- Executive summary

- Introduction

- Social perceptions of EVs in India

- ICE (Petrol/Diesel) owners' perspective

- Perspective of people without vehicles

- EV owners' perspective

- Two-wheelers

- BEVs (Battery Electric Vehicles)

- Hybrids (PHEV, MHEV, HEV)

- Electric bicycles in India

- Electric public transportation in India

- Conclusion

- Survey methodology

Executive summary

This report presents key insights from a recent survey conducted by Zoho Survey, aimed at capturing the pulse of India’s electric vehicle (EV) landscape. The survey gathered perspectives from a wide range of respondents—across different regions, ownership types, and usage patterns to understand what drives EV adoption and what continues to hold it back.

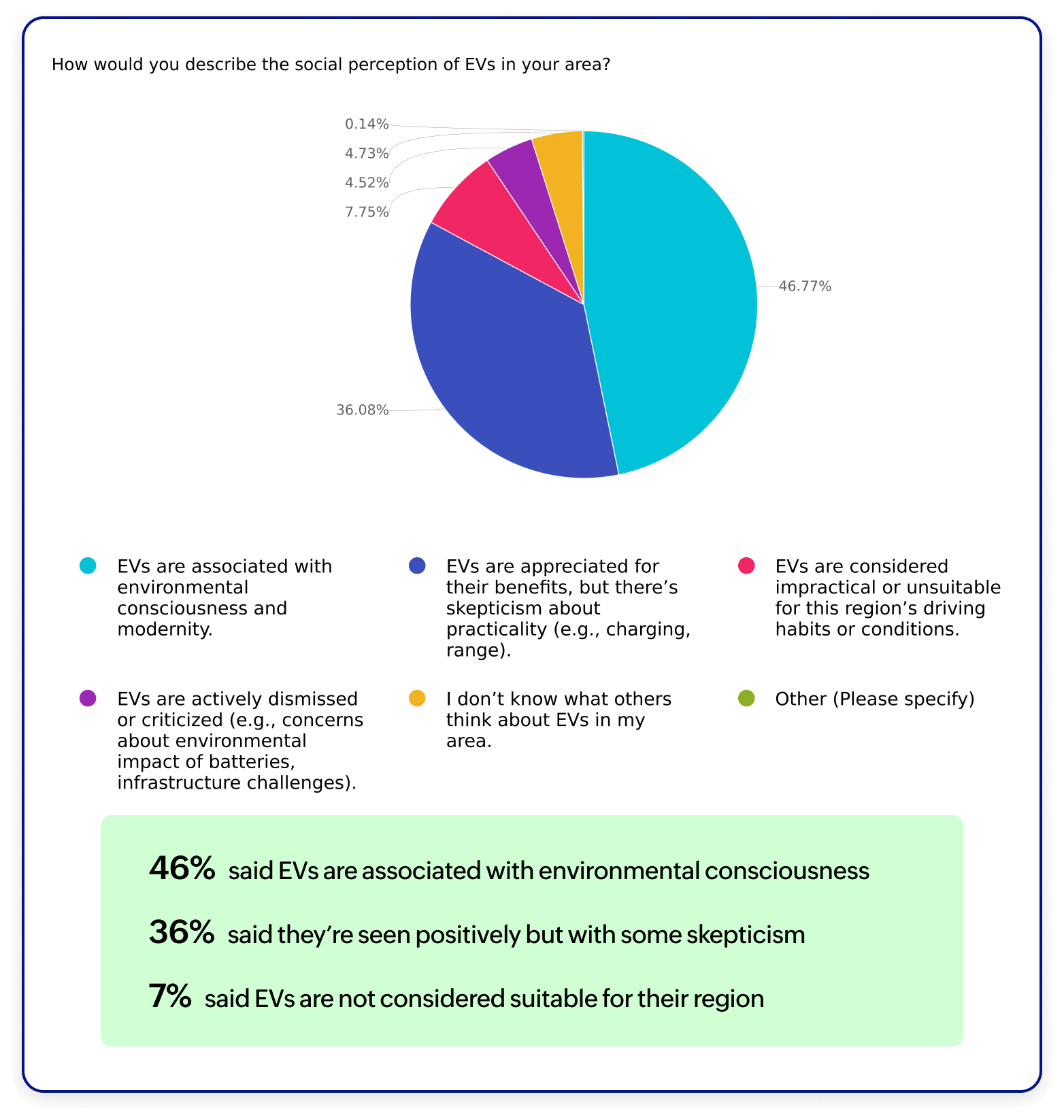

Social perception of electric vehicles in India

EVs are increasingly seen in a positive light. 46% of respondents associated EVs with environmental consciousness, while 36% said they were viewed positively but with some skepticism. However, 7% felt EVs were unsuitable for their region—primarily respondents from Northeastern states, where hilly terrain and limited infrastructure present practical challenges.

