Contractors

Note This feature is currently in early access. Contact support@zohopayroll.com and we’ll enable the feature for you.

Contractors are people or organizations that an organization hires to do a particular job or project for a specified amount of time. They are not employees and usually work under a contract that specifies the scope, duration, and terms of payment of their work.

Scenario

Let’s consider Notre, a technology company that is currently working on developing emerging AI tech for a major client. To handle the sudden spike in workload, they bring in Seetha, a freelance developer tools consultant, on a 3-month contract.

She’s not a full-time employee—she uses her own tools, sets her own hours, and the firm pays her at the end of each month.

Once the product launch wraps up and her contract ends, Seetha’s engagement with the company is complete. She’s no longer part of your project workflows or the organisation.

This is how a contractor works—brought in for specific tasks, for a fixed period, and not formally employed by your organisation. Now, let’s see how you can manage contractors in Zoho Payroll:

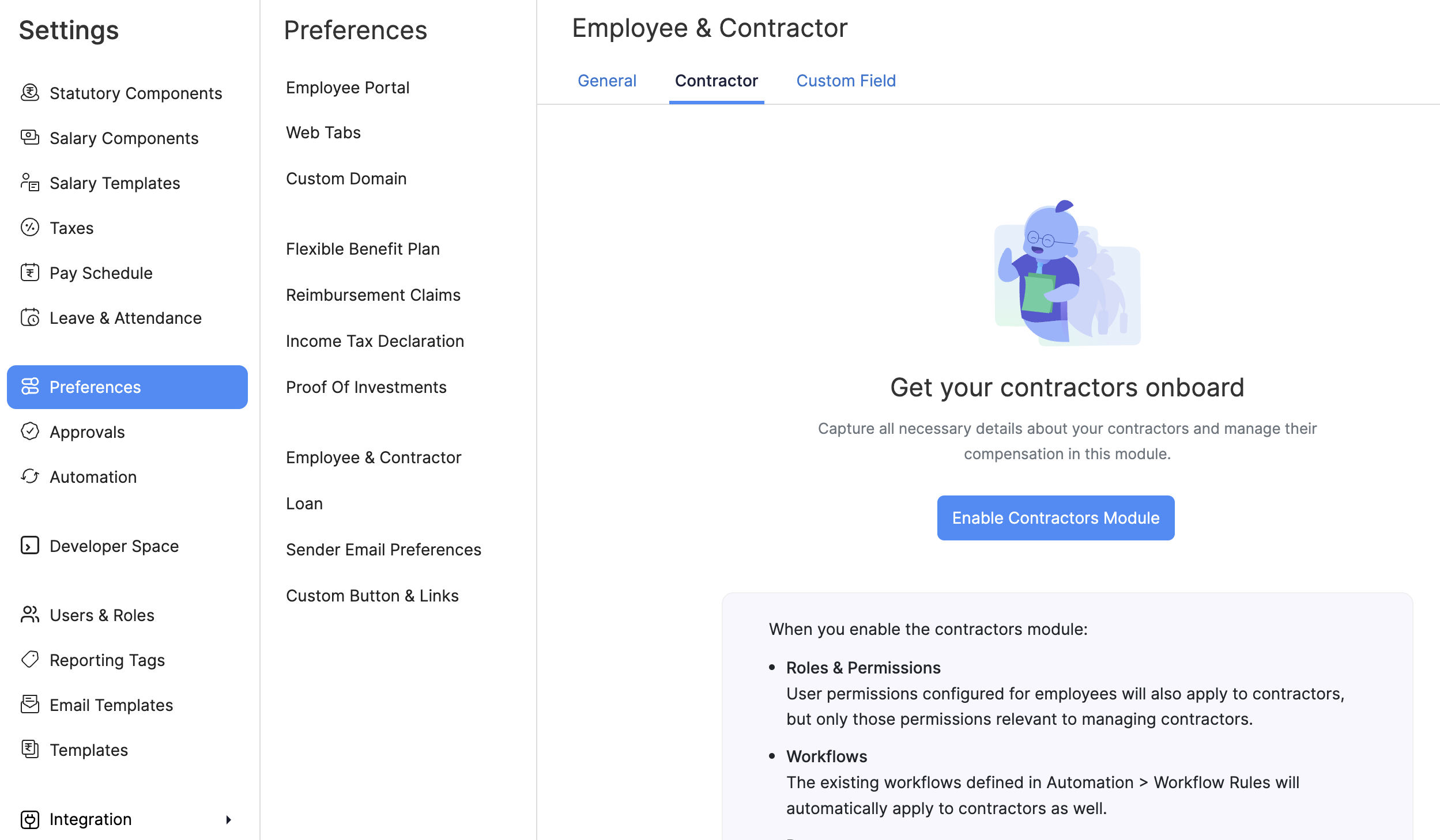

Enable Contractors

Before you start adding contractors, you must enable the module first. Here’s how:

- Click Settings in the top right corner and select Preferences.

- Click Employee and Contractors in the Preferences panel.

- Switch to the Contractors tab.

- Click Enable Contractors.

You’ll now be able to add, manage, and include them to the payrolls.

