Tax Payment

The tax return generated in Zoho Books will be helpful during your tax return filing. This Tax return will be in accordance with your tax period and the transactions recorded in Zoho Books.

ON THIS PAGE

Insight: Tax payments can be recorded either via a Bank or a Cash Account. However, a tax claim can be recorded only through a bank account.

Tax Return Process

Once you file your tax return to the ZATCA, you can mark the generated tax return as filed in Zoho Books. After you have paid the tax amount to ZATCA or reclaimed the tax amount from ZATCA. you can record it from three different modules in Zoho Books:

- Reports

- Accountant

- Banking

Reports

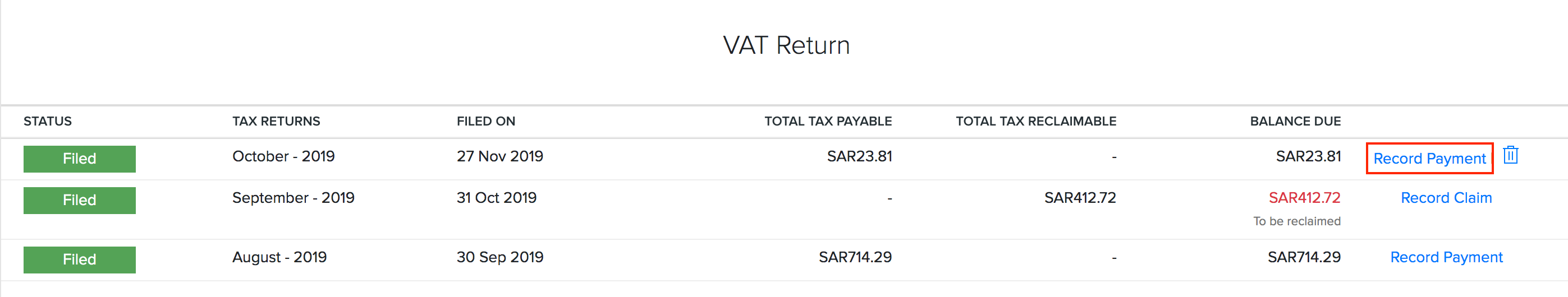

You can record tax payments or claims for the filed returns from the Reports module. Here’s how:

