Choosing the right tech stack for your modern accounting practice

Building a successful accounting practice today isn’t just about expertise; it’s about efficiency, scalability, client experience, and staying ahead of compliance chaos. And the core of all that?

Your tech stack.

A well-selected tech stack becomes your silent partner: organizing workflows, reducing manual grunt-work, ensuring compliance accuracy, and helping you serve more clients without burning out. But with so many tools, platforms, and “best practices” floating around, most chartered accountants feel overwhelmed about where even to begin.

This article breaks it down—simply, practically, and from the lens of a modern accountant handling audits, tax, compliance, team management, and client expectations.

Why your tech stack matters

Most accounting firms face the same challenges:

Too much time spent on follow-ups

Client documents scattered everywhere

Team members not knowing what’s due or when

Manual work eating up hours

No clear visibility into deadlines or workload

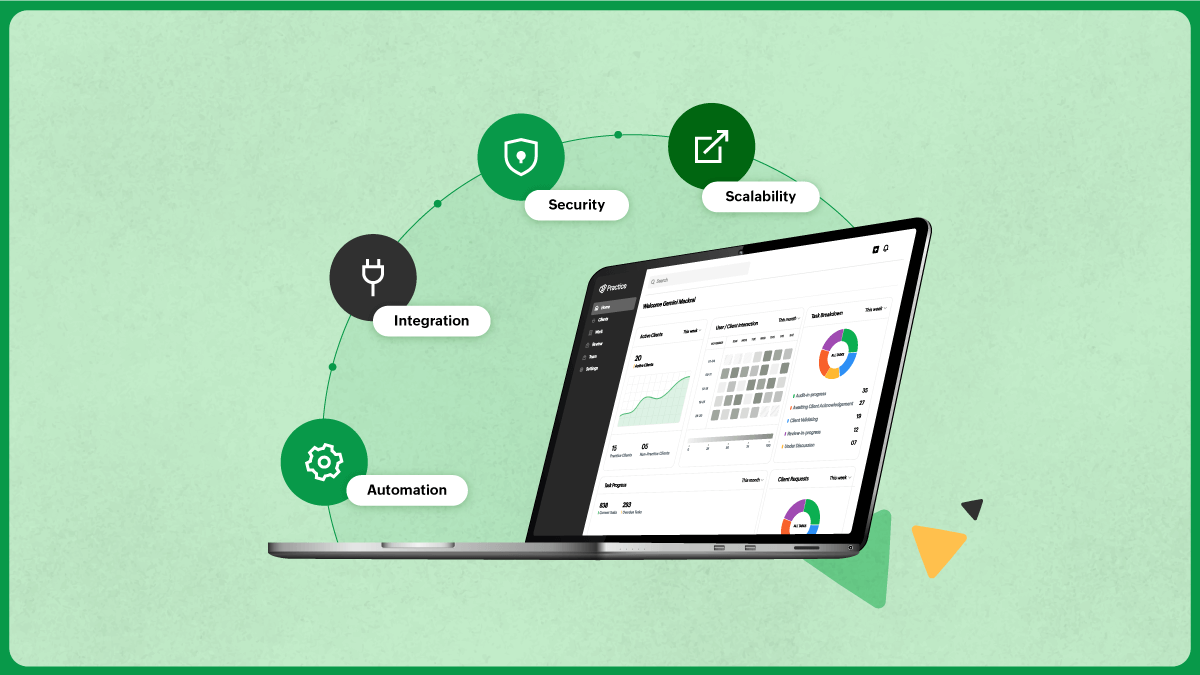

A good tech stack helps you solve these problems. It ensures your practice runs in a predictable, organized, and scalable way without adding extra work. Features like structured client databases, automated workflows, integrated time tracking, billing, and unified communication logs make a noticeable difference even before you add advanced tools.

The essential layers of an accounting practice tech stack

Think of your tech stack as five layers. When these layers work together, your practice becomes far more efficient.

1. Practice management – The center of everything

This is the most important layer in your tech stack.

A good practice management system helps you handle:

Client master data

Compliance calendars

Task tracking and workflows

Team workload

Time tracking and billing

Document management

Client communication logs

Subtle but powerful features like task templates for recurring work, centralized client timelines, automated follow-ups, role-based access, and timesheet-to-billing mapping play a huge role in removing chaos.

