Taxes

VAT Ready Features in Zoho Books

This section will give you a brief overview about the VAT Ready features that are available in Zoho Books.

Configuring your Zoho Books account

Zoho Books is now VAT ready. As part of the rollout, you will have to follow a few basic steps in order to get your organization ready for VAT.

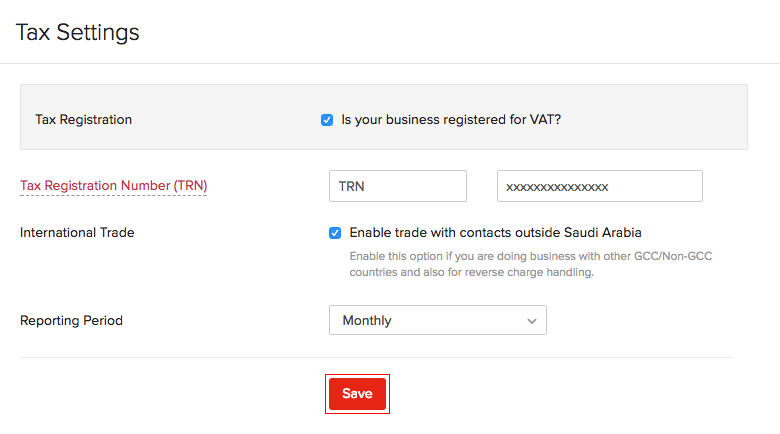

Enabling Tax Settings

To enable the VAT settings for your organisation in Zoho Books:

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Settings.

- Check the box Is your business registered for VAT?.

- Enter your Tax Label and Tax Registration Number(TRN).

- If your business involves international trade (importing or exporting outside GCC), check the box Enable trade with contacts outside Saudi Arabia.

- Click Save.

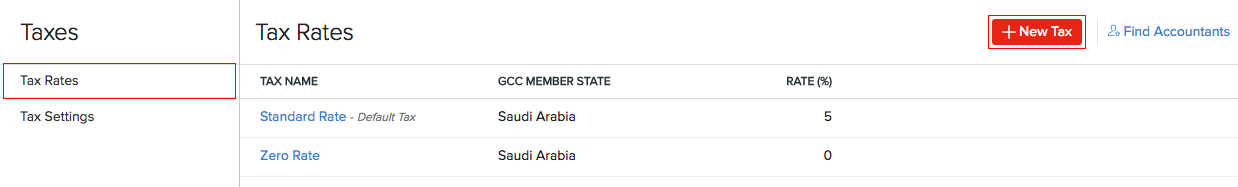

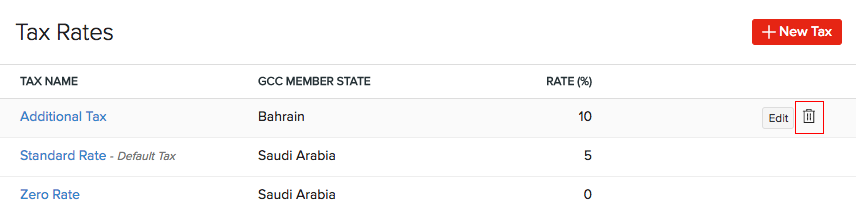

Setting up Tax Rates

Once you’re done with the VAT Settings, the next step is to set up the VAT Rates.

There are two default VAT rates are enabled if you have configured your tax settings in Zoho Books:

- Standard Rate (5%)

- Zero Rate (0%)

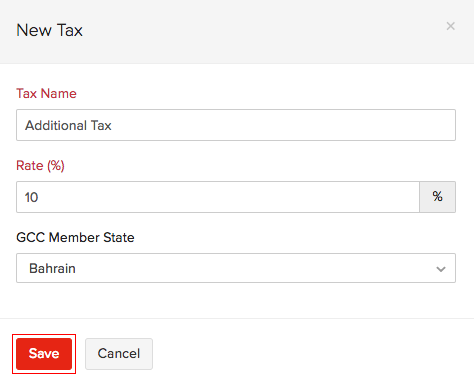

Adding New Taxes

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Rates.

- Click the + New Tax button in the top right corner of the page.

- Fill in the Tax Name and Rate (%) in the New Tax page.

- Click Save.

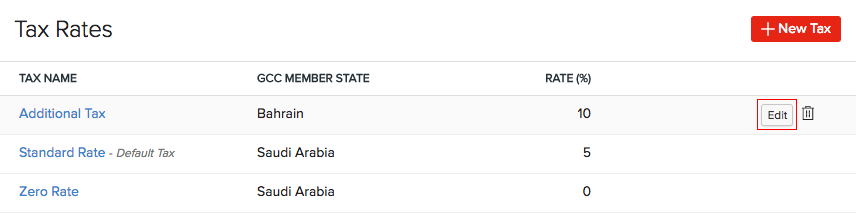

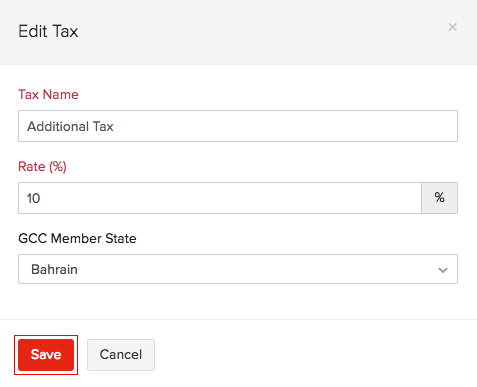

Editing Taxes

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Rates.

- Click the Edit button on the right side of the VAT to edit.

- Click Save.

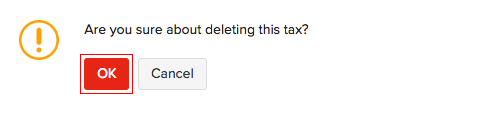

Deleting Taxes

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Rates.

- Click the Trash button on the right side of the VAT to delete.

- Click OK.

Yes

Yes