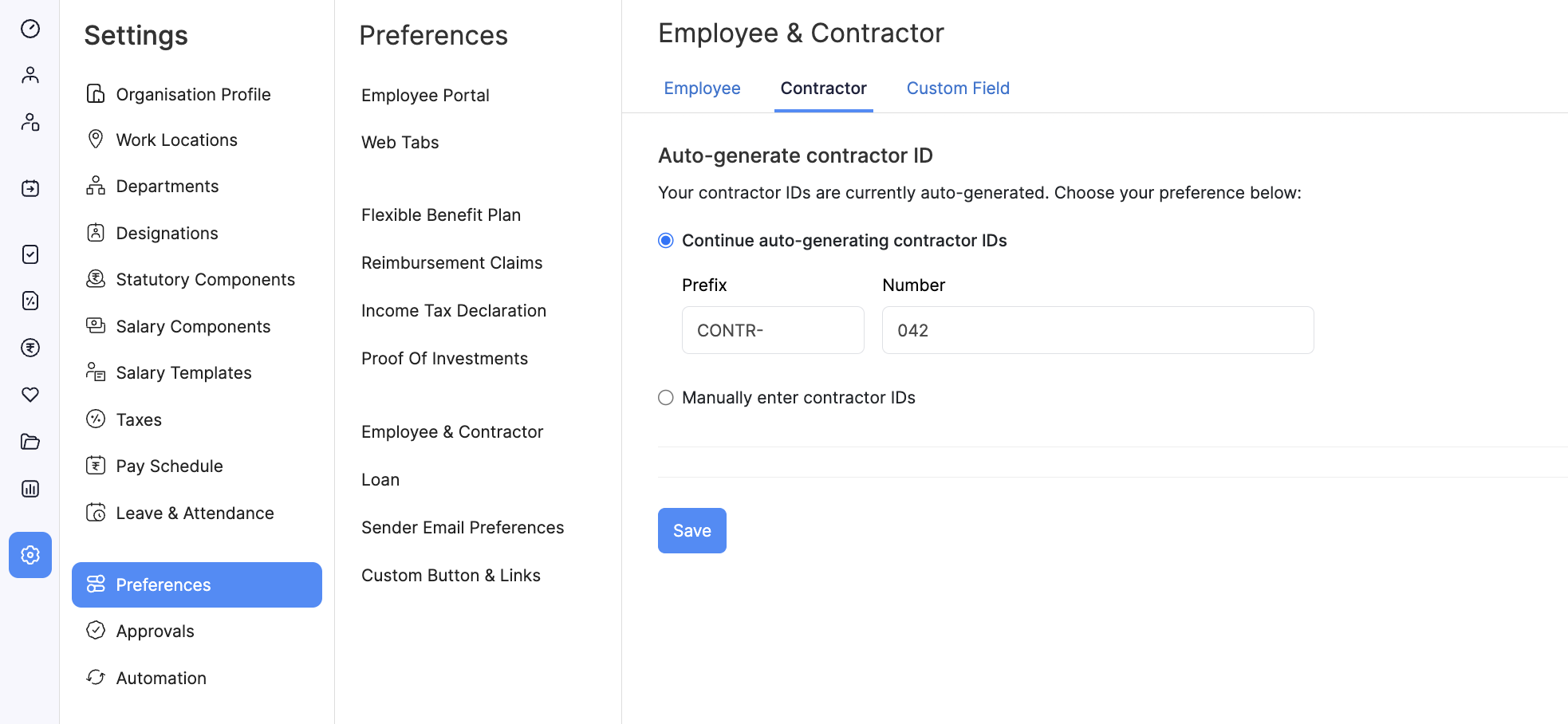

Contractor ID Preferences

Contractor IDs are unique numbers associated with a contractor for quick identification. Once you enable contractors for your organisation, you can either choose to auto-generate these IDs or manually enter them while creating a contractor.

To auto-generate contractor IDs:

- Click Settings in the top right corner and select Preferences.

- Click Employee and Contractors in the Preferences panel.

- Switch to the Contractors tab.

- Enter the prefix and the number.

- Click Save.

Based on the prefix and number you’ve entered, the contractor ID will be auto-generated subsequently, and you can view the auto-generated ID while creating a contractor.

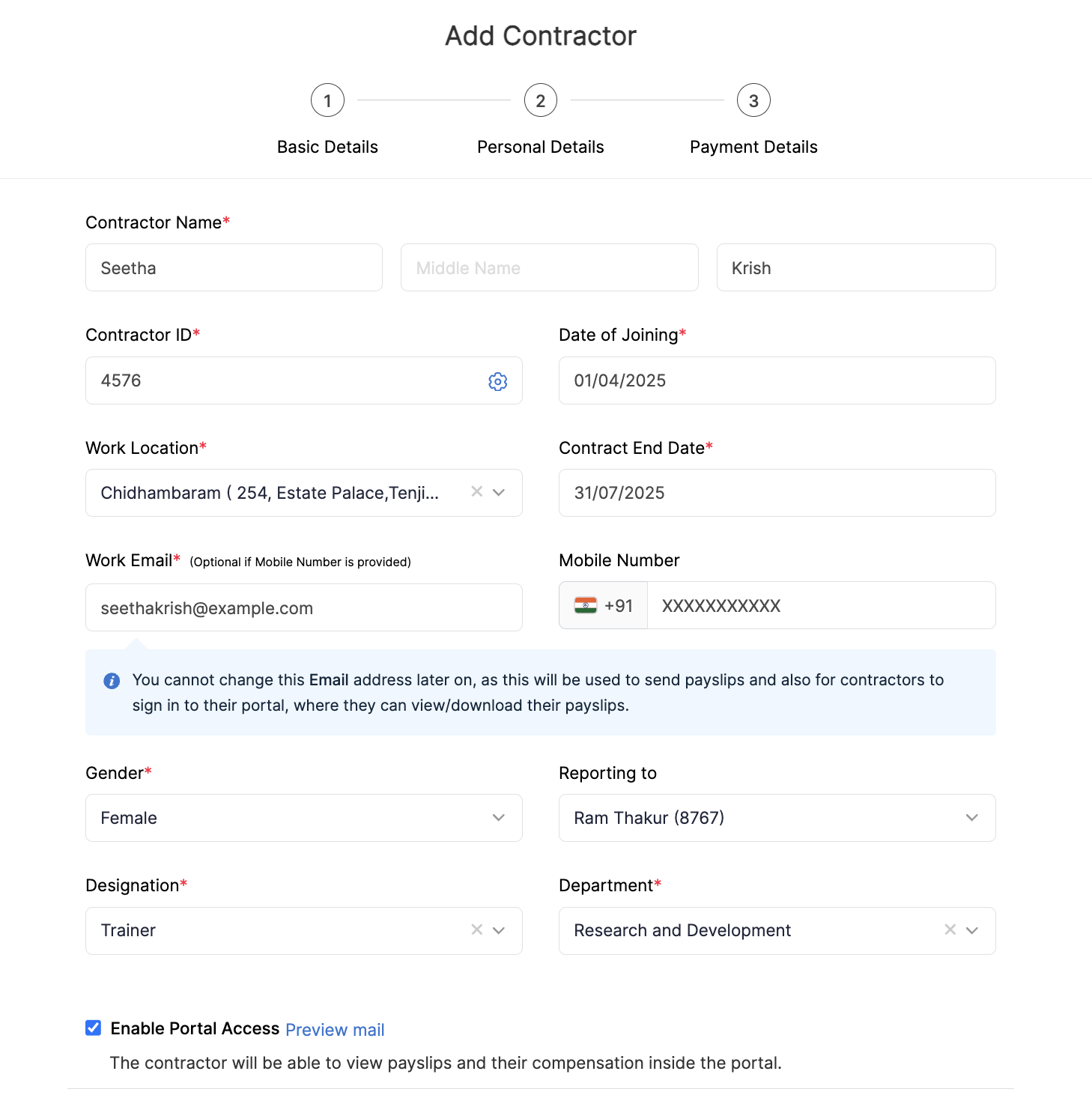

Create Contractors

To create a contractor:

- Click Contractors on the left sidebar.

- Click Add Contractor.

- Enter the basic details.

| Basic Details | Description |

|---|---|

| Contractor ID | Enter the unique ID used to identify the contractor. You can either enter the ID manually or choose to auto-generate them by clicking the Settings icon. |

| Date of Joining | The day when the contractor begins to work for the company officially. |

| Work Location | The location where the contractor works. |

| Contract End Date | The date the contract ends. The contractor will no longer work after the contract end date. |

| Reporting To | Select the person who oversees the work of the contractor. |

| Designation | Select the position of the contractor in your organisation. |

| Department | Select the department or team the contractor belongs too. |

| Enable Portal Access | Once this option is selected, the contractor will be able to view the payment details in the portal. |

