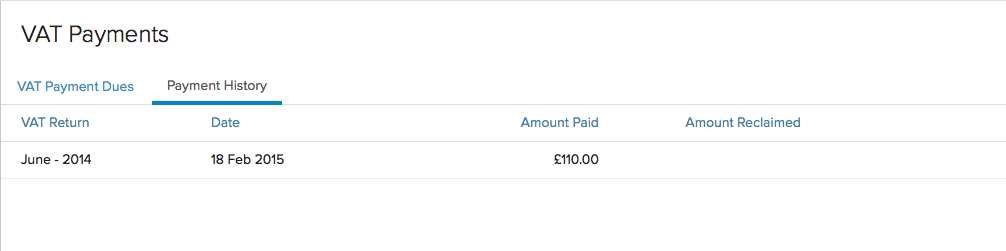

All the VAT Payments or Reclaims that you record will be displayed in the Payment History. You can delete/edit your records in the payments history tab to record it again with modifications if any.

Match VAT Payments From HMRC

Zoho Books fetches the payments details from the HMRC and you can match them with the corresponding return.

Note: If you’ve chosen to generate and submit VAT returns through Zoho Books, you will not be able to record or reclaim payments manually in Zoho Books.

You should manually fetch payments from the HMRC to import them into Zoho Books. To fetch payments:

- Go to the VAT tab.

- Select VAT Payments.

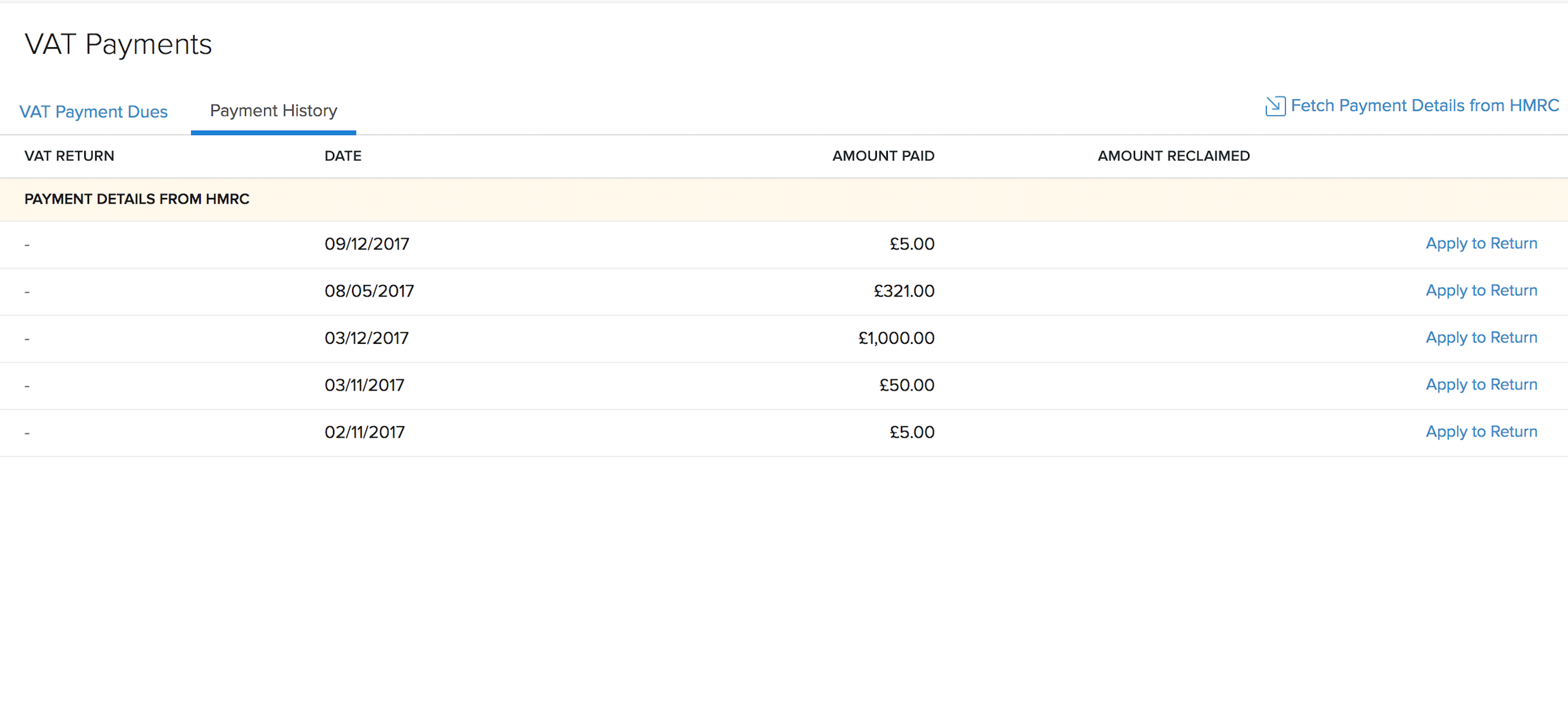

- Go to the Payment History.