The split

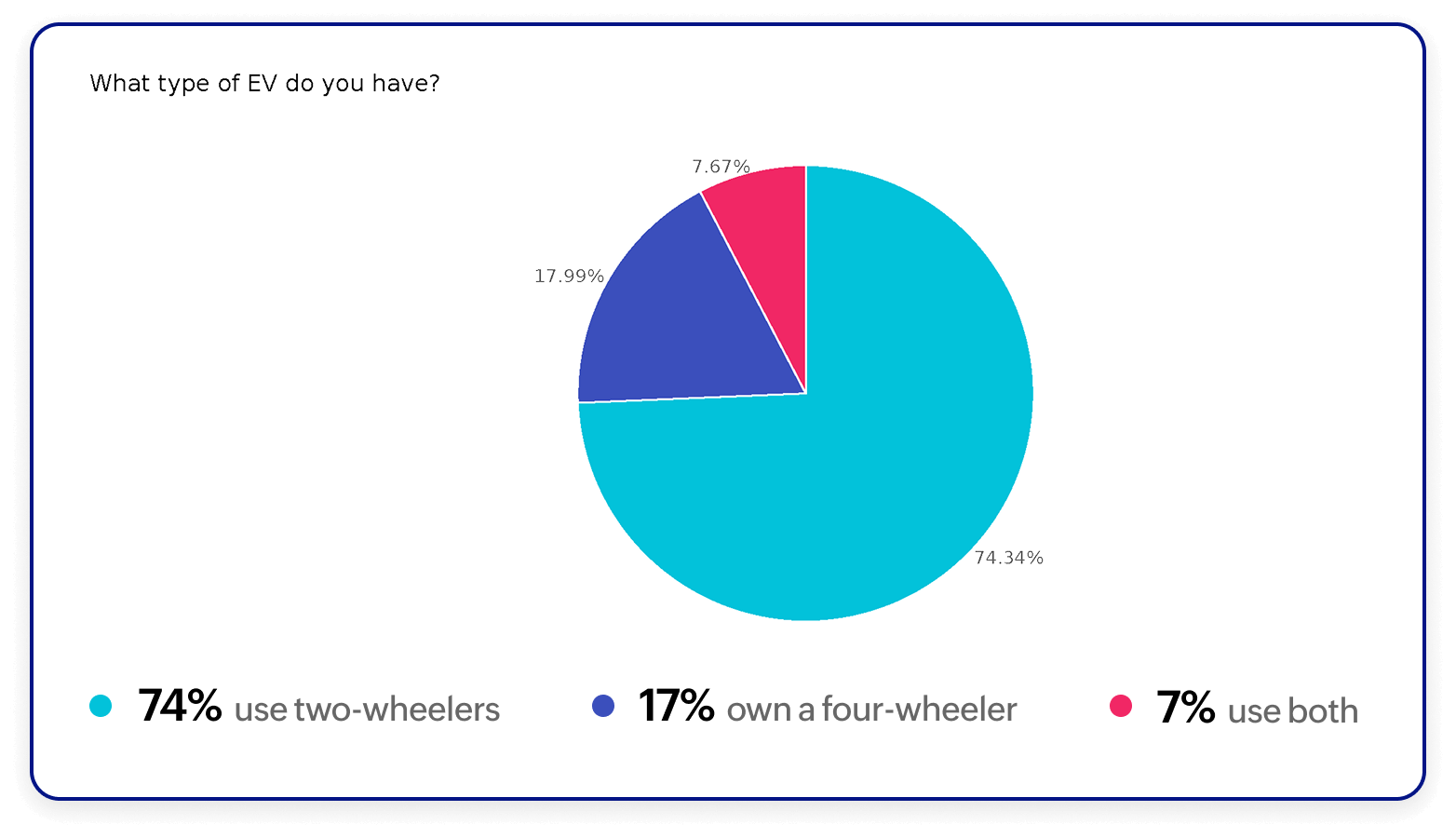

While the EV ecosystem is steadily growing, internal combustion engine (ICE) vehicles still dominate. Around 30% of respondents currently use some form of electric vehicle, while the majority continue to rely on petrol or diesel-powered vehicles. Among EV owners, a significant 74% use electric two-wheelers. In the four-wheeler category, battery electric vehicles (BEVs) lead the pack and the rest have some form of hybrid vehicles.

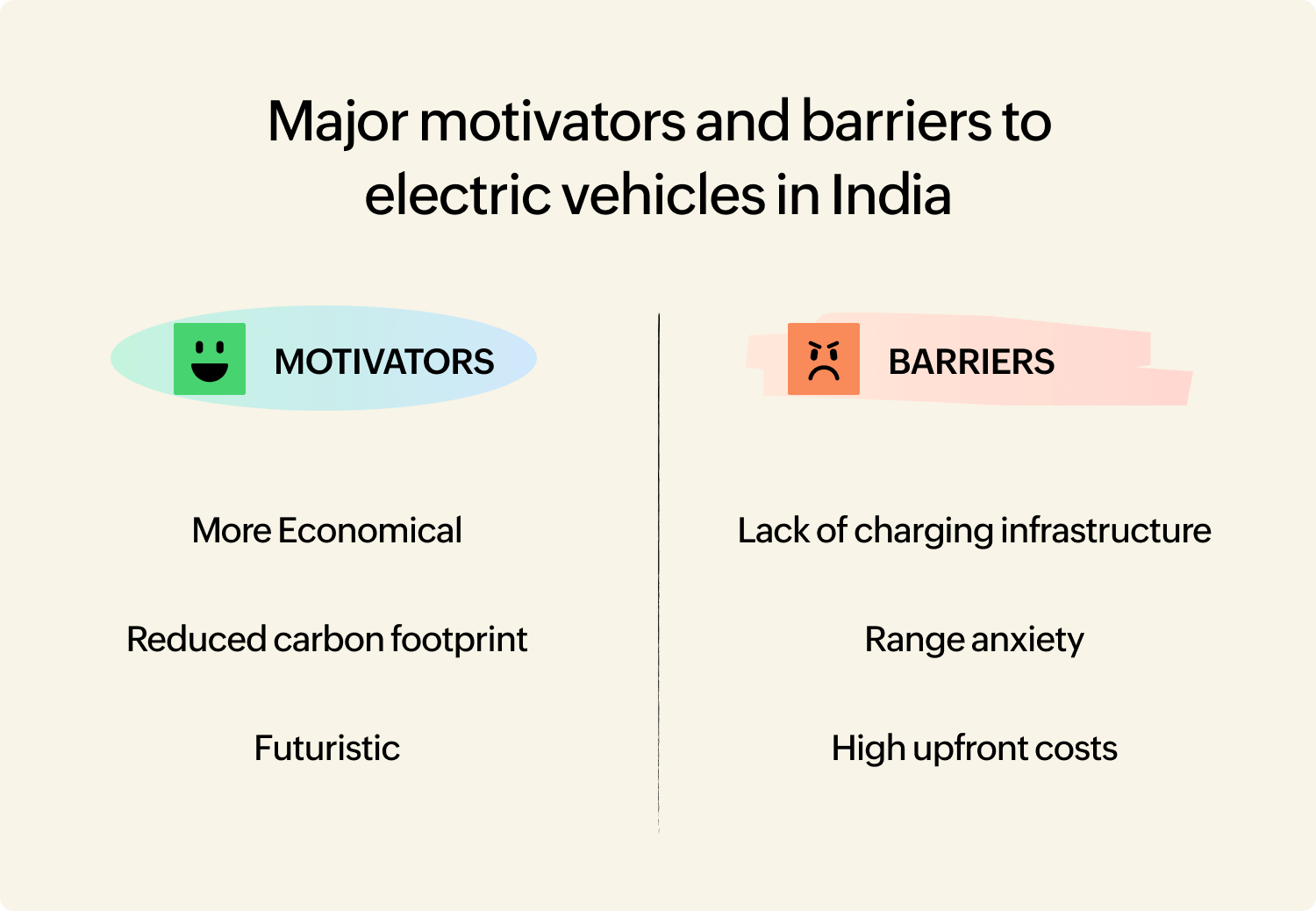

ICE owners and people without vehicles

Among ICE users, rising fuel costs and environmental concerns emerged as top motivators to consider EVs. However, hesitation around charging infrastructure, cost, and reliability remains strong. Non-vehicle owners cited affordability and reliable public transport as key reasons for not owning a vehicle. Yet, a significant portion expressed interest in EVs for future purchases.

