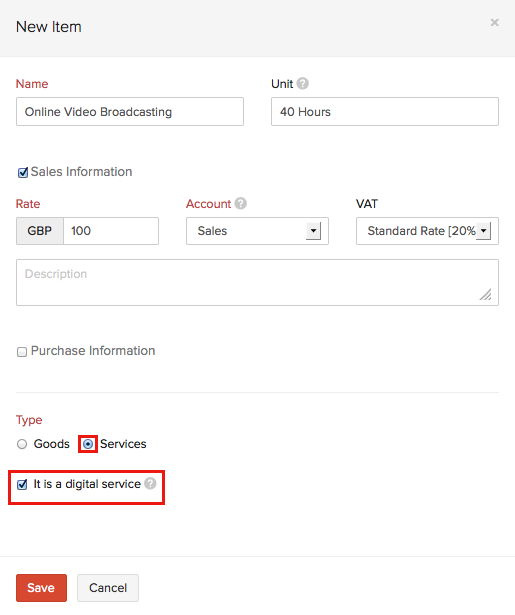

Creating a Digital Service as an Item

To create a digital service in Zoho Books,

- Navigate to the Items tab and select + New Item.

- Enter details of the digital service you provide in the item creation form.

- When selecting the product type, select Services.

- Now, check the Is it a digital service box, this will save the item as a digital service.

- Click on Save.

P.S: If you select a UK VAT rate for the digital service item while creating, it will be applied only on sales inside UK.

Notes: Post Brexit (i.e. from 1 January 2021), the tax treatment for all the countries outside the UK will be considered as Overseas. Therefore, UK VAT MOSS will not be applicable when digital services are provided for businesses that are located outside the UK. Instead, you can register for the Non-Union VAT MOSS scheme in an EU member state or register for VAT in each EU member state where you supply digital services.

Notes: Post Brexit (i.e. from 1 January 2021), the tax treatment for all the countries outside the UK will be considered as Overseas. Therefore, UK VAT MOSS will not be applicable when digital services are provided for businesses that are located outside the UK. Instead, you can register for the Non-Union VAT MOSS scheme in an EU member state or register for VAT in each EU member state where you supply digital services.

Yes

Yes