Trusted by great brands

Provide instant assistance with the best financial services customer engagement software

Educate

Offer educational resources that help customers make informed decisions.

Support

Be available to customers and prospects 24/7 to render quick assistance.

Retain

Stand out from the competition by offering instant information on products of interest to the customer.

Secure data handling

Ensure customer data security with credit card number masking and password protection during the export of files shared via live chat. Give them control over their data with privacy policy disclosure before a chat and consent form for the processing of details obtained.

Round-the-clock assistance with chatbots

Deploy a custom chatbot to resolve common questions, ask relevant questions and provide solutions, facilitate document collection and sharing, set up meetings, automate KYC verification, and more. Check out our article on chatbots for financial services for more use cases.

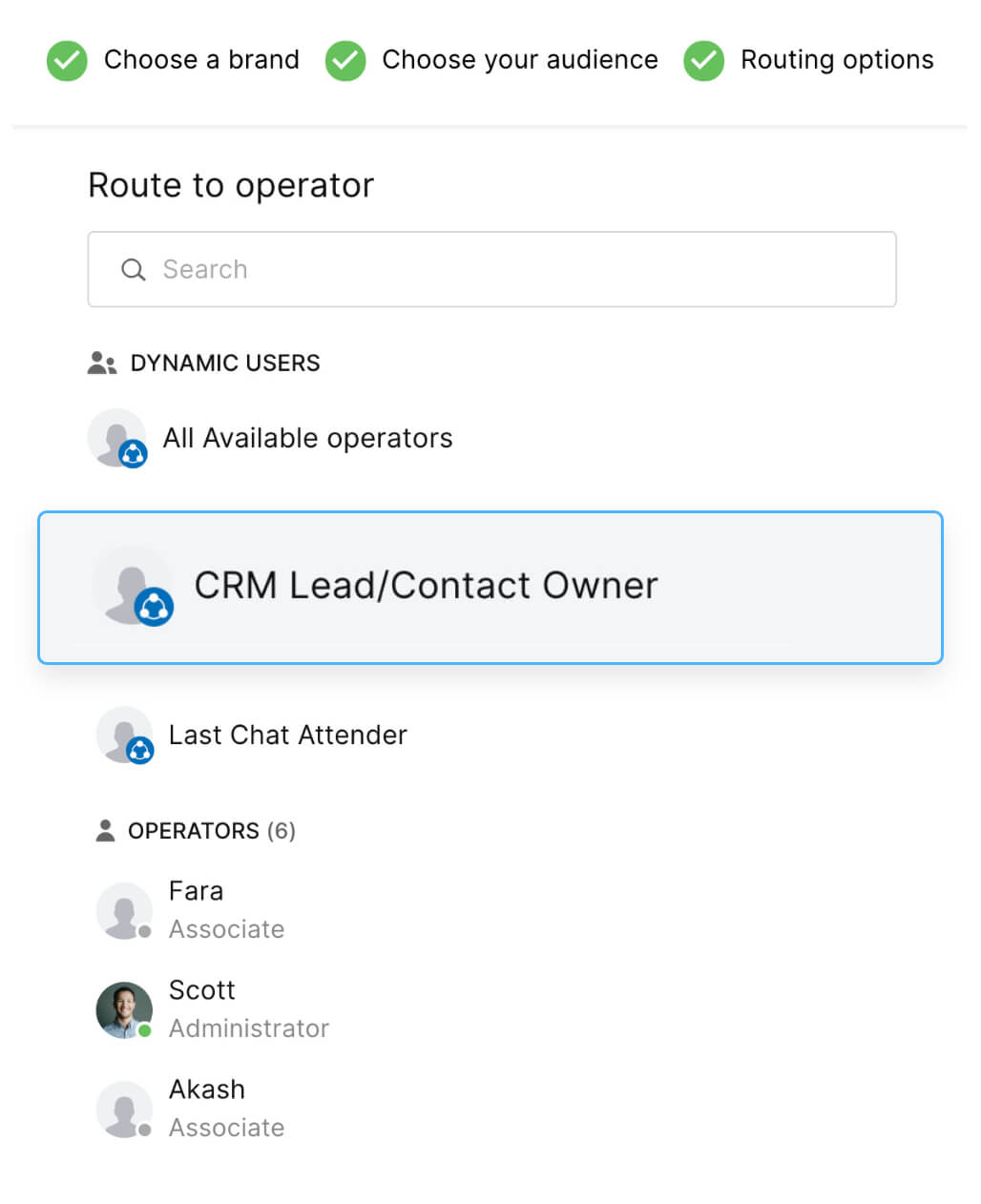

Hassle-free expert advice

When it comes to financial decisions, customers prefer connecting with the same agent who has the context of their financial history. Our financial services customer engagement software lets you connect prospects and customers with the agents best suited to help them make the best financial decisions. Agents can also make free internet audio calls right from the chat window when they need to explain why a prospect should go with a particular investment opportunity.