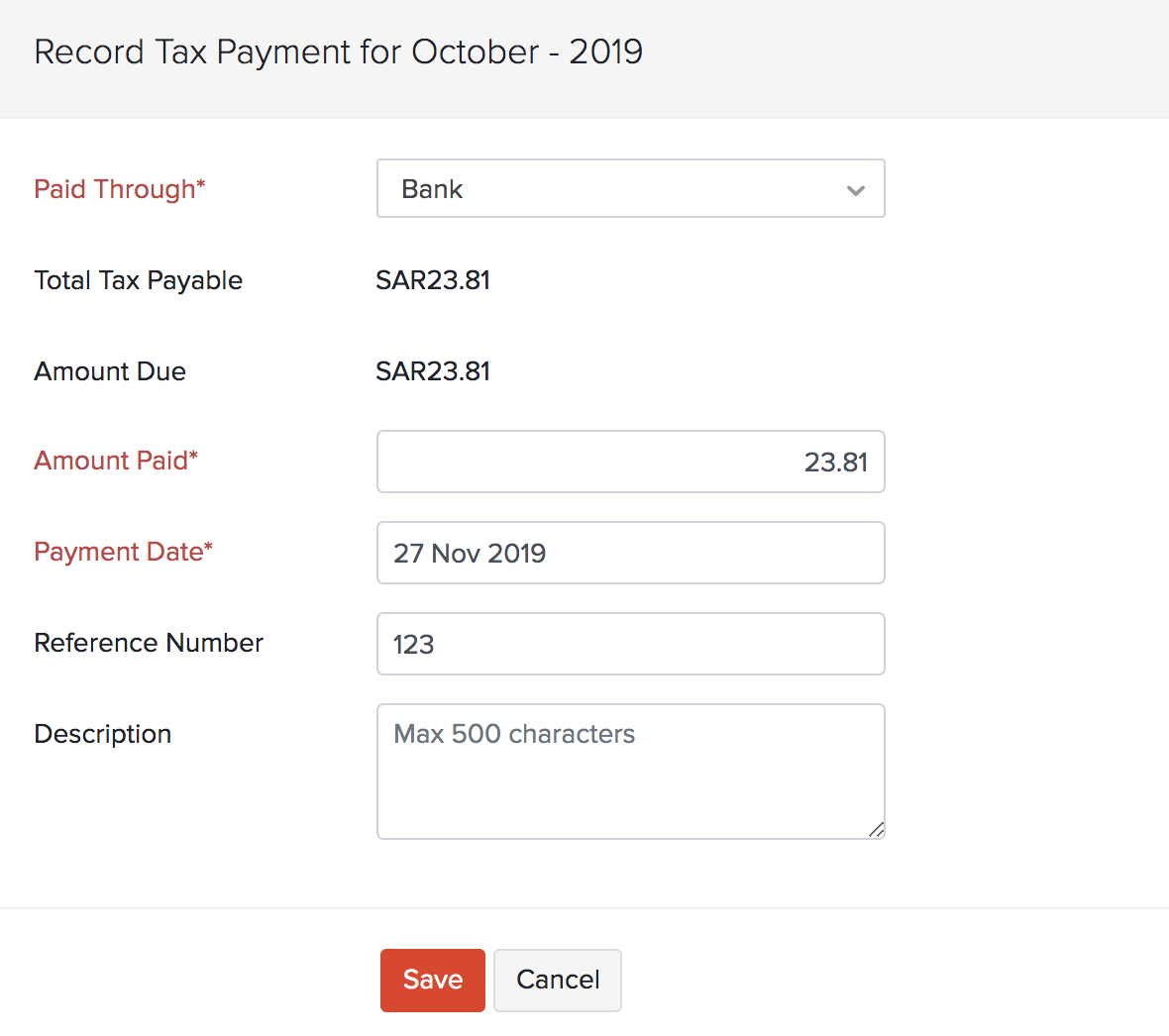

Tax Payment

- Go to Reports > Taxes > Tax Return.

- Click Record Payment.

- Select the payment mode that you Paid Through.

- Enter the Amount Paid.

- Select the Payment Date.

