VAT

Zoho Books is a completely VAT compliant accounting application. We have tailor-made it to suit all your accounting needs for VAT in Saudi Arabia. With Zoho Books, you can:

- Create and send VAT-compliant invoices

- View business reports

- Generate VAT returns (in the format specified by the ZATCA)

Let’s start off with the basic configuration of VAT in Zoho Books.

ON THIS PAGE

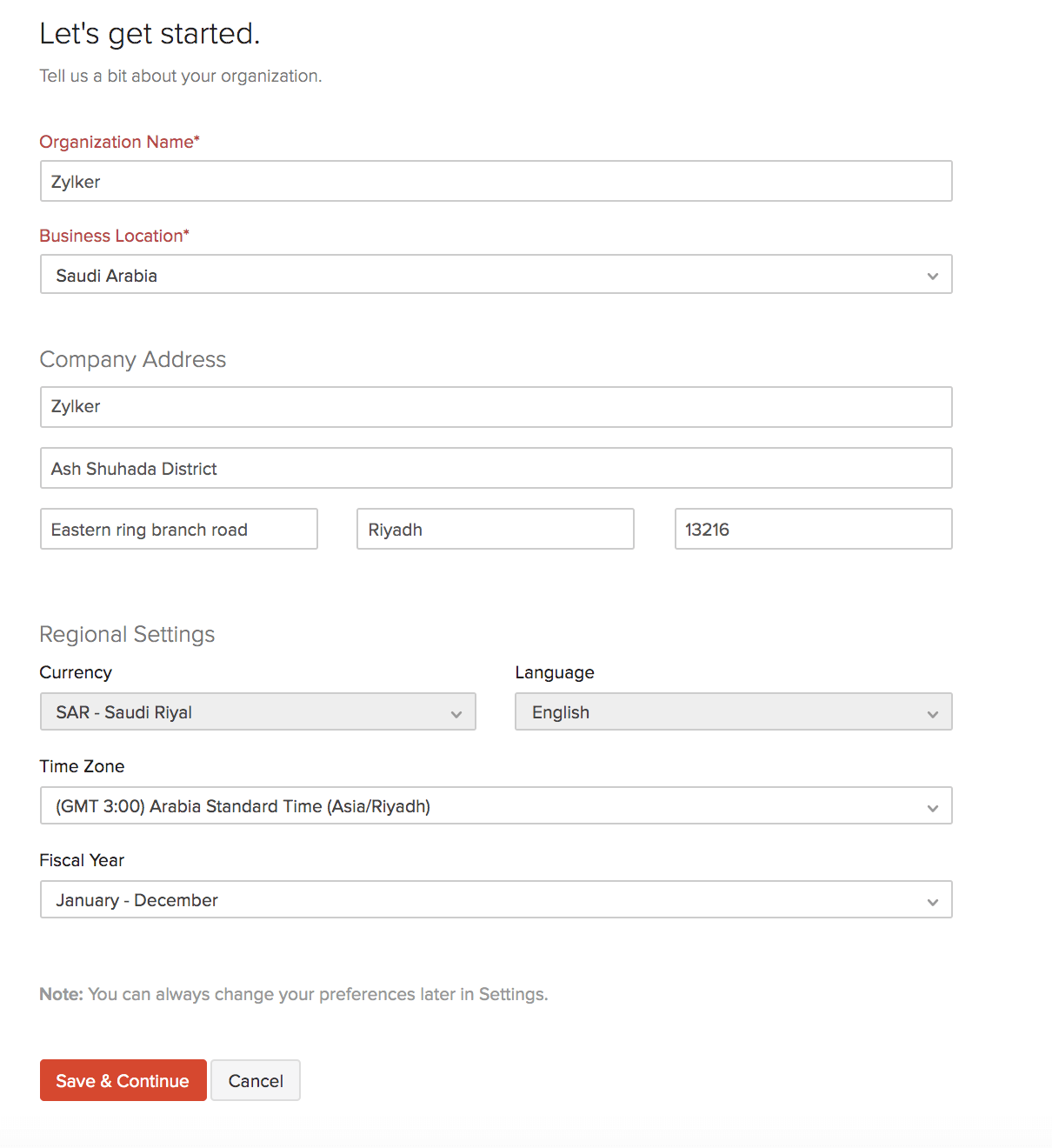

Set Up Your Organization

When you are initially setting up your organization in Zoho Books, you will have to follow the steps below in order to configure your VAT settings:

- Select the Business Location as Saudi Arabia.

- Enter the Company Address.

- Click Save & Continue.

Note: The Business Location cannot be changed once you have entered it while setting up your organization.

