Data Import

Data import can be done in two modules:

- Employee Details (basic details, personal details, and payment information)

- Employee Salary details (perquisites, salary structure, and salary revision)

- Investment declaration and proof of investment

- LOP details

- One time earnings and deductions

Employees Module

In the Employees module you can import all the data that are required to build an employee’s payroll profile, that is, basic and personal details, payment information, salary details (perquisites, salary structure, salary revision) and investment details. You can import this data in bulk for multiple employees at one go.

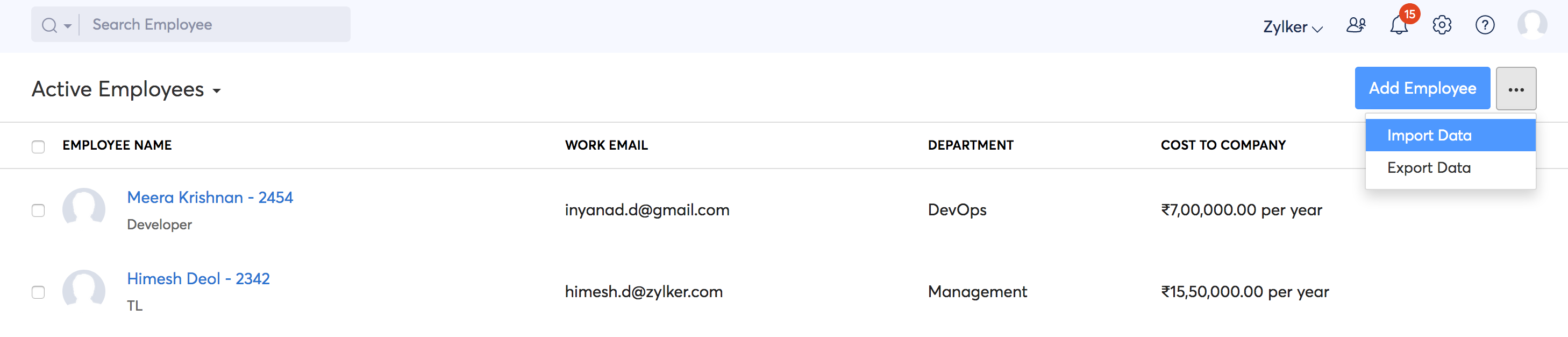

- Go to the Employees module.

- Click the More icon and select Import Data.

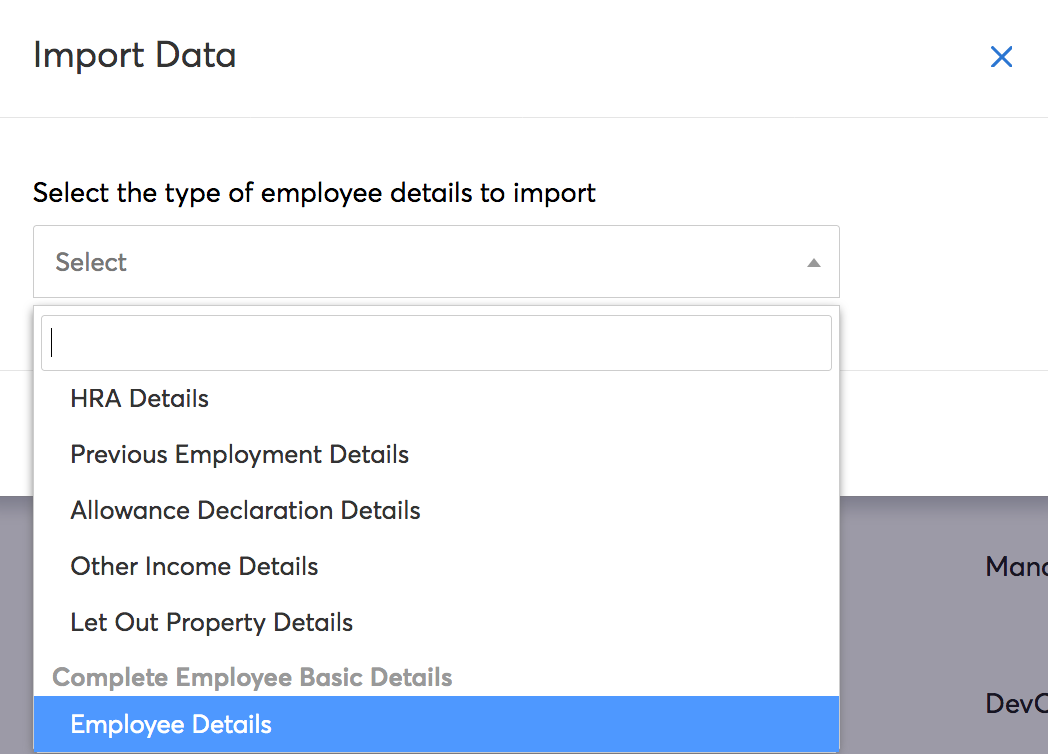

- From the dropdown, select the type of data you are importing (for example: basic details, salary details, etc.) and click Proceed.