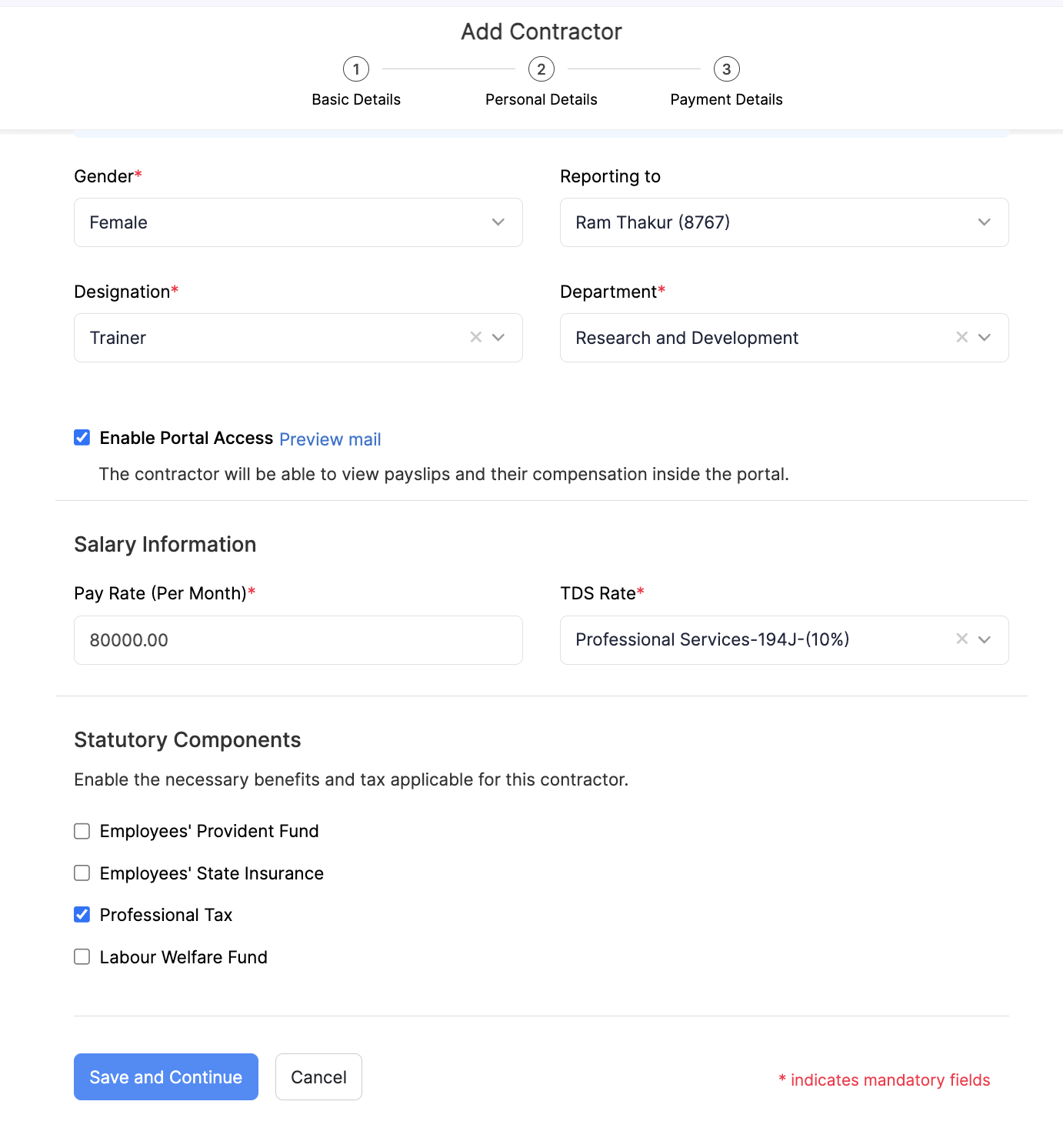

| Pay Rate | Enter the fixed amount that you pay to the contractor every month. |

| TDS | The tax deducted at source for the contractor’s monthly pay. |

| Enable Statutory Components | Select to configure the benefits applicable to the contractor. |

In Zoho Payroll, you can associate three types of TDS to a contractor.

| TDS Rate | Description |

|---|---|

| No TDS | No tax will be deducted from their paid rate if it is 50,000 during the year. |

| Technical Services TDS 194J - (2%) | Apply this TDS for managerial, consultancy, and technical services. |

| Professional Services TDS 194J - (10%) | Apply this TDS for medical, architectural, advertising, legal, engineer, and other notified professions. |

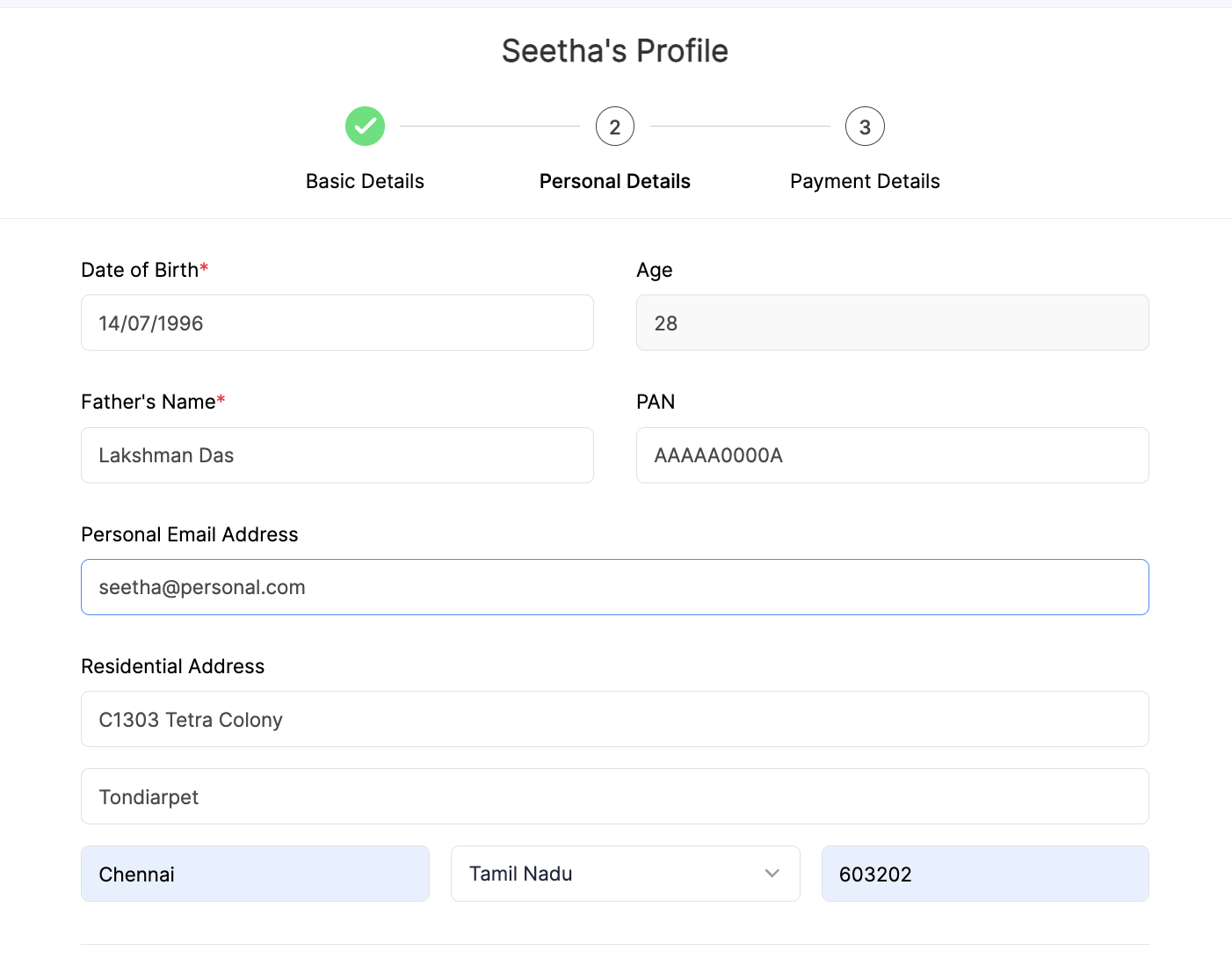

Next, you have to enter the personal details of the contractor, such as their date of birth, father’s name, age, residential address, PAN, and personal email address.