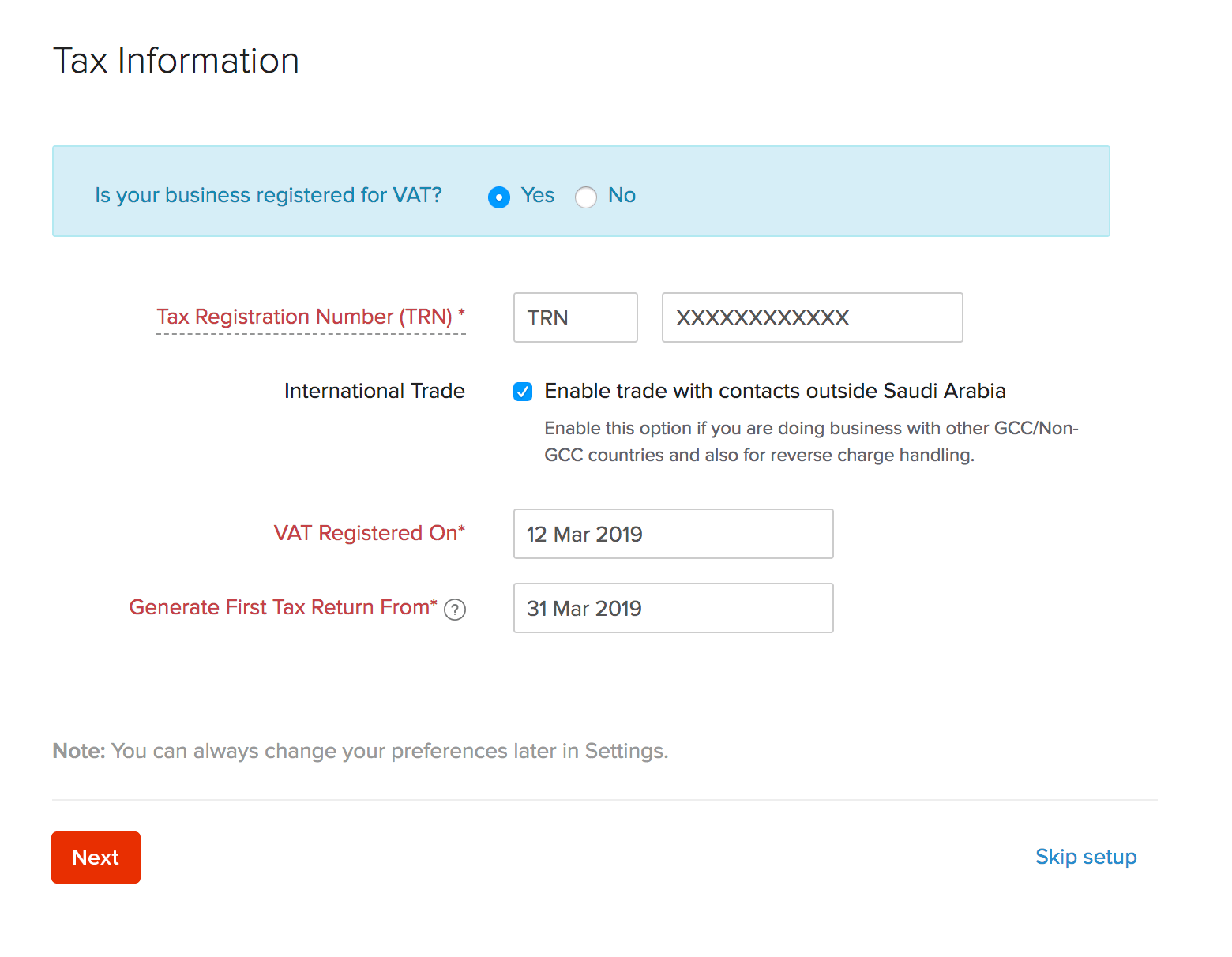

- Enter your Tax Information.

- Enter the VAT Registered On date.

Insight: The TRN is a unique 15-digit number provided to you by the ZATCA for tax purposes.

If you deal with businesses outside the Kingdom of Saudi Arabia, mark the box Enable trade with customer or vendor outside Saudi Arabia.

- Click Next.

With this, you have successfully entered the VAT details while setting up your organization.

