What is Kerala Flood Cess?

In view of the floods that affected Kerala in August 2018, the Government of Kerala has decided to collect a Kerala Flood Cess of 1% or 0.25% on the sale of goods and services for two years, starting from August 1, 2019. The money collected through this cess will be used for rebuilding the state.

Kerala Flood Cess must be applied on the goods or services in the following manner:

| Supply Type | Applicable Cess |

|---|---|

| Goods taxable at 1.5% SGST | 0.25% |

| Goods taxable at 6%, 9% and 14% SGST | 1% |

| All services under SGST | 1% |

Who should collect the cess and from whom?

GST registered persons must collect the cess on the sale of goods or services to unregistered persons within Kerala i.e. only on intra-state B2C transactions. Also, they must collect cess while making an intra-state supply of goods or services to other GST registered persons if the sold goods or services will not be used for business purposes.

Note: This cess will not be applicable to businesses that are in the composition scheme.

How do I file the cess return?

You (a taxable person or business who has collected the cess) must file a monthly return in Form No. KFC-A on or before the due date for filing the GSTR-3B return. The cess return must contain all the details of the sale of goods or services that attract the Kerala Flood Cess.

To file the cess return:

- Go to www.keralataxes.gov.in.

- Generate a user ID and password.

- Log in to the website and file your cess return.

The cess you had collected must be paid along with this return. Also, the details of sales mentioned in this return must match with the details of sales in the GSTR-1.

Note: There will be no refund of the cess you pay along with the return.

Is interest applicable on delayed payment of Kerala Flood Cess?

Yes, you will have to pay interest at 18% on the delayed payment of Kerala Flood Cess as per the provision under Kerala Goods and Services Tax Act, 2017 and Central Goods and Services Tax Act, 2017.

How do I set up the Kerala Flood Cess in Zoho Invoice?

You can configure taxes in Zoho Invoice so that the cess is applied on the sale of goods or services to unregistered persons within Kerala. Here’s how:

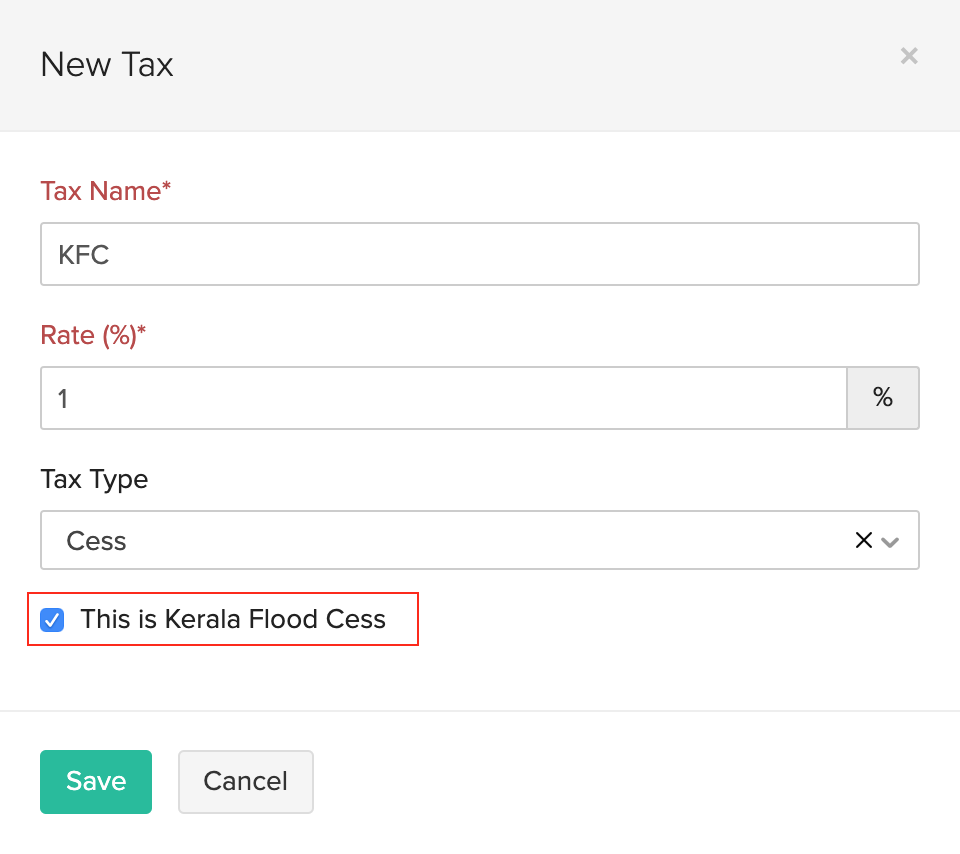

If you are yet to create KFC:

Create new tax rates as Kerala Flood Cess with its rate as 0.25% and 1%.

- Go to Settings > Taxes > Tax Rates.

- Click + New Tax and enter a tax name for the cess. (For example, Kerala Flood Cess @ 1%.)

- Enter the rate as 1%.

- Select the tax type as Cess.

- Check the option This is Kerala Flood Cess.

- Click Save.

Once you’ve created the KFC, the new tax groups that contains the cess and the GST rates will be automatically created.

If you sell goods at 3% GST, you can repeat the steps above and create another tax for the cess of 0.25%. In this case, you must create the tax group manually, which will contain SGST 1.5%, CGST 1.5% and Cess 0.25%.

If you have created KFC already:

Edit the KFC and check the option This is Kerala Flood Cess so that the transactions that have the cess applied on them is included in their respective returns.

- Go to Settings > Taxes > Tax Rates.

- Hover over the KFC tax rate and click Edit.

- Check the option This is Kerala Flood Cess.

- Click Save.

The tax groups that you had created which included the KFC will be automatically updated as a KFC tax group.

Now, when you make a sale of goods or services to an unregistered person, you can select the corresponding tax group from the dropdown and apply it to the line item.

If your business mostly supplies goods or services to unregistered persons within Kerala, you can set these tax groups as the default tax rates for your items and they will be applied automatically when you create a transaction.

Yes

Yes