How can I add one-time deductions to my employees every month?

You can add one-time deductions to your employees while processing your monthly pay runs.

- Go to the Pay Runs tab.

- Click Create Pay Run or View Details if you already have a draft pay run.

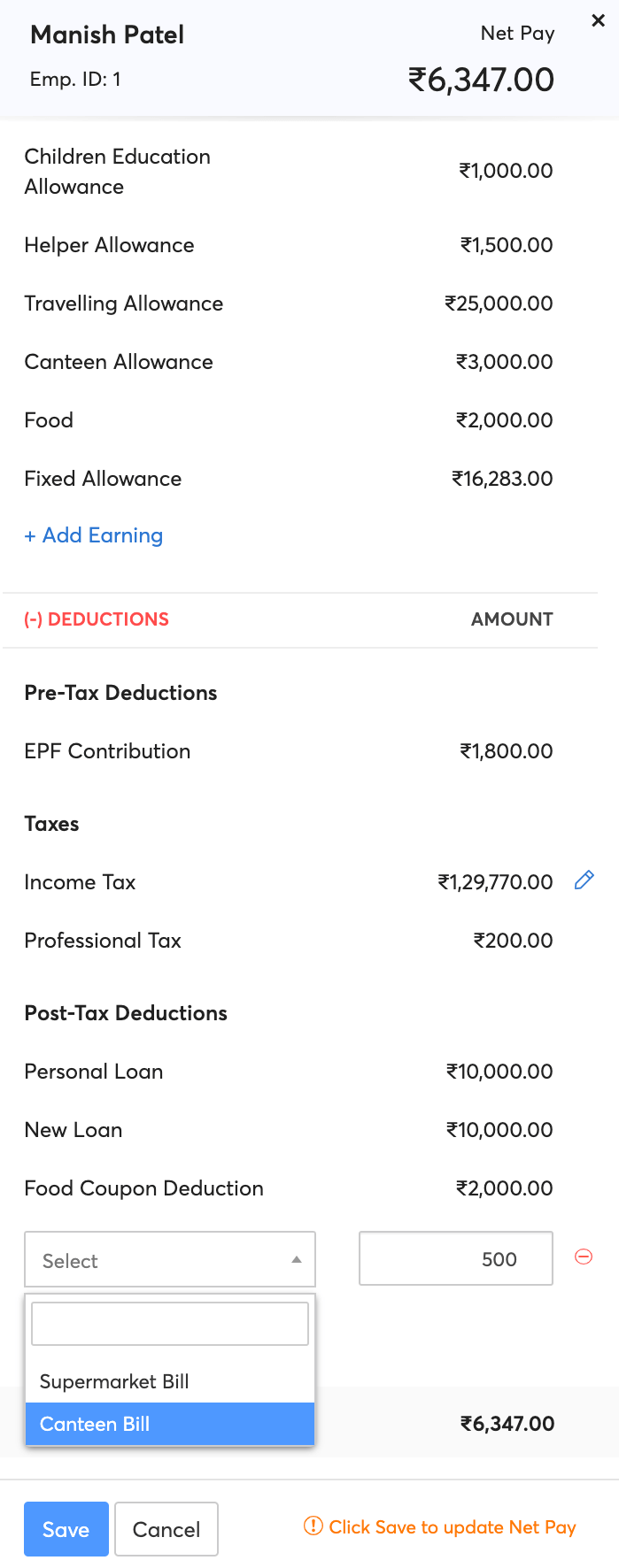

- Click next to the employee name, scroll down and click +Add Deduction from the side panel.

- Choose the post-tax deduction from the drop down and enter an amount. You have to configure the component through Settings > Salary Components for it to show up here.

- Click Save.

Alternately, you can import one-time deduction by uploading a XLS or CSV file.

- Click Import/Export > One-time Earnings and Deductions.

- Upload your CSV or XLS file containing the one-time deduction details. You can view a sample file to make sure that you’ve entered the data in the correct format.

- Select the Character Encoding and File Delimiter.

- Click Next.

- Map the Zoho Payroll fields with the columns in your import file.

- Click Next.

- View the import preview and click the Import button.

The deduction will be added to the pay run once you click Apply Changes.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!