Statutory Components

These are components defined under certain enactments passed by government bodies like Employee Provident Fund Organisation (EPFO) and Employees’ State Insurance Corporation (ESIC). Contributions are made by employees and employers towards the employees’ long term financial and social well-being.

Employee Provident Fund

EPF is a retirement benefit scheme available to all employees. The main purpose of this scheme is to help employees save a fraction of their salaries every month (12% of Basic Pay + DA), so that they can use it when they retire or if they develop any disability.

Guidelines for EPF

- EPF is mandatory for employees earning less than ₹ 15,000 per month.

- Both employee’s and employer’s contribution is 12% of (Basic + DA).

- Employer’s contribution is split up as:

- 3.67% towards the employee’s provident fund account

- 8.33% towards the employee’s pension scheme

- Additionally, the employer has to contribute 1.01%:

- 0.50% towards administrative charges

- 0.5% towards the employee’s Deposit Linked Insurance Scheme

- 0.01% as Inspection charges

- Employer needs to deposit the PF payments on the 15th of the following month

- If employee wants to contribute more than 12%, he can contribute towards VPF.

- Current EPF interest rate is 8.10%

Set up EPF for your organisation

Here’s how you can configure EPF for your organisation:

- Go to Settings and click Statutory Components under Setup & Configurations.

- Switch to the EPF tab.

- Click Enable EPF.

- Enter your EPF Number. You can find this in the registration letter which you received from the Employee Provident Fund Organisation (EPFO).