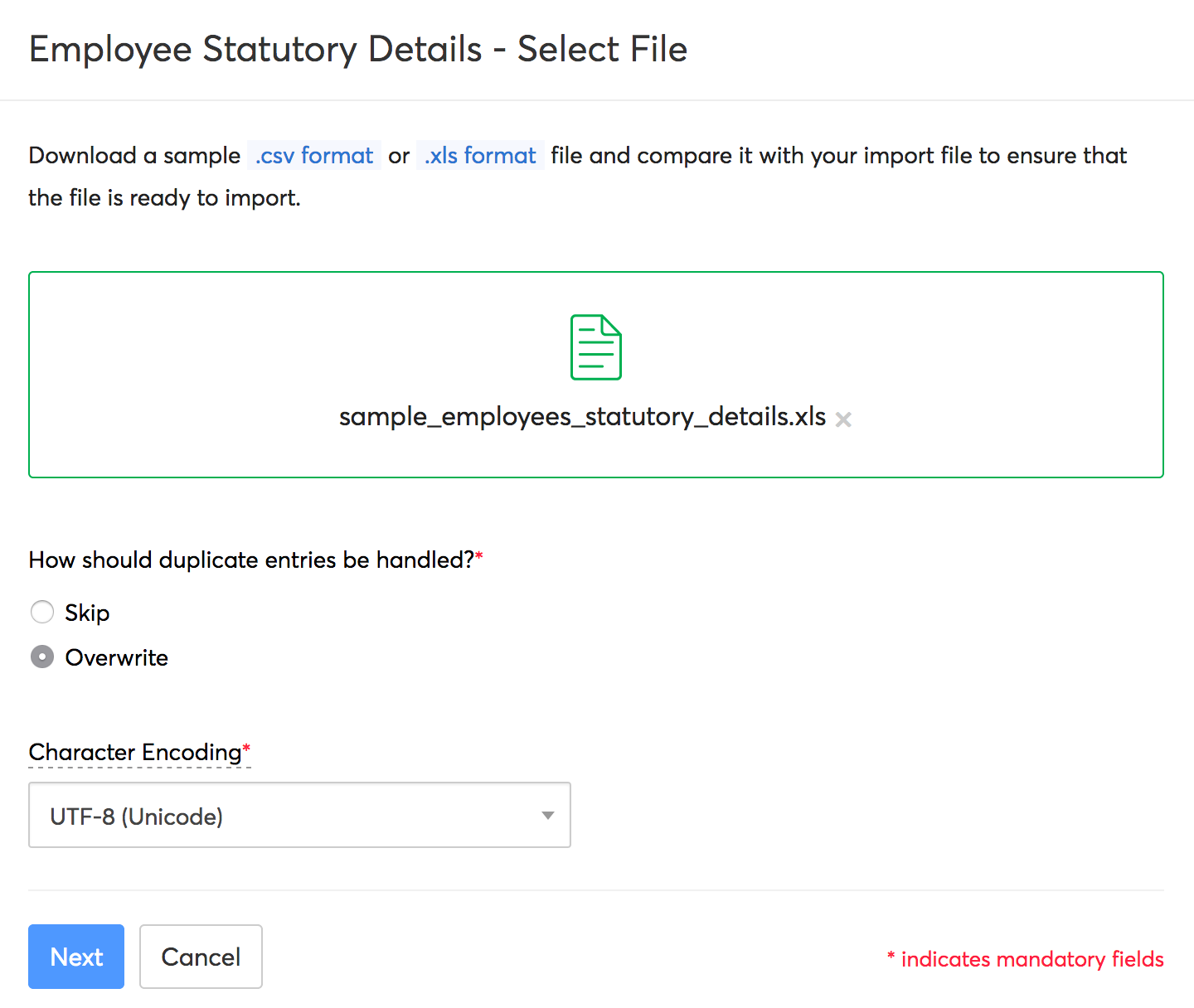

- If you need to refer a sample file, click .xls or .csv. You can download the file in the link and compare the fields with the import file.