EV owner opinions

Among ICE users, rising fuel costs and environmental concerns emerged as top motivators to consider EVs. However, hesitation around charging infrastructure, cost, and reliability remains strong. Non-vehicle owners cited affordability and reliable public transport as key reasons for not owning a vehicle. Yet, a significant portion expressed interest in EVs for future purchases.

Electric bikes and public transport

Electric bicycles received positive feedback for their dual-mode functionality, despite a few concerns around weight and charging availability. The survey results also showed that public EV transport options like e-buses and e-rickshaws are widely used, with customers expressing appreciation for comforts like AC and cleaner rides. However, concerns about safety (due to low noise) and limited availability were also noted.

Broader insights

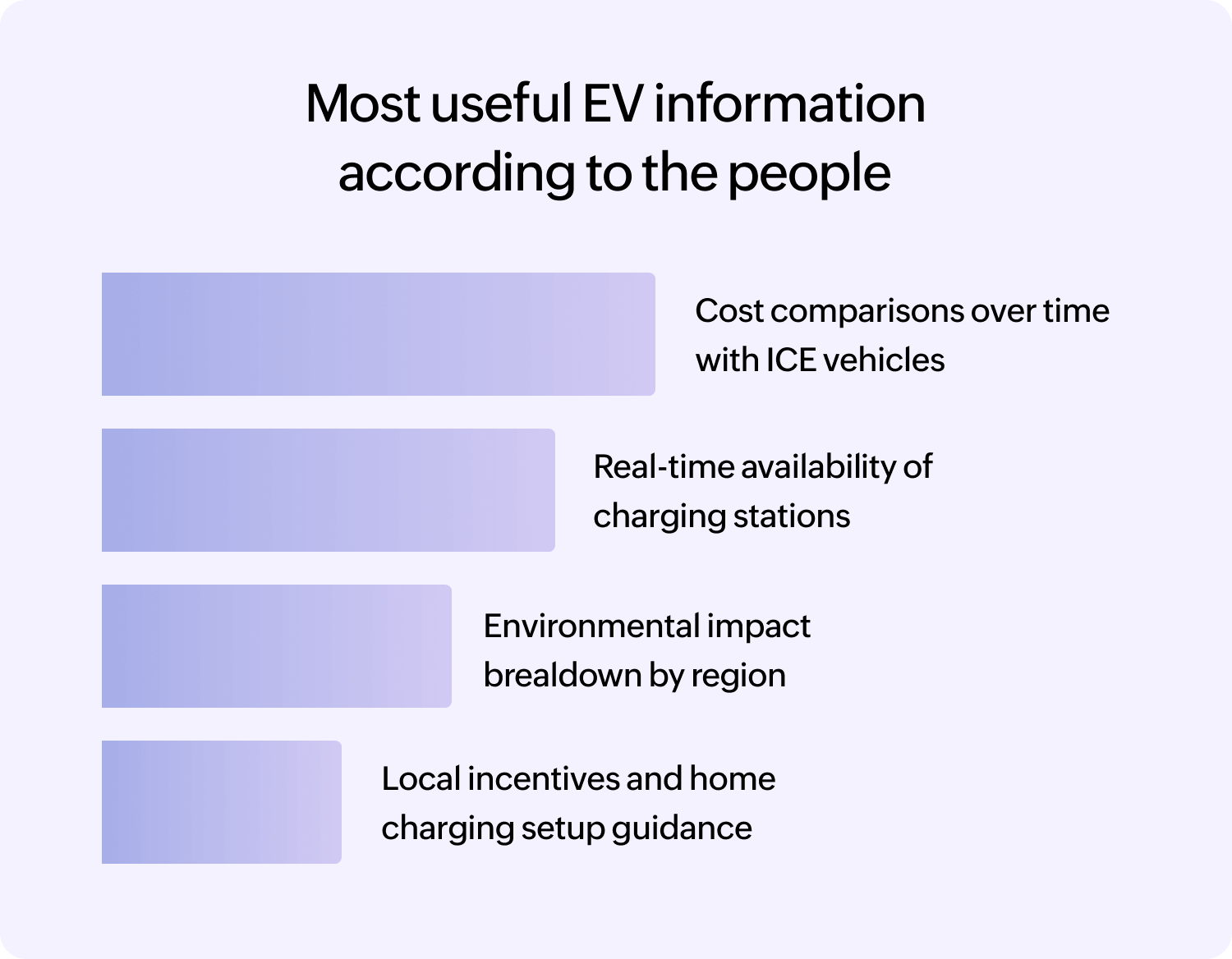

A majority of respondents said they’d be open to letting EVs feed electricity back to the grid in exchange for lower energy bills (84%) and would support a temporary fare hike in public EV transport if it meant long-term benefits (85%). When asked about useful EV-related information, cost comparisons, real-time charging maps, and region-specific environmental data topped the list.