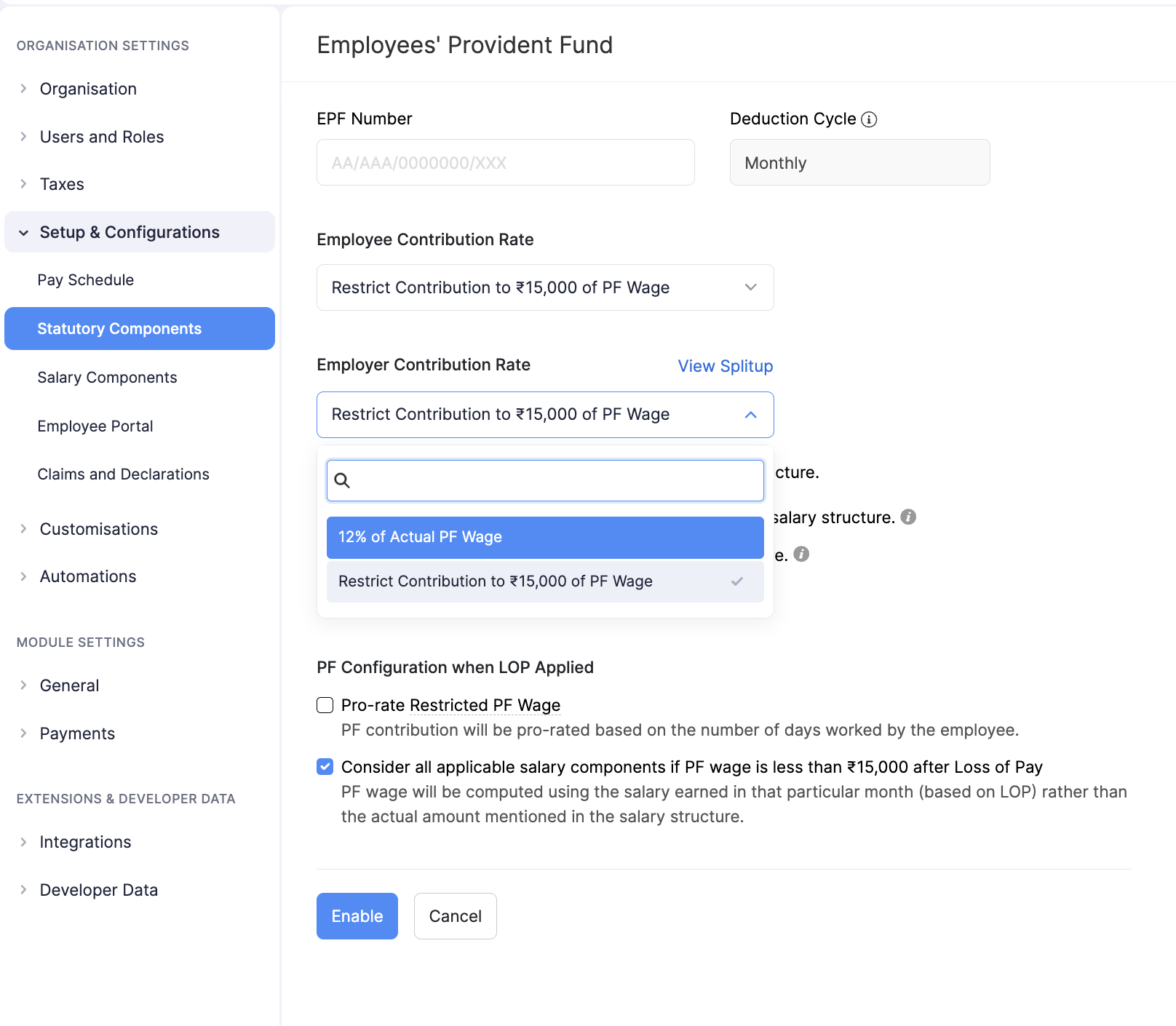

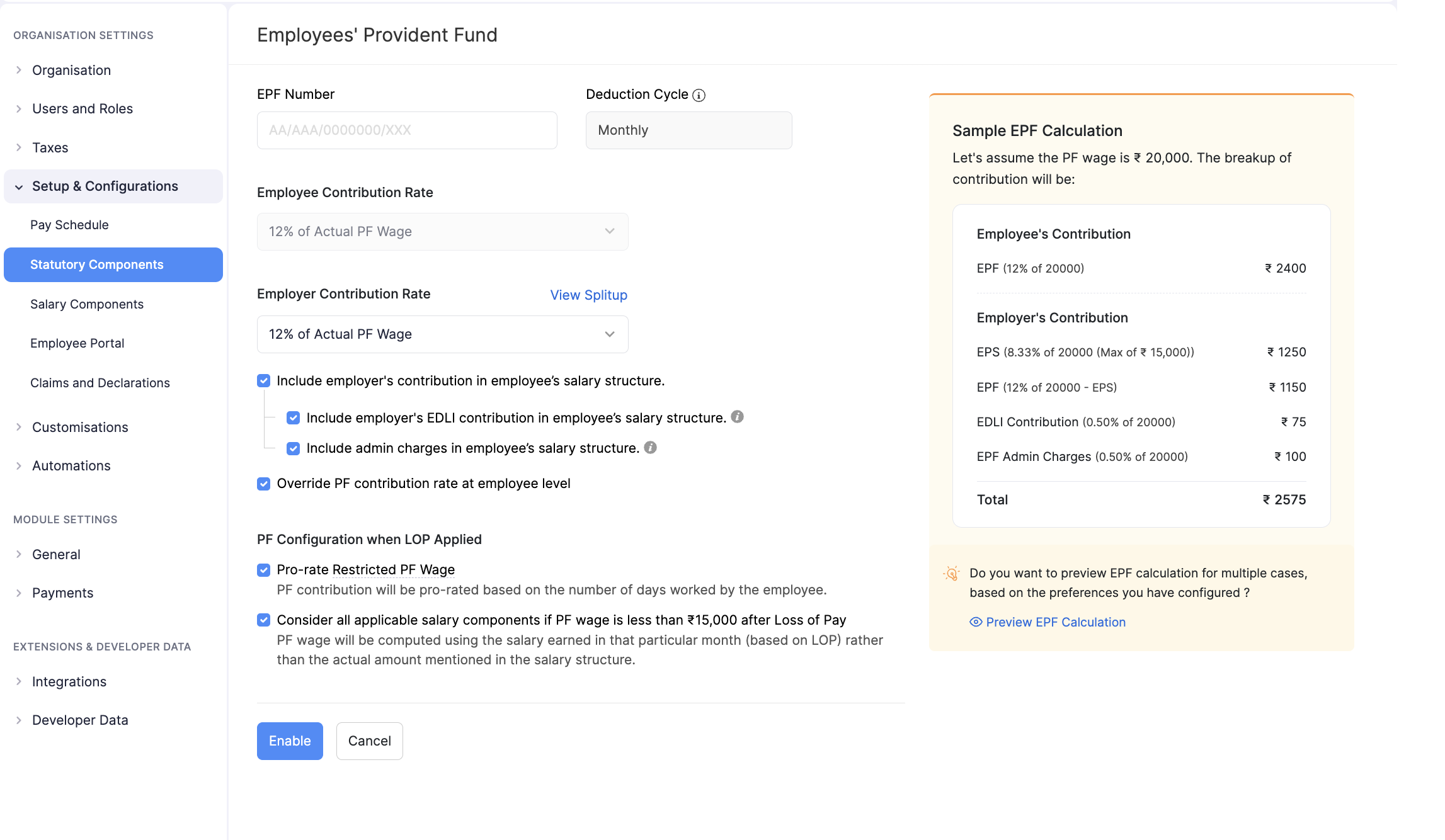

- Select the Employer Contribution Rate. The employer contribution rate can either be 12% of Actual PF wage or you can restrict the Employer Contribution to be Rs. 15,000 of the Actual PF wage. All employees automatically follow this rate.

If you restrict employer’s contribution calculation to ₹15,000 of PF wage, employer’s contribution will be calculated only for ₹15,000, even if the PF wage exceeds that amount. If the PF wage is below ₹15,000, only 12% of that amount will be considered.

Note If you select the employer contribution rate to be 12% of the Actual PF wage, the employee’s contribution rate will also be 12% of the actual PF wage by default.

- Select if you want to include the employer’s contribution as a part of employees’ salary structure. If you select this option, select if you want to Include employer’s EDLI contribution in employee’s salary structure and include admin charges in employee’s salary structure.

Note EDLI contribution will be 0.5% of the PF wage and the maximum employer contribution towards EDLI will be 75 Rs. The EPF admin charges will be 0.50% of the PF wage.

