The subscription business landscape has witnessed exponential growth over the past decade and shows no sign of slowing down. As a result, companies no longer compete with a handful but with hundreds of subscription businesses. With new competitors offering attractive alternatives and testing your customers’ loyalty, you must be innovative and act with foresight to sustain your business’s growth.

That said, the number of deals you close does not amount to true subscription success. It comes from the deals you retain by building strong relationships with happy and engaged customers. As we know, the benefit of the subscription business model is predictable growth with recurring revenue. However, if your customers churn just as fast as they sign up, your acquisition spending and recurring revenue will never be able to reach their true potential.

So, customer retention is the need of the hour, and understanding churn at the granular level is critical to achieving this.

This guide will walk you through what churn rate is, how it is measured, and why every subscription business should monitor it closely.

What is churn rate?

Churn rate, also known as attrition rate or customer churn, is the rate at which the customers stop doing business with a company. It is the percentage of subscribers who discontinue their subscriptions over a specific period.

Different types of churn

Churn can either be voluntary (active churn) or involuntary (passive churn). While both churn types result in loss of customers and revenue, they have different underlying causes and prevention strategies.

Voluntary churn

Voluntary churn happens when a customer actively chooses to terminate their subscription. Business owners focus primarily on this type of churn, as these customers make conscious decisions to leave your business. There could be different reasons behind a customer’s decision, but the common ones include:

-

Their experience with the product or service did not meet their expectations or solve the problems they thought it would solve.

-

The customer had a dissatisfactory experience with your product or service causing them to check out other alternatives.

-

The competitor bought their attention with a more attractive alternative solution that suits their needs or budget.

-

The customer is shutting down their operations or going out of business, and no longer needs your service.

To prevent and reduce voluntary churn, it’s important to deeply understand your customers’ engagement and satisfaction with the product. Making your product and customer service indispensable and providing frequent value that they can’t live without is a tested way to plug the revenue leak due to voluntary churn.

Involuntary churn

Involuntary churn happens when the business discontinues the service provided to the customers due to non-payment. When a customer’s payment attempt fails without them noticing, it results in the cancellation of subscriptions. The major reasons for involuntary churn are:

-

Card expiration

-

Hard payment declines that prevent fraudulent attempts when the card is lost or stolen

-

Soft payment declines when the credit card is maxed out

-

Network failures

Businesses try to avoid involuntary churn by optimizing their checkout page and deploying smart dunning or payment recovery strategies to effectively communicate with customers to recover payments.

Why is monitoring churn rate important for subscription businesses?

Churn rate is a crucial metric to be monitored by any subscription business as it helps you understand the long-term stability of your business and forecast growth.

Tracking this metric has deeper implications on the short-run and long-run performance and sustainability of your business.

Understand business performance

Your churn rate tells a lot about your company’s financial health. For example, you can get a solid snapshot of the number of customers bailing on your business, the speed at which you are losing them, and the impact those churned customers are having on your bottom line.

You can understand this better by relating the churn rate values with other subscription metrics like Customer Acquisition Cost (CAC), which is the total sales and marketing cost you spend to acquire a customer. When a business loses its existing customers, it will have to deal with both the loss of revenue and business opportunities, along with the need to spend more on acquiring customers to compensate for those that have churned.

That’s why businesses should find ways to control their churn rate. In order to do so, they have to track it closely.

Measure it to improve it

It’s one thing to recognize that you have a problem with customer retention, but unless you have reliable churn values and other related data points, it’s hard to overcome the problem.

Your customer could leave your business due to price, poor fit, the product not solving their problems as expected, and many other reasons. You will only be able to tell which areas need improvement if you learn why customers are leaving your business.

When you take time to monitor and analyze churn rates, not only can you understand the historical performance of the business, but you can also forecast the company’s growth potential and do more controlled experiments to measure the impact of targeted changes made to your product to fight churn.

Without reliable churn calculation, businesses are more likely to end up making assumptions or randomly use online-recommended tactics like changing pricing, features, and processes with minimal or no returns.

