Invoicing an Expense

In most cases, the work doesn’t stop with simply tracking your expenses . Sometimes, you might need to spend money out of your pocket while carrying out a job for the client, such as buying raw materials, labor charges or travel expenses.

If it’s agreed that such expenses are to be reclaimed from your client , they are referred to as reimbursable expenses. For instance, if your assignment involves frequent travel, your client might agree to reimburse your fuel charges. In such cases, you can record these expenses in Zoho Invoice and invoice your client to get it

Creating and Invoicing a Reimbursable Expense

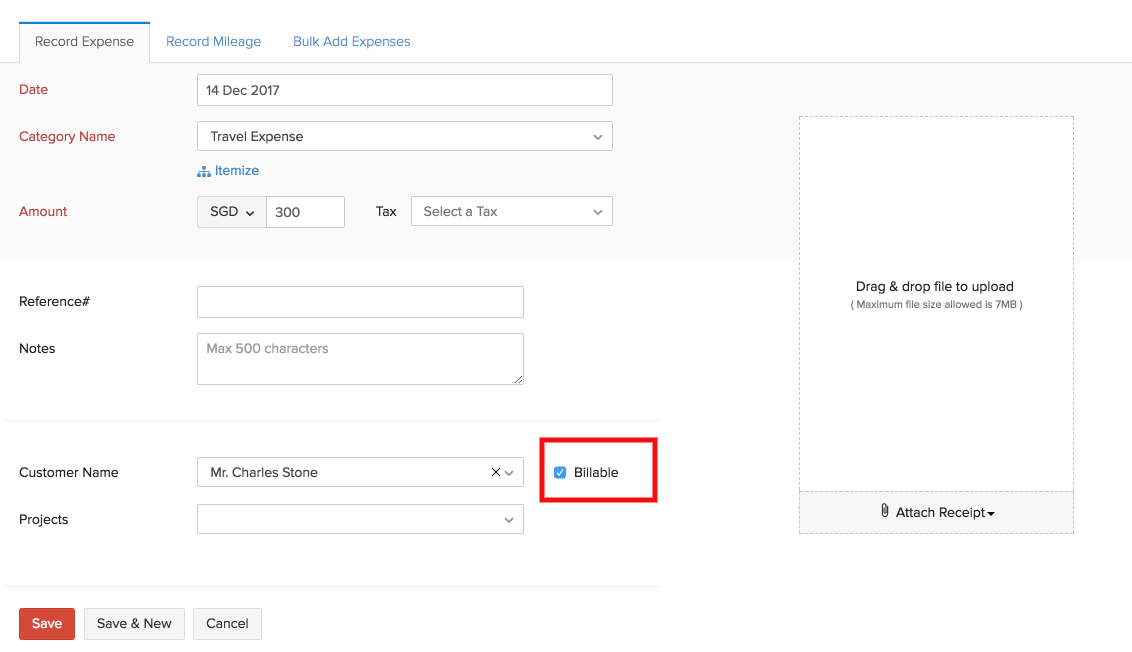

1. Make the expense billable

- Create a new expense.

- Select the customer who is reimbursing you and check the box that says Billable.

- Save the expense. This expense can now be converted to an invoice.

Insight: Expenses that have not been marked billable cannot be invoiced to a client.

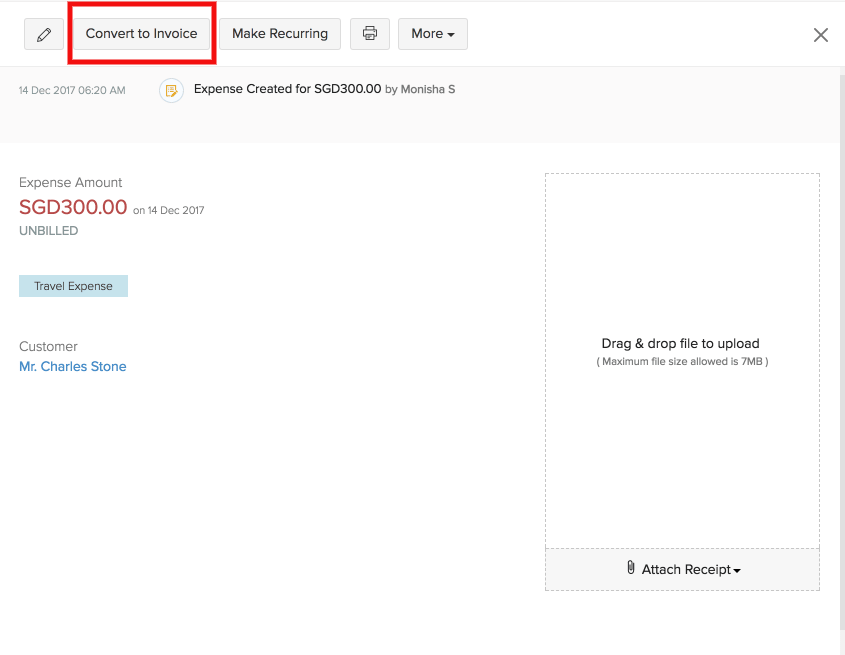

2. Invoice the expense

- Select the particular expense.