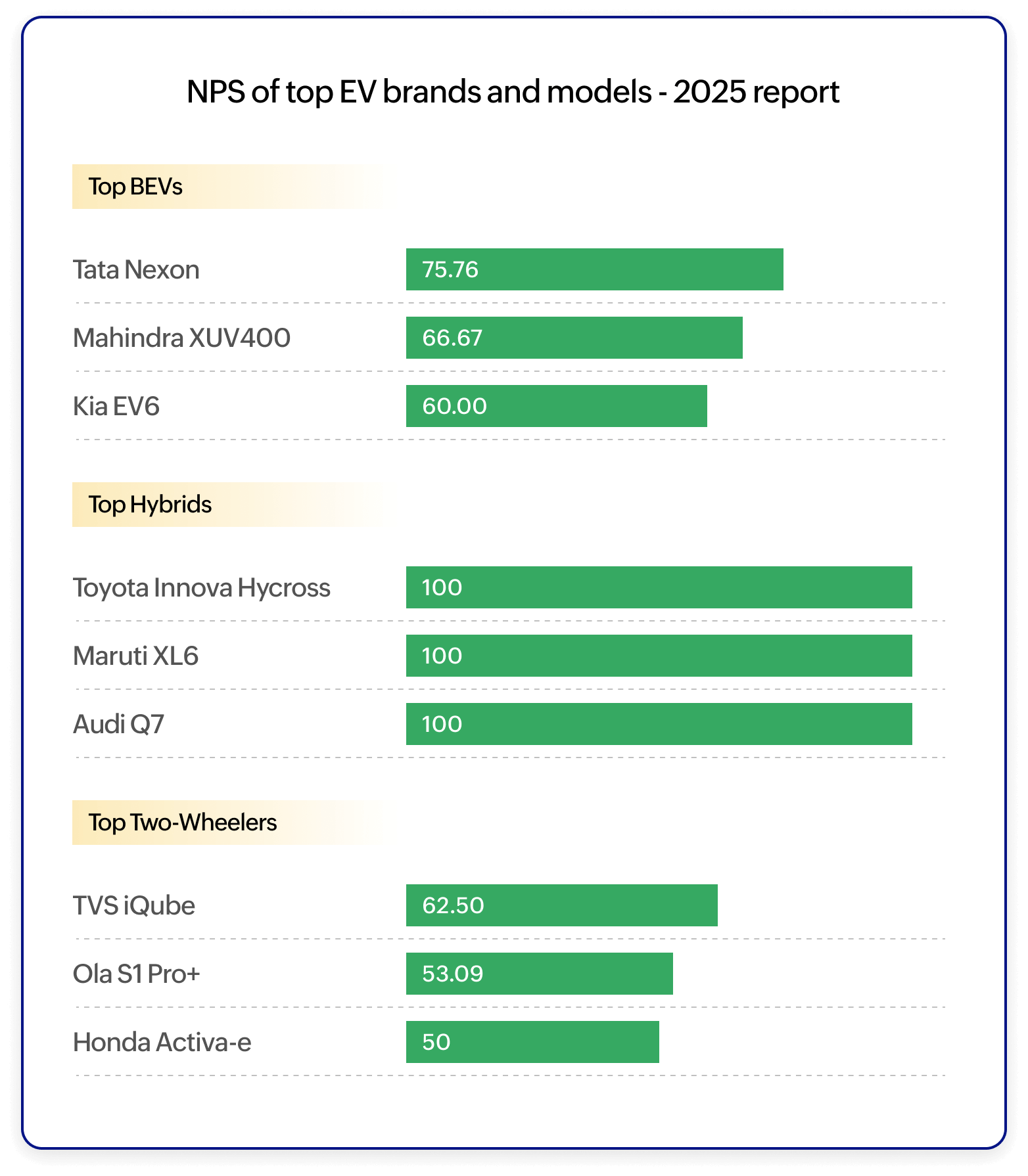

NPS of top EV brands and models

Introduction

In a world steadily shifting towards cleaner energy sources, it’s impossible to talk about the future without talking about electric vehicles. EVs are often positioned as the solution to pollution and a symbol of sustainable living. But how much of that promise holds up in everyday life? Are EVs truly delivering on what they claim, or are we caught in the middle of yet another overhyped trend?

These questions become even more important when we bring India into the picture; a country as demographically and geographically diverse as it gets. From its bustling metro cities to its remote hill towns, India presents some uniquely complex challenges for EV adoption.

The goal of this survey was simple—to take the pulse of the Indian public on electric vehicles. With EV policies like FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India), a growing network of transport options, and a fast-evolving auto market, the EV landscape in India is no longer what it was just a few years ago.

But many questions remain. How many people are already on board? Who’s still skeptical? What’s stopping them? And most importantly, where does electric mobility truly stand in the future of Indian transportation?

Social perception of electric vehicles in India

Perceptions of electric vehicles are changing in India. When asked how EVs are viewed in their local area:

Interestingly, most of the respondents who flagged EVs as regionally unsuitable were from the Northeastern states (regions known for their hilly terrain and challenging geography). In places like these, it’s not just about whether EVs can offer benefits, it’s about whether they’re practical.

The split

Going over the ownership patterns:

8% of people said they don’t own any vehicle. Of the rest, 70% use ICE (internal combustion engine)/Petrol/Diesel vehicles and 30% have made the switch to some kind of electric vehicle.

Among EV owners, 74% use electric two-wheelers, 17% use electric fourwheelers and 7% use both.

Of the four-wheeler segment, 76% own BEVs (Battery Electric Vehicles), while the rest use hybrid formats like HEV (Hybrid Electric Vehicles), PHEV (Plug-in Hybrid Electric Vehicles) and MEHV (Mild Hybrid Electric Vehicles).

Since the majority of respondents are still ICE vehicle owners, it makes sense to start with this group. Considering the perspectives of vehicles owners who haven't switched to EVs can help us understand what’s driving, or holding back, EV adoption.

Petrol/Diesel owners' perception of EVs

ICE vehicle owners were asked whether they planned to buy or lease a new vehicle in 2025 and here’s what they had to say.

45% said they are open to buying an EV as an additional vehicle

28% said they’d switch entirely

13% were open but hesitant

8% weren’t planning to purchase any vehicle soon

4% were firmly against EVs

From the street: Here's a glimpse into what people said:

“Petrol costs are rising every day. EVs cost only 1.2 rupee per km—it’s efficient and eco-friendly.”

“Driving an electric vehicle can help you reduce your carbon footprint because there will be zero tailpipe emissions.”

“No more standing in line at the petrol pump—and avoiding being cheated with underfilled tanks!”

“Lack of charging infrastructure while traveling interstate. Even major cities don’t have proper charging infrastructure.”