Set Up Taxes

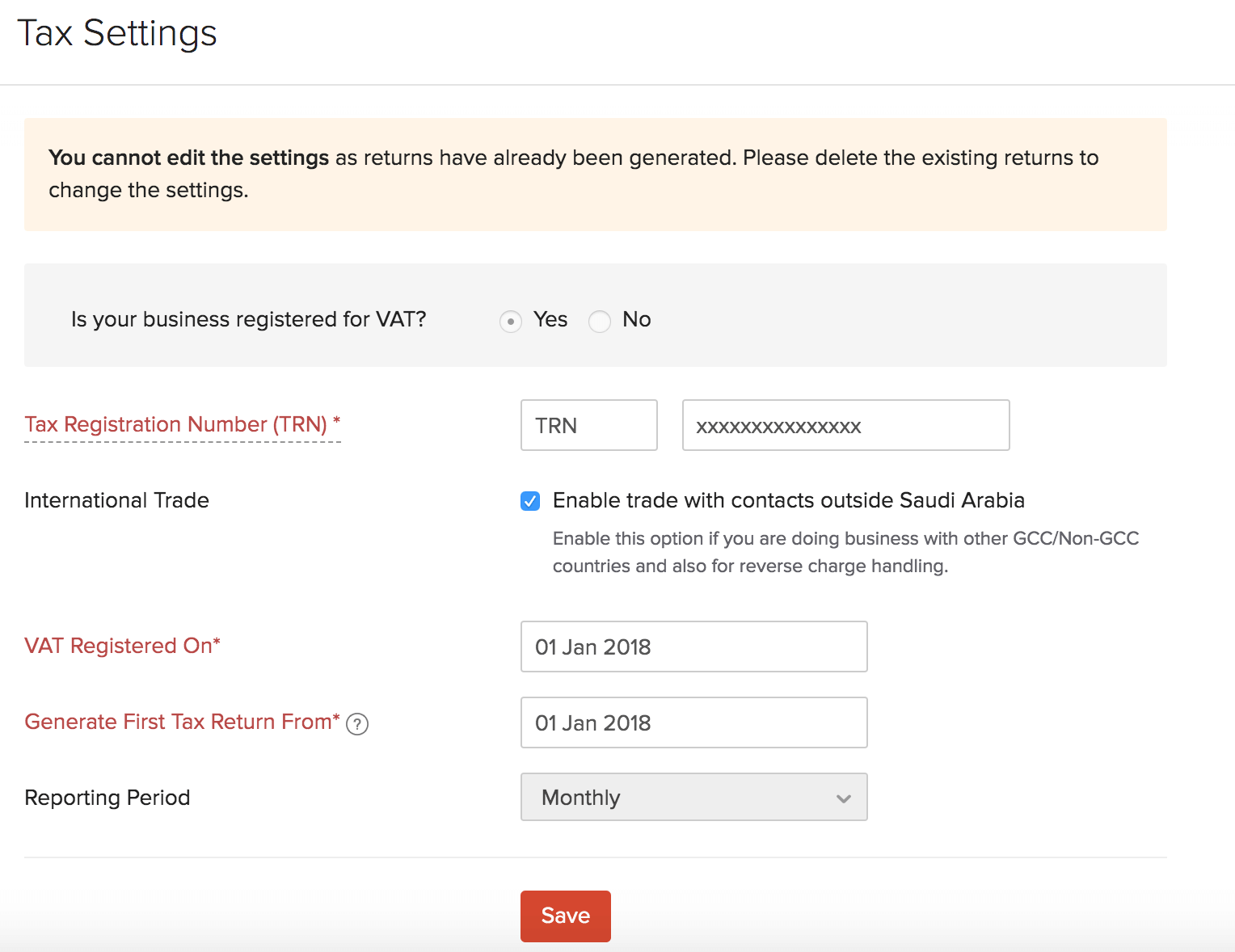

If you haven’t set up your VAT information while setting up your organization, here’s how you can do it:

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Settings.

- Enter the Tax Registration Number.

- Enter the VAT Registered On date.

- Click Save.

| Fields | Description |

|---|---|

| TRN | Enter the Tax Registration Number provided to you by the ZATCA. |

| International Trade | If you deal with businesses outside Saudi Arabia, mark the box Enable trade with customer or vendor outside the Saudi Arabia. |

| Reporting Period | You can file your tax returns either Monthly, or Customise the time period. |

| VAT Registered On | The date on which you have registered for VAT. You can create VAT transactions from the VAT registration date. |

After you set up your tax information, the different tax rates that will be auto-populated while creating transactions are:

Standard Rate [5%]

VAT of 5% can be applied on transactions created in Zoho Books. Most of the transactions that occur in Saudi Arabia fall under this tax rate.

Zero Rate [0%]

VAT of 0% can be applied on transactions created in Zoho Books.

Learn more about sectors which are taxed at 0%.

Exempt

If any of the items are exempted from VAT, you can select them as exempted from VAT while creating transactions. You don’t need to create a new tax for such transactions.

Learn more about sectors which are exempted from VAT.

Out of Scope

If the supply of any of your items does not fall under the scope of VAT, then you can select this option while creating transactions for them.

Learn more about the basics of VAT

Next >

Customers and Vendors

Yes

Yes