- Enter the Reference Number and a Description (optional).

- Click Save.

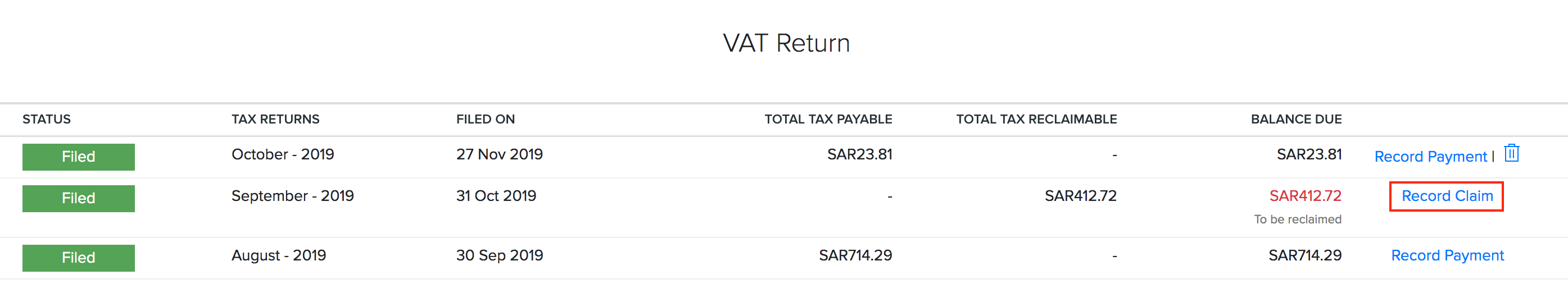

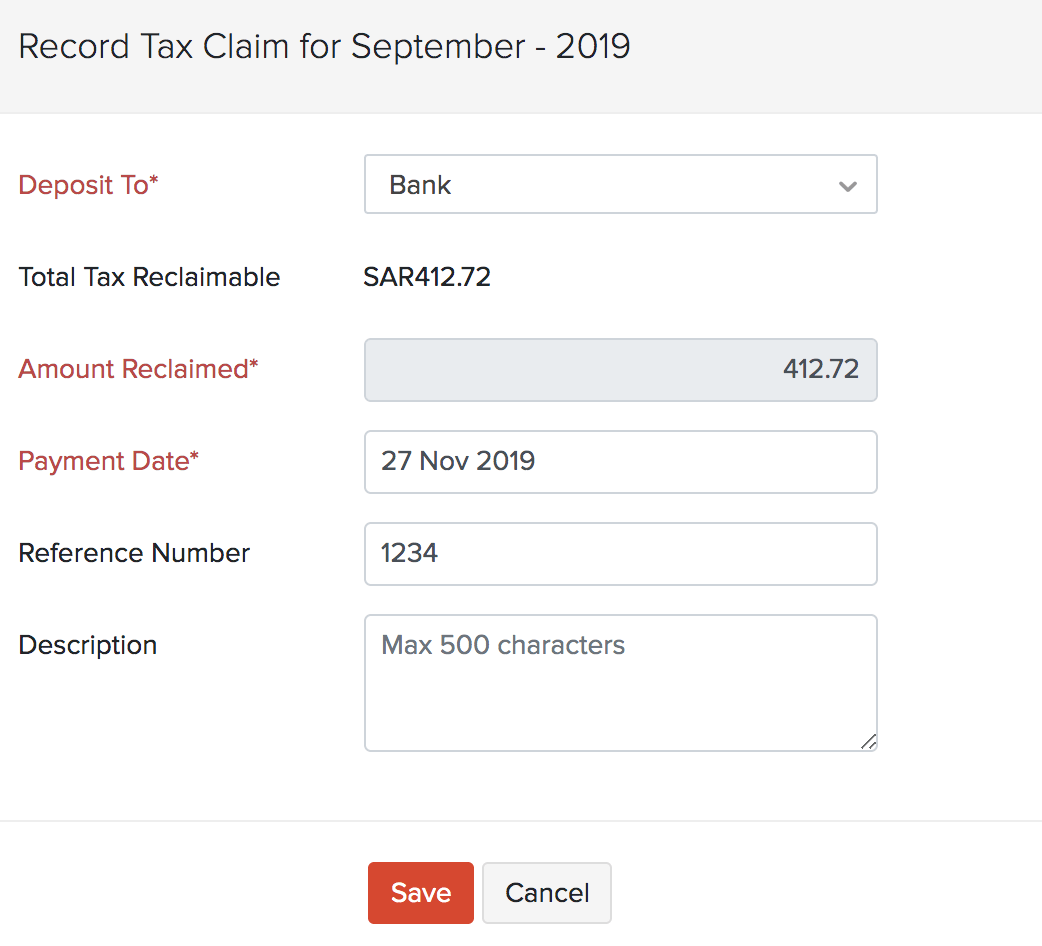

Tax Claim

- Go to Reports > Taxes > Tax Return.