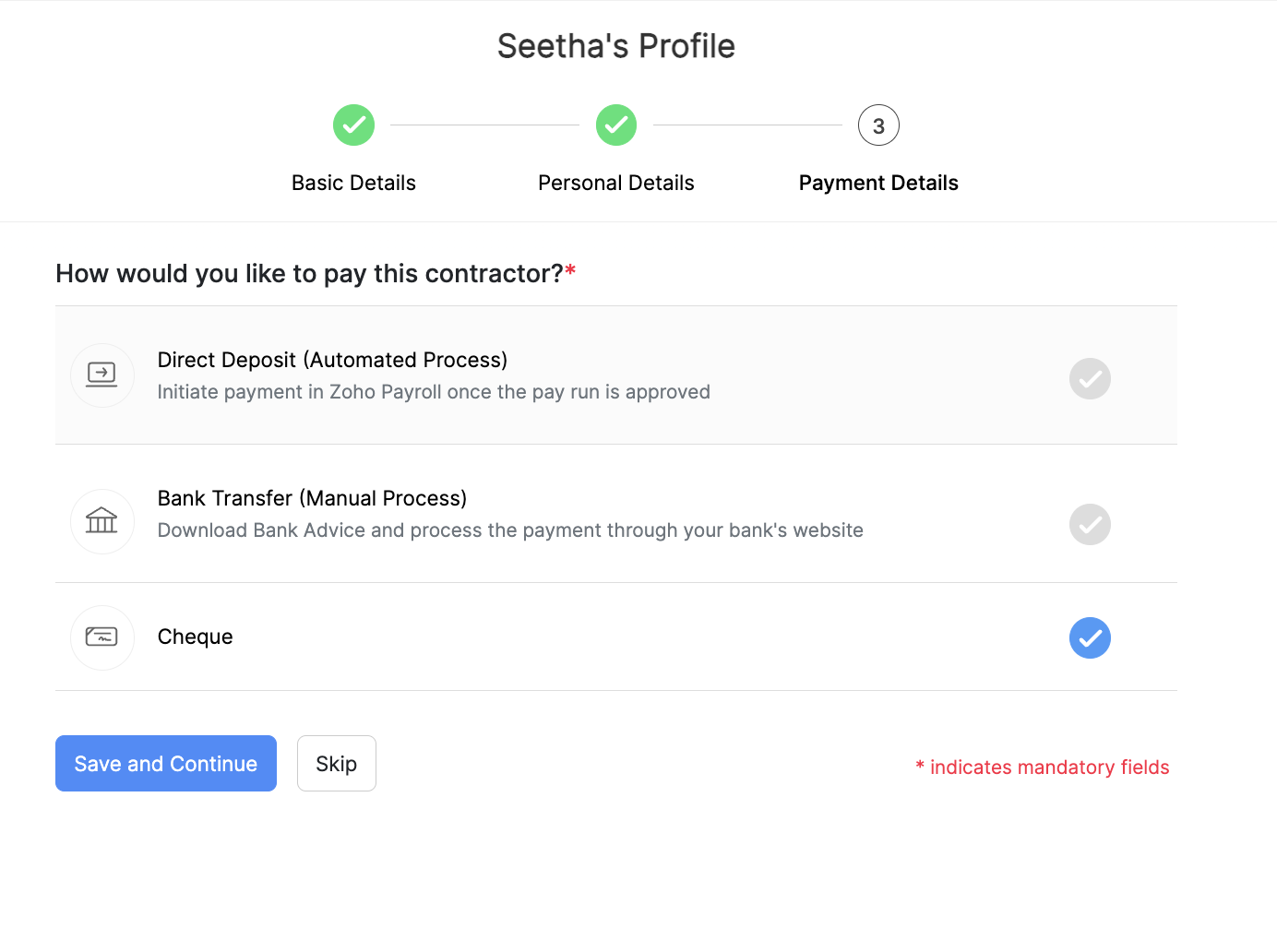

Choose the payment method you would like to use to pay this contractor.

Direct Deposit: Transfer the money directly to your contractor’s bank account. You would have to configure Yes Bank or HSBC Bank for your Zoho Payroll organisation to choose this payment method.

Bank Transfer: Manually transfer the money to your contractor’s bank account.

Cheque: Manually send cheques to your contractors and record them in Zoho Payroll.

Click Save and Continue.

You have now created a contractor.

Sync Contractors from Zoho People

To sync contractors from Zoho People, ensure the following prerequisites are met:

Prerequisites

- Contractor profiles in Zoho People must have a Date of Exit.

- Contractor profiles must include the following custom fields: Payment Mode, Bank Holder Name, Bank Name, Account Number, IFSC Code, and Account Type, along with the corresponding data.

