Zoho Books Integrated with Zoho Payroll

Keeping track of the salaries you pay your employees is as important as paying them on time.

The wages you pay and the taxes you deposit need to be kept track of using an accounting software. Posting accounting entries manually after every pay run could be time-consuming.

This is where integrating Zoho Payroll with Zoho Books comes to the rescue. Zoho Books is an end-to-end accounting software for your business. If you’re not using Zoho Books to manage your accounting, you can sign up for a 14-day free trial today.

When you integrate with Zoho Books, all your payroll transactions are in sync with your books. All your payroll expenses and tax liabilities will be automatically recorded in the correct Expense and Liability accounts. This will be reflected in your Profit and Loss statement so that your Net Profit is accurate.

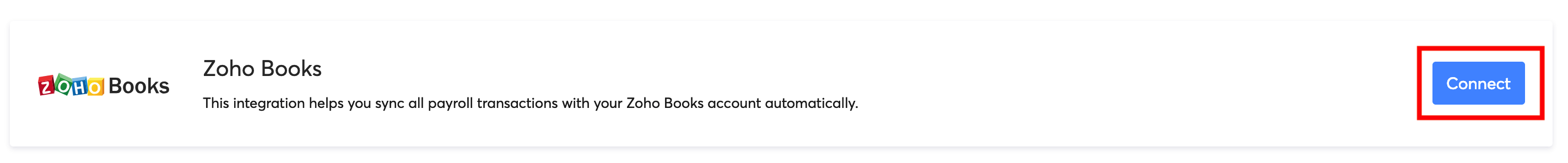

Connect With Zoho Books

To set up the integration:

- Go to Settings > Integrations > Zoho Apps.

- Click Connect next to Zoho Books.

- Click Join Organisation in the pop up window. Now your Zoho Payroll organisation will be linked to Zoho Books.