- Select if you want to override the PF contribution rate at employee level. If you select this option, you can specify a different PF contribution rate for each employee.

- Next, select if you want the PF contribution to be pro-rated based on the number of days worked by the employee.

- Select if you want to consider all applicable salary components if PF wage is less than ₹15,000 after Loss of Pay. * This ensures PF compliance for employees whose pay dips below ₹15,000 due to LOP, so contribution reflects actual earned wage, not just structure.

- Click Save.

After saving your EPF settings, any changes you make later will apply only to new employees, not to the existing ones.

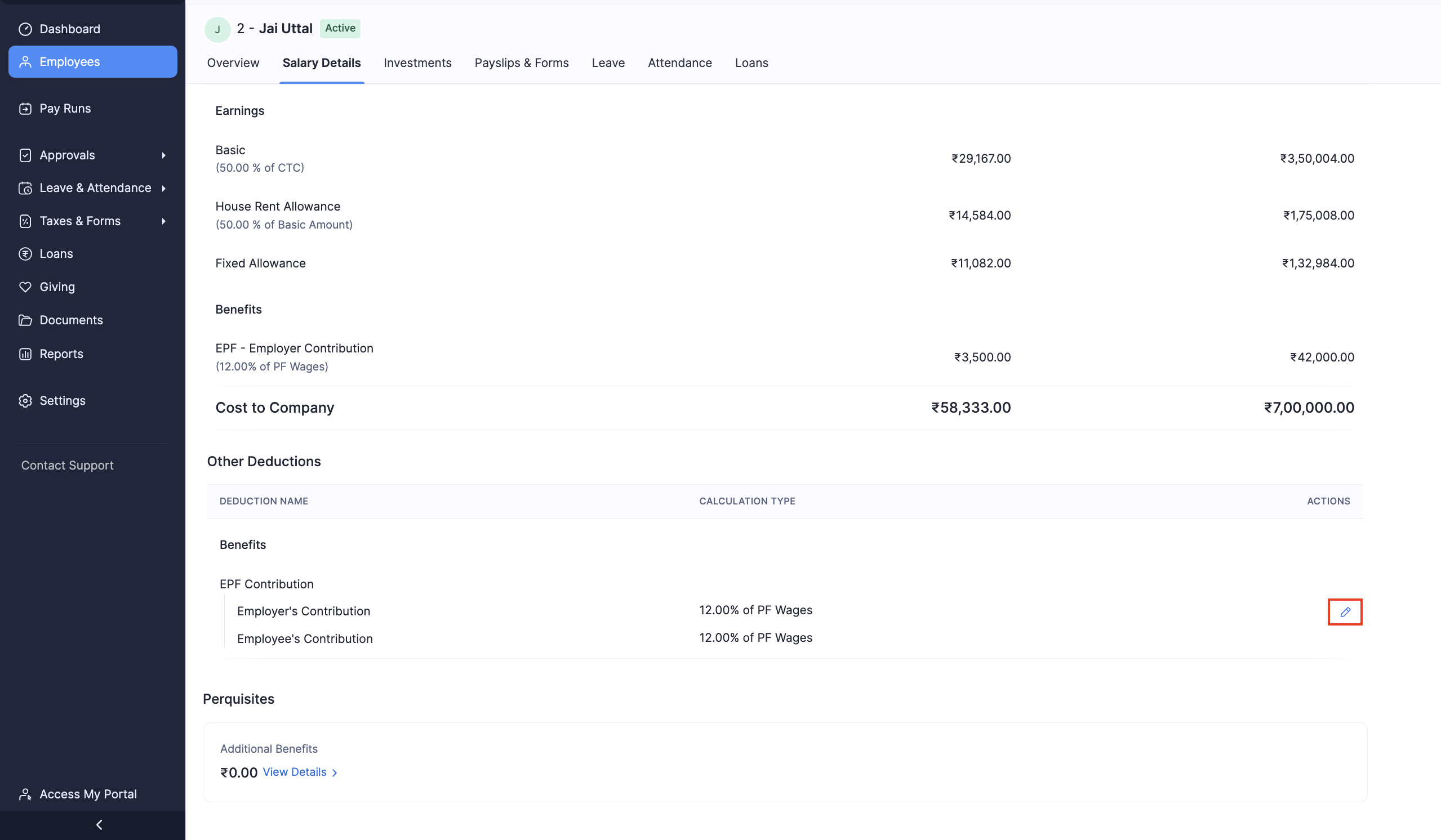

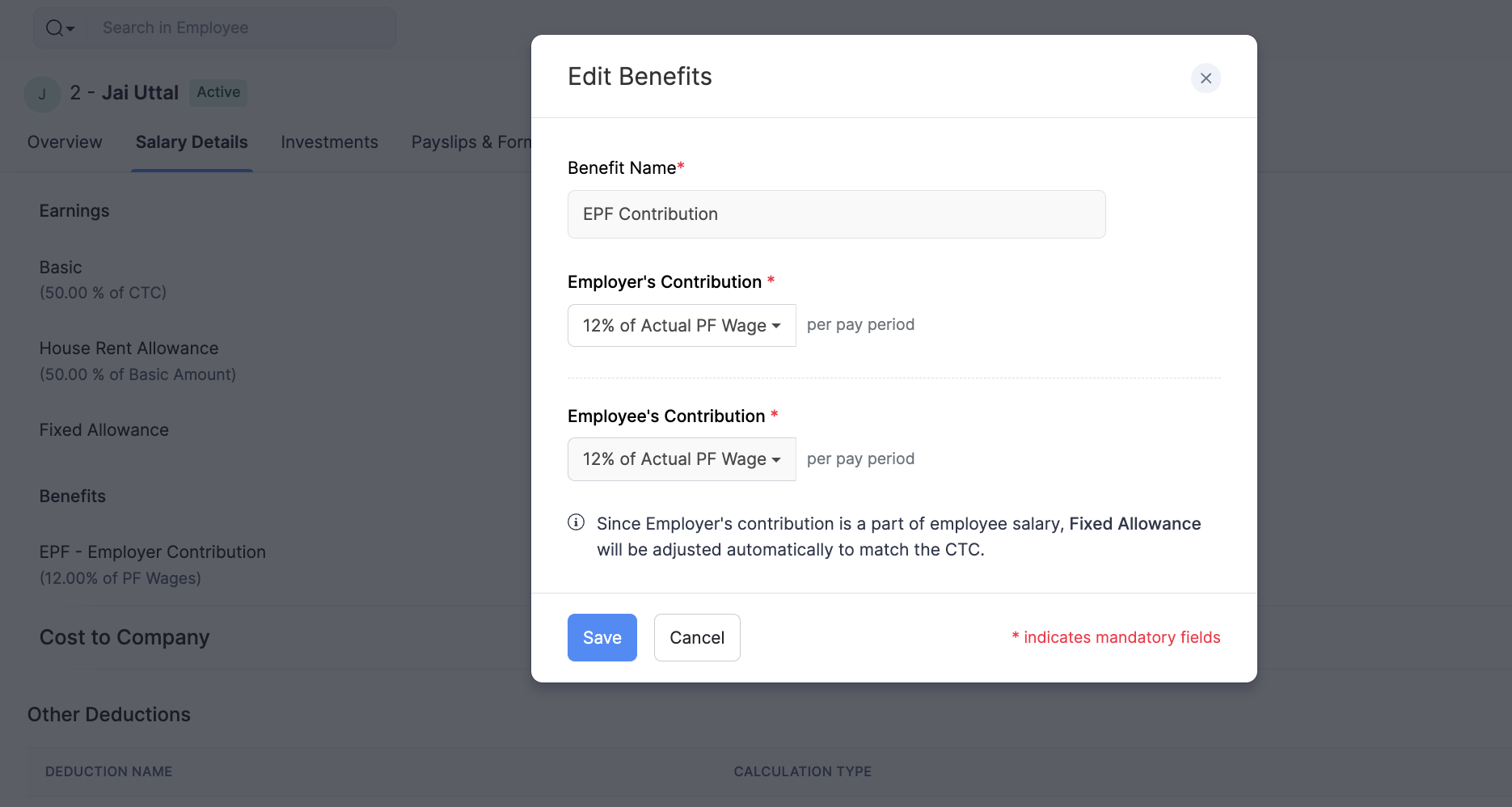

If you have enabled the option to override the PF contribution rate at the employee, here’s how you can choose a different PF contribution for an employee.

- Go to Employees on the left sidebar and select an employee.

- Switch to the Salary Details tab.

- In the Other Deductions section, click the Edit icon next to the EPF contribution.

- Update the contribution rates and click Save.

Once you’ve set up EPF for your organisation, the PF contributions of will be deducted automatically every month.

Employee State Insurance

This is a self-financing social security and health insurance scheme applicable only to employees whose monthly salary is ₹21,000 or less. The employees’ contribution for ESI is 0.75% of Gross Pay and your contribution would be 3.25% of Gross Pay. It is available in all states except Manipur, Sikkim, Arunachal Pradesh and Mizoram.

Guidelines for ESI

- Only employees earning ₹ 21,000 or less can opt for ESI.

- Employer’s contribution is 3.25% of Basic + Dearness Allowance.

- Employee’s contribution is 0.75% of Basic + Dearness Allowance.

- Employer needs to deposit ESI payments within the 15th of next month.

To set up ESI for your organisation,

- Go to Settings > Statutory Components.

- Click the ESI tab.

- Enter your ESI Number.

Make sure that you configure ESI when you add a new employee, if it applies to them.