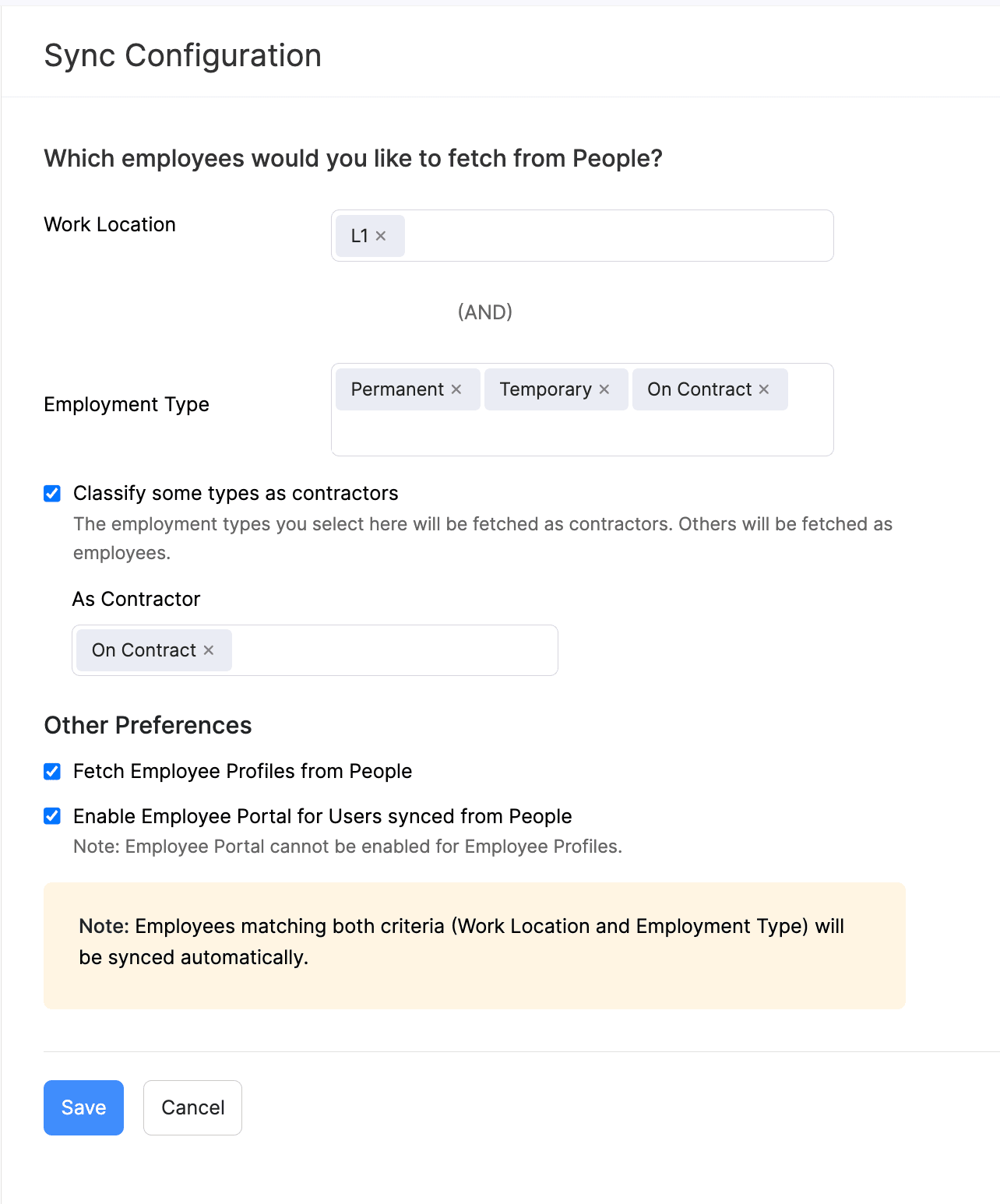

You need to configure Sync Preferences in the Zoho People integration to be able to sync contractors from Zoho People. Here’s how:

- Click Settings in the top right corner and select Zoho apps under Integration.

- In the Which employees would you like to fetch from People? section, select the employment type who are contractors in Zoho People.

- Next, select the Classify some types as contractors option.

- In the Select Employment Type field, select the employment type for contractors in Zoho People again.

- Click Save.

By default, the contractor data from Zoho People gets synced every 24 hours.

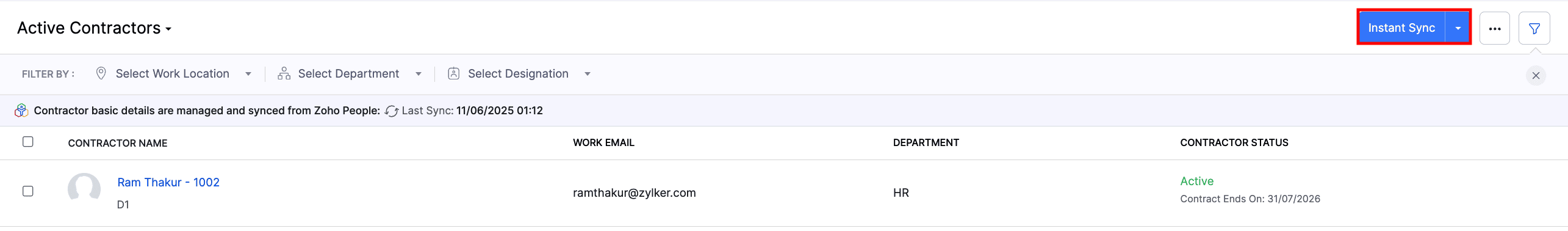

However, you can choose to sync contractors manually at any time, if required. Here’s how:

- Go to Contractors in the left sidebar.

- Click Instant Sync in the top right corner.

The contractors from Zoho People will be synced to Zoho Payroll.