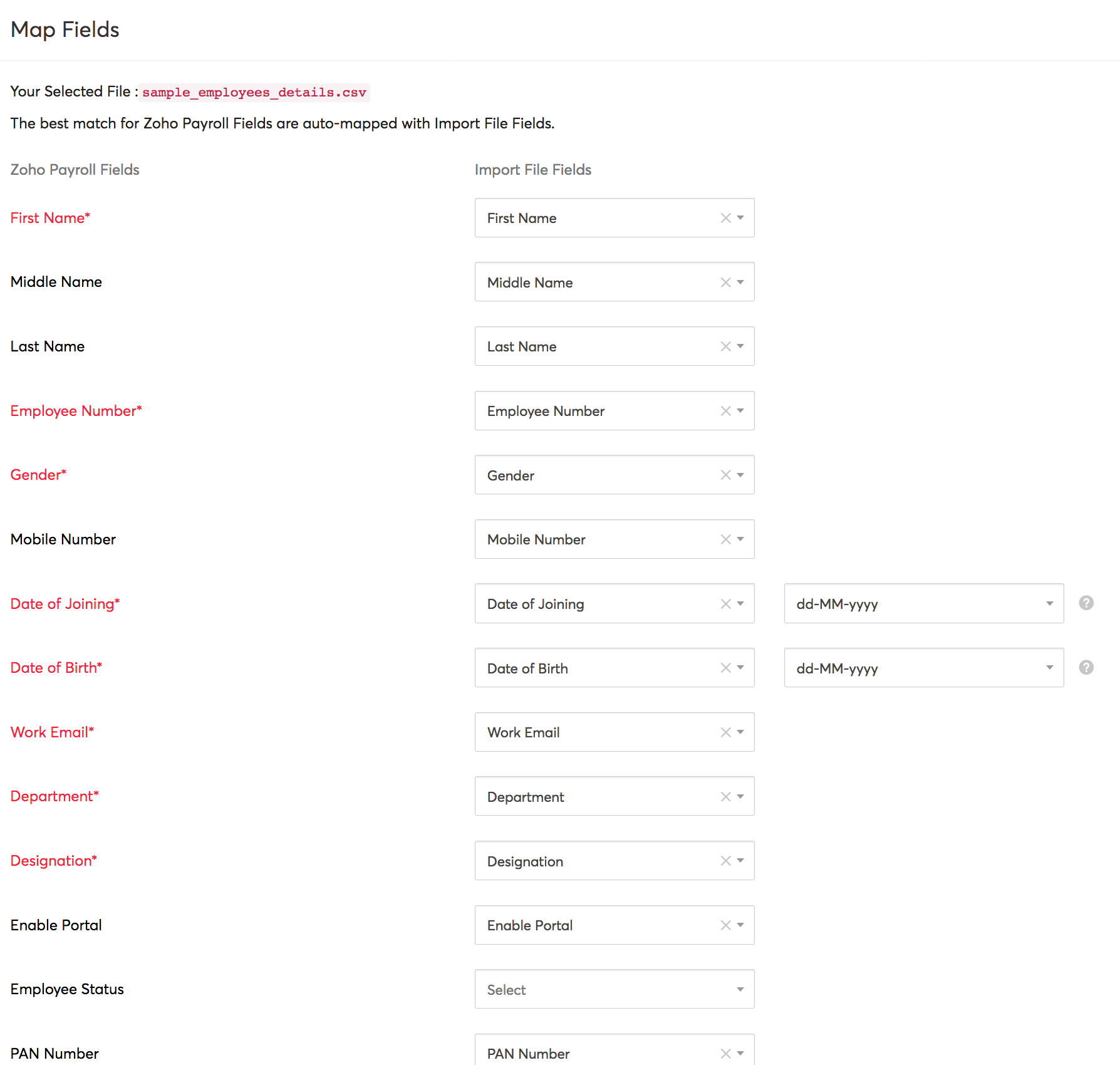

The required fields for mapping the employees’ details have been listed below. You can use these fields in your excel file and enter the respective employee’s data as field values.