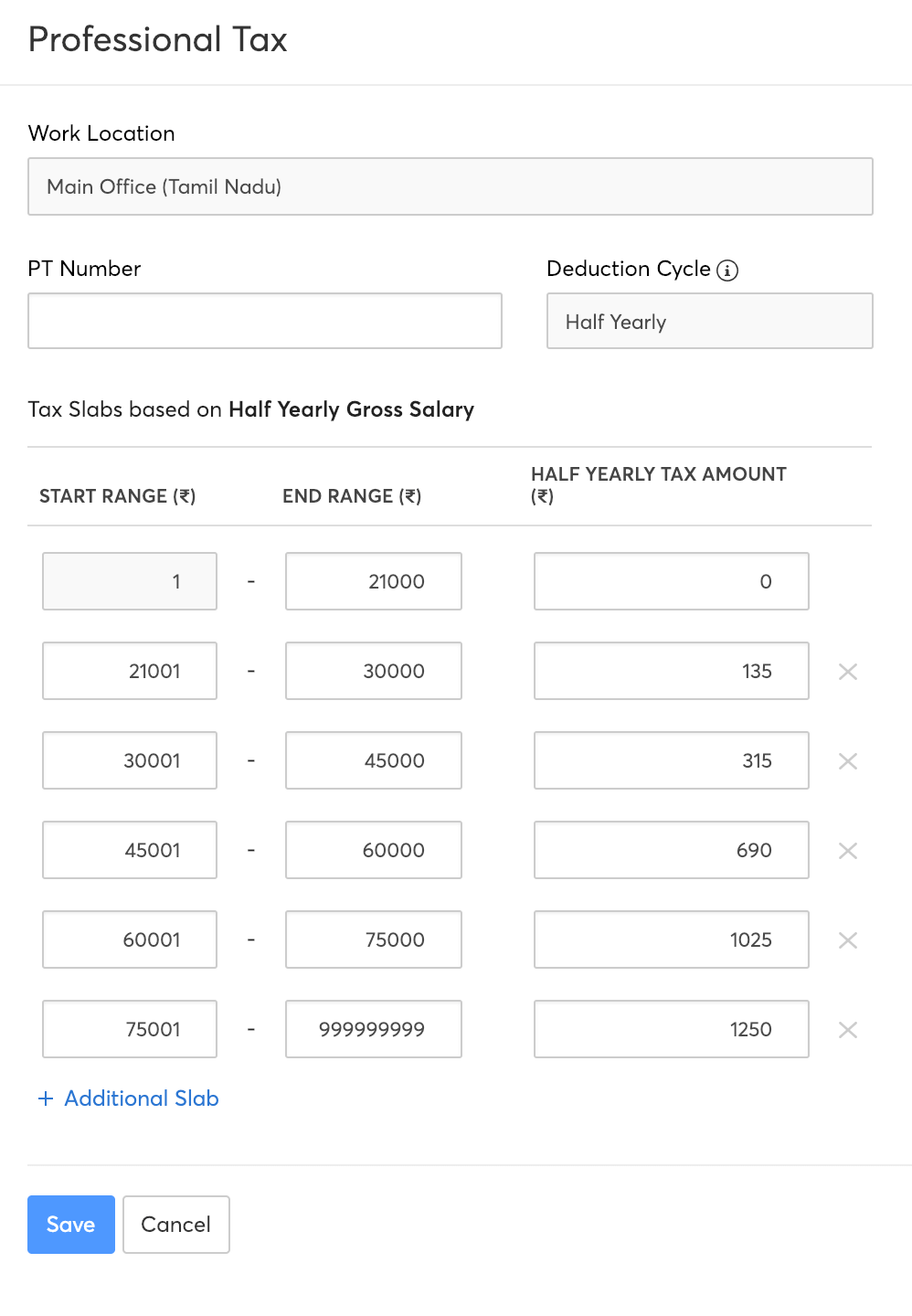

Professional Tax

It is a tax levied on all professionals and salaried individuals by the State Governments. Employees belonging to different salary slabs would need to pay different amounts as Professional Tax. The tax slabs vary for each state or municipality. The deduction cycle may be monthly, half-yearly or yearly depending on your state.

To set up Professional Tax for your organisation,

- Enter your Professional Tax Number.

- The tax slabs will be pre-configured based on your state.

- Modify the existing tax slabs (if needed).

All you need to do now is configure PT when you add a new employee.