Stay prepared in the face of competition

Tracking the churn rate also involves keeping tabs on your competition, which is another critical area to stay on top of in your business. The reason is that the customer churn rate tends to increase when competitors introduce their products with large discounts or launch new features, which may make your customers churn and switch to other brands. As a result, customer retention takes a big hit for typical reasons, and for some customers, it can be a permanent shift to your competitor. So, the ability to predict the churn rate and control it whenever possible is essential for a company’s long-term success at all levels.

How to calculate the churn rate?

Measuring churn rate at an aggregate level, or just as an overall percentage of total customers and associated revenue, is not enough to draw actionable insights. Several factors influence churn; each plays a significant role in understanding the dynamics at play and focusing on exactly what you need to accomplish.

Subscription businesses need to be aware of the different ways to calculate churn depending on what they need to know.

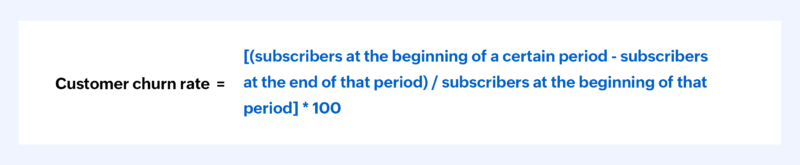

Customer churn rate

Customer churn rate is calculated by dividing the number of customers whose subscriptions have been canceled over a certain period by the total number of customers at the beginning of that period.

For example, if you had 100 subscribers at the start of the billing period and 10 of them churned out during the period, the customer churn rate calculation would be:

[(300-290)/300] * 100 = 0.03 * 100 = 3%

Therefore, the customer churn rate is 3%.

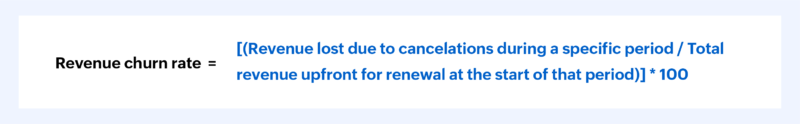

Revenue churn rate

Revenue churn rate is the rate at which you are losing revenue due to subscription downgrades and cancellations.

While the customer churn rate tells you the percentage of customers lost over a specific period, the revenue churn rate gives the percentage of revenue lost over the same period. The revenue churn rate can be calculated by dividing the amount of revenue lost due to subscription cancellations over a specific period by the total amount of revenue up for renewal at the beginning of the period.

For example, let’s assume that your business had $10M in recurring revenue up for renewal a year ago. Today, your subscription cancellations contributed to the revenue loss of $2M. The ARR churn rate would be:

ARR churn rate = ($2M / $10M) * 100 = 20%

Similarly, the Monthly Recurring Revenue (MRR) churn rate can be found for a month, including the MRR value in the calculation.

For instance, if your total MRR for a specific month is $30,000 with the churn of $1000, then the net MRR churn rate would be $1000 / $30,000 * 100 =3.33%

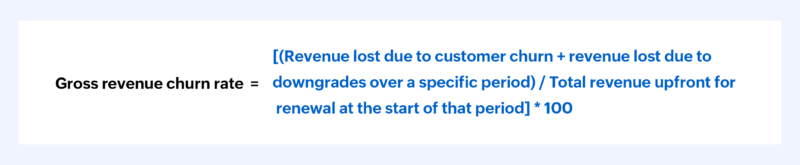

Gross revenue churn rate

You may have observed that the above calculation explicitly considers only the revenue lost due to subscription cancelation. It does not include the revenue lost due to the downgrades from higher pricing to a lower one. The revenue churn rate calculation is very closely related to another metric called the Gross revenue churn rate, which is the sum of revenue lost due to both canceled subscriptions and downgrades.

For example, let’s imagine you begin the month of March with $100K MRR, but lost subscriptions worth $10K. And two of your customers moved from the top tier service to the basic service tier, leading to the reduction in MRR of $5000. So the gross MRR churn rate would be:

10000 + 800 = 10800

10800 / 100,000 = 0.108

0.108 * 100 = 10.8%

Factoring in MRR contraction from customers’ downgrades, your business has a gross MRR churn of 10.8%.

The gross revenue churn rate should be as low as possible. If it is too high, it means you ended the financial term with a lot of new customers without any noticeable improvement in revenue.