- Click Record Claim.

- Select the account to which the claim is Deposit To.

- Select the Payment Date.

- Enter the Reference Number and a Description (optional).

- Click Save.

Accountant

You can record tax payments and tax claims from the Accountant module. Here’s how:

Tax Payment

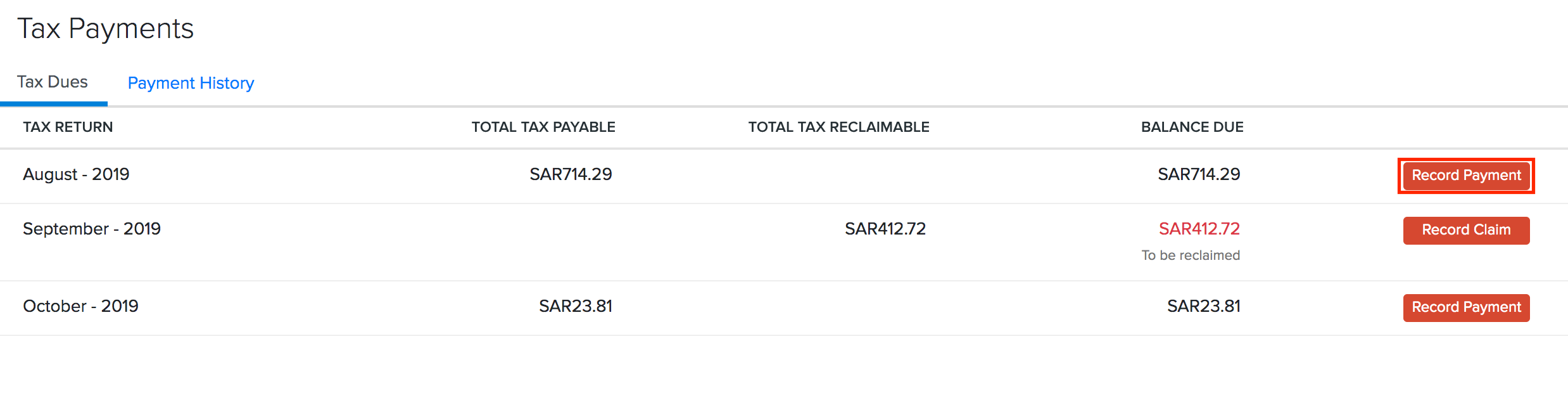

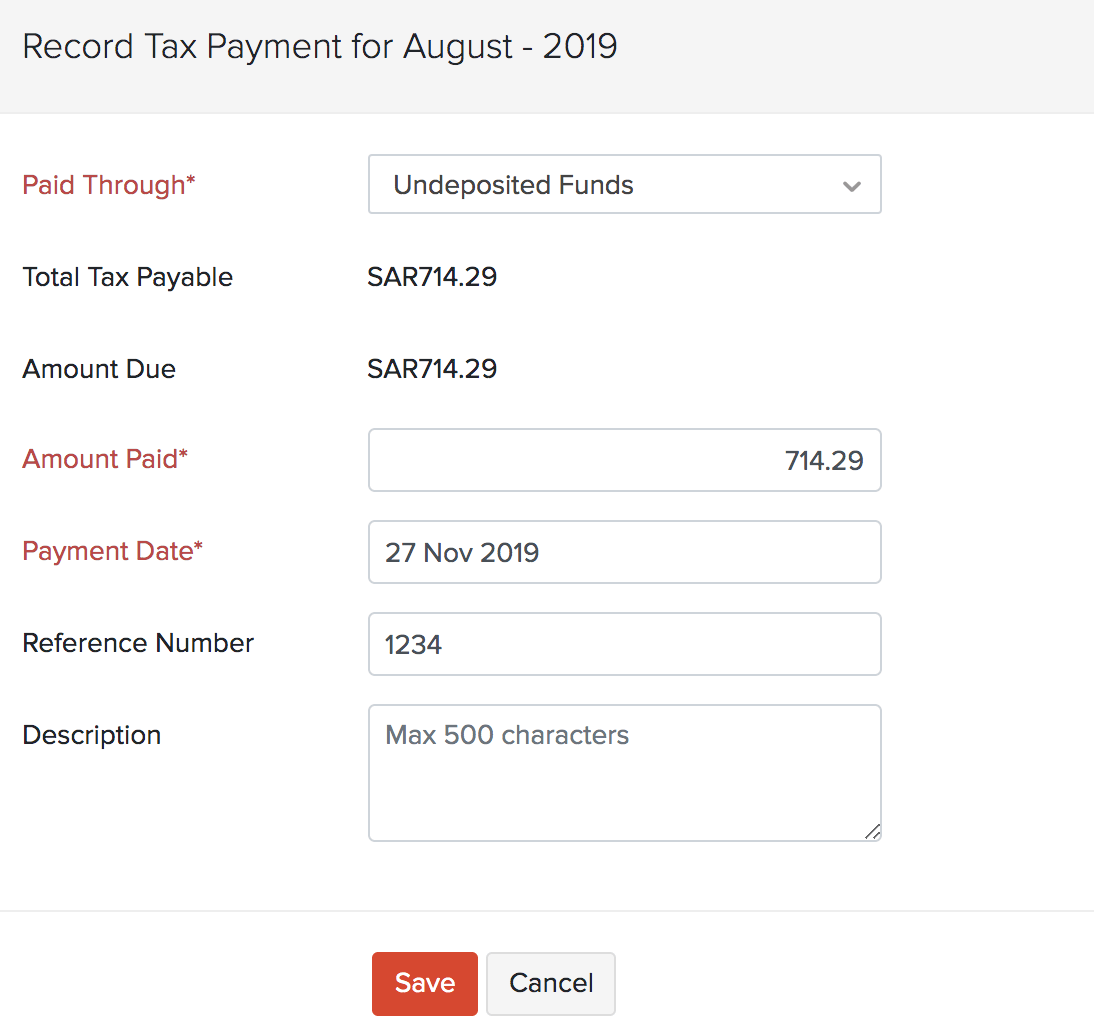

- Go to Accountant > Tax Payments.

- Click Record Payments.

- Select the account that you Paid Through.

- Adjust the amount you want to record in the Amount Paid field. You can record partial payments too.

- Select the Payment Date.

- Enter the Reference Number and a Description (optional).

- Click Save.