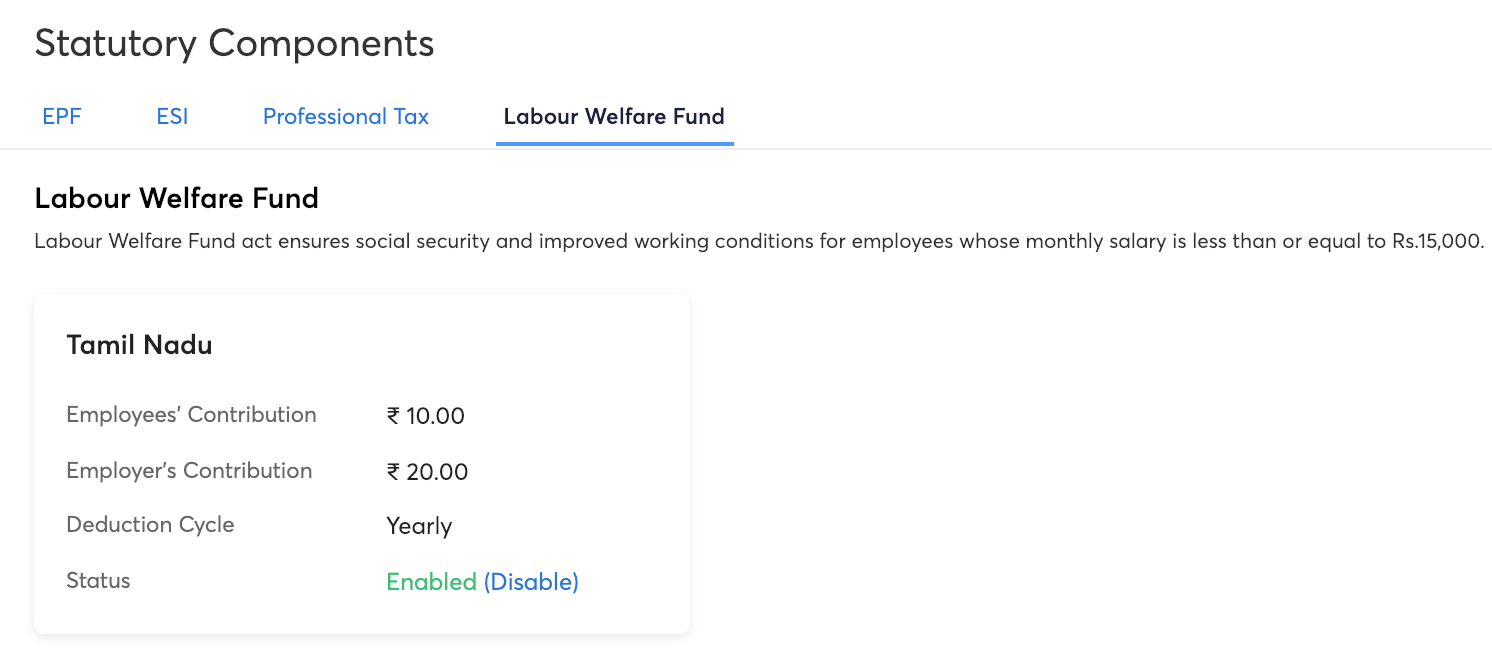

Labour Welfare Fund

It is a scheme which ensures social security and improved working conditions for employees. It is applicable only for employees whose monthly salary is ₹15,000 or less. The deduction cycle may be monthly, half-yearly or yearly depending on your state.

- Click the Enable or Disable button to enable/disable LWF for each state

Statutory Bonus

The Statutory Bonus is a crucial component of employee compensation, mandated by the Government of India. Statutory bonus ensures that your employees receive their fair share of rewards based on their earnings and the prevailing labour regulations.

It is a bonus paid to employees as per the Payment of Bonus Act, 1965. The act applies to all factories and other establishments that employ 20 or more workers.The amount of statutory bonus that an employee is entitled to depends on the following factors:

- The employee’s salary or wages (Basic Pay + DA)

- The profits of the establishment

- The number of days the employee has worked in the establishment during the accounting year

The minimum statutory bonus is 8.33% of the employee’s salary or wages. The maximum statutory bonus is 20% of the employee’s salary or wages. The statutory bonus is payable within 8 months of the end of the accounting year.

Who is eligible for a statutory bonus?

To be eligible for the statutory bonus, an employee must:

- Have worked in the establishment for at least 30 days during the accounting year.

- Earn a salary or wages that does not exceed Rs. 21,000 per month.