“Charging points are hard to find in public places. If your battery runs out midway, you’re stuck.”

“I bought my car just two years ago—can’t switch to an EV within five.”

“EVs cost at least 25% more than ICE vehicles.”

Perspective of people without vehicles

Those who currently do not own a vehicle also shared some thoughtful perspectives. The most commonly cited reasons for not owning a vehicle were the rising costs of ownership and maintenance, along with the availability of reliable public transport in their area.

As for future plans, nearly half indicated that they intend to purchase a vehicle in 2025. And when asked whether they would consider an EV, the responses revealed some interesting trends.

Among this group, 65% said they would prioritize EVs

26% were open to EVs but also considering ICE

7% preferred petrol/diesel due to infrastructure concerns

Below are some of the mixed responses, shared directly by the respondents.

“In a developing country like India, where electricity isn’t always reliable, owning an EV is a challenge. Affordability is another issue.”

“The future depends on EVs. Petroleum is running out, and it’s harming our environment.”

"Global warming is real. EVs are a way to reduce carbon emissions and pollution."

Shifting gears, it's time to hear from those who’ve already gone electric. What convinced them to make the move? Did the reality match their expectations? And how does the experience stack up now?

EV two-wheeler experiences

In a country where more than 75% of the population rides two-wheelers, it’s no surprise that EV ownership follows the same trend. Among all EV owners in this survey, a striking 74% use electric two-wheelers.

Satisfaction score: 4.36 / 5

Net Promoter Score (NPS): 55.6

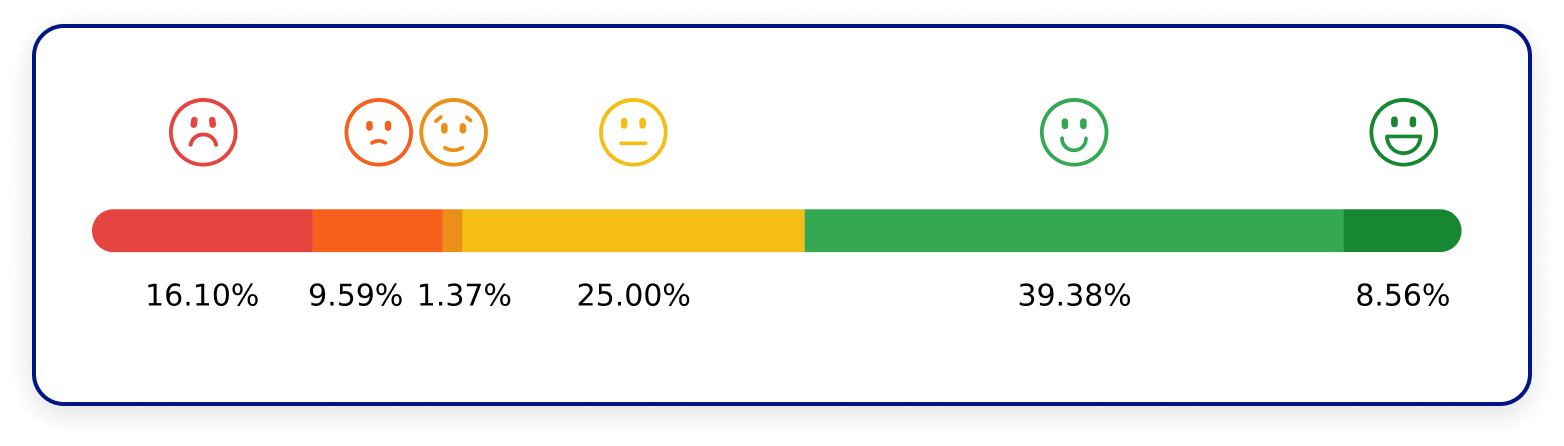

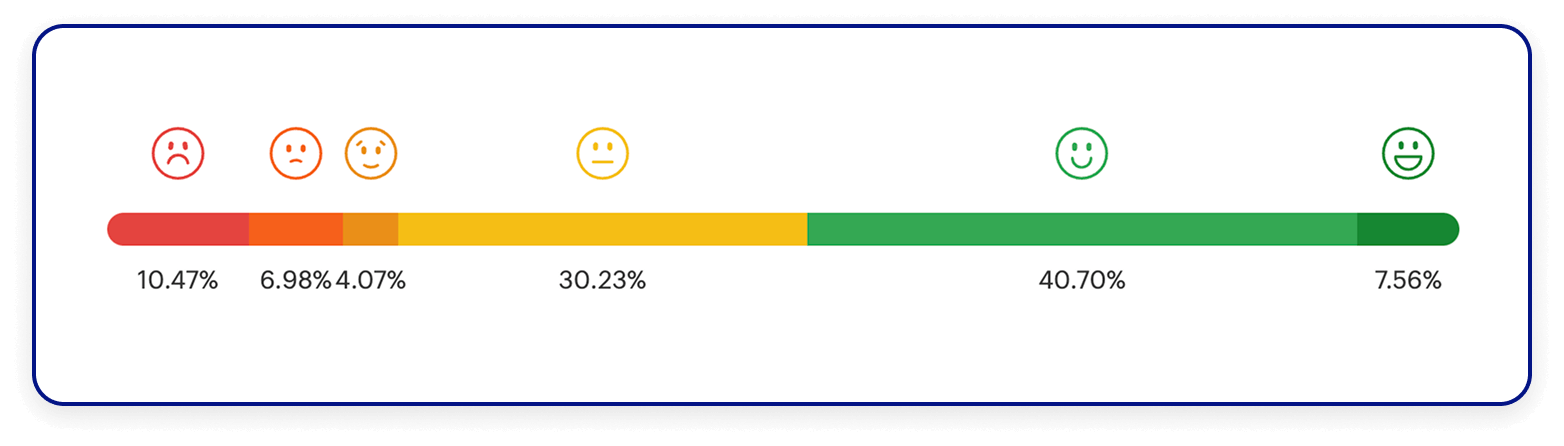

We asked owners what they liked, or didn’t, about their vehicles. Here’s what the sentiment analysis showed. Sentiment was split, not by number of people, but by the tone and emotional weight of the words used in their responses.