| Field | Data Type | Fields to be mapped |

|---|---|---|

| Employee Details | Employee Basic Details | * Employee Number * First Name * Middle Name * Last Name * Gender * Status * Date of Birth * Date of Termination * Work Email * Work Location Name * Date of Joining * Department * Designation * PAN Number * Enable Portal * Personal AddressLine1 * Personal AddressLine2 * Personal City * Personal StateCode * Personal Country * Personal PostalCode |

| Employee Statutory Details | * Employee Number * Is Eligible For PF * Is Eligible For EPS * PF Account Number * UAN Number * Is Eligible For ESI * ESI Number * Is Eligible for Professional Tax * Is Eligible For LWF | |

| Employee Payment Details | * Employee Number * Payment Mode * Bank Holder Name * Bank Name * Account Number * IFSC Code * Account Type | |

| Salary Details | Perquisites | * Employee Number * Accommodation Amount * Accommodation Amount Recovered From Employee * Cars/other vehicles Amount * Cars/other vehicles Amount Recovered From Employee * Helper Amount * Helper Amount Recovered From Employee * Gas, electricity, water Amount * Gas, electricity, water Amount Recovered From Employee * Holiday expenses Amount * Holiday expenses Amount Recovered From Employee * Free/concessional travel Amount * Free/concessional travel Amount Recovered From Employee * Free meals Amount * Free meals Amount Recovered From Employee * Free education Amount * Free education Amount Recovered From Employee * Gifts, vouchers, etc. Amount * Gifts, vouchers, etc. Amount Recovered From Employee * Credit card expenses Amount * Credit card expenses Amount Recovered From Employee * Club expenses Amount * Club expenses Amount Recovered From Employee * Use of movable assets Amount * Use of movable assets Amount Recovered From Employee * Transfer of assets to employees Amount * Transfer of assets to employees Amount Recovered From Employee * Other services/privileges Amount * Other services/privileges Amount Recovered From Employee * Non-qualified stock options Amount * Non-qualified stock options Amount Recovered From Employee * Other benefits/amenities Amount * Other benefits/amenities Amount Recovered From Employee |

| Employee Vehicle Details | * Employee Number * Expense Met By * Engine Capacity * Is Driver Provided | |

| Employee Salary Details | * Employee Number * CTC (per annum) Basic | |

| Employee Pre-tax deduction Details | * Employee Number * Voluntary Provident Fund Employee Contribution * Voluntary Provident Fund Employee Max Amount * NPS Employer Contribution * NPS Employer Max Amount * NPS Employee Contribution * NPS Employee Max Amount * LIC Employer Contribution * LIC Employer Max Amount * LIC Employee Contribution * LIC Employee Max Amount * 80D Preventive Health Checkup Employee Contribution * 80D Preventive Health Checkup Employee Max Amount * 80D Preventive Health Checkup Employer Contribution * 80D Preventive Health Checkup Employer Max Amount | |

| Salary Revision | * Employee Number * Revised CTC (per annum) * Is CTC Changed by Percentage * Revision Percentage * Effective From * Payout Month * Basic * House Rent Allowance * Conveyance Allowance * City Compensatory Allowance * Helper Allowance * Children Education Allowance * Telephone Allowance * Hostel Expenditure Allowance * Transport Allowance * Travelling Allowance * Uniform Allowance * Daily Allowance * Fixed Medical Allowance * Project Allowance * Food Allowance * Holiday Allowance * Entertainment Allowance * Fixed Allowance * Medical Reimbursement * Fuel Reimbursement * Fuel Reimbursement Is Enabled * Fuel Reimbursement Max Amount * Driver Reimbursement * Telephone Reimbursement * Leave Travel Allowance * Leave Travel Allowance Max Amount * Leave Travel Allowance Is Enabled * Leave Travel Allowance Yearly Carry Forward * Dearness Allowance * Bonus * Salary Template Name | |

| Investments | Section 6A | * Employee Number * Life Insurance Premium * Public Provident Fund * Unit-linked insurance plan * National Savings Certificates * Mutual Fund * Tuition Fees * Sukanya Samriddhi Deposit Scheme * 5 Year fixed deposit in Scheduled Banks * Term deposit in post office * Senior Citizen Savings Scheme * NABARD Rural Bonds * Infrastructure Bond * Stamp duty and registration fee on buying house property * Contribution to annuity plan of LIC * National Pension Scheme * Medi Claim Policy & Preventive health check up forAdditional exemption on voluntary NPS * Rajiv Gandhi Equity Saving Scheme * Medi Claim Policy & Preventive health check up for self, spouse, children * Medi Claim Policy & Preventive health check up for self, spouse, children for senior citizen * Medi Claim Policy & Preventive health check up for parents parents for senior citizen * Preventive health check up * Treatment of dependent with disability * Treatment of dependent with severe disability * Medical expenditure for self or dependent for very senior citizen * Interest paid on Education loan * Additional interest on housing loan borrowed between 1 Apr 2016 and 31 Mar 2017 * Additional interest on housing loan borrowed between 1 Apr 2019 and 31 Mar 2020 * Interest on electric vehicle loan borrowed between 1 Apr 2019 and 31 Mar 2023 * Interest from Savings Account * Interest from Savings Account for senior citizen * Permanent physical disability (self) * Permanent severe physical disability (self) |

