My customer paid for an invoice using a cheque but the cheque bounced. How do I record bounced cheques in Zoho Books?

If your customers pay for invoices using cheques, there is a possibility that the cheques may bounce. To record bounced cheques in Zoho Books, you can create an account (say Dishonored Payment), under the type Other Current Liability.

For the Money In transaction, you can record a deposit to the Dishonored Payment account and for the Money Out transaction, you can record an expense.

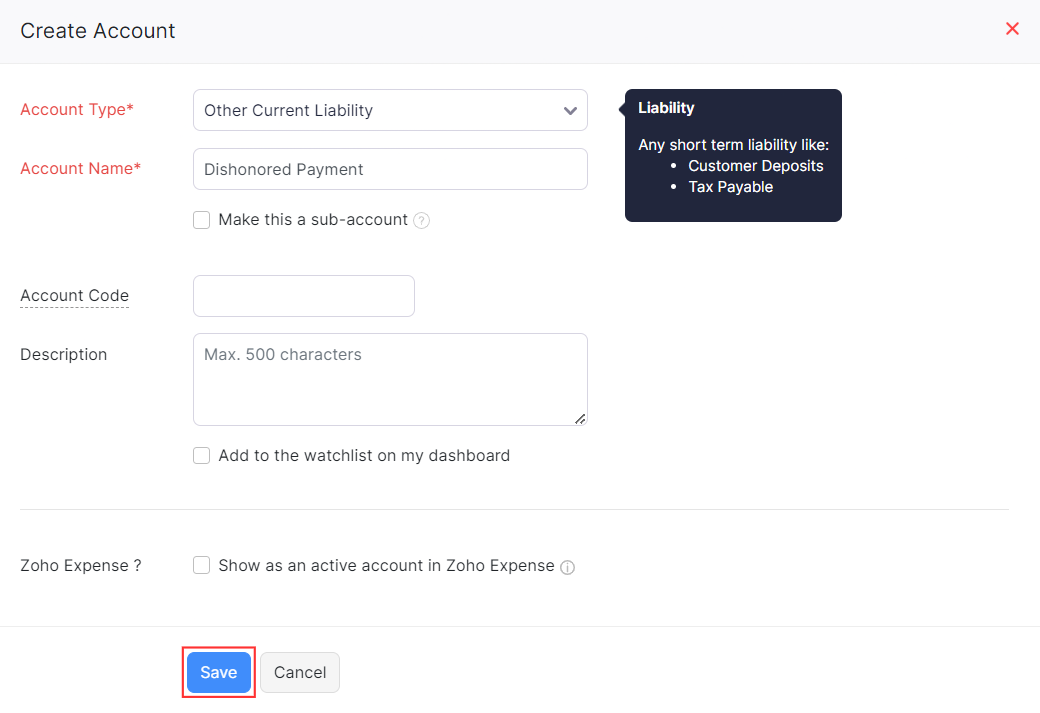

To create an account for dishonored payments:

- Go to the Accountant module on the left sidebar and select Chart of Accounts.

- Click + New Account on the top right corner of the page.

- Enter the Account Name (Dishonored Payments in this case) and select the Account Type as Other Current Liability.

- Enter the Account Code and write a short description for the account, if required.

- Click Save.

A new account will be created. Next, you can record a deposit. Here’s how:

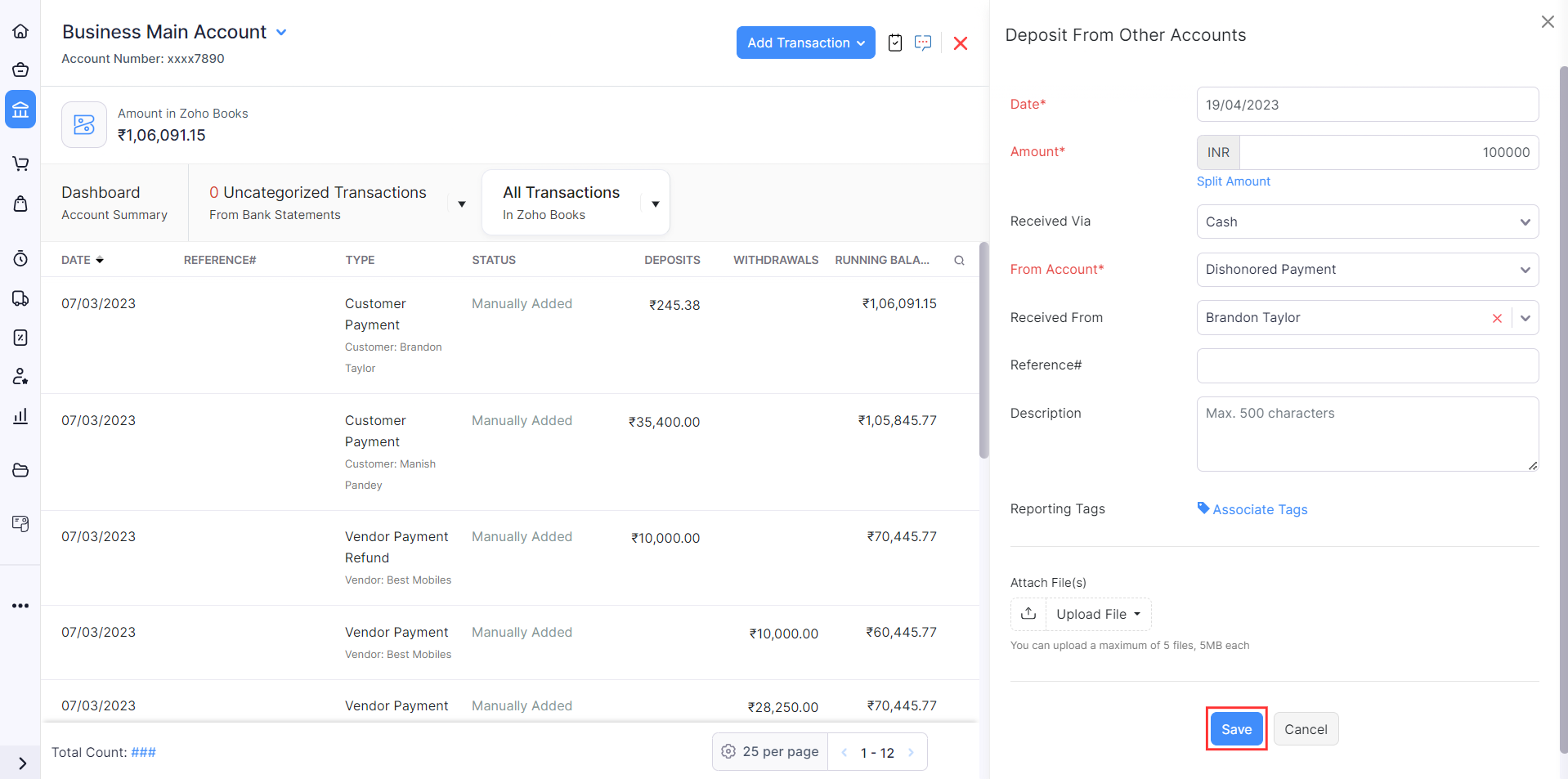

- Go to the Banking module on the left sidebar and select the bank account in which you want to record the transaction.

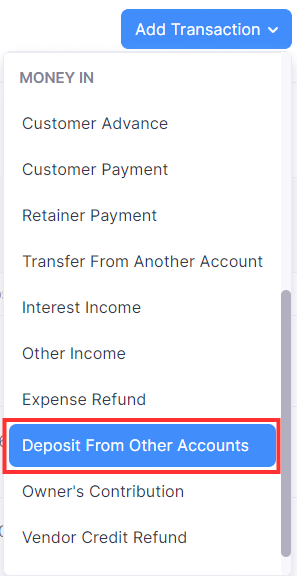

- Click Add Transaction and select Deposit From Other Accounts under Money In.

- In the pane that appears, choose the From Account as Dishonored Payment.

- Fill in details in the mandatory fields like Date and Amount.

- Click Save.