The goal is simple: at any moment, you should know what’s going on in your practice without asking anyone. If you still depend on spreadsheets, WhatsApp, and calls to manage work, this should be the first layer you fix.

2. Accounting & bookkeeping software – Your core work tool

This is the engine behind your service delivery.

Look for tools that:

Are cloud-based

Support taxes, bank feeds, and e-invoicing

Allow multi-client management

Enable real-time collaboration with clients

A common question accountants ask is: “Should I standardize or use whatever software my clients use?”

The honest answer:

For your internal work, always standardize.

For client-side accounting, adapt only where required.

Standardization saves time, improves accuracy, and reduces chaos.

3. Compliance tools – Your accuracy layer

Your compliance tools should make return filing and audit preparation smoother, not harder.

Look for:

Tax return preparation + reconciliation

ITR + TDS utilities

ROC & MCA support

Automated reminders

Easy document attachments

If your compliance tools don't sync with your practice workflows and task timelines, you’ll end up doing double work.

4. Collaboration & communication tools – A smoother client experience

For many firms, this is the biggest gap; clients send documents through WhatsApp, email, and drive links, and things get lost.

Choose tools that:

Keep communication organized

Allow secure document sharing

Track status of client requests

Reduce follow-up cycles

Capabilities like client portals, shared workspaces, and audit trails drastically reduce back-and-forth and keep everything in one place.

5. Automation & analytics tools – Your growth engine

If your firm wants to scale, you need automation, not more staff.

Look for automation in:

Recurring task creation

Reminder and follow-up sequences

Document requests

Timesheet entry and billing

Client onboarding workflows

Analytics to track:

Revenue per client

Profitability per service

Staff productivity

Turnaround time

Pending workloads

These insights help you make data-driven decisions rather than gut-based assumptions.

How to choose the right tech stack

Most accountants pick software based on recommendations. But the right way is to evaluate based on your practice’s needs.

Step 1: Identify your biggest bottlenecks

Examples:

Missing deadlines

Too many manual tasks

No visibility into team workload

Client follow-ups taking too long

No single place to track work

Your tech stack should directly solve these.

Step 2: Don’t choose too many tools

More tools = more confusion.

Start with one solid practice management tool, then add specialized tools only when needed.

Step 3: Make sure the tools integrate

If your accounting, workflow, client communication, and billing systems don’t talk to each other, you’ll always be duplicating efforts.

Step 4: Consider adoption and ease of use

A tool is only valuable if your team actually uses it. Look for simple, intuitive, predictable workflows.

Step 5: Use a seven-point evaluation checklist

Before finalizing any tool, check:

Cloud-based?

Secure?

Compliance-ready?

Scalable for multi-client work?

Easy for your team?

Reduces manual work?

Good support and onboarding?

If a tool doesn’t meet at least five of the seven points, skip it.

Common questions accountants have

Should I choose an all-in-one solution or multiple specialized tools?

Start with one strong central system (practice management), then add specialized tools only if needed.

What about security? Can cloud tools handle confidential data?

Yes. Look for ISO 27001, SOC compliance, encryption at rest + in transit, and role-based access controls.

What if my team is not tech-savvy?

Start small. Set SOPs. Provide training; people adapt faster than you think.

What if my clients don’t adopt the tools?

Begin with internal adoption. Slowly introduce client-facing features where needed—don’t force a tech change on clients too early.

Will automation reduce my control?

Automation handles repetitive tasks. You still manage oversight, approvals, and decisions. It actually strengthens control.

How much should I budget for a good tech stack?

Most modern accounting firms spend 1–3% of their annual revenue on software. The ROI in saved hours is massive.

What a modern practice management tech stack looks like

A clean, efficient tech stack usually includes:

Practice management system

Accounting software

Tax compliance functionalities

Document storage

Client portal or collaborative tools

Automation

Analytics dashboards

This setup helps your firm stay organized, predictable, and scalable without feeling overwhelming.

Final note

Your tech stack is not just software; it’s the backbone of how your practice functions. With the right setup, you spend less time chasing information and more time delivering high-value work to clients.

If you're looking for a platform that ties together client management, workflow automation, task tracking, time & billing, document organization, compliance oversight, and team collaboration into one integrated system, Zoho Practice gives you exactly that.

It’s built for modern accounting firms, engineered around the real bottlenecks accountants face, and designed to help you scale without adding chaos or extra headcount.

If you want a tech stack that actually moves your practice forward, Zoho Practice is the best choice.