| Previous Employement Details | * Employee Number * Income After Exemptions * Income Tax * Professional Tax * Employee Provident Fund | |

| Allowance Declaration Details | Employee Number * Children Education Allowance * Hostel Expenditure Allowance * Helper Allowance * Travelling Allowance * Uniform Allowance * Daily Allowance * Conveyance Allowance | |

| Other Income Details | * Employee Number * Interest Paid on Home Loan * Interest Earned from Savings Deposit * Interest Earned from Fixed Deposit * Name Of Lender * PAN Of Lender * Income from Other Sources * Principal Paid on Home Loan | |

| Let-out Property Details | * Employee Number * Annual Rent Received * Municipal Taxes Paid * Interest Paid on Home Loan * Name Of Lender * PAN Of Lender | |

| Complete Employee Basic Details | Employee Details | * Employee Number * First Name * Middle Name * Last Name * Gender * Status * Date of Joining * Date of Termination * Designation * Work Email * Department * Work Location Name * Enable Portal * Is Eligible For PF * Is Eligible For EPS * PF Account Number * UAN Number * Is Eligible For ESI * ESI Number * Is Eligible for Professional Tax * Is Eligible For LWF * Personal Email * Father Name * Mobile Number * Date of Birth * Personal Address Line 1 * Personal Address Line 2 * Personal City * Personal StateCode * Personal Country * Personal PostalCode * PAN Number * Payment Mode * Bank Holder Name * Bank Name * Account Number * IFSC Code * Account Type * Salary Template Name |

- Once you have your file ready, click the Cloud icon and upload it.

- Check Skip or Overwrite to perform the respective options on duplicate entries.

- Select the right character encoding format from the dropdown menu and click Next.