Tax Claim

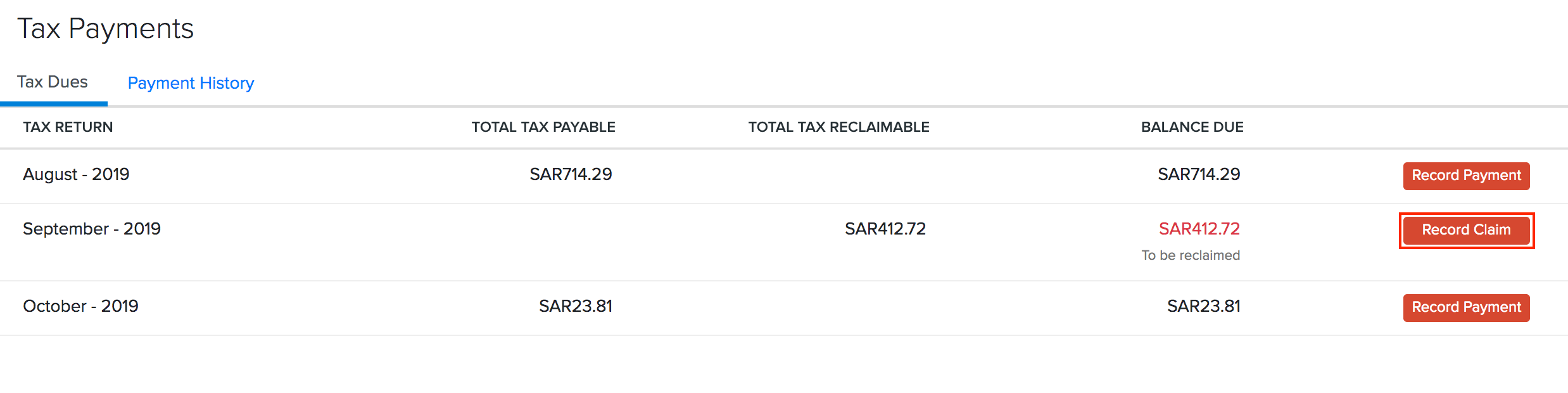

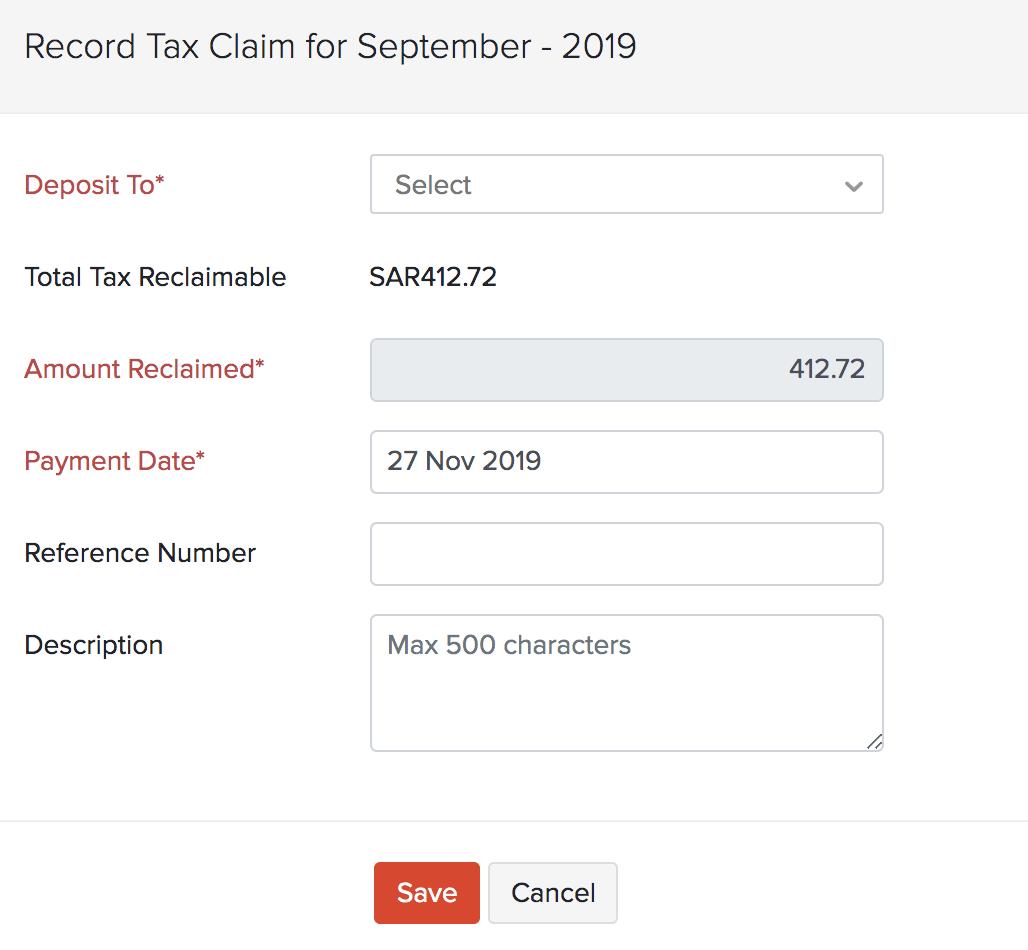

- Go to Accountant > Tax Payments.

- Click Record Claim.

- Select the account that you Deposit To.

- Select the Payment Date.

- Enter the Reference Number and a Description (optional).

- Click Save.

Banking

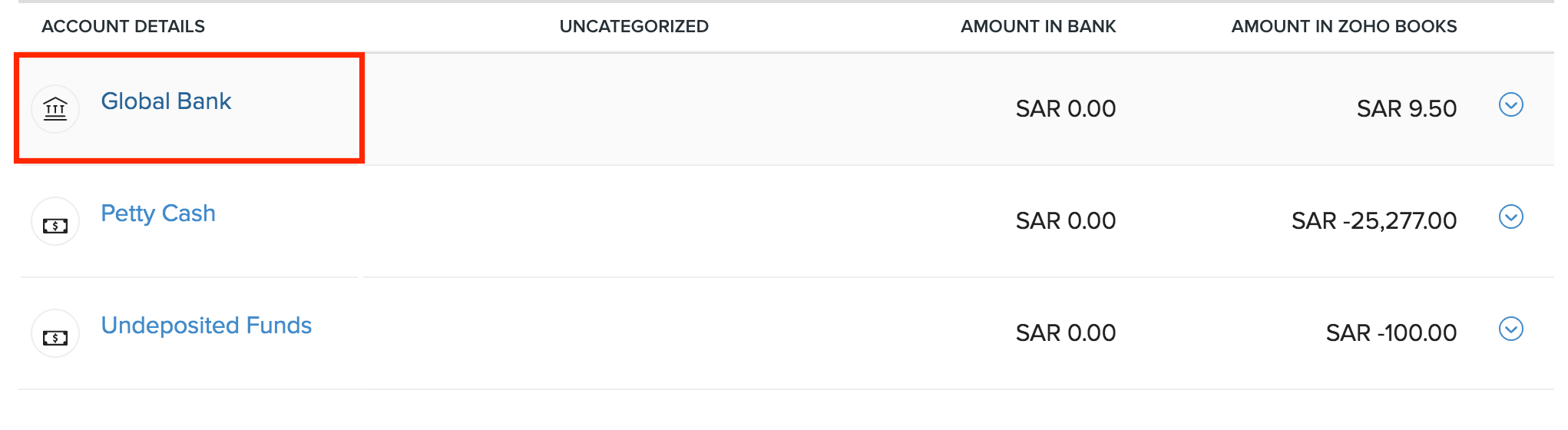

You can record tax payments and claims from the Banking module. Here’s how:

Tax Payment

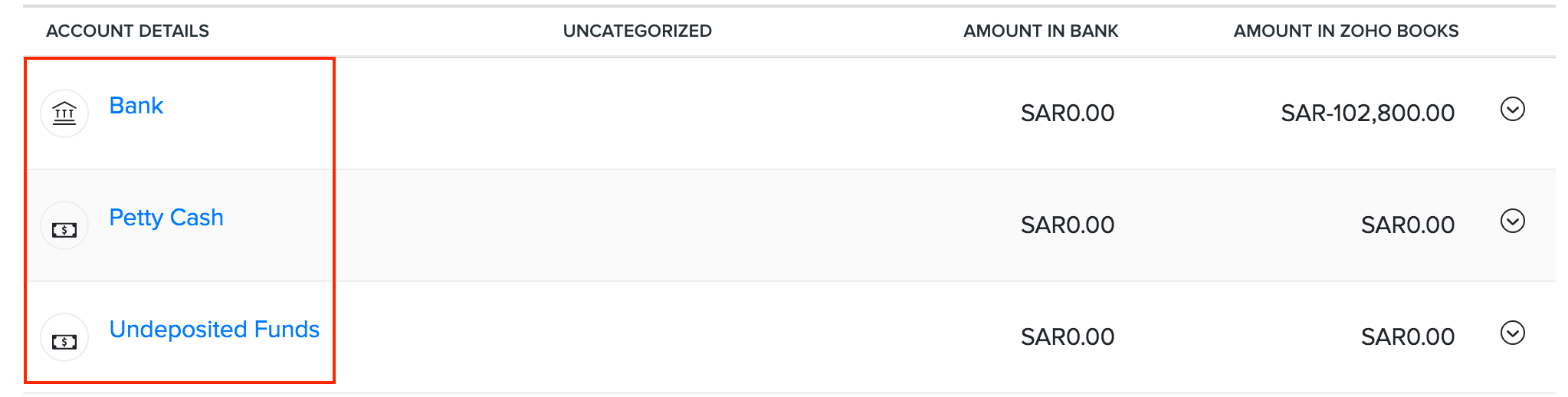

- Go to the Banking module.

- Select a bank or a Cash Account.

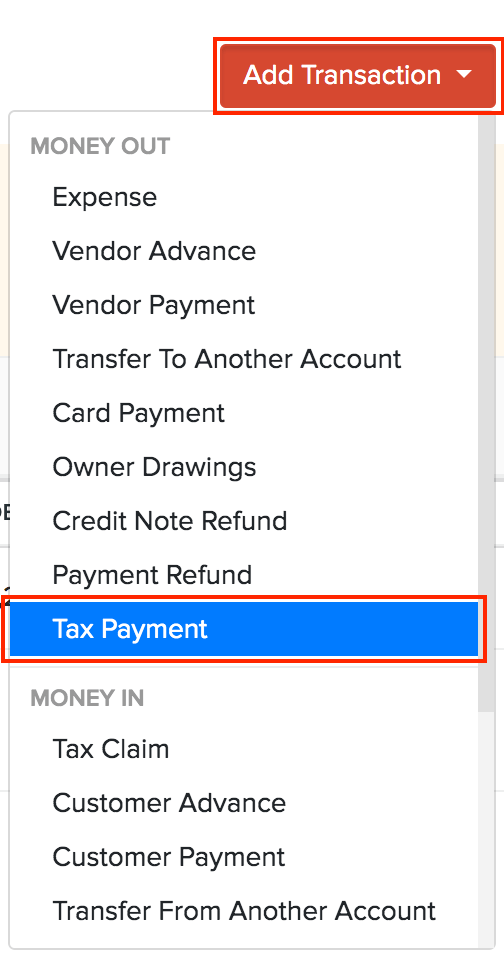

- Click Add Transaction in the top right of the page.

- Select Tax Payment.