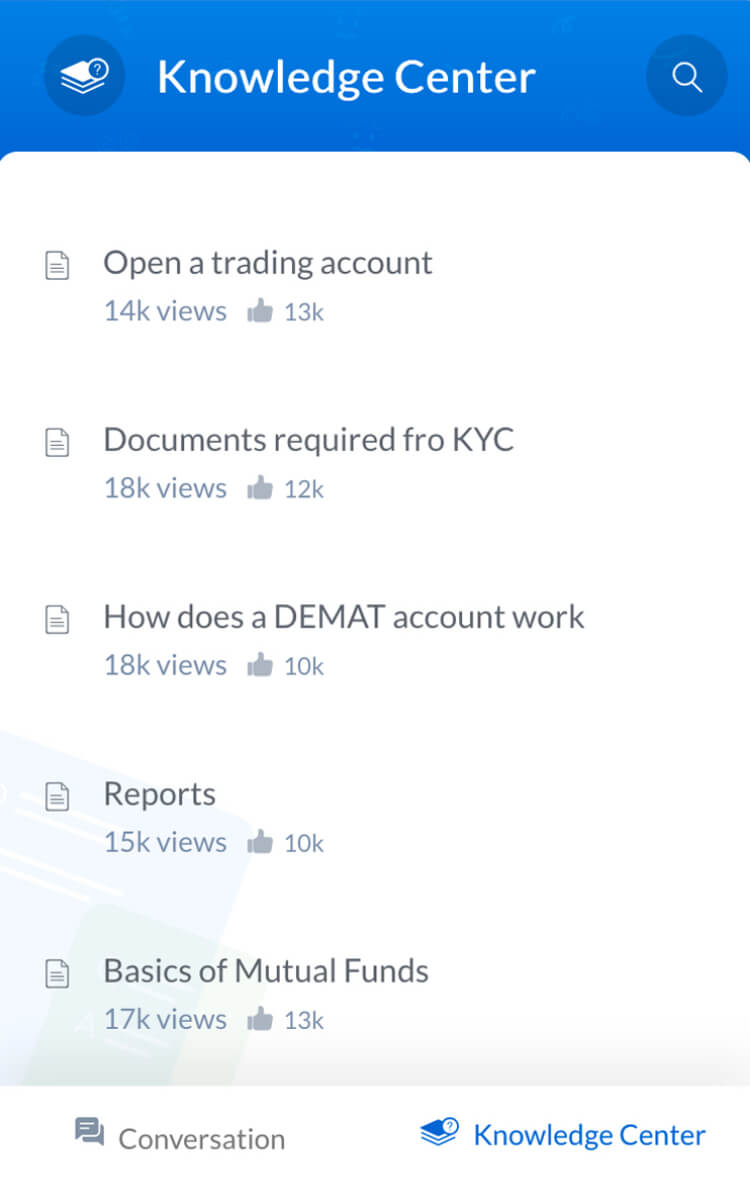

Handy self-service options

Create a library of finserv-related FAQs, articles, and documents your prospects and customers can access right from the chat window. You can also deploy a knowledge-base chatbot that parses through these articles to answer customer queries.