Happy responses: 39%

Neutral responses: 25%

Disappointed responses: ~10%

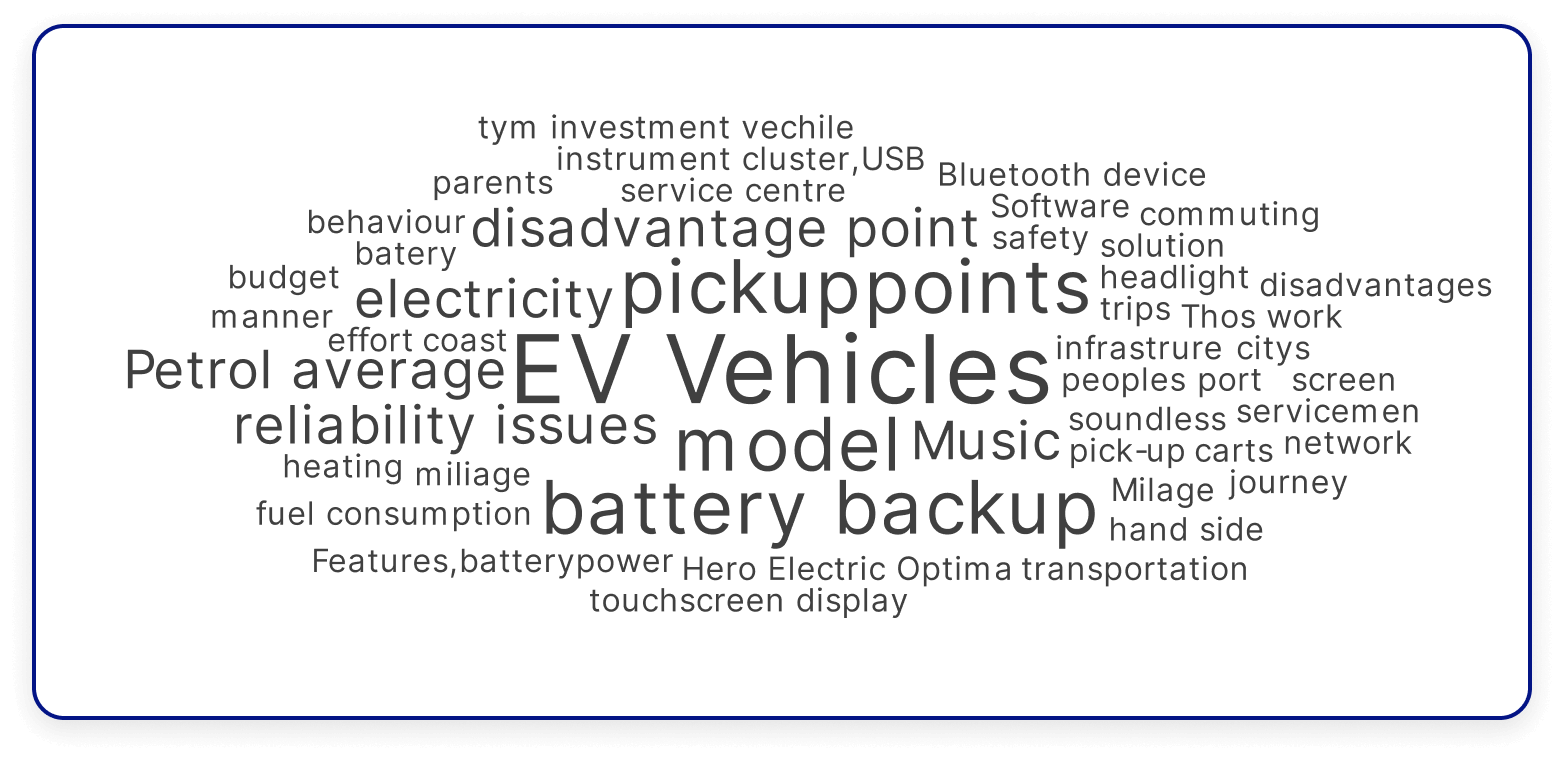

And here’s what a quick glance at the word cloud reveals—the features and frustrations that popped up most frequently in what owners had to say.

🛵 Did You Know?

It is often the simple things that stand out. Many two-wheeler owners specifically mentioned how useful features like USB charging ports and the reverse option are in day-to-day riding.

“I love the mileage as it covers a lot of distance with just a single charge, it has music system in it, as well as the reverse gear which makes it more comfortable to drive"

"I love that my two-wheeler EV is quiet, eco-friendly, and saves a lot on fuel costs."

"The instant torque makes city rides smooth and fun. I just wish the charging speed was faster and the range a bit longer."

"The soundlessness makes other people unaware of vehicles approaching."

Next up: the thoughts and experiences of four-wheeler EV owners.