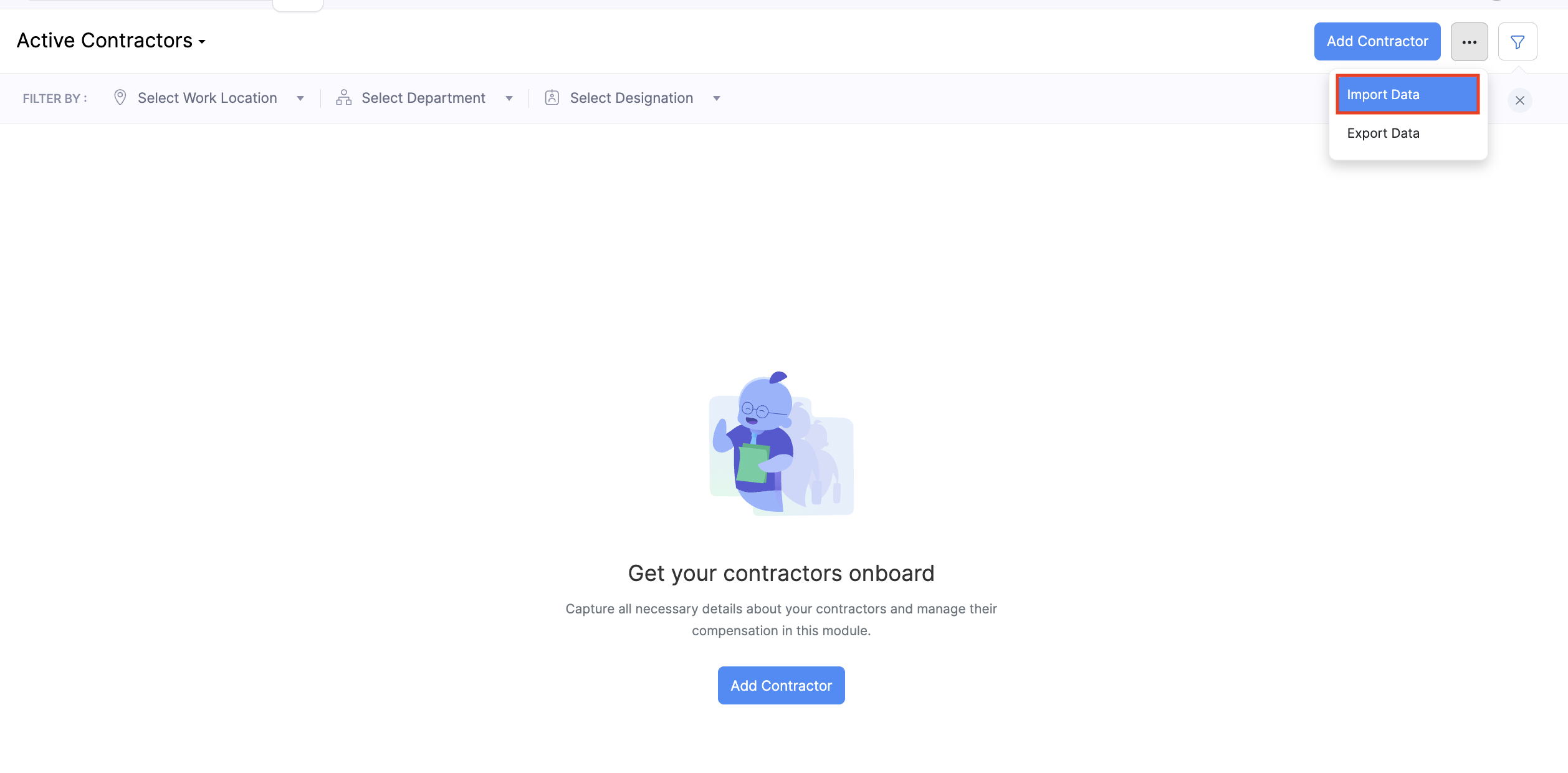

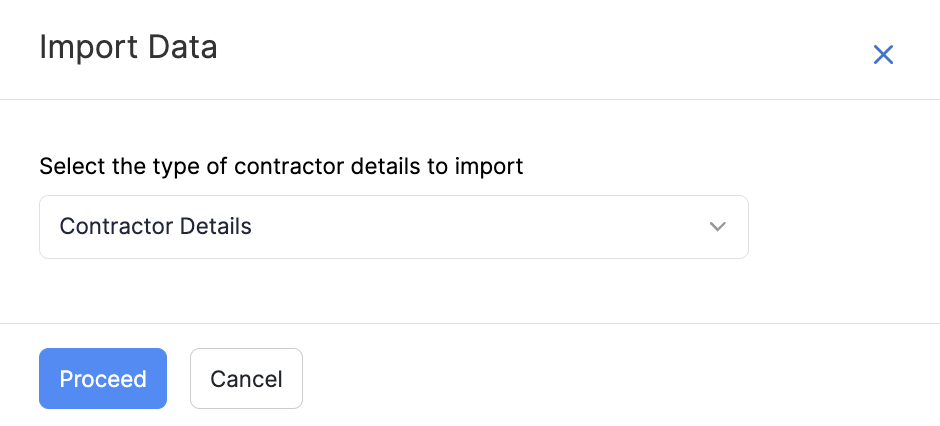

Import Contractors

If you want to add multiple contractors to Zoho Payroll at once, you can import them. Here’s how:

- Click Contractors on the left sidebar.

- Click the More icon and select Import Data.

- Select Contractor Details as the type of contractor details you want to import.

- Click Proceed.

- Upload the import file and map the Zoho Payroll file fields with the import fields.

- Click Next and click Import.

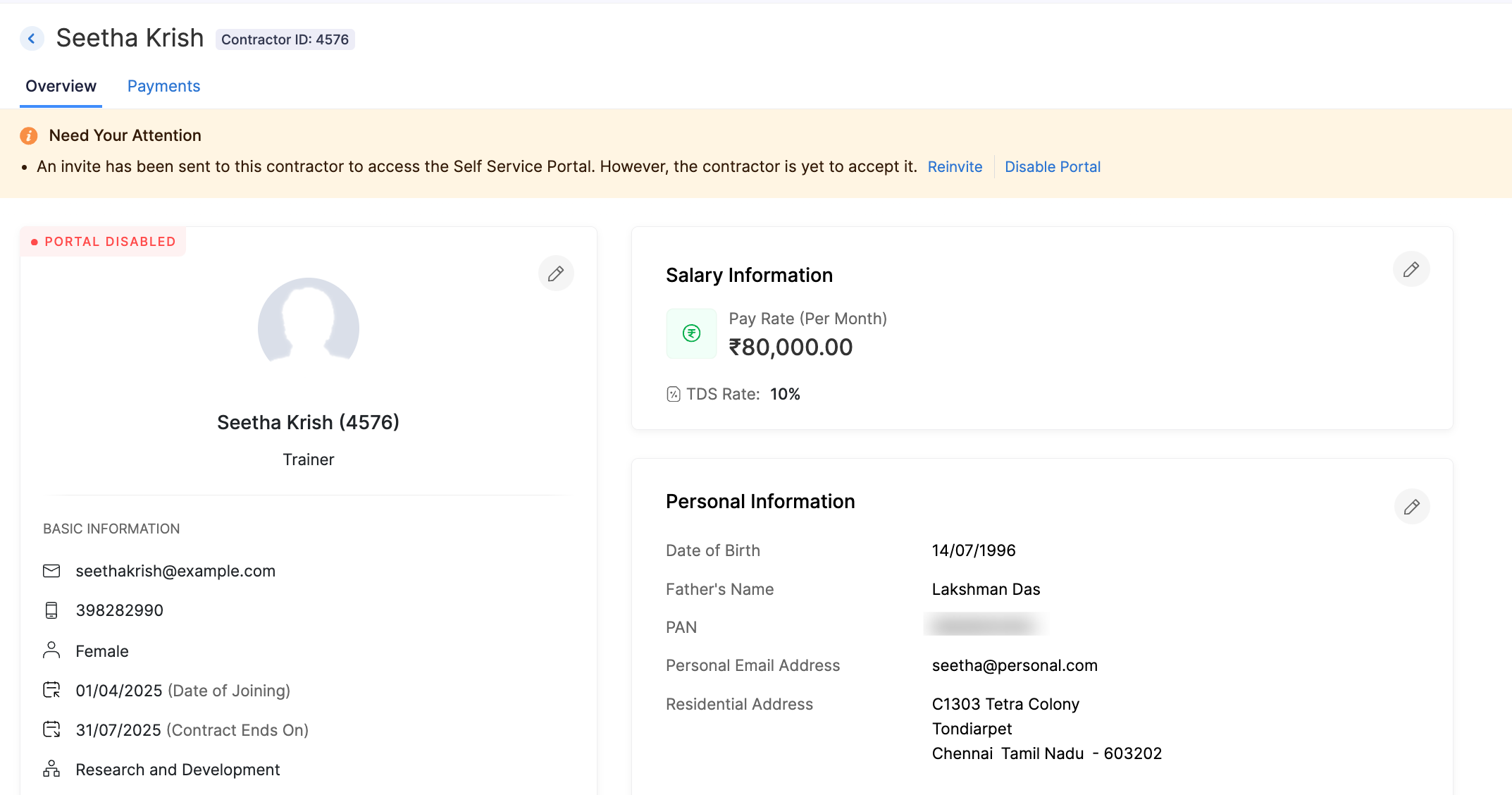

View Contractor Details

Once you’ve added contractors, here’s how you can view their details:

- Navigate to the Contractors module.

- Select the contractor whose details you want to view.

Here, you will be able to view all the details related to the contractor.

View Contractor Payments

If you have run pay runs which include contractors, you would want to view a contractor’s payment history. Here’s how:

- Navigate to the Contractors module.

- Select the contractor whose details you want to view.

- Switch to the Payments tab.

Here, you will be able to view the payment history of the contractor.

Pro Tip You can use the period filter to view payment history based on the year.