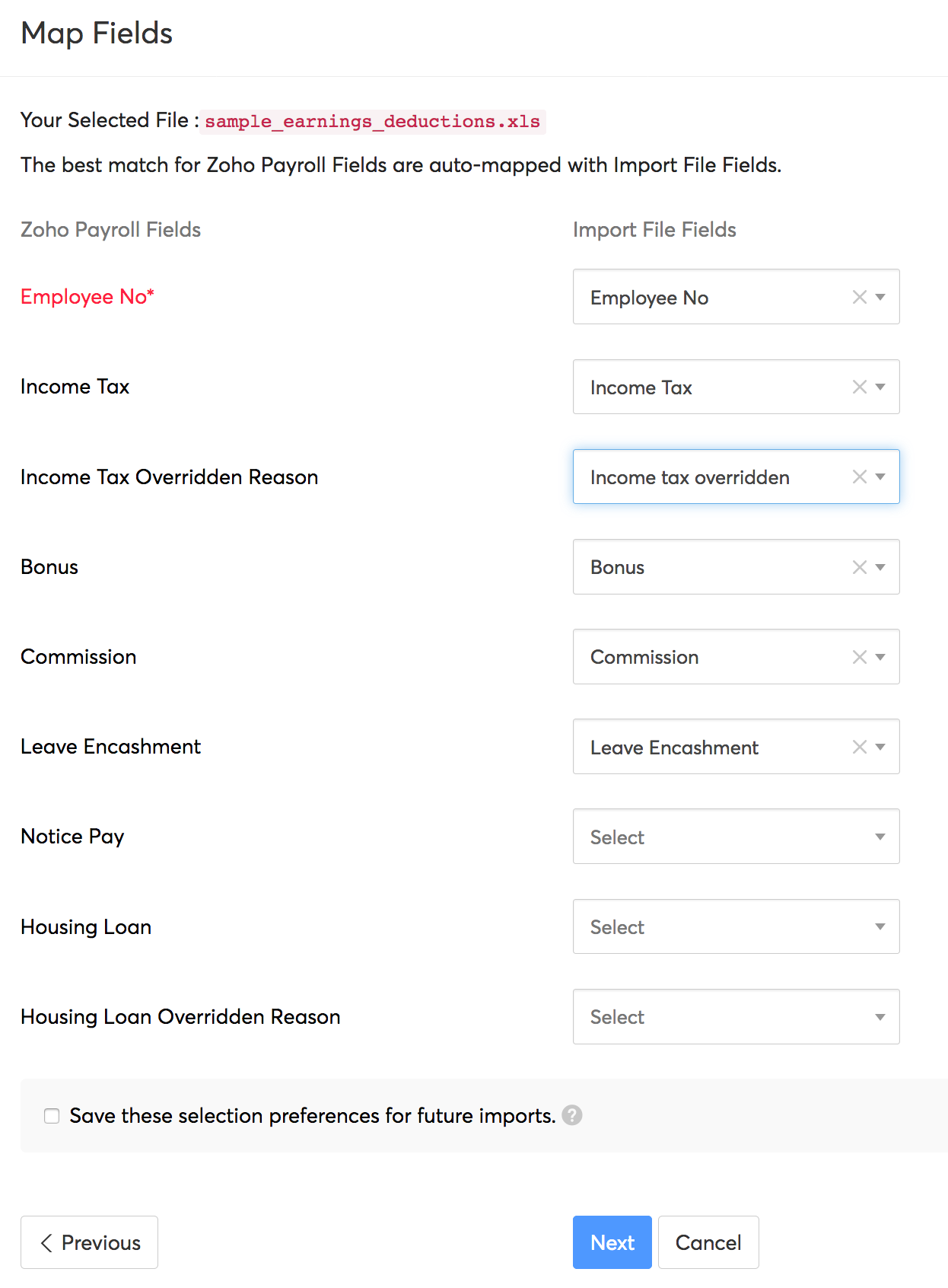

- In the Field Mapping page, map all the import fields in the file with the Zoho Payroll fields.

- Make sure the mandatory fields are mapped correctly.

- Ensure that the date format is mapped correctly.

Pro-tip: If you have trouble with the date format in the XLS format, use the CSV format to import data.

- Check the Save these selection preferences for future imports option if you want to use the same preferences for future imports.

- Select Next.

