VAT MOSS in Sales Transactions

Notes: Post Brexit (i.e. from 1 January 2021), the tax treatment for all the countries outside the UK will be considered as Overseas. Therefore, UK VAT MOSS will not be applicable when digital services are provided for businesses that are located outside the UK. Instead, you can register for the Non-Union VAT MOSS scheme in an EU member state or register for VAT in each EU member state where you supply digital services.

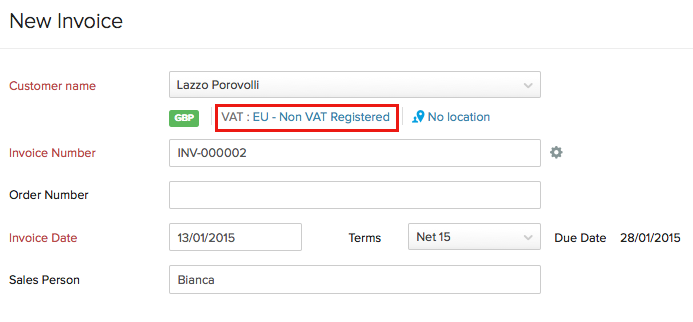

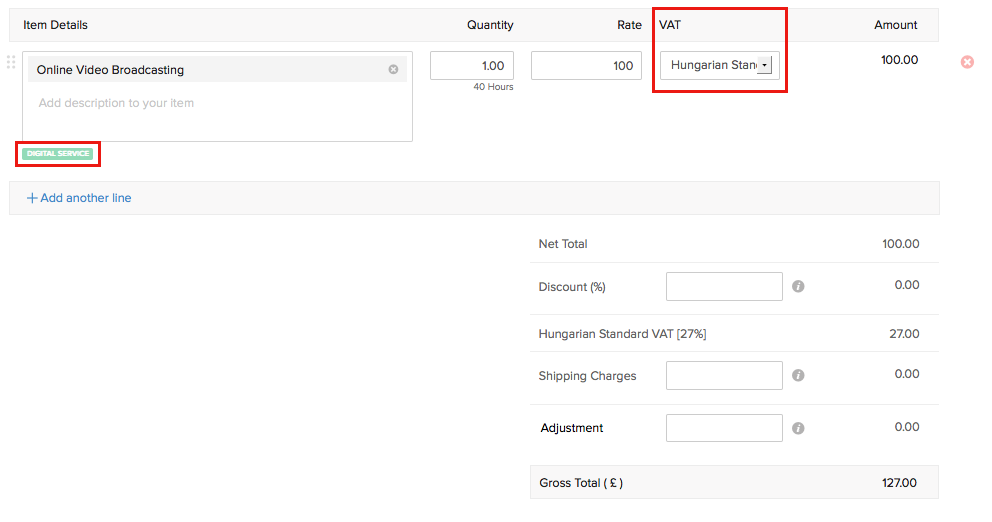

VAT MOSS is applicable only on the sales of a digital service to a EU-Non VAT Registered customer. When creating a sales transaction i.e: Quote, Invoice, Sales Order etc, make sure that,

Customer’s VAT treatment is EU-Non VAT Registered.

The item added is a Digital Service.

The VAT rate for the EU member country to which you sell the service should be selected.

After completing other relevant information, you can send the invoice to your customer.

Once the sales transaction is sent, the tax information will be recorded in the MOSS report.

Notes:

- You cannot record sales of digital services for different countries in a single sales transaction (Invoice, Quote, Sales Order etc.). Each country should have a separate sales transaction.

- VAT rate of other member countries cannot be used for VAT Treatments other than EU-Non VAT Registered & item type as Digital Service.

- Any number of Digital Service items can be added in a single sales transaction for the same country.

Quick Tip:

While processing the sale of cross-border digital services, it is important to know the place of supply so as to apply the correct VAT rate. To ease the process of obtaining this information, you can presume your customers’ place of residence based on any accompanying evidence and apply the VAT applicable in that country.

While Zoho Books does not have the option to enter the evidence information directly, we recommend that you use Custom Fields to store this information for your reference while creating invoices.

Yes

Yes