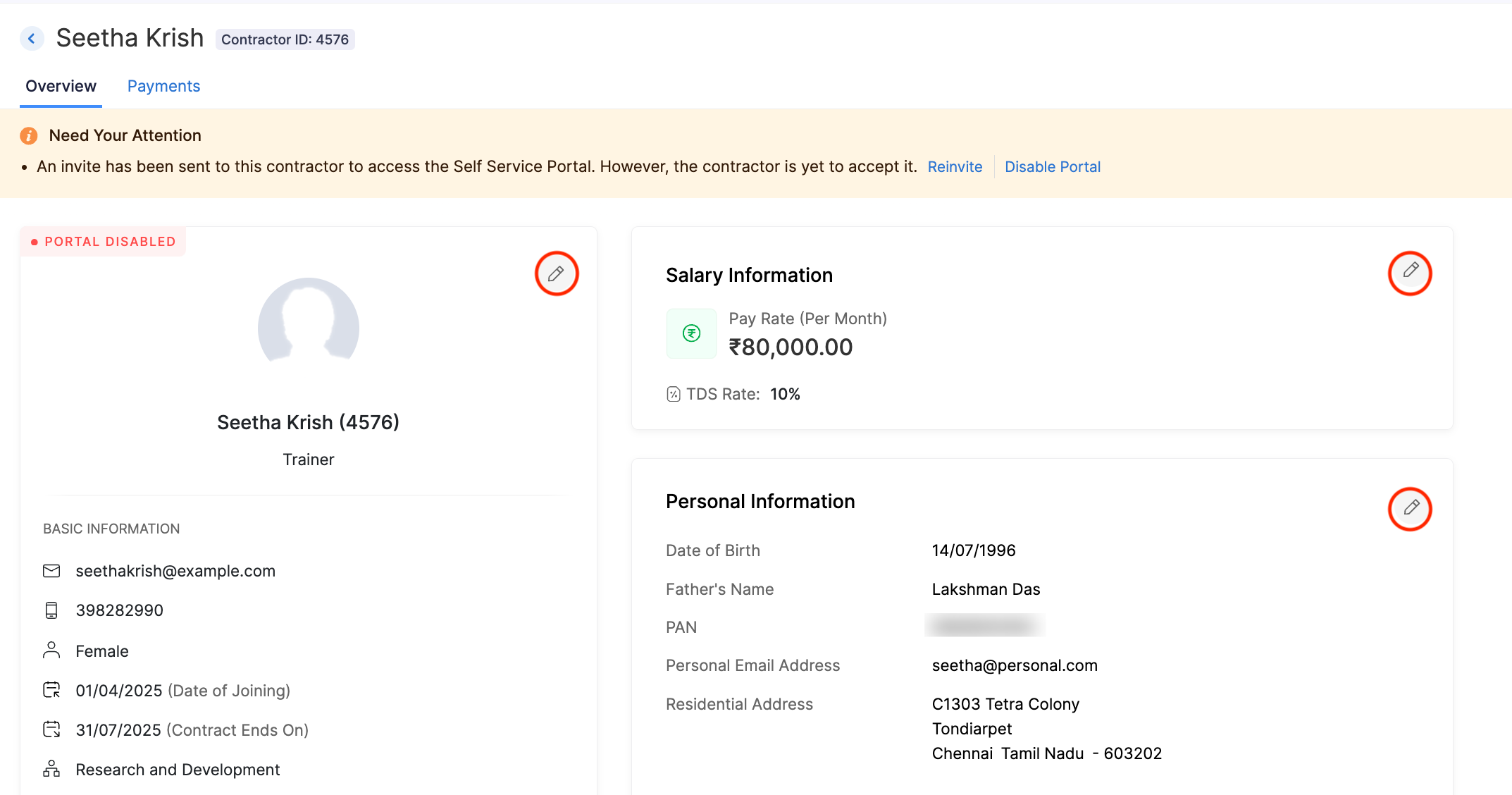

Edit Contractor

To edit the details of an contractor:

- Navigate to the Contractors module.

- Select the contractor whose details you want to edit.

- Click the Edit icon next to the section that you want to edit.

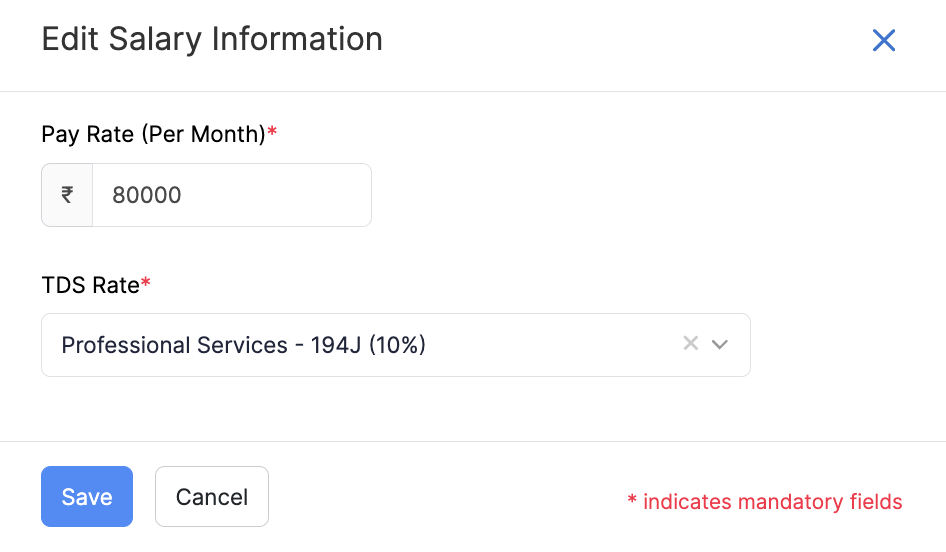

Edit Salary Information

To edit the salary information of the contractor before they have been involved in a pay run:

- Navigate to the Contractors module.

- Select the contractor whose details you want to edit.

- Click the Edit icon.

- Update the details and click Save.

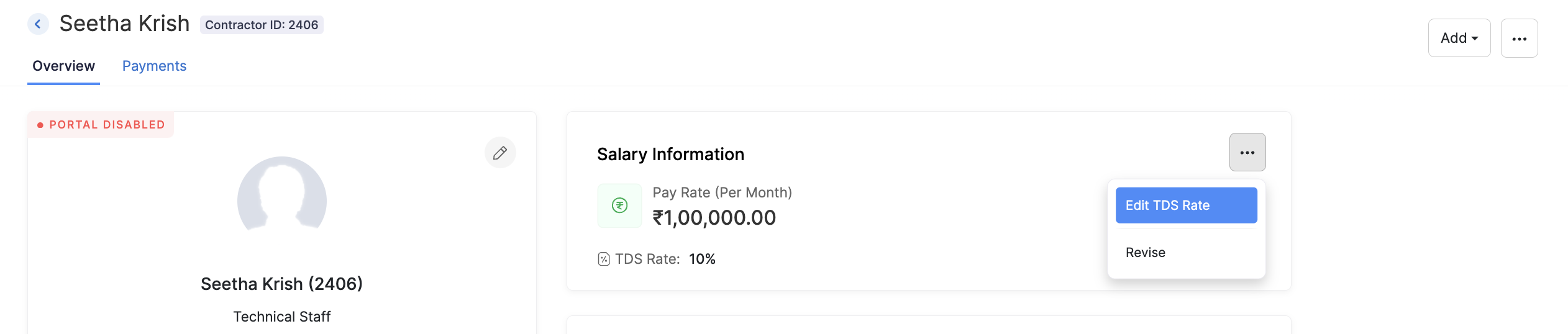

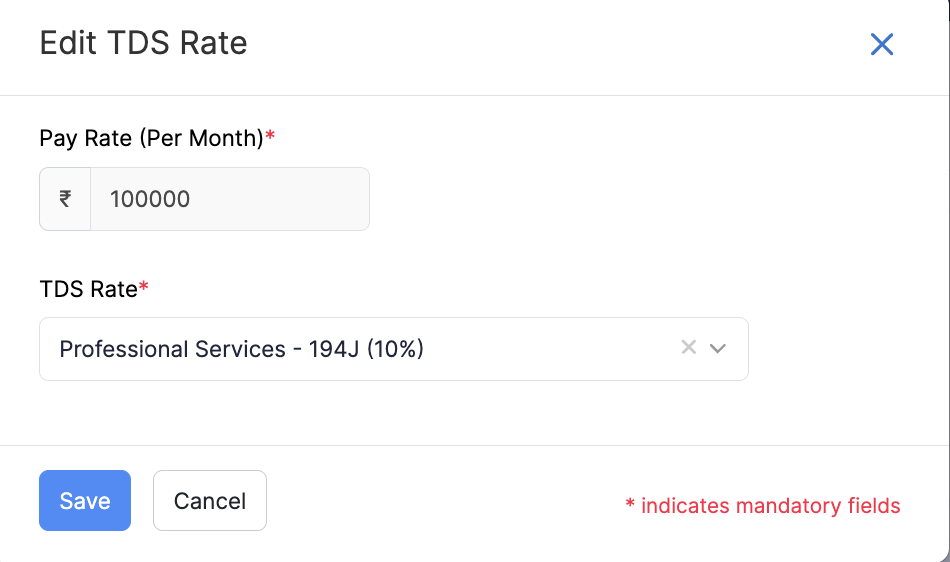

Edit TDS Rate

To edit the TDS rate of an contractor after they have been involved in a pay run:

- Navigate to the Contractors module.