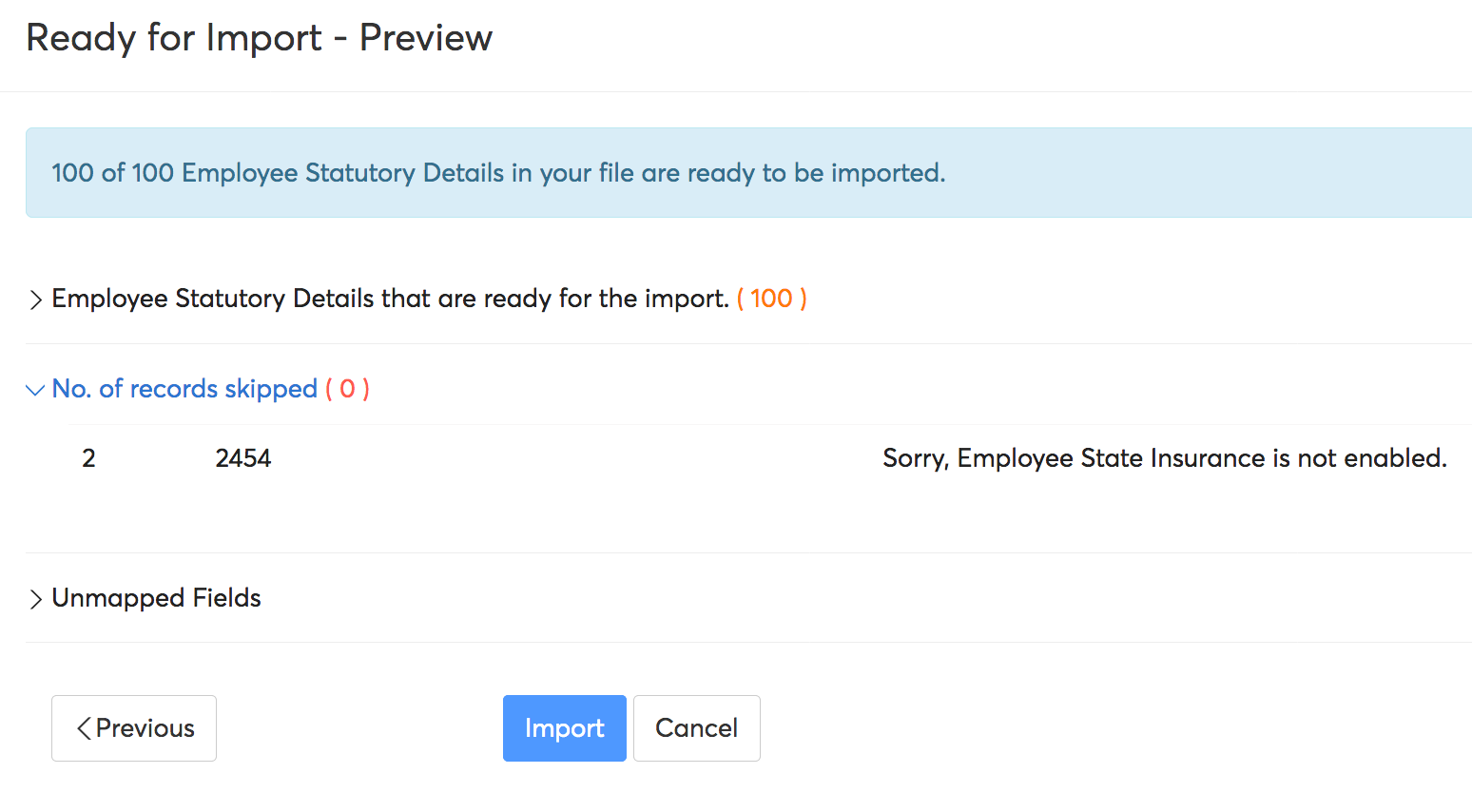

- In the Preview page, review the records skipped and the unmapped fields.

- Click Import to import the data.

- Go to the Employees module and complete the employee setup for the imported employees.

Pay Runs Module

In the Pay Runs module, you can import LOP data and One-time Earnings and Deductions.

To import LOP data:

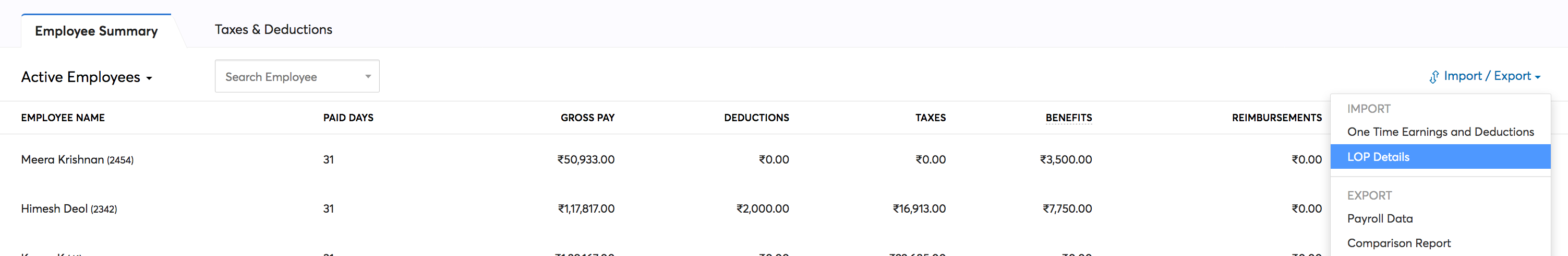

- Go to the Pay Runs module.

- Create a pay run.

- On the top right corner of the Employee Summary, click Import/Export.

- Select LOP Details.

- Upload your file containing the required fields: Employee Number and LOP Days.

- Select the Character Encoding format from the dropdown menu.

- Click Next.