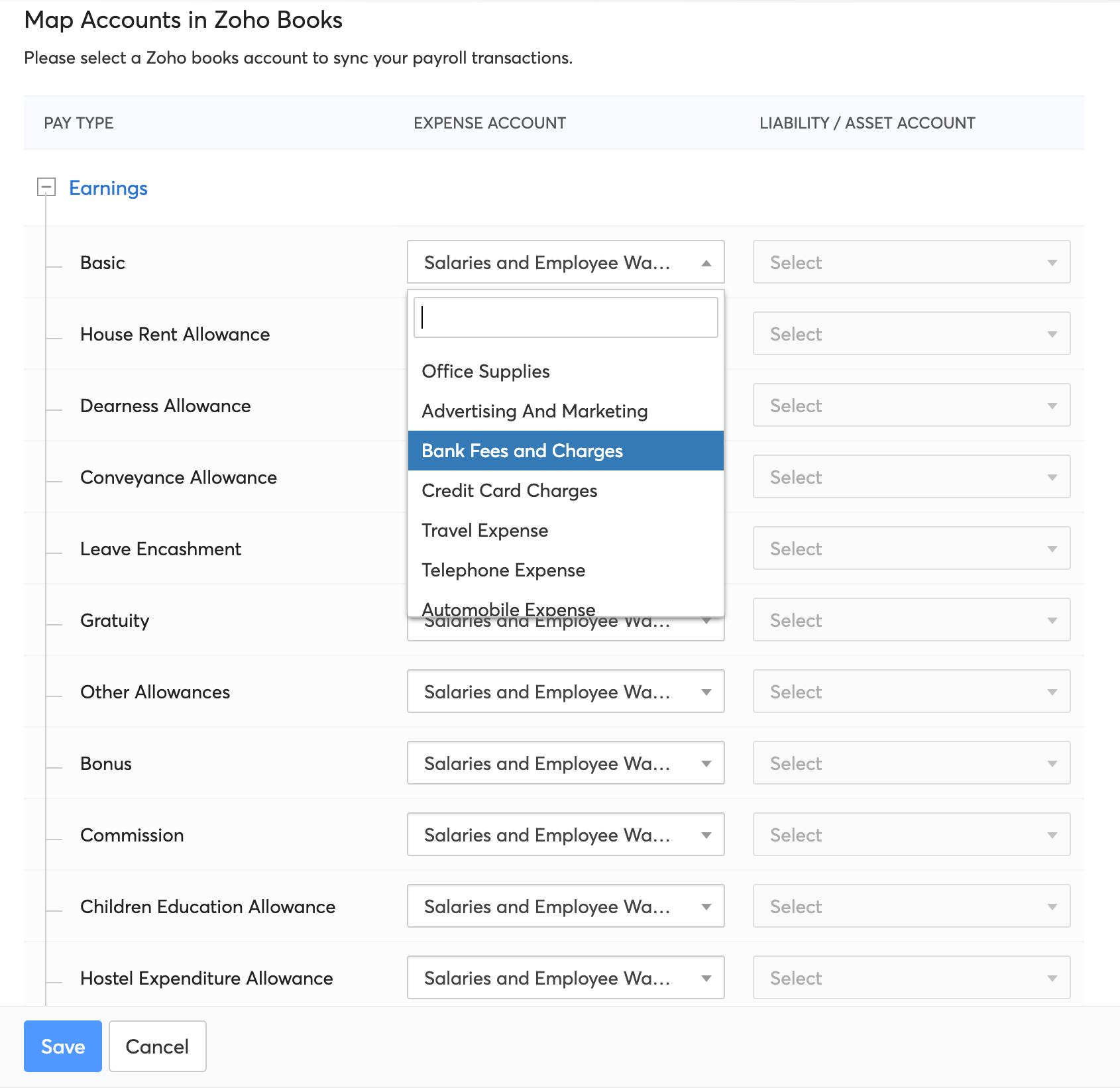

Once you’ve linked both organisations, you can configure the integration by selecting the accounts in which you want the payroll transactions to be recorded in. For instance, you can choose to track all statutory deductions under a single account, or track EPF, ESI and PT under different accounts. You can also create sub-accounts in Zoho Books depending on your requirements and select them in Zoho Payroll.

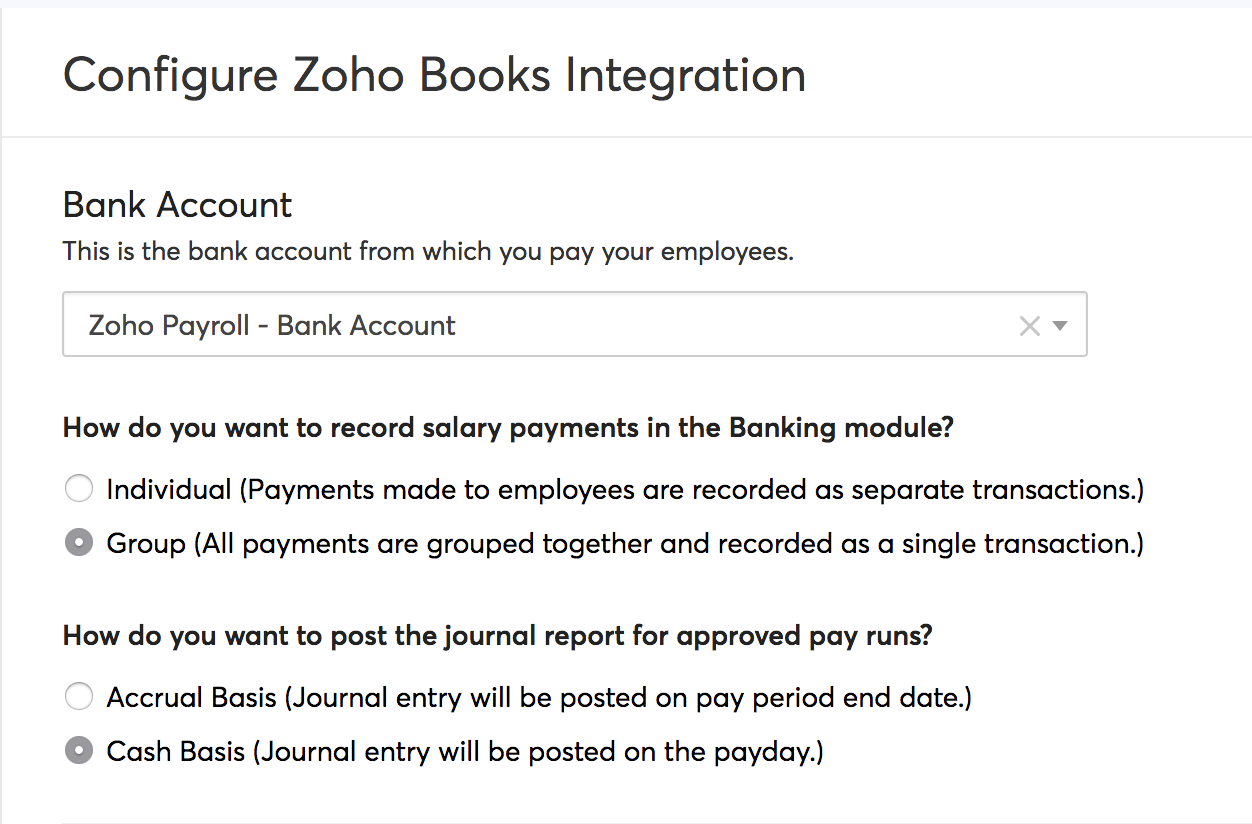

In the Configure Zoho Books Integration page:

- Select the Bank Account from which payroll expenses are paid.

- Select whether you want to record payments individually or as a group. * Individual - Payments made to each employee will be recorded as individual transactions in the Banking module of Zoho Books. * Group - All salary payments will be grouped together into a single transaction in the Banking module of Zoho Books.

- Select whether you want to post the journal report on Accrual basis or cash basis. * Accrual Basis - The journal entry will be posted on the last day of the pay period. * Cash Basis - The journal entry will be posted on the organisation’s payday.

- Select the Expense and Liability accounts for each payroll transaction under Compensation, Taxes, Benefits, and Deductions. For example, for ‘Basic Pay’ transaction under Earnings, you can select ‘Salaries and Employee Wages’ as the expense account.

- Click Save.

You can change these settings anytime. Any change you make will only be reflected in future pay runs.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!