- Select the contractor whose details you want to edit.

- Click the More icon next to the Salary Information section and select Edit TDS Rate.

- Change the TDS rate and click Save.

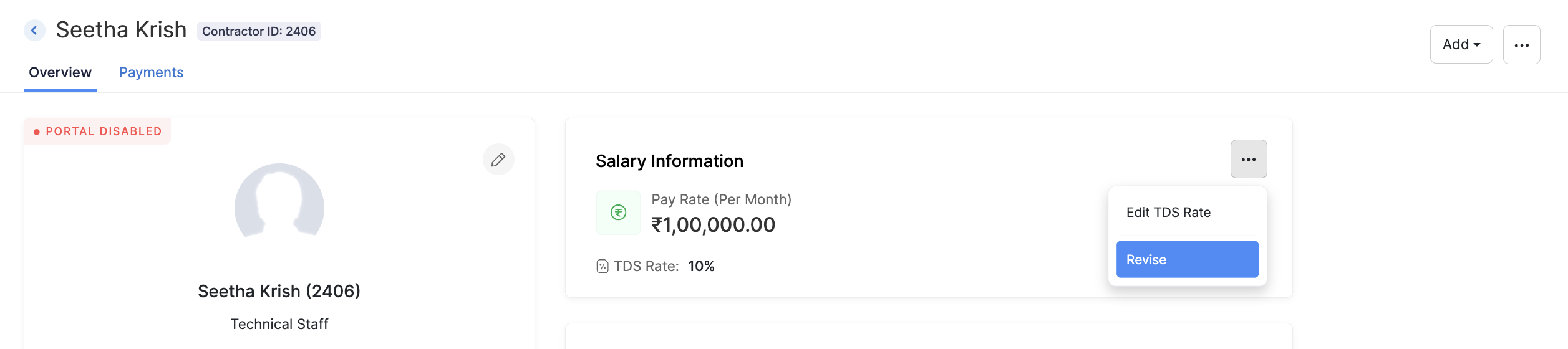

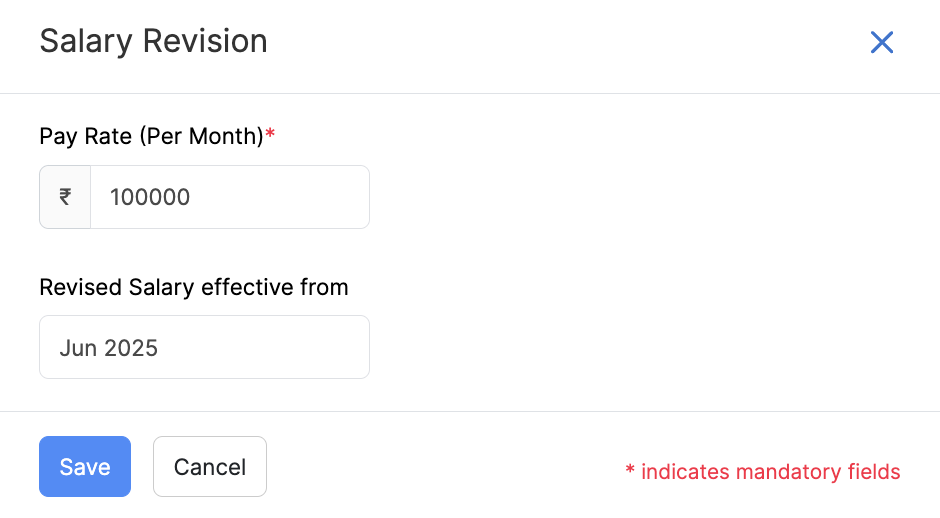

Revise Contractor Salary

To revise the salary of a contractor after they have been involved in a pay run:

- Navigate to the Contractors module.

- Select the contractor whose salary you want to revise.

- Click the More icon next to the Salary Information section and select Revise.

- Enter the Pay Rate per month and Revised Salary effective from date.

- Click Save.

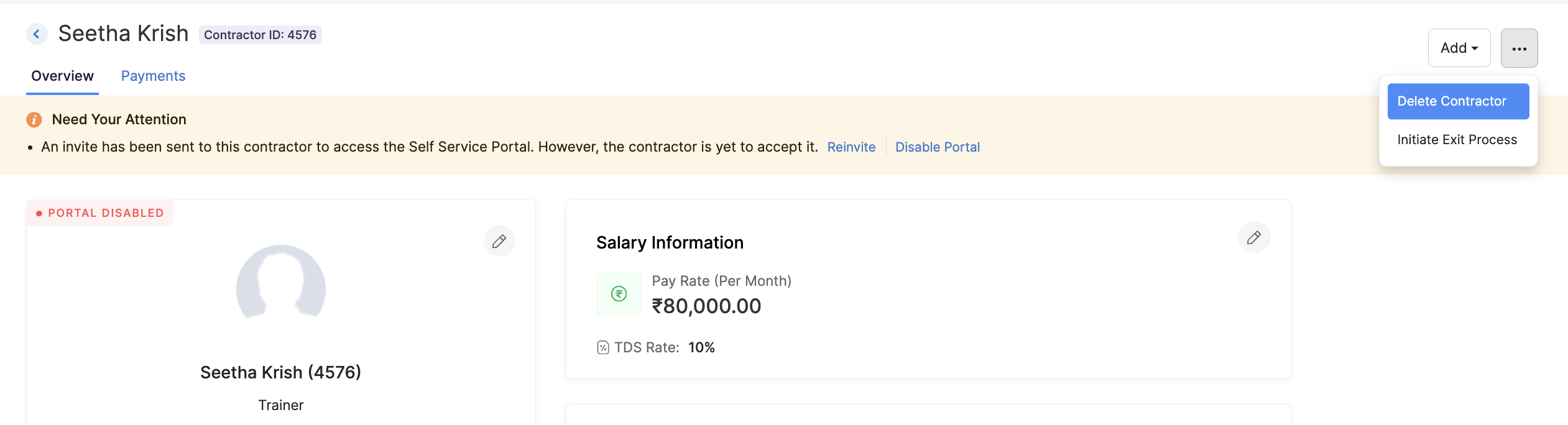

Delete Contractor

If an contractor is not a part of any current or completed pay runs and you , you can delete them from Zoho Payroll. Here’s how:

- Navigate to the Contractors module.

- Click the name of the contractor whose details you want to delete.

Click the More icon and select Delete Contractor

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!