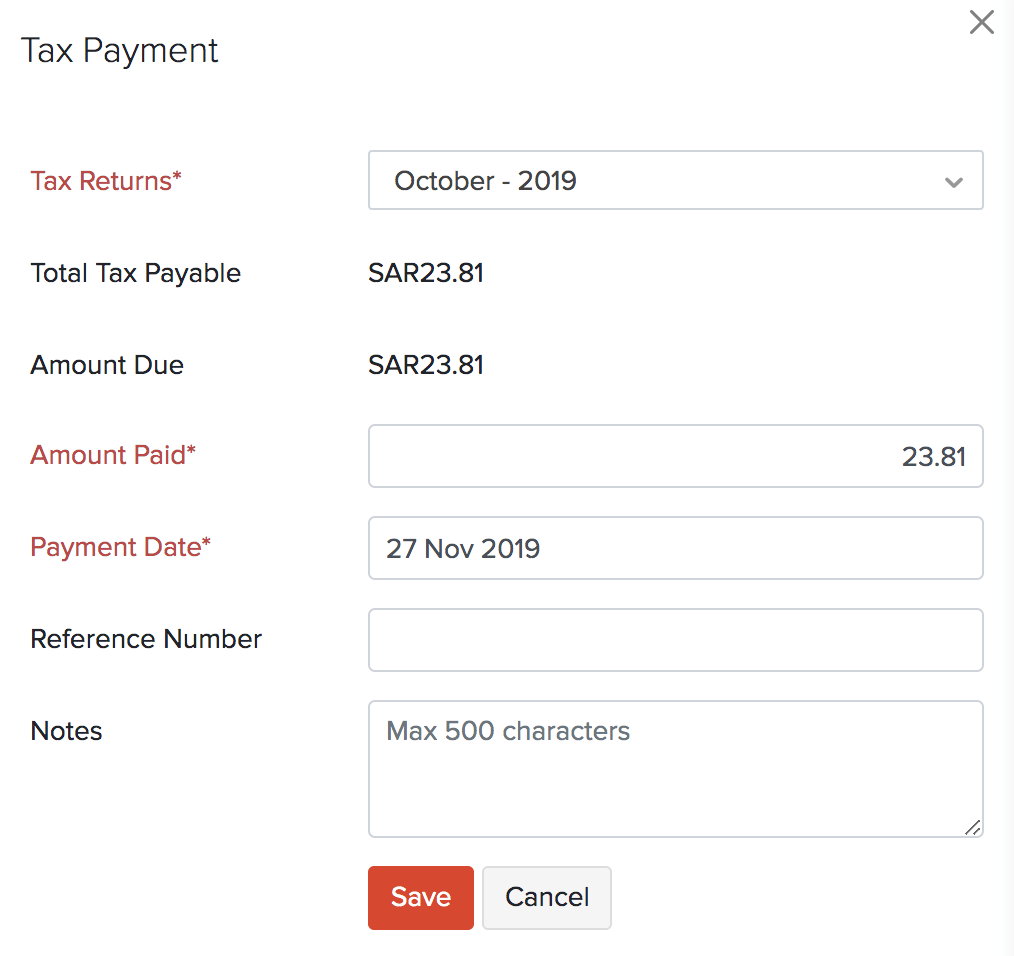

- Select the Tax Returns period for which you want to record the payment.

- Enter the Amount Paid. You can record partial payments too.

- Select the Payment Date.

- Enter the Reference Number and Notes (optional).

- Click Save.

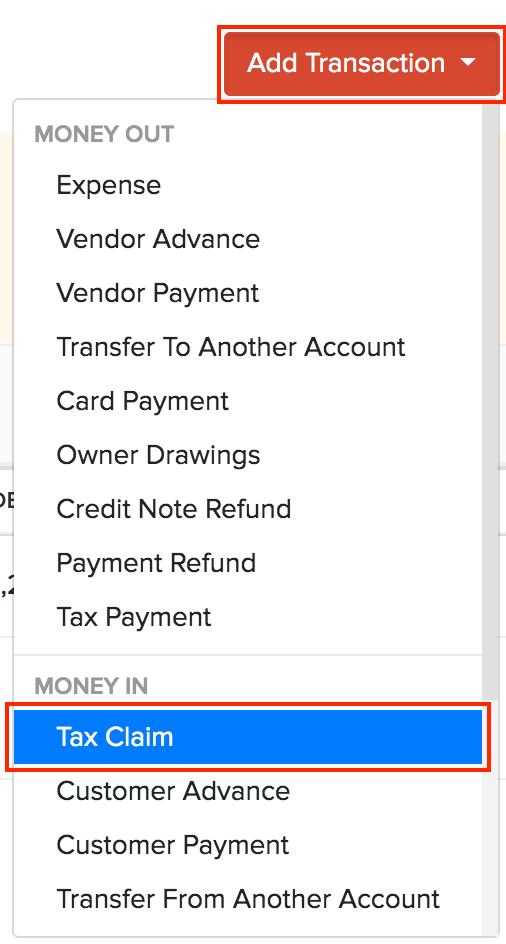

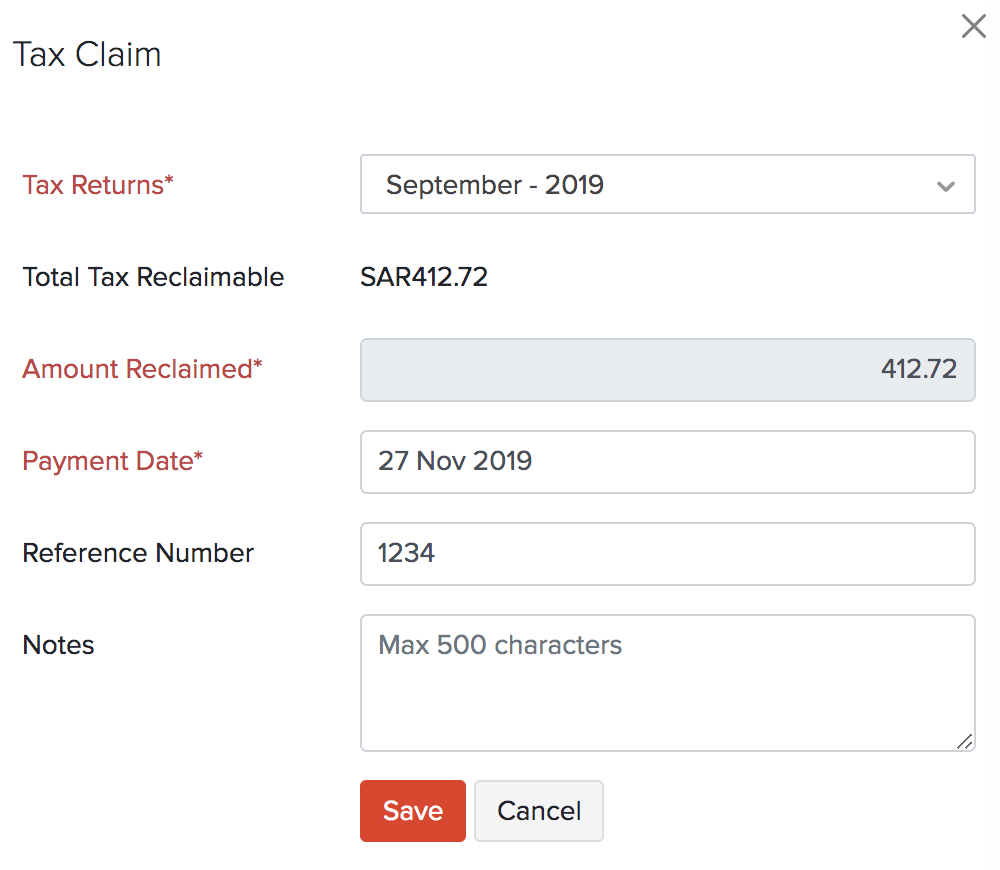

Tax Claim

- Go to the Banking module.