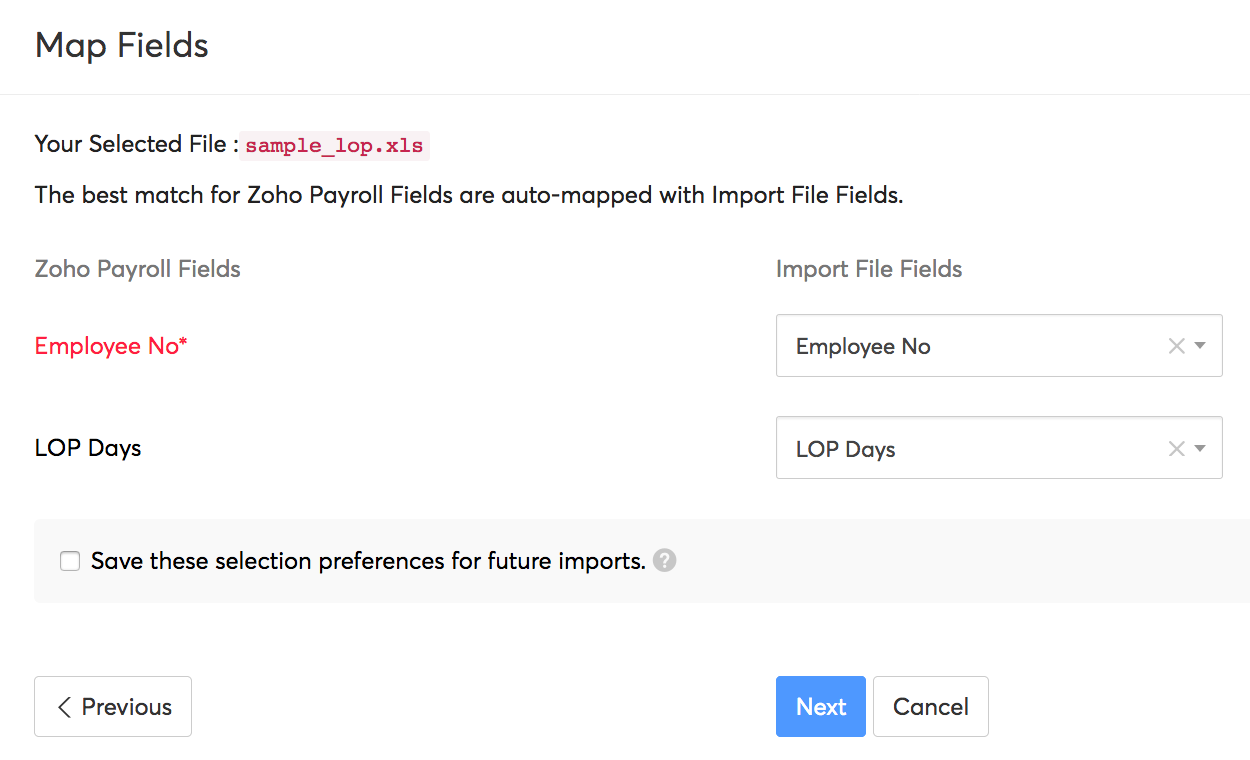

- In the Field Mapping page, map all the import fields in the file with the Zoho Payroll fields.

- Make sure the mandatory fields are mapped correctly.

- Check the Save selection preferences for future imports option if you want to use the same preferences for future imports.

- Select Next.

The LOP details will be imported for the respective employees.

To import One-Time Earnings and Deductions:

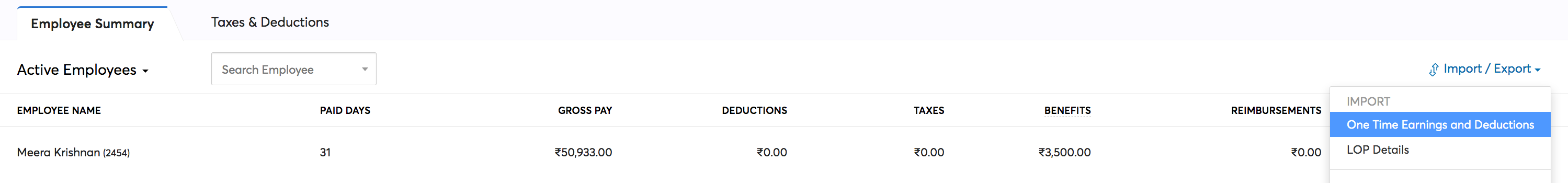

- Go to the Pay Runs module.

- Create a pay run.

- On the top right corner of the Employee Summary, click Import/Export.

- Select One-Time Earnings and Deductions.

- Upload your file containing the following required fields

- Employee Number

- Bonus

- Commission

- Leave Encashment

- Deductions

- Loan

- Loan Overridden Reason

- Recurring Deductions

- Recurring Deduction Overridden Reason

- Select the Character Encoding format from the dropdown menu.

- Make sure the mandatory fields are mapped correctly.

- Check Save these selection preferences for future imports option if you want to use the same preferences for future imports.

- Select Next.

The one-time earnings and deductions will be imported for the respective employees.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!