- Click on the button Convert to Invoice.

- Fill in the required details such as invoice date and payment terms before sending the invoice.

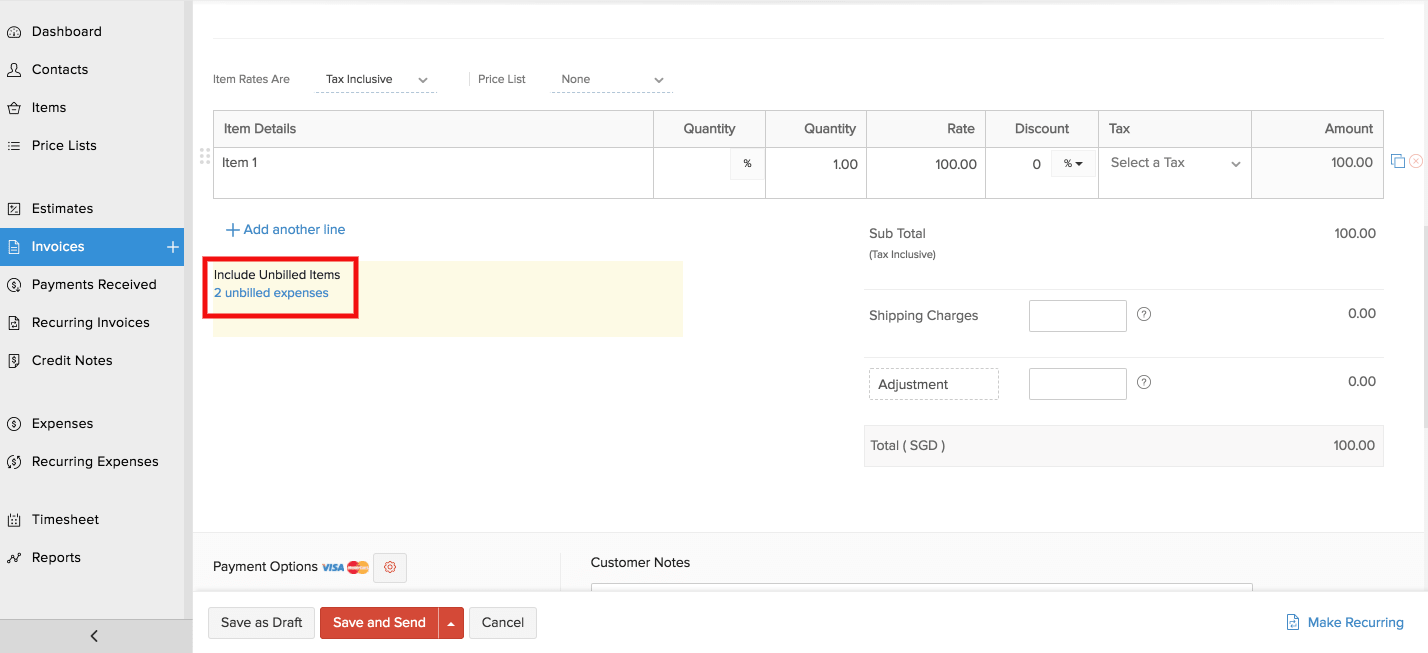

Including a Billable Expense within an Invoice

Let’s say you offer painting services, and purchased a few cans of paint for a particular job. It doesn’t make sense to invoice the client for the service separately, while sending out a fresh invoice for reimbursement on the paint cans. Combining them both as a single invoice looks much more professional, and makes your accounting much less confusing.

In such cases, you can include the recorded expense as a line item within the main invoice.

- Select the client from your contacts list and create the invoice.

- At the bottom, Zoho Invoice will prompt the unbilled expenses associated to this contact.

- Select the expenses that are associated with this particular job, they will be added to the invoice as separate line items.

Insight: If you are carrying out multiple jobs for the same client, double check to make sure the expenses you’re including are the ones pertaining to the job you’re invoicing for.

Yes

Yes