Making Tax Digital for Income Tax

Making Tax Digital for Income Tax is an initiative by HMRC (His Majesty’s Revenue & Customs) that requires sole traders with an annual turnover over £50,000 to file their taxes online every quarter.

You can connect your Zoho Books organisation with HMRC to fetch and view your quarterly submission obligations. Next, map the accounts in Zoho Books to the respective categories. Once done, you can finalise and submit the quarterly updates to stay compliant and maintain accurate financial records.

Prerequisite:

You can fetch and submit quarterly updates only if the Business Type is set to Sole Trader during your Zoho Books organisation setup. If you’re an existing user, you can update this under Settings > Organisation > Profile.

Enable Making Tax Digital for Income Tax

To enable Making Tax Digital for Income Tax in your Zoho Books organisation:

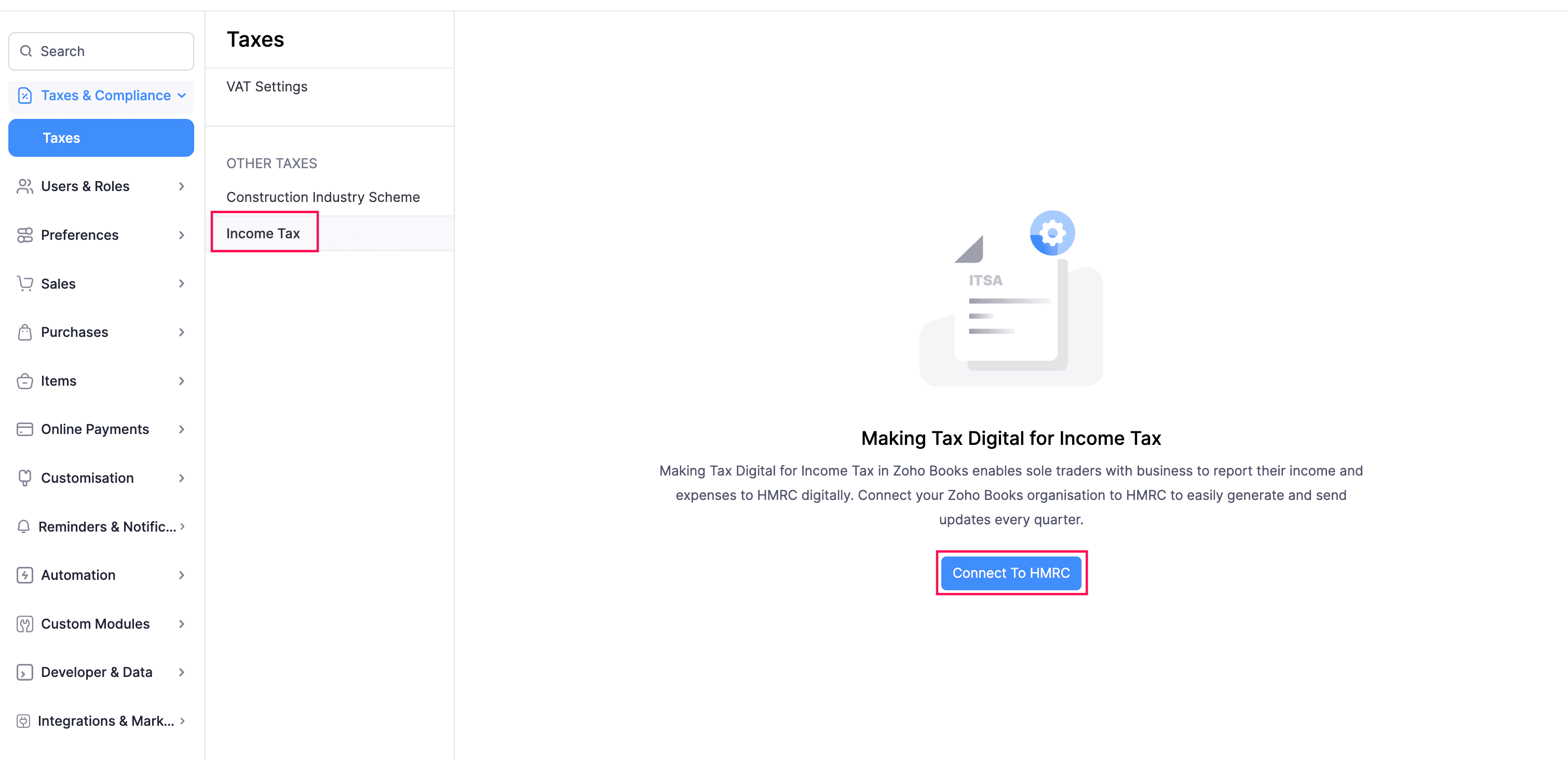

Go to Settings.

Select Taxes under Taxes & Compliance.

In the Taxes pane, select Income Tax under Other Taxes.

In the Income Tax page, click Connect to HMRC.

