Put benefits on auto-pilot

Handle CTC-based reimbursements, pre-tax, or post-tax deductions to stay compliant and support employees.

Eliminate manual paper work

From startups to enterprises, go digital with reimbursements and deductions, so you can focus less on paperwork.

Customize to your organization

Choose from different deduction cycles, percentage or flat amount, or applicability for all types of employees.

Manage benefits easily for your

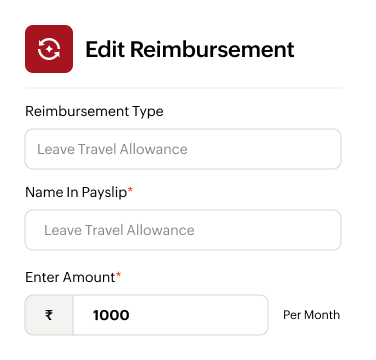

Set different limits for different employees

Provide employees with perks like travel, fuel, and telephone reimbursements. Set appropriate pay limits to manage them effectively.