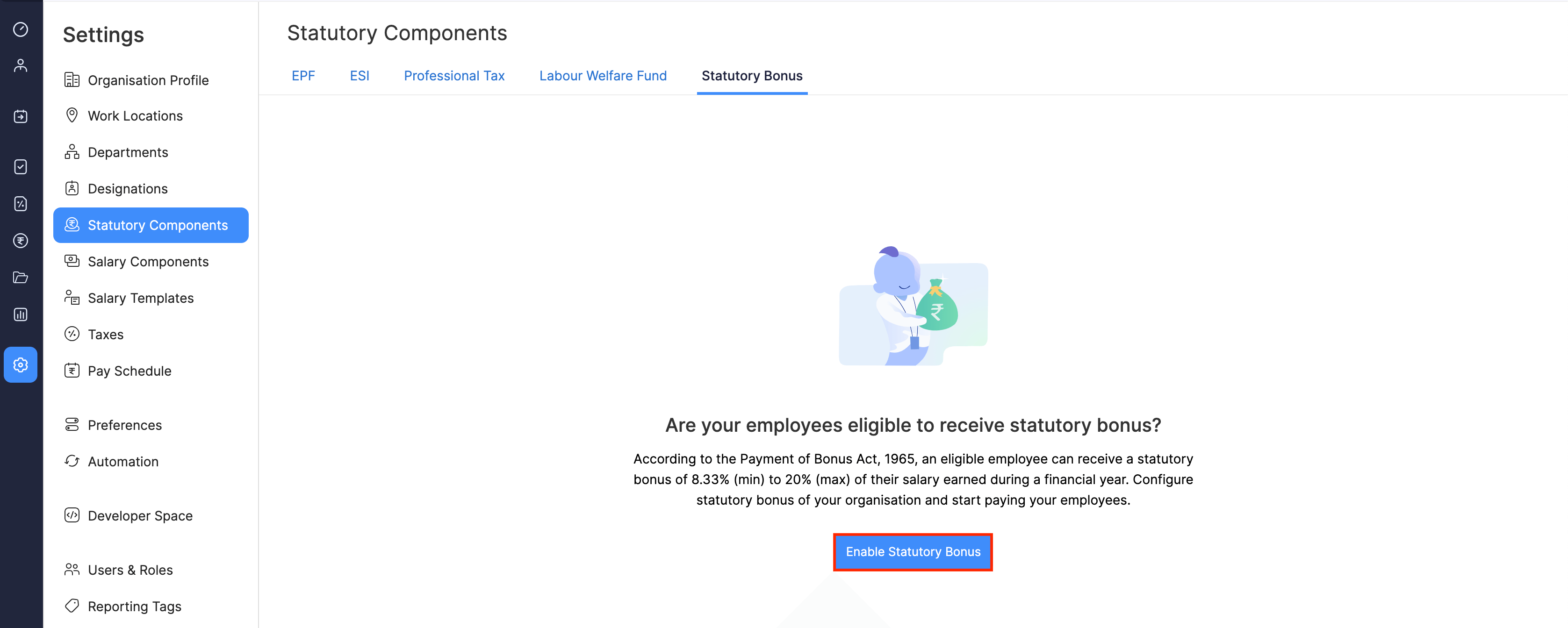

Enabling statutory bonus

Enable the option for your organisation before you configure statutory bonus for your employees. Here’s how:

- Click Settings in the top right corner and select Statutory Components.

- Switch to the Statutory Bonus tab.

- Click Enable Statutory Bonus.

Configuring statutory bonus

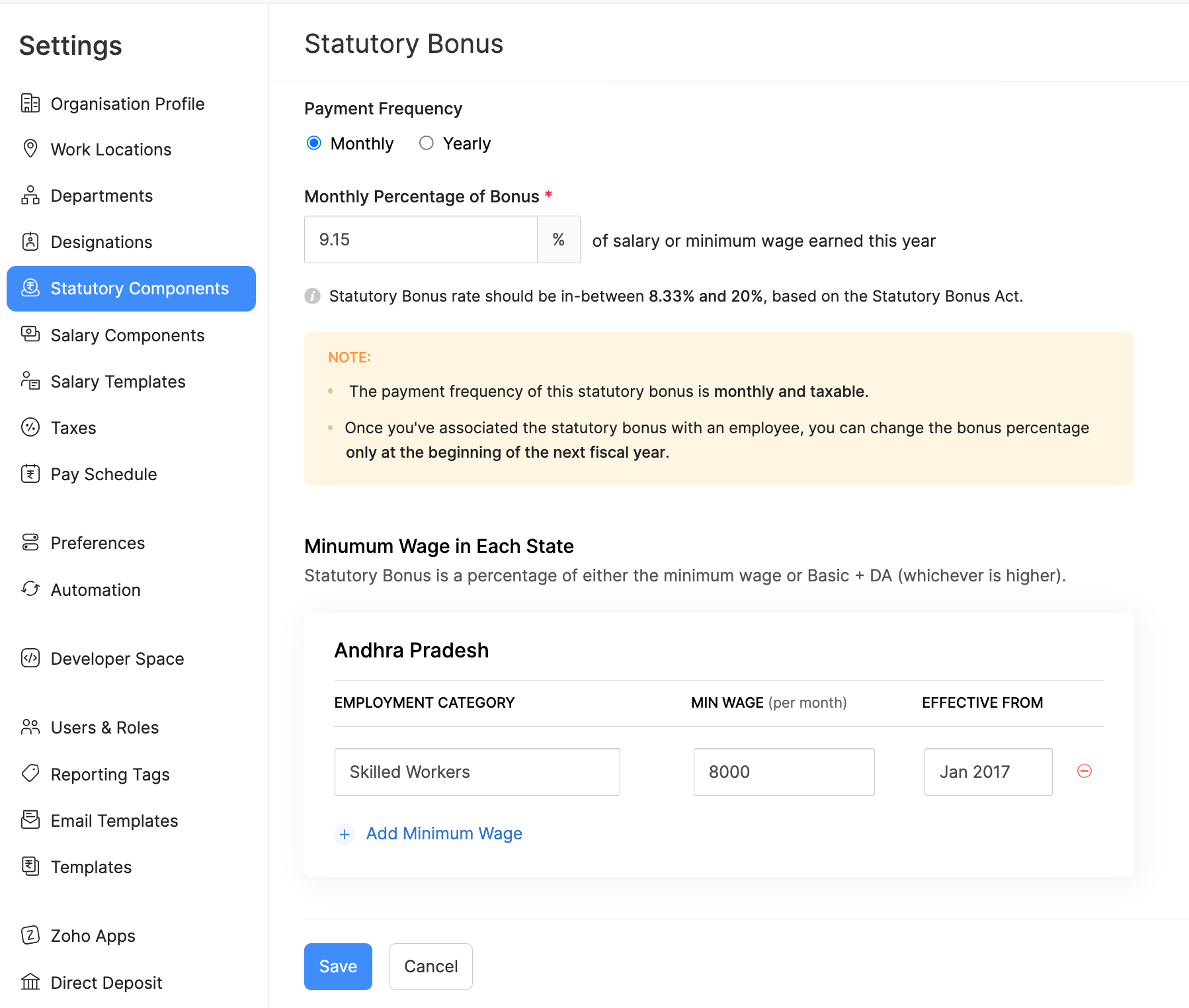

To configure statutory bonus for your organisation:

- Click Settings in the top right corner and select Statutory Components.