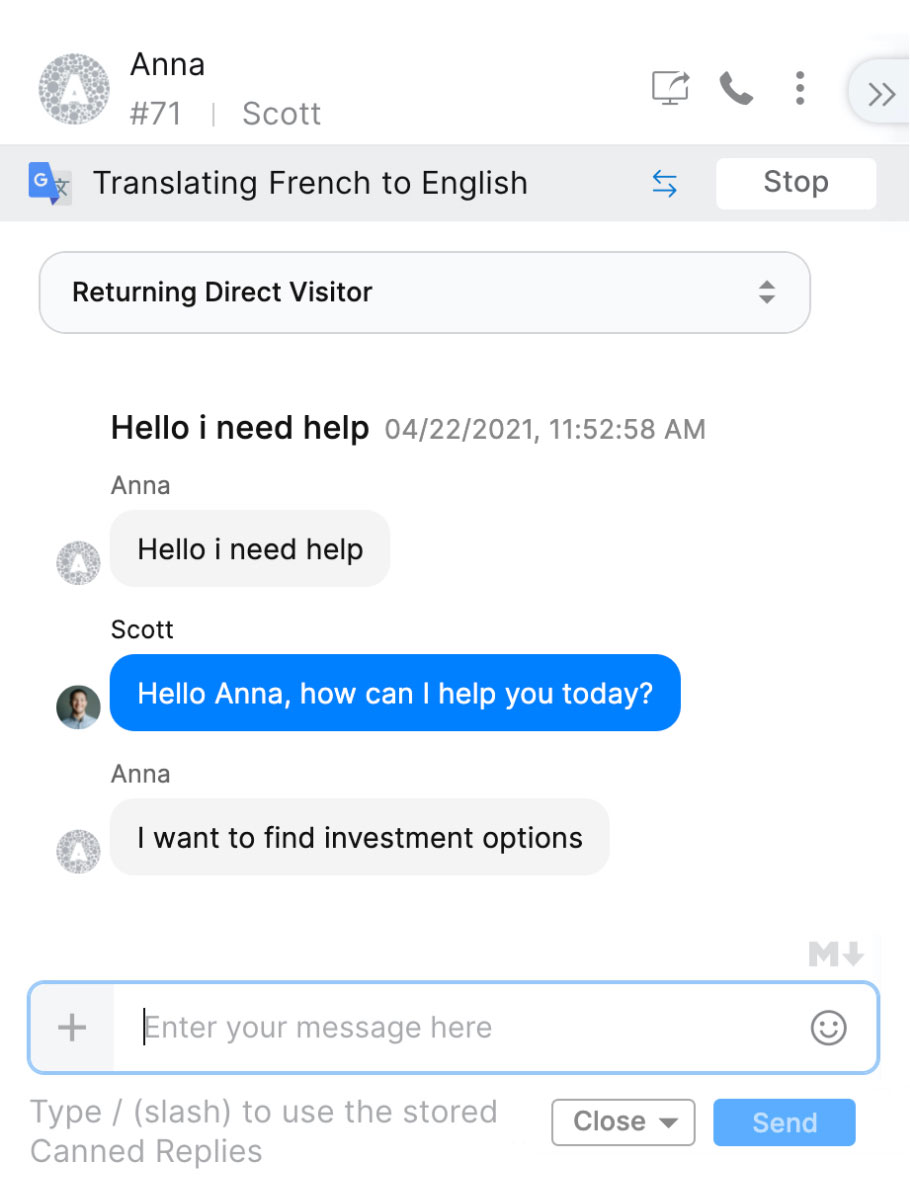

Global assistance with chat translation

Real-time translation in SalesIQ ensures you communicate seamlessly in your customer’s language of choice.

Start your customer journey with SalesIQ

Try it for freeFrequently asked questions?

What is client engagement in financial services?

Client engagement in financial services refers to the continued interaction that a financial service provider has with its clients, aimed at building a long-term relationship. Client engagement in the financial sector involves understanding the clients' financial needs and goals to provide them with relevant products, services and support. This can include various activities such as regular communication, education, personalized services, and value-added services.

What is the importance of a customer engagement platform in financial services?

The BFSI (banking, financial services, and insurance) industry is very competitive with people being more conscious of the ways they can save and invest their money with the maximum returns and the lowest exit barriers. And, trust is a big factor when it comes to selecting a bank/financial service/insurance company.

Just by offering the best interest rates and making sure people's money is safe, no company in the financial sector can win customers and stay ahead in the market. It requires continuous interaction with prospects and customers, providing information they value like financial planning tips and trainings, and understanding their financial needs and suggesting the right products or services. Manually doing this for your entire prospect and customer base is practically impossible, raising the need for financial services customer engagement software.

What are the benefits of using a financial services engagement platform?

Some of the key benefits of using a financial services customer engagement platform are:

- Better customer experience: A financial services user engagement platform helps financial service providers understand customers and offer personalized assistance leading to a better user experience.

- Improved client loyalty: When customers get the best service, all the information they need, and personalized service from their service provider, they have no reason to look for another one. This fosters client loyalty and even advocacy.

- Increased client trust: Having a customer engagement software on the website and providing all the information customers need makes financial companies look more approachable and trustworthy to customers.

Why is Zoho SalesIQ the best customer engagement software for financial services?

Here's why Zoho SalesIQ would be the absolute best choice:

- Customer self-service: Zoho SalesIQ can help your prospects find all the information they need right within the chat window, or even operate their accounts in a conversational manner with chatbots, leading to a better user experience.

- Complete prospect details: You get a real-time view of what your prospects are interested in, where they're having trouble, and even have access to collated publicly available details like where they work and their job role, using which you can estimate their net worth and provide appropriate suggestions.

- Integration with your tech stack, most importantly, helpdesk and CRM: SalesIQ has seamless integration with CRM and helpdesk tools, and other Zoho and third-party apps help you get a 3600 view of your customer.

- Multi-channel support: In addition to live chat, SalesIQ supports instant messaging channels like WhatsApp, Telegram, Facebook Messenger, and Instagram, making financial advice available to customers in their preferred apps.

- Hybrid chatbots: Every customer engagement tool lets you create bots that help customers complete their KYC and find details on the financial services you offer. But SalesIQ helps you merge the two to create a bot that answers customer queries using your resources and still conversationally help customers with any account-related activity they need to do.