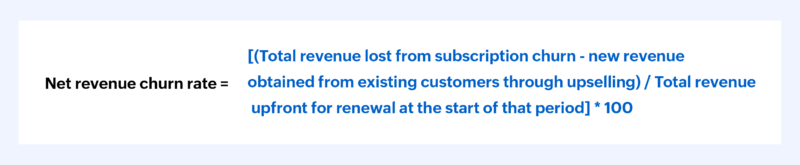

Net revenue churn rate

Net revenue churn rate is the sum of revenue lost from canceled and downgraded subscriptions minus the revenue gained from the subscription upgrades and reactivations.

For example, suppose your opening MRR is $50,000 and lost $4000 worth of subscriptions through cancellations and downgrades. However, two of your customers upgraded to a premium plan during that month, resulting in an additional MRR of $2000.

In this case, Net Revenue Churn = [($4000 – $2000) / $50,000] * 100 = 4%.

Factoring in MRR expansion from customers’ upgrades, your business has a net MRR churn of 4%.

Although typically expressed as a monthly rate, this metric can also be an annual rate as the Net ARR churn rate. The calculation of this metric combines both unhappy and happy subscribers giving out the full picture of how your business is succeeding or failing.

Net negative revenue churn rate

Net negative churn is achieved when the expansion revenue, (which is the additional revenue generated from existing customers through upselling & cross-selling) is greater than the revenue lost due to customer downgrades and cancellations. In the net negative churn calculation, the revenue generated by new customers is not considered.

For example, let’s assume you started out with the MRR of $10,000 at the beginning of the month. Your business lost $1000 in MRR due to downgrades and customer churn. But you gained an additional revenue of $1500 from existing customers upgrading their subscription plan and purchasing add-ons.

The revenue churn calculation will be as follows:

$1000 – $1500 / $10,000 * 100

-$500 / $10,000 * 100

= -0.05 * 100

= -5%

This negative value of the revenue churn rate indicates that you have made a profit despite the monthly churn.

Benchmarking churn rates

Obviously, a lower churn rate is always better. However, estimating an upper limit for churn can be helpful in financial modeling and better prioritization of customer retention efforts. The practice of benchmarking your churn rate against industry standards can be useful in putting the financial health of your business in perspective.

However, you should remember that industry standards shall vary depending on various factors such as the sector your company operates in, the maturity of your company, and the type of customers you are targeting. For example, it won’t make sense to compare the churn rate of a start-up with the churn rate of a long-standing business that offers products exclusively for enterprise customers who typically stay longer.

So, what benchmarks should a subscription business aim for? What is an acceptable churn rate from an industry standard?

Typically, an acceptable annual churn rate for SaaS companies is found to be in the range of 5 – 10%. It means if 50 customers are churning out of every 1000 customers per year, it is still acceptable.

Businesses should make sure to differentiate between monthly and annual churn rates, because 5-10% may be a decent churn rate range but dangerous as a monthly churn rate.

However, this is a very generic statistic that may not make sense for every kind of subscription business.

Startups and early-stage businesses: If you are a start-up still looking for product-market fit, you are more likely to experience higher churn rates, especially in the first year, where it tends to hover around 10-15% per month (and touch as high as 24%). The reason can be such early-stage companies are still working out their marketing, pricing, and customer engagement strategies to retain their target customers.

Mid-market businesses: For mid-market businesses, the acceptable churn rates are somewhere in the middle with figures between 11 – 22%.

Enterprise-level businesses: Established and enterprise subscription businesses that have found their product-market fit should aim for a churn rate that is less than 1%. It should decline in subsequent years until the business reaches net negative churn.

Key takeaway

Retaining your customers is as important as acquiring them in any subscription business. If your sales funnel is missing the bottom, it wouldn’t even matter how many customers enter it because you are anyway going to end up with an empty bucket. Monitoring churn is crucial for subscription businesses irrespective of the sector or the type of customers they serve.

We learned that different types of businesses will have different churn rates and as the company evolves, the churn rate benchmarks also change. Hence, you need to calculate and closely monitor your churn to make sure it’s under control so that your business thrives under any circumstances.

2

2

Good article with the all information needed. If you are interested in retaining your customers and making them the advocates of the brand then monitoring the churn rate should be your priority.

I think most of the clients leave during the onboarding stage. So it is important to control every stage of business. Starting from the early stages when the clients are starting to get to know your service close.

100% agree.