- Switch to the Statutory Bonus tab.

- Select the Payment Frequency (Monthly or Yearly) and enter the Percentage of Bonus (between 8.33% and 20%).

- For the states your organisation operates in, you set the minimum wage for each applicable state. To do this, click on + Add Minimum Wage.

- Click Save.

Once you configure statutory bonus, the above calculations will be processed along with the salary of the employees.

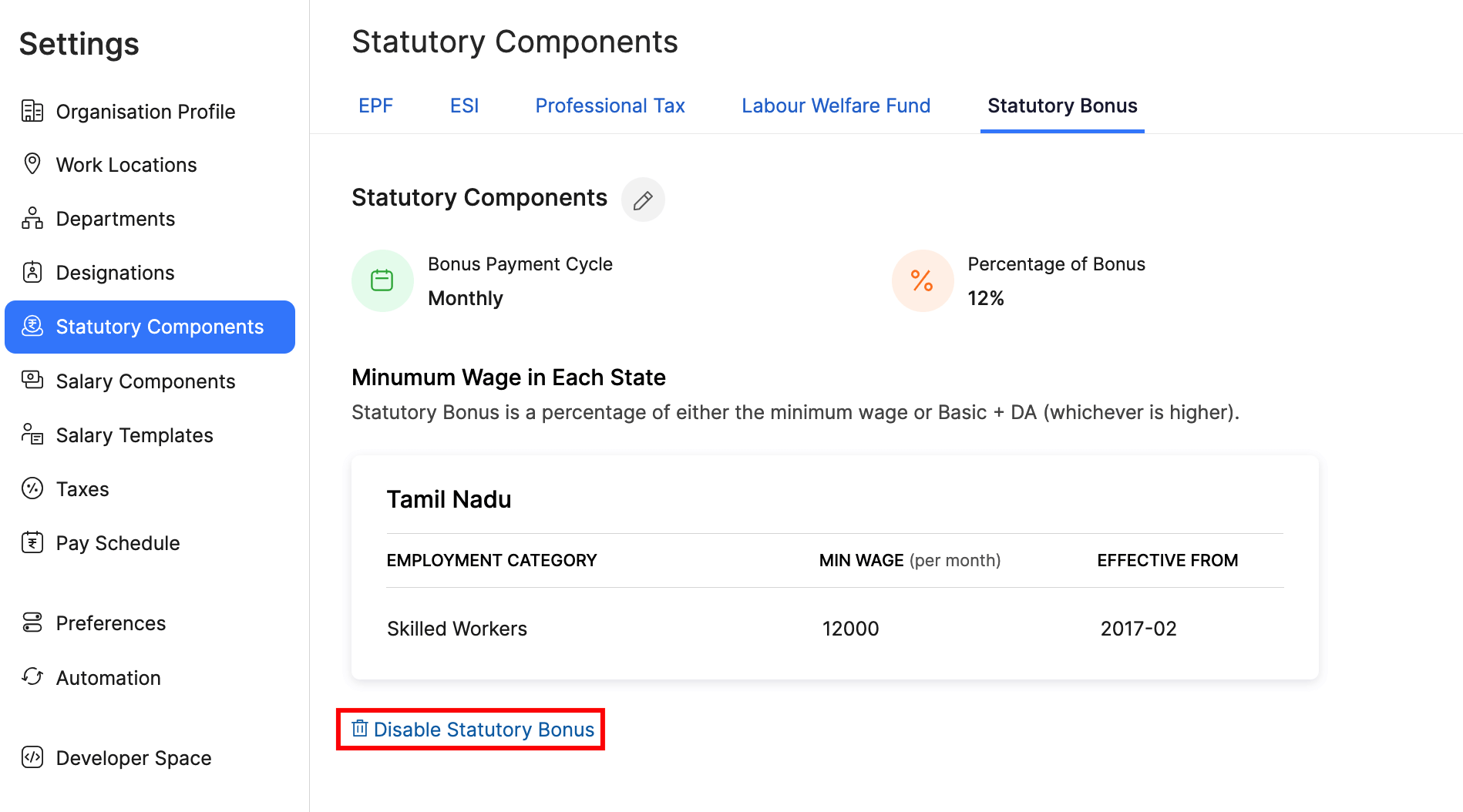

Disabling statutory bonus

You can disable statutory bonus for your organisation if it does not apply to your employees.

- Click Settings in the top right corner and select Statutory Components.

- Switch to the Statutory Bonus tab.

- Click Disable Statutory Bonus.

Note: You cannot disable the option for your organisation if you’ve processed a pay run after configuring the statutory bonus.

Once you’ve disabled statutory bonus, you will no longer be able to process them in the pay run.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!