- Click Fetch Payments Details on the top right corner.

Once your payments have been imported to Zoho Books, you will be able to match payments and claims with the returns .

Match VAT Payments From HMRC with the returns

- Go to the VAT tab.

- Select VAT Payments.

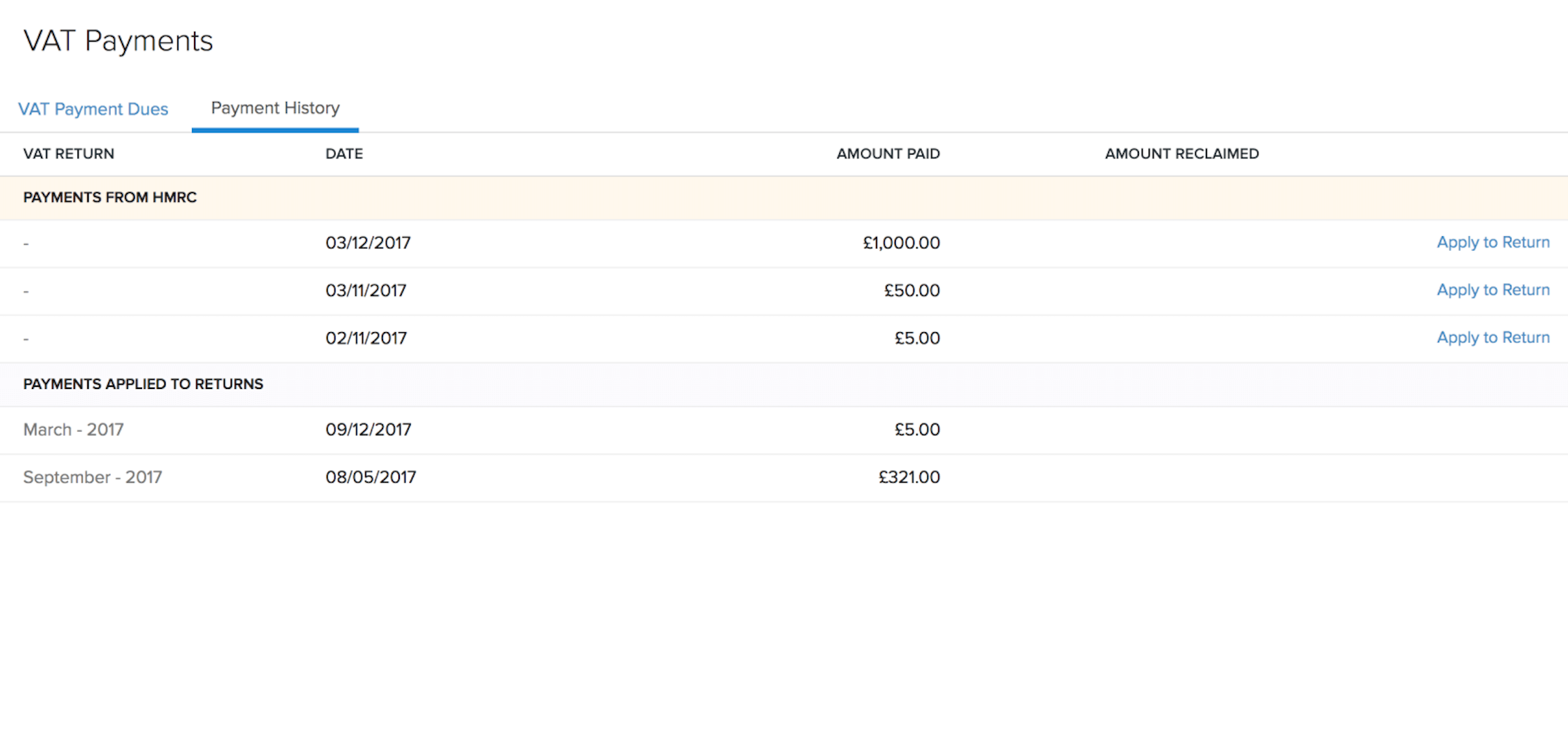

- Go to the Payment History.

- Click Apply to Return button placed next to a payment which has to be matched.

In the Match Payment with Return pop up, select the corresponding VAT return from the options available in the dropdown.

- Click Save.

In the next window,

- Enter the Account, Payment Date, Reference Number and a description.

- Click Save.