BEVs in India

Satisfaction score: 4.36 / 5

Net Promoter Score (NPS): 74.39

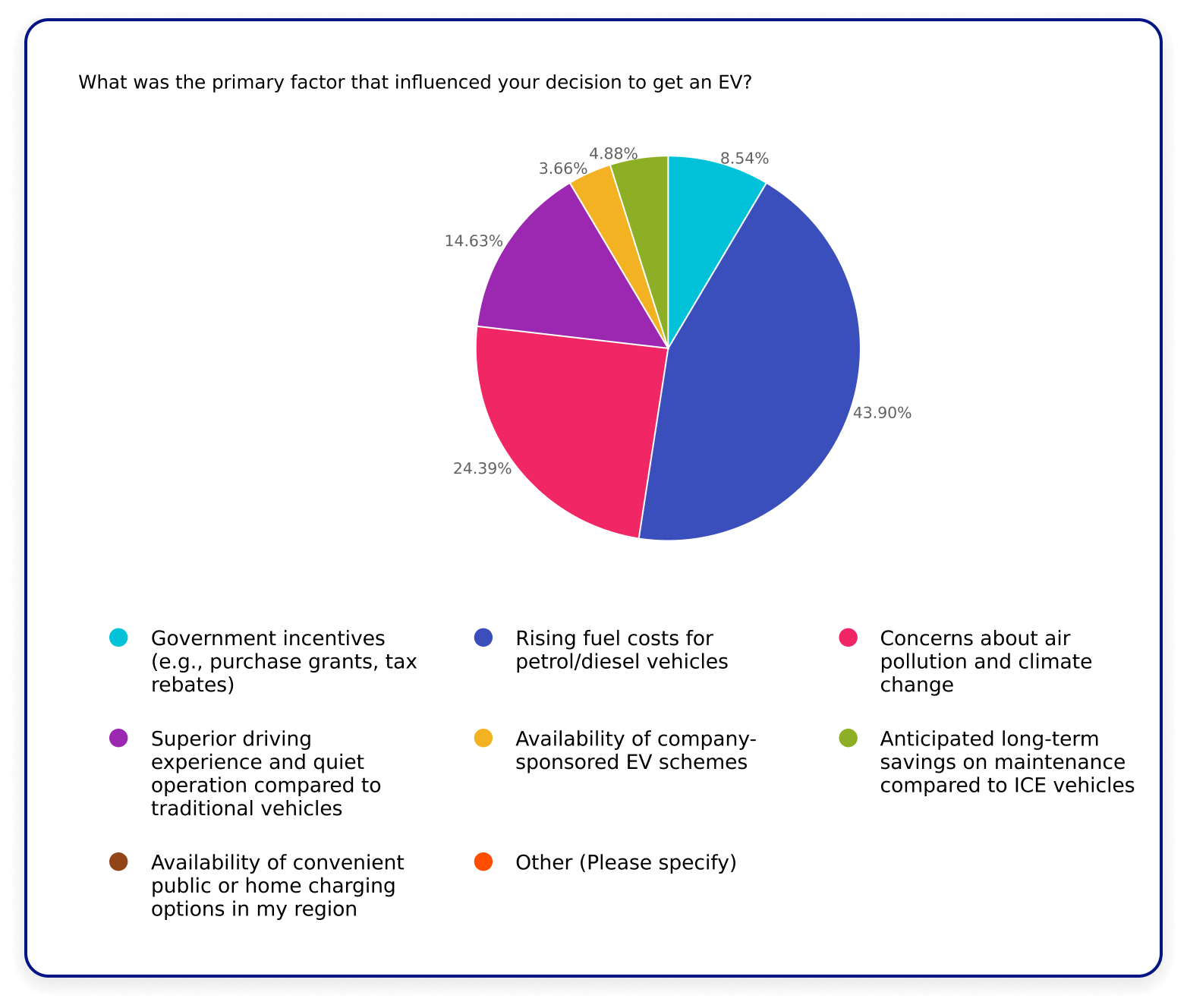

Rising fuel costs turned out to be the most common motivator among BEV owners, edging out environmental concerns, which came in second. While the push for sustainability is strong, practical factors that affect day-to-day life seem to be the stronger driver of purchasing decisions.

And here’s what a quick glance at the word cloud reveals—the features and frustrations that popped up most frequently in what owners had to say.

When asked whether their EV had delivered on cost savings:

57% said yes, especially in fuel cost savings

14% said expectations were exceeded

14% said expectations weren’t met

And as for the environmental impact:

90% believed their EV had made a positive difference.

Hybrid vehicles in India

Satisfaction score: 4.68 / 5

Net Promoter Score (NPS): 88

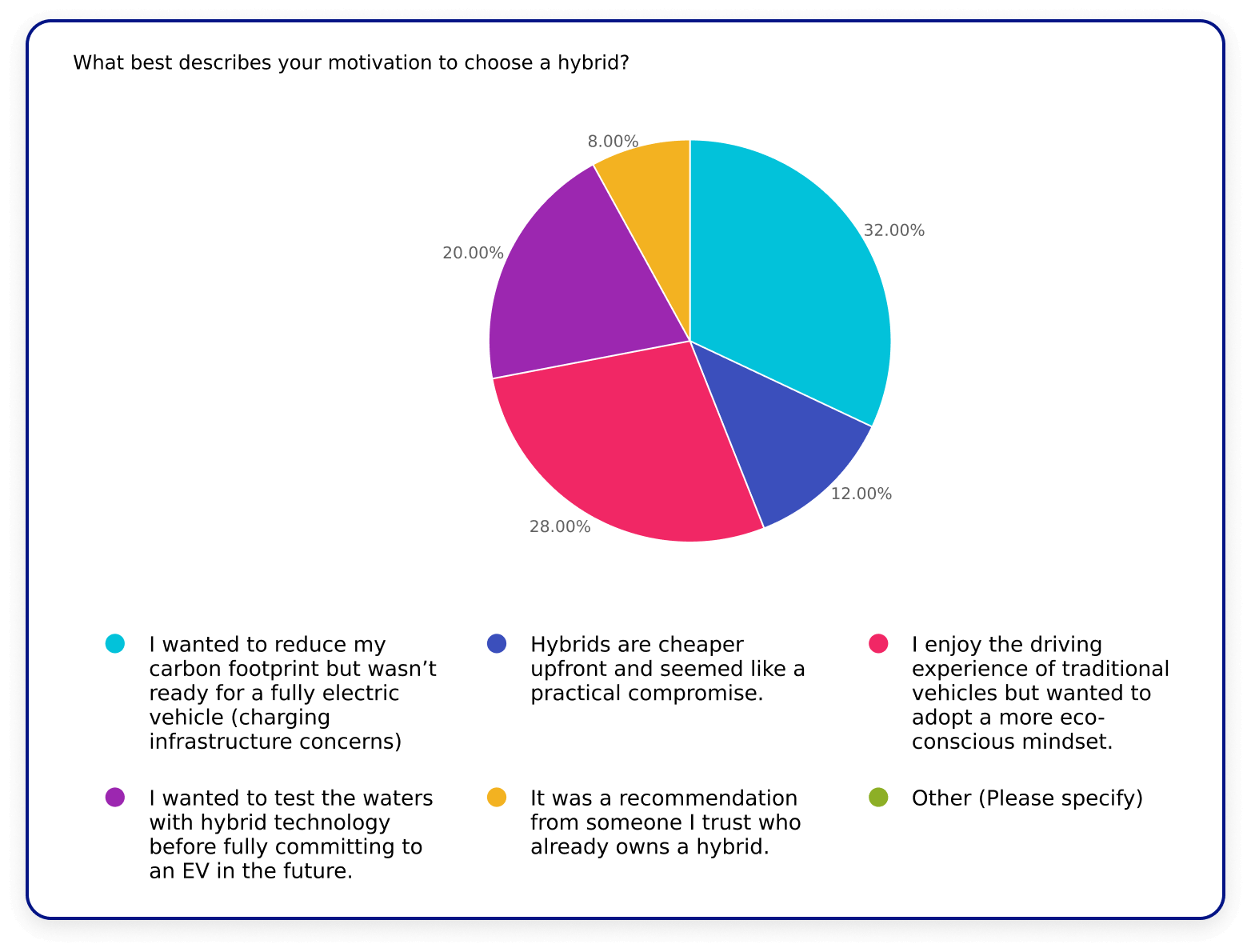

Hybrid owners were the most enthusiastic group. Why? Possibly because they get the perks of electric without giving up the confidence of traditional driving.