- Select a bank Account.

- Click Add Transaction in the top right of the page.

- Select Tax Claim.

- Select the tax return for which you want to record the claim.

- Select the Payment Date.

- Enter the Reference Number and Description.

- Click Save.

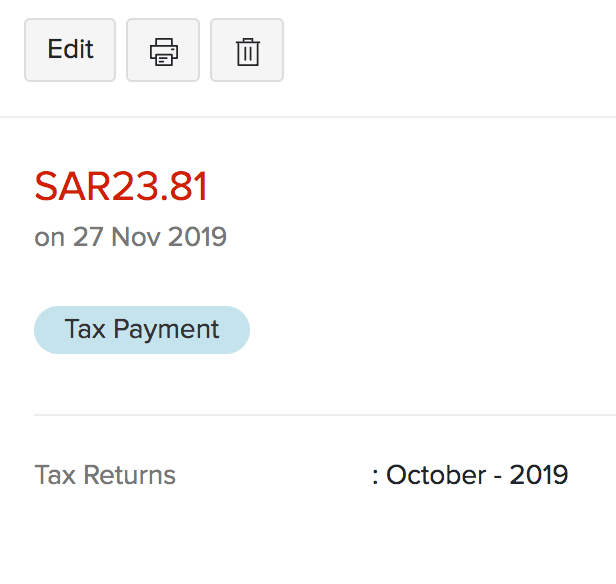

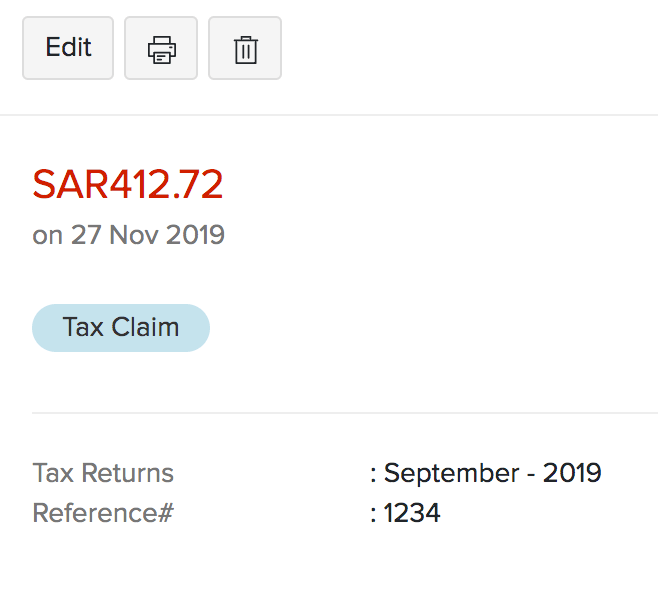

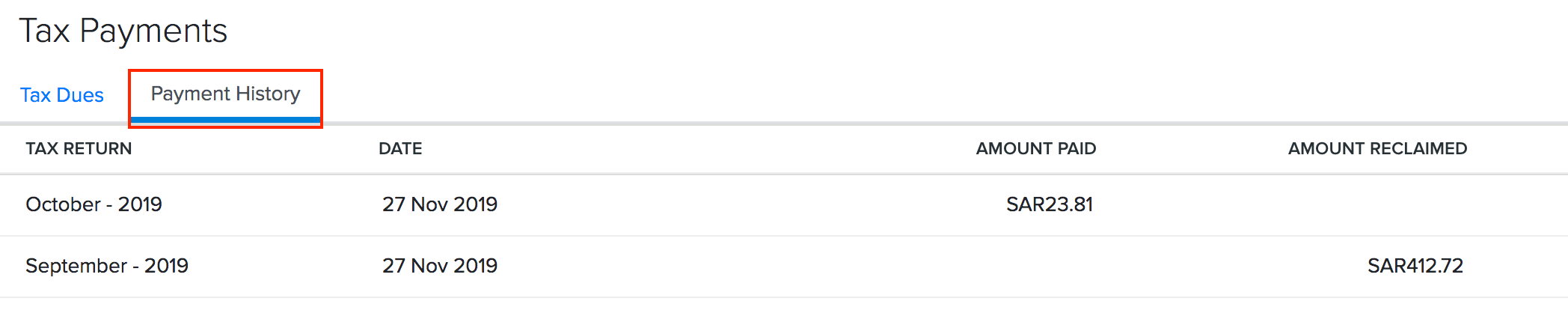

Payment History

Now that you have recorded all the payments and claims, you can also view them in the payments history section. Here’s How

Go to Accountant > Tax Payments. Select the Payment History tab in the top of the page.

The list of all the tax payments and tax claims will be listed here.

Related

VAT Set-up

Customers and Vendors

Items

VAT in Transaction

VAT Filing

Yes

Yes