Match VAT due payments with Returns

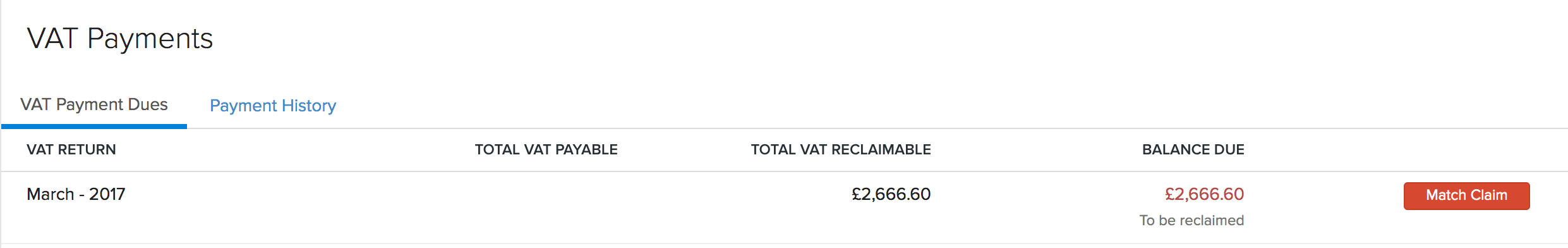

- Go to the VAT tab.

- Select VAT Payments.

- Go to the VAT Payment Dues.

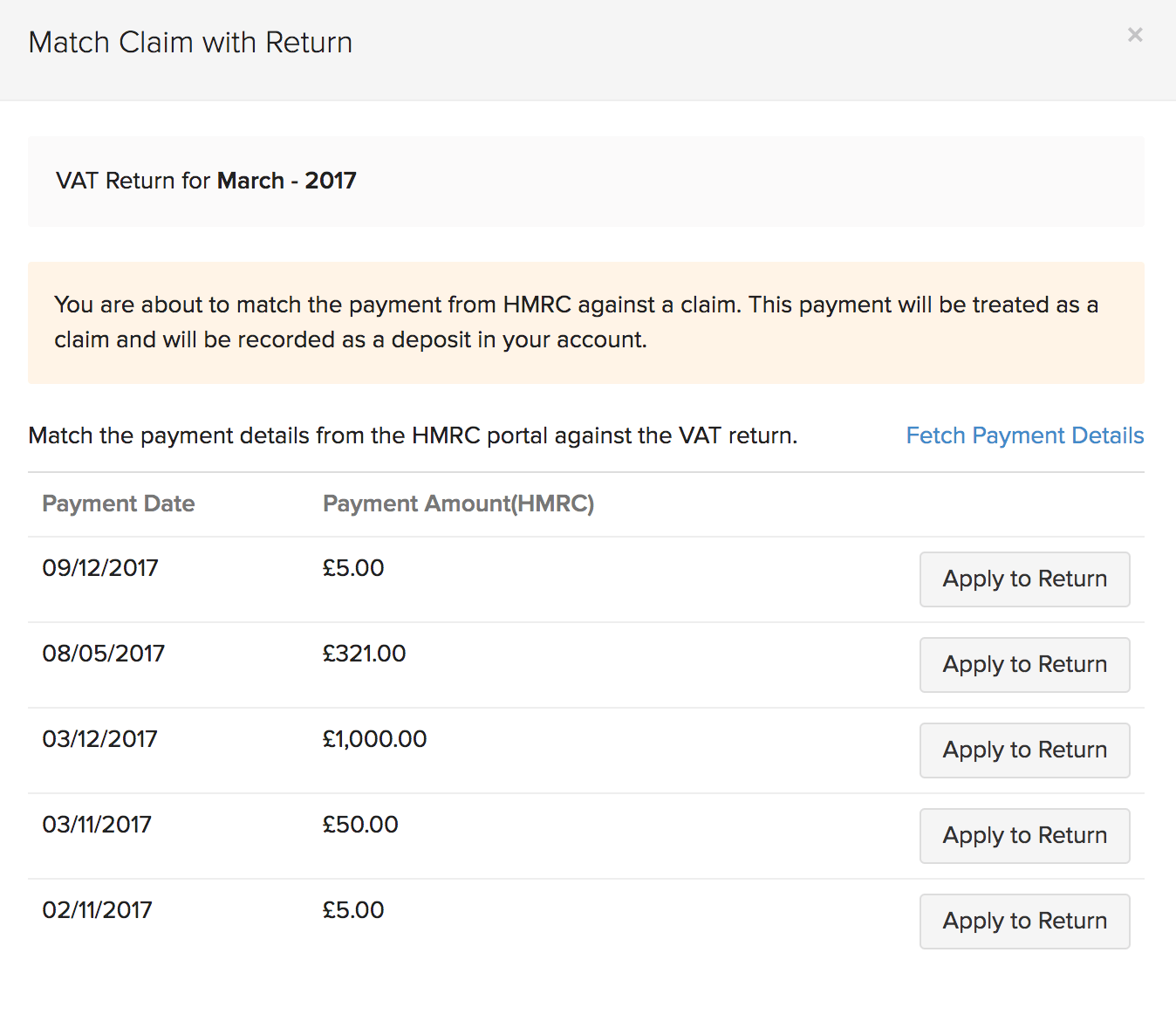

- Click Match Claim next to the return which has to be matched.

- Click Apply to Return next to the Payment details.

- Enter the Payment Date, Reference Number and a description, if necessary.

- Click Save.

Yes

Yes