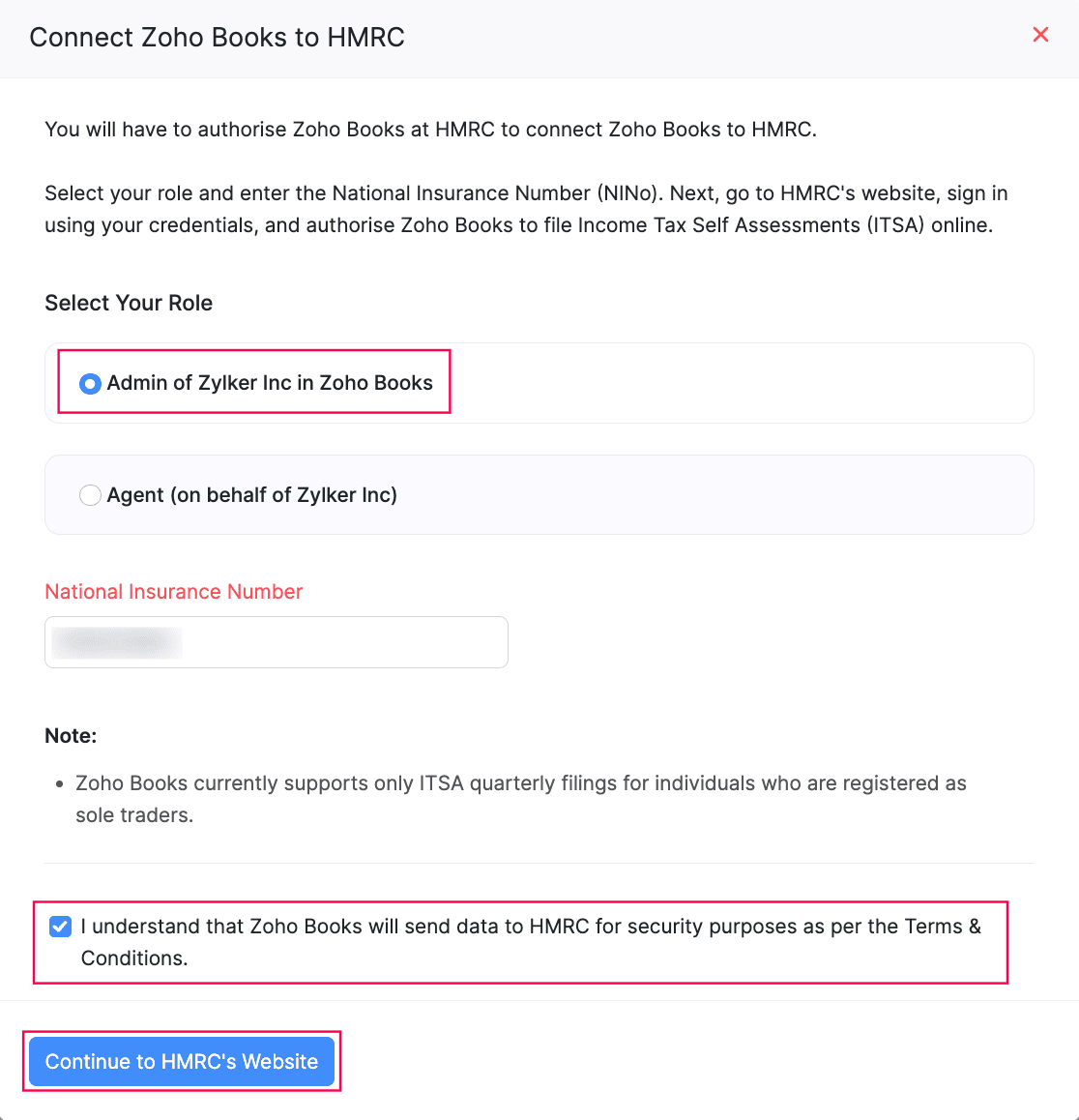

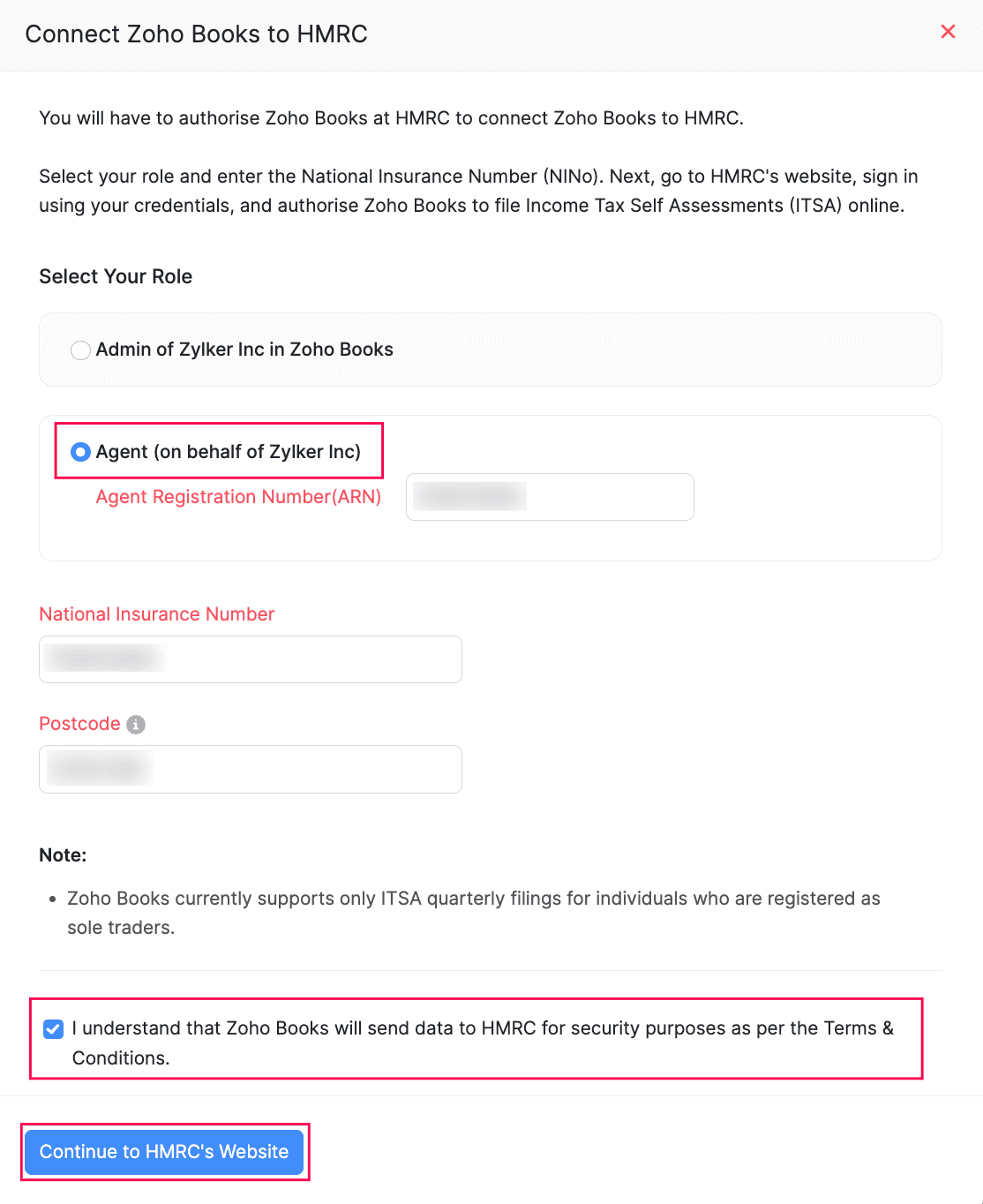

In the Connect Zoho Books to HMRC pop-up, choose:

- Admin if you’re the business owner submitting the quarterly updates to HMRC through Zoho Books, or

- Agent if you’re an accountant submitting the quarterly updates on behalf of your client. Ensure that you’re authorised as an agent by HMRC before submitting the updates.