Top motivator:

32% wanted to reduce their carbon footprint but weren’t ready to go fully electric, citing infrastructure limitations.

Expectations:

75% said they’ve made a positive environmental impact, and 25% said partially.

100% agreed that hybrids offer the perfect middle ground.

⚠️ Note: Hybrid owner sample size was small, hence insights should be read accordingly.

ebikes in India

Electric bicycles are steadily gaining attention, and no conversation about EVs feels complete without including them.

What riders said:

"I like that I can switch to electric mode when I get tired."

"We can reach places faster"

"It starts with the push of a button—so simple that everyone can use it."

"The soundlessness makes other people unaware of vehicles approaching."

"Heavier than regular bikes due to the motor and battery, which can make them harder to carry."

Most riders were happy overall, though there were occasional concerns around security and weight.

Electric public transport experiences

Moving on to public transportation—one of the most efficient ways to enable collective commute. When done right, it maximizes the value of both money and fuel spent, making it an economical and sustainable option. The stronger the public transport network, the easier it becomes for people to rely less on private vehicles. That’s why, in any conversation about sustainability and environmental impact, it’s important to look at how electric vehicles can enhance and support public transportation systems.

70% of respondents have used electric public transport

57% have used e-buses

53% have used electric auto-rickshaws

Here’s what the sentiment analysis showed:

35% of the sentiment leaned happy

24% was neutral

16% reflected disappointment

16% conveyed frustration

This was the feedback received on electric public transport

"It’s very silent and vibration-free."

"Electric buses are clean and good."

"Sometimes routes are limited or waiting times are longer."

"They’re too quiet—people can’t hear them approaching."

"E-autos reduce pollution on the streets."

"Limited operation in my city, but otherwise comfortable."

"No smoke, no noise."

"Felt light and fresh—regular rickshaws are noisy and polluting."

"AC buses are a blessing in hot, humid weather."

"Cheaper than ICE buses and still air-conditioned."

"Ride quality is just as good as diesel buses."

"The bus has USB’s for all the seats in the back half. Find a seat there and enjoy unlimited recharging for your phone."

"As a pedestrian, the silence is a bit unsettling."

"Cost-effective and quiet."

Once again, there are some not-so-obvious factors that aren’t in plain sight at first glance. The fact that many electric buses are air-conditioned came up as a primary motivator, especially for people in regions of India where summers can be extreme. However, there were also a few raised eyebrows about EVs being too quiet, which can potentially pose safety risks for pedestrians.

Broader perspectives (EV charging infrastructure and policies)

Before wrapping up, this section takes a step back to explore some big-picture takeaways. These insights could be particularly useful for stakeholders, policymakers, or anyone involved in shaping the future of electric vehicles in India.

84% are willing to feed electricity back into the grid if it means lower energy bills

58% are open to paying an annual fee for access to EV-only priority lanes

85% would accept a temporary hike in e-bus fares if it means longer-term benefits

If limited access to the right information is one of the hurdles keeping people from choosing EVs, then these are the useful EV information that could help the most—straight from the people themselves.

Final thoughts : The future of EVs

Like any idea that challenges the status quo, EVs have been met with a mix of optimism and hesitation. Supporters view them as essential for environmental responsibility, while naysayers question whether they’re truly the solution we need. And in a country as vast and diverse as India, where complete electrification is still underway, the question of practicality is a valid one.

Yet, the overall sentiment leans positive. Perhaps, the underlying belief is simple: Even if EVs aren’t the perfect answer, doing something is better than doing nothing. Alternatives like fuel cell electric vehicles (FCEVs), powered by splitting hydrogen and oxygen molecules, are also being explored, but remain niche for now.

But what matters most is that conversations continue. As long as people are willing to experiment, share their experiences, and learn from one another, we move closer to finding solutions that work—not just for a few, but for everyone.

Survey methodology

This survey was conducted using Zoho Survey. For a holistic approach in understanding people's experiences and perception of EVs, the survey used a variety of question types, like single choice, multiple choice, ranking, Likert scales, and open-ended fields.

Pre-screening and qualification

The pre-screening questions were designed in a way that ensured only genuine and relevant participants answered the survey. A combination of niche questions with a mix of irrelevant answer choices made sure that fraudsters were weeded out before the actual set of survey questions were presented. In some cases, participants were also required to correctly identify relevant details, such as vehicle brand and model, to proceed.

Data analysis

Post-collection, the data underwent a rigorous analysis process:

Data cleaning: Duplicate and irrelevant responses were removed.

Custom filters: Data was split into different sections (EV, hybrid, petrol vehicle owners, and vehicle-less) using filters. This helped identify trends and patterns within specific groups.

Cross-tabulation: Parallels between variables (e.g., EV ownership vs. regional perception of EVs) were drawn to discover nuanced insights.

Sentiment analysis: Open-ended responses were put through sentiment analysis using the tool's built-in system. This helped in identifying the reasons behind the respondents' answer choices.

Limitations

While the survey achieved its objectives, a few limitations have to be acknowledged.

Biases: Responses may be influenced by individual biases.

Sample constraints: A larger sample size could yield more accurate data and finer-grained insights, especially for smaller demographic groups.

Technological understanding: Some respondents might have limited knowledge of technical aspects like V2G capabilities.

Excluded groups: To keep the survey focused, certain segments such as taxi drivers, commercial truck operators, and logistics-based EV users were not included. These groups offer important perspectives and may be considered for future studies.