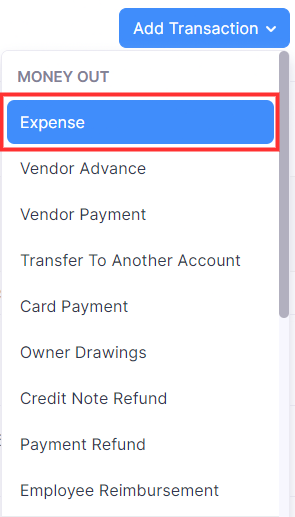

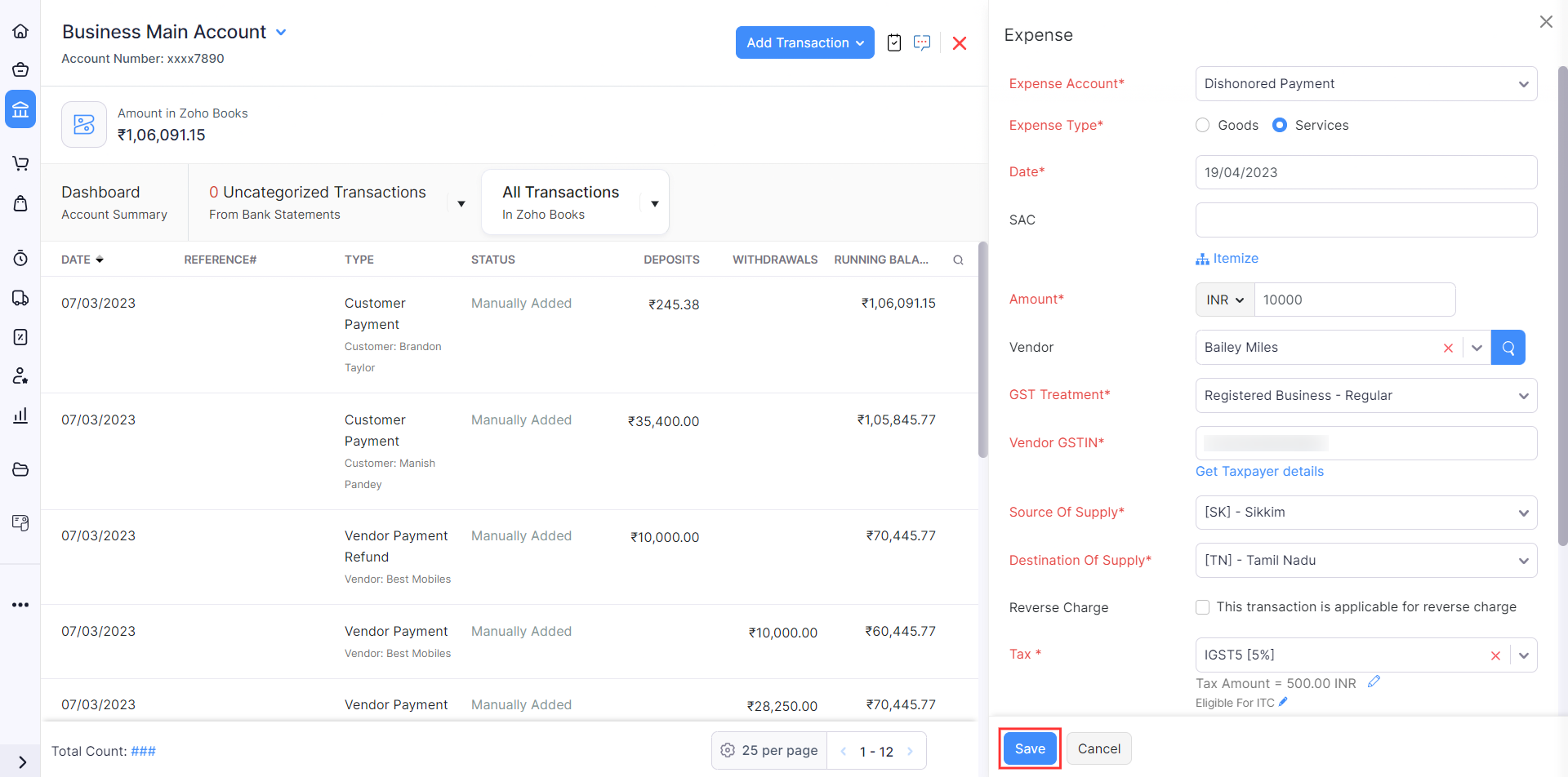

Next, record an expense. Here’s how:

- On the same page, click Add Transaction and select Expense under Money Out.

- In the pane that appears, choose the Expense Account as Dishonored Payment.

- Fill in the details of mandatory fields like Amount, Date, and Invoice Number.

- Click Save.

Note: If you had recorded payments with the cheque, you will have to delete those payments as the cheque was dishonored and the payment recorded via the cheque is no longer valid. After you delete the recorded payment, the status of the invoice will be updated to Overdue or Sent. Also, this ensures that there are no discrepancies in your company’s financial records.

Yes

Yes