If you choose Admin, fill in the following fields:

- National Insurance Number: Enter the unique number issued by HMRC.

- Read and agree to I understand that Zoho Books will send data to HMRC for security purposes as per the Terms & Conditions.

- Click Continue to HMRC’s Website.

- Enter the required credentials and click Sign in. You’ll be redirected to your Zoho Books organisation.

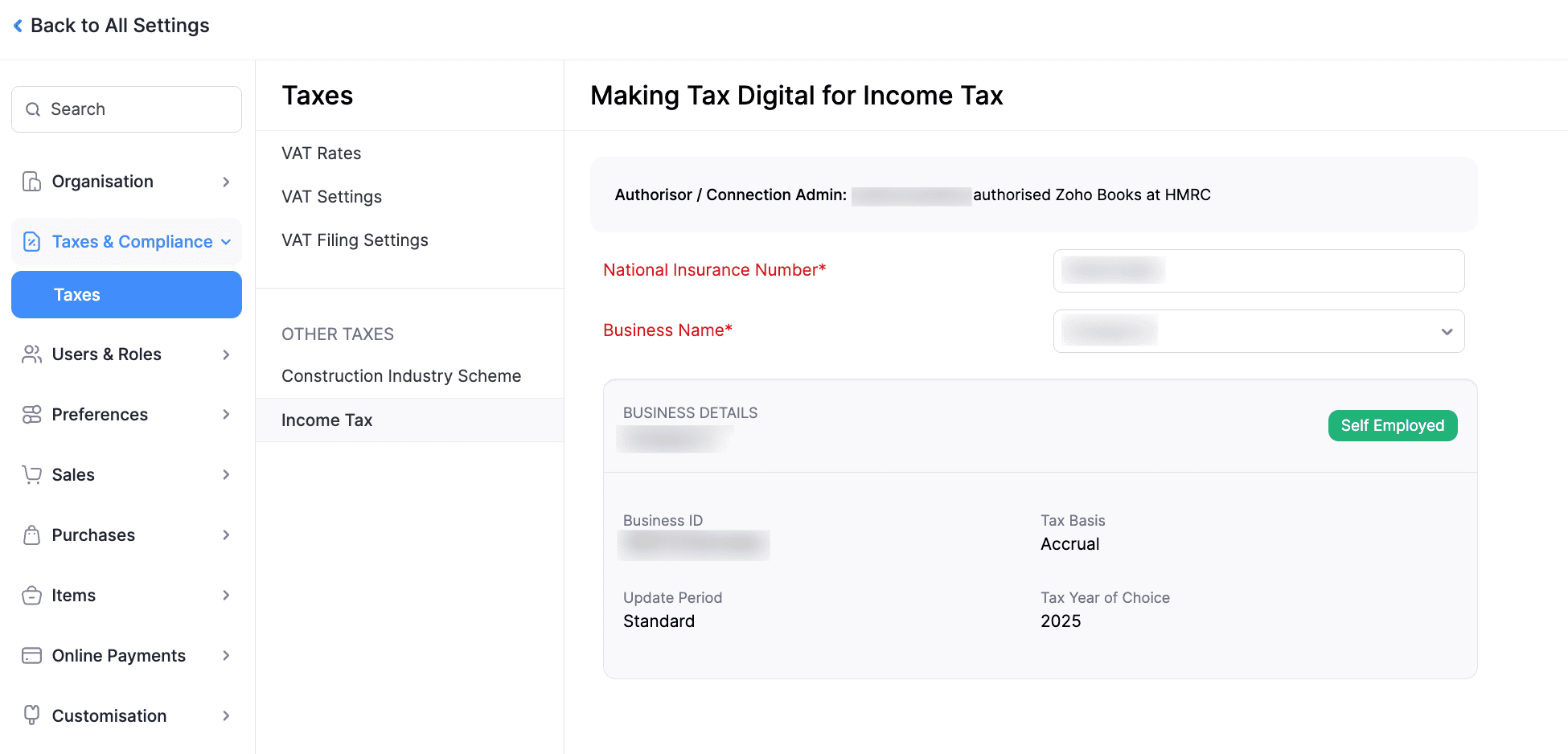

- In the Making Tax Digital for Income Tax page, select the Business Name that is registered with HMRC. Your business details will be displayed.

- Verify the details and click Save.

If you choose Agent, fill in the following fields:

- Agent Registration Number (ARN): Enter the unique number issued by HMRC when you were authorised as an agent eligible to submit quarterly updates.

- National Insurance Number: Enter the unique number issued by HMRC to your client.

- Postcode: Enter the postcode of your client’s business for verification.

- Read and agree to I understand that Zoho Books will send data to HMRC for security purposes as per the Terms & Conditions.

- Click Continue to HMRC’s Website.

- Enter the required credentials and click Sign in. You’ll be redirected to your Zoho Books organisation.

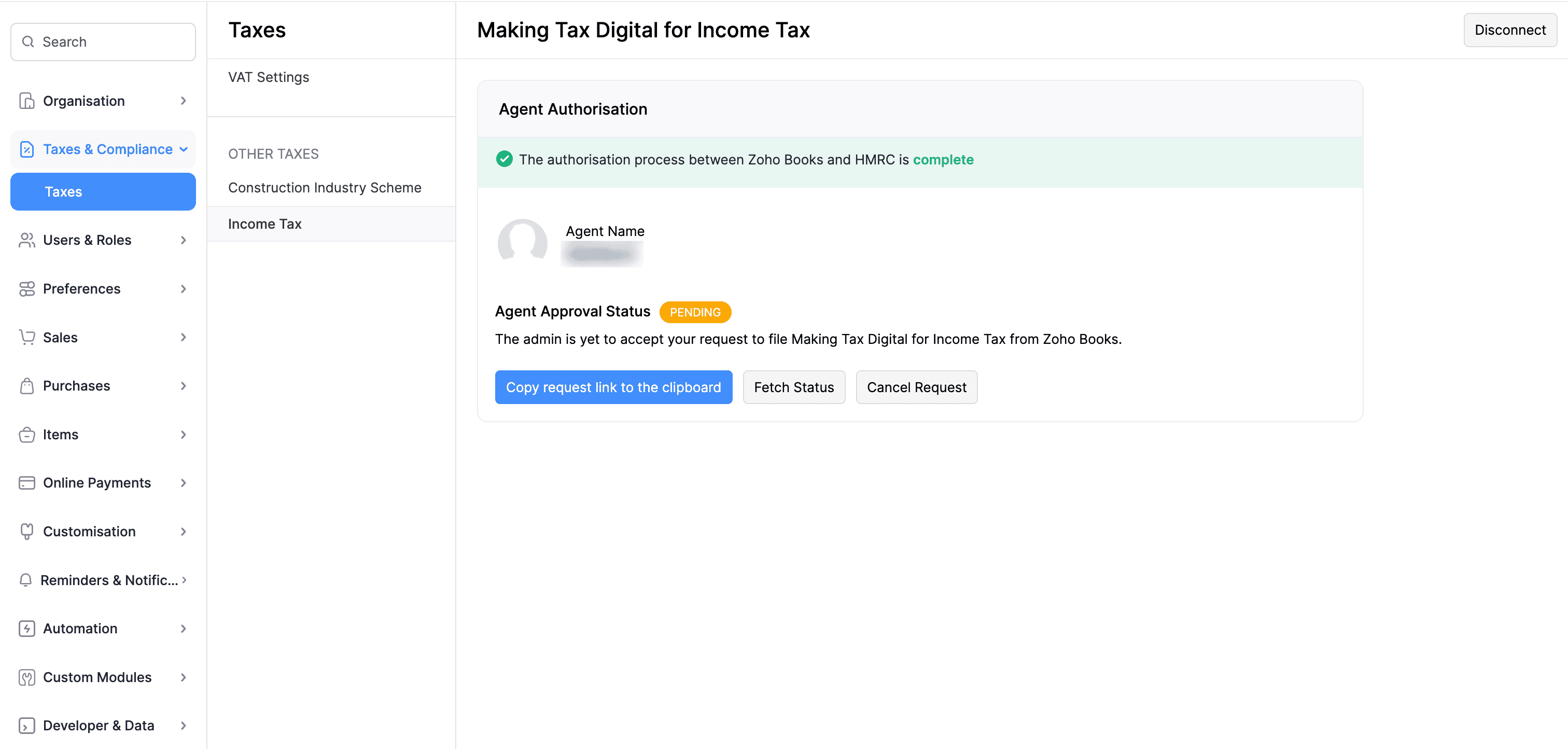

- In the Making Tax Digital for Income Tax page, the request for authorisation will appear with the Pending status. An email will be sent to your client’s Zoho Books organisation for approval. After approval, you can start submitting the quarterly updates on their behalf. You can also perform the following actions:

- Copy request link to the clipboard: Click to copy the request link and send it manually to your admin.

- Fetch Status: Click to check if your admin has approved your request to submit quarterly updates. If approved, the request’s status will be changed to Accepted.

- Cancel Request: Click to cancel the approval sent to your admin. Once cancelled, the request’s status will be changed to Cancelled. To send the approval request to your admin, click Send Request.

- Once your client approves the request, select their Business Name registered with HMRC. Their business details will be displayed.

- Verify the details and click Save.

You can now fetch and submit the quarterly updates to HMRC directly from your Zoho Books organisation.

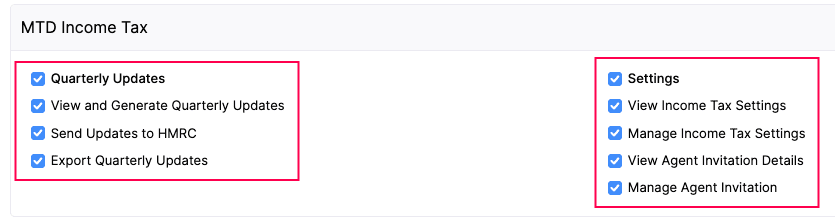

Create a Role for Quarterly Updates, Tax Settings, and Agent Invitations

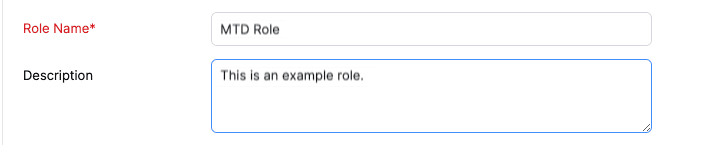

You can create a role to let users view, generate, send, and export quarterly updates, view and manage income tax settings, and access agent invitation details. Enable the permissions you want the role to have access to based on your preferences. To create the role:

Go to Settings.

Select Users under Users and Roles.

Click New Role in the top right corner.

On the New Role page:

- Enter the Role Name and an optional Description.

- Under the MTD Income Tax section, select the permissions you need:

- Quarterly Updates: Check this to enable all of the following options. You can also check them individually based on your requirements:

- View and Generate Quarterly Updates: Allow users to view and create updates.

- Send Updates to HMRC: Allow users to send updates to HMRC.

- Export Quarterly Updates: Allow users to export updates.

- Settings: Check this to enable all of the following options. You can also check them individually based on your requirements:

- View Income Tax Settings: Let users view tax settings.

- Manage Income Tax Settings: Let users change tax settings.

- View Agent Invitation Details: Let users view agent invitation details.

- Manage Agent Invitation: Let users edit agent invitation details.

- Set other permissions for the role based on your requirements, and click Save.

You can now assign this role to any existing or new users in Zoho Books. These users will then have the necessary access. You can also edit existing roles and enable these permissions for them, if needed. Learn about how to add or edit users with the necessary roles in Zoho Books.

Insight: All user changes and the time they occurred are recorded in the Activity Logs & Audit Trail report. To view it, go to Reports > Activity > Activity Logs & Audit Trail.

Fetch Quarterly Updates

To fetch quarterly updates from HMRC into Zoho Books:

Go to Filing & Compliance on the left sidebar and select Income Tax.

In the Making Tax Digital for Income Tax page, click Fetch Details from HMRC. The quarterly submission periods will be fetched from HMRC and displayed in Zoho Books.

Select the quarterly update period you want to submit to HMRC.

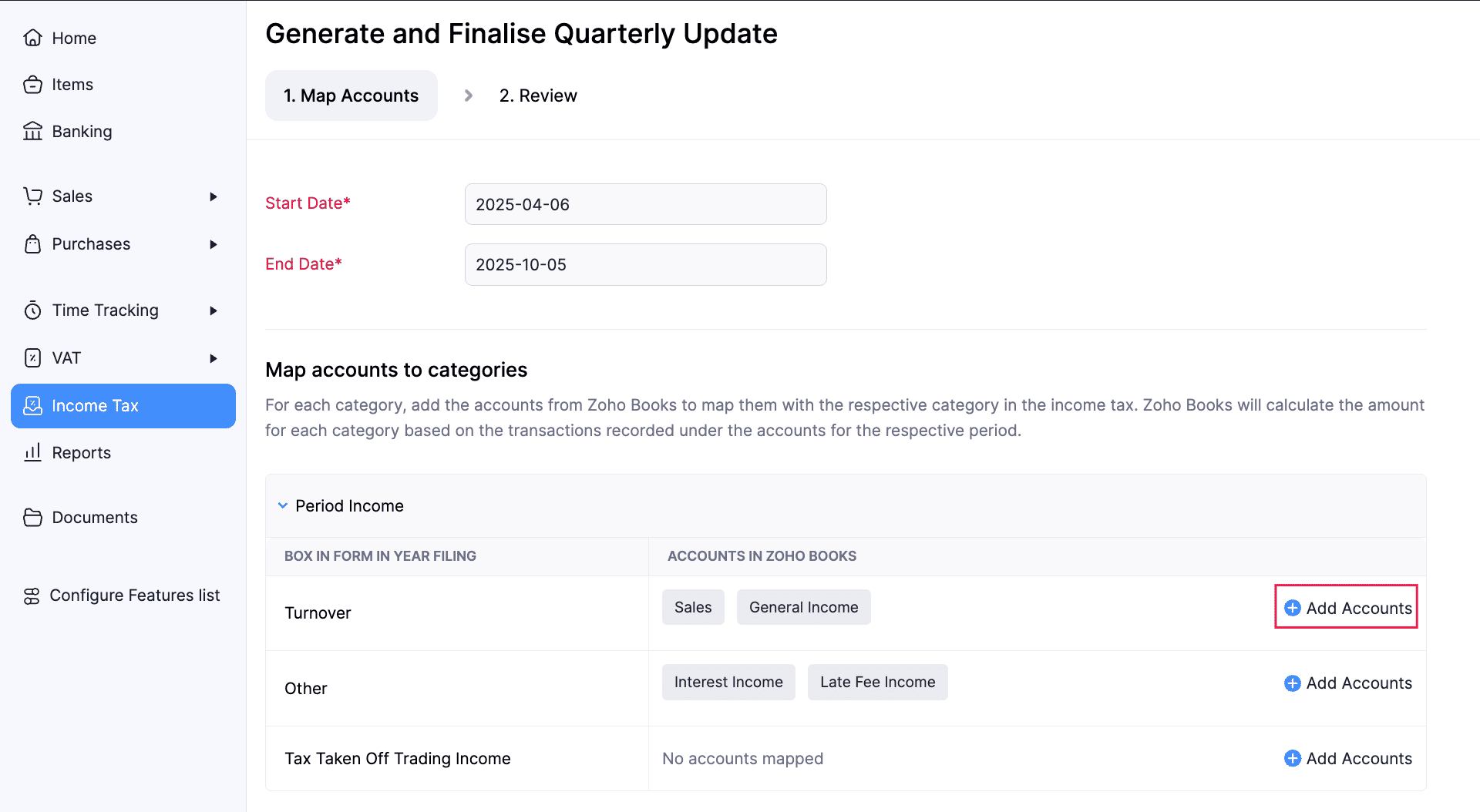

In the Generate and Finalise Quarterly Update page, under the Map Accounts tab, fill in the following fields:

- Map accounts to categories: Map the accounts in Zoho Books to the respective categories in the quarterly update. The available categories are: Period Income, Period Expenses, and Period Disallowable Expenses. To do this:

- Click + Add Accounts next to each category.

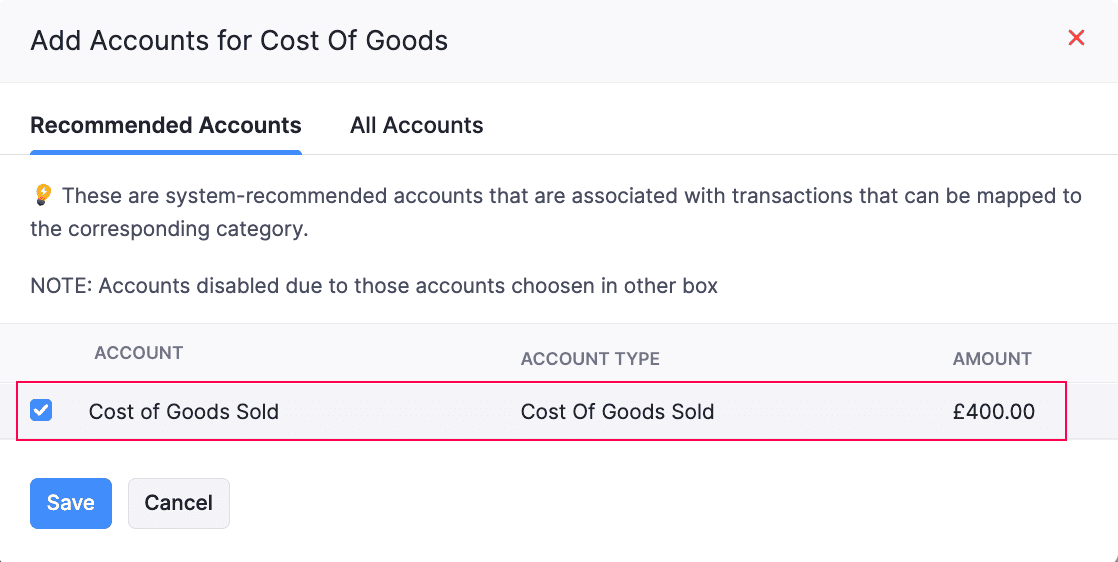

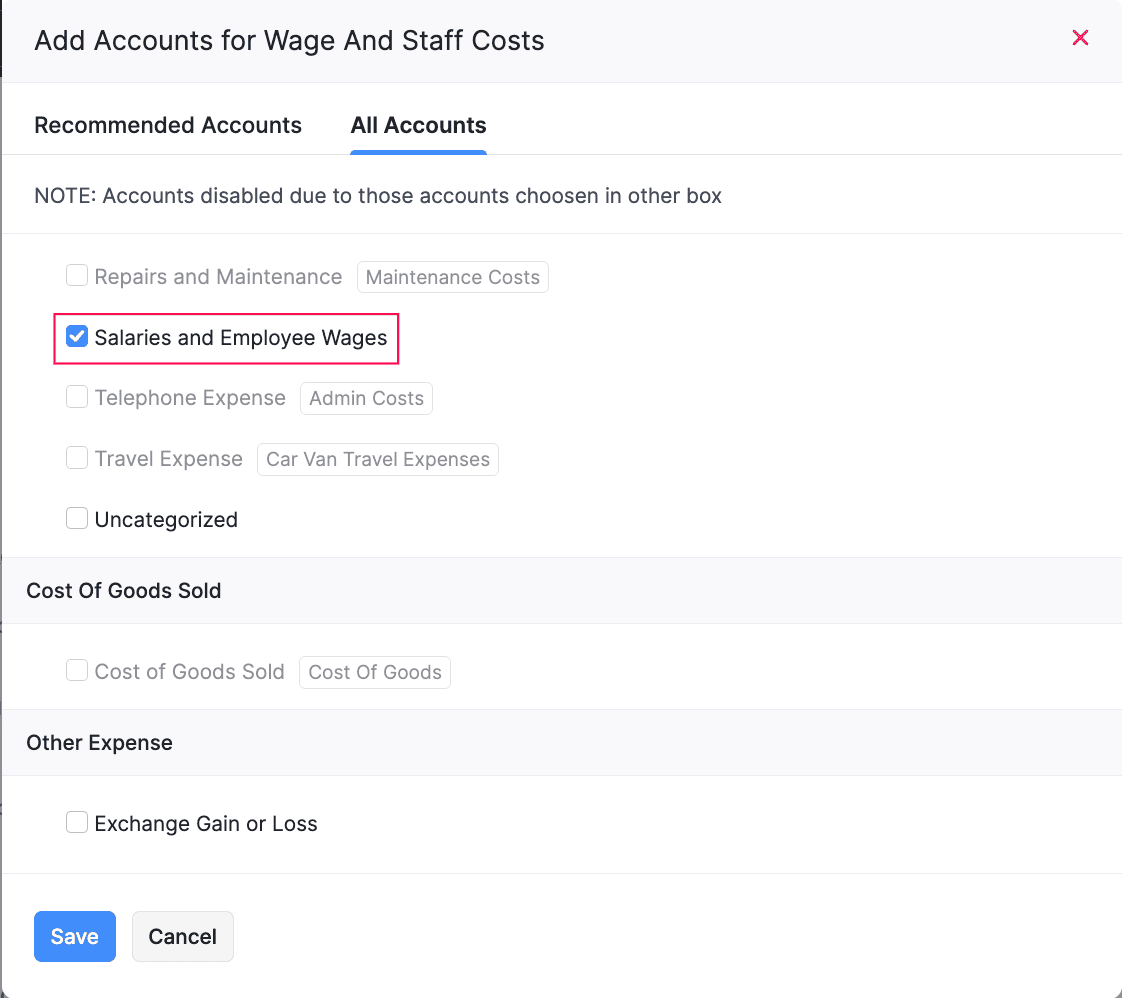

- In the Add Accounts for Category pop-up, under Recommended Accounts, the most relevant accounts will be filtered based on your transactions. Select the required accounts and click Save.

- If not, go to the All Accounts section, select the required accounts, and click Save.

- Once you’ve mapped the required accounts with the categories, click Save and Generate.

Insight:

- Period Income: The total income your business earned in a quarter.

- Period Expenses: The total expenses your business incurs in a quarter. These reduce your taxable profit when calculating income tax.

- Period Disallowable Expenses: The expenses that HMRC doesn’t allow as tax deductions. These are reported separately, and they don’t reduce your taxable profit.

Under the Review tab, verify the amounts included in the respective boxes under each category, and click Finalise Return.

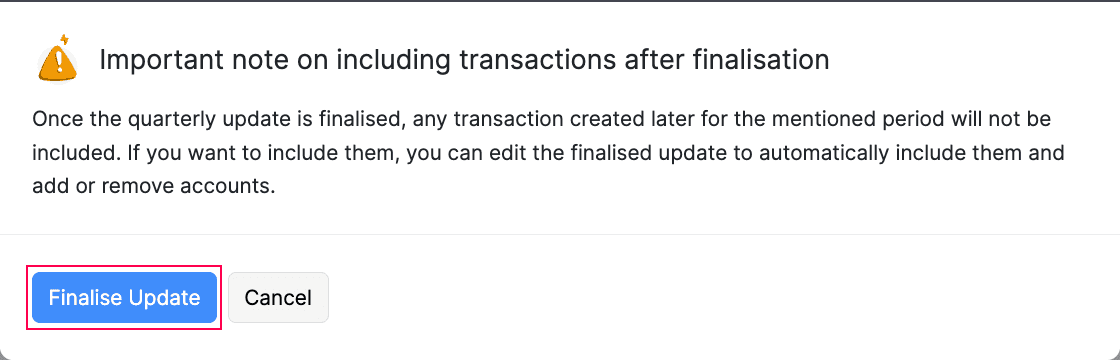

In the pop-up that appears, read and agree to the terms, and click Finalise Update.

The respective quarterly update will be marked as Finalised. You can now submit your quarterly updates to HMRC.

Submit Quarterly Updates

Prerequisite:

Before submitting the quarterly updates to HMRC, ensure that your Zoho Books organisation is connected to HMRC. If not, reconnect to HMRC to submit the updates.

To submit your quarterly updates to HMRC:

Go to Filing & Compliance on the left sidebar and select Income Tax.

Select the tax return you want to submit.

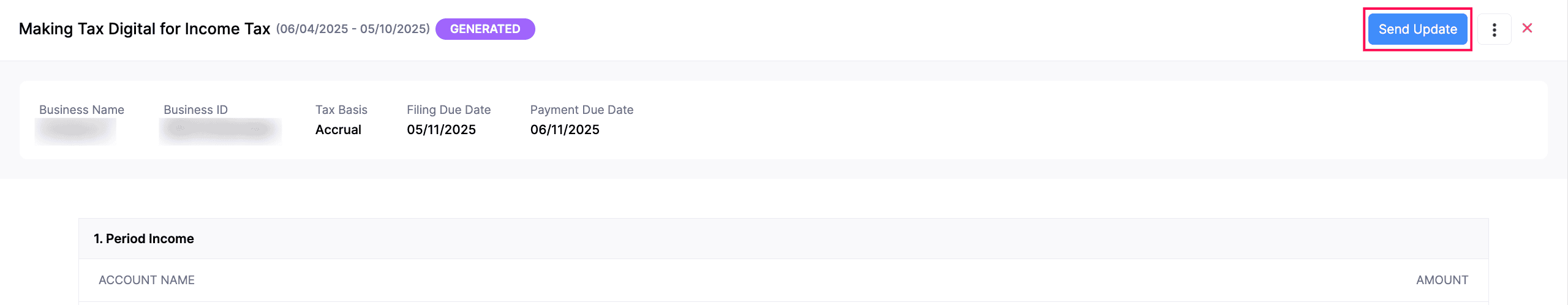

In the Making Tax Digital for Income Tax page, click Send Update in the top right corner.

The quarterly update will be marked as Submitted.

Making Tax Digital for Income Tax - Operations

Edit Quarterly Updates

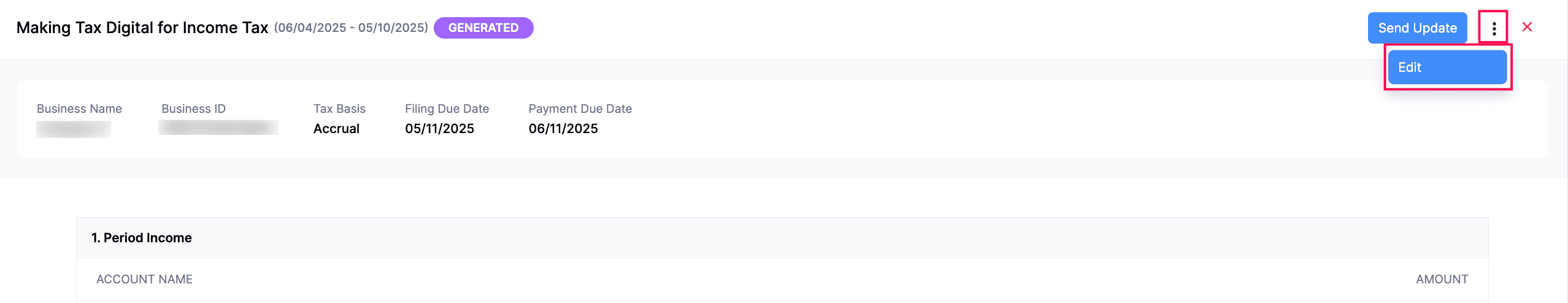

To edit a quarterly update:

Go to Filing & Compliance on the left sidebar and select Income Tax.

Select the quarterly update you want to edit.

In the Making Tax Digital for Income Tax page, click the More icon in the top right corner and select Edit from the dropdown.

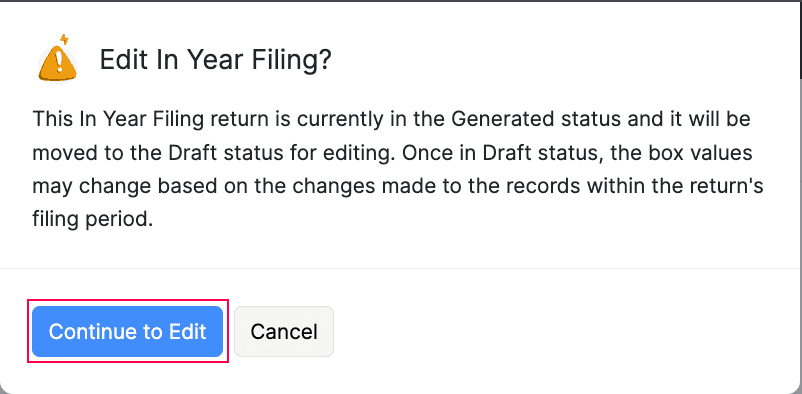

In the Edit In Year Filing pop-up, click Continue to Edit.

In the next page, make the necessary changes, review, and finalise the quarterly update.

The quarterly update will be updated.

Reauthorise Connection With HMRC

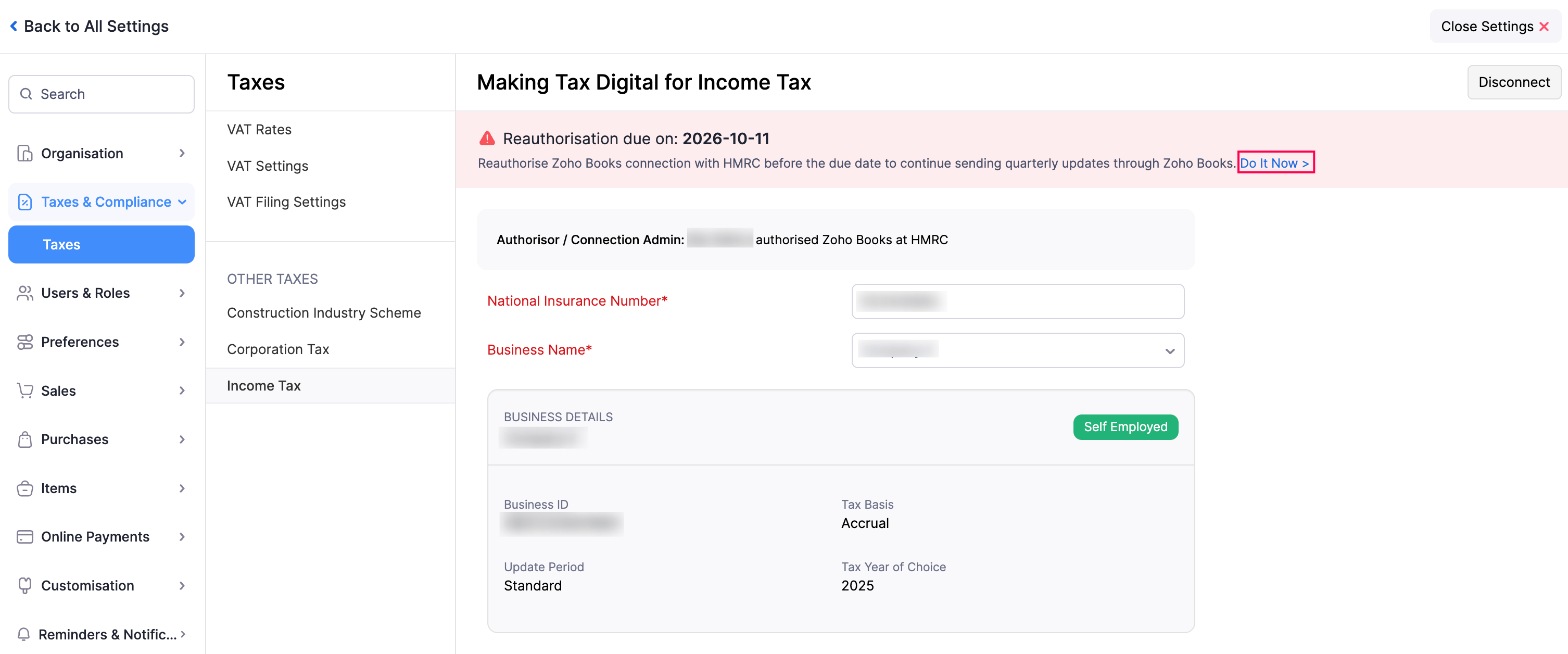

When you connect your Zoho Books organisation with HMRC, the connection will be valid only for 18 months. You won’t be able to send quarterly updates once the connection is expired. If so, you must reconnect your Zoho Books organisation with HMRC. To do this:

Go to Settings.

Select Taxes under Taxes & Compliance.

In the next page, select Income Tax in the Taxes pane.

In the Making Tax Digital for Income Tax page, click Do It Now >. You’ll be redirected to the HMRC’s website.

Enter the required credentials and click Sign in.

Your Zoho Books organisation will be reconnected with HMRC, and you can send quarterly updates with ease.

Disconnect Making Tax Digital for Income Tax

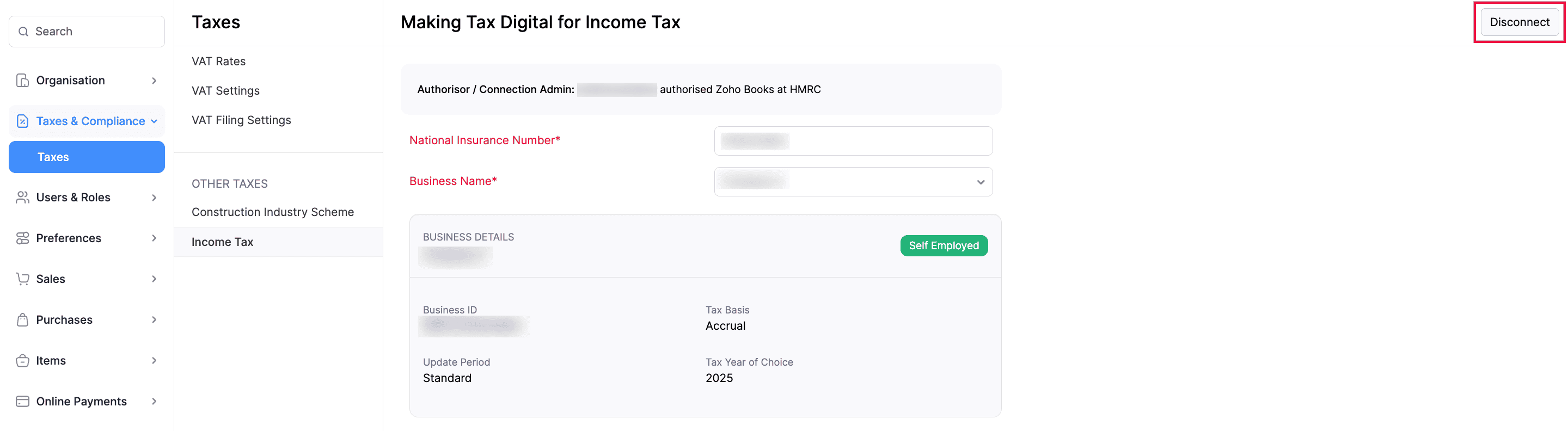

If you no longer want to send quarterly updates to HMRC, you can disconnect Making Tax Digital for Income Tax. To do this:

Go to Settings.

Select Taxes under Taxes & Compliance.

In the next page, select Income Tax in the Taxes pane.

In the Income Tax page, click Disconnect in the top right corner.

In the pop-up that appears, click Disconnect to confirm.

Making Tax Digital for Income Tax will be disconnected from your Zoho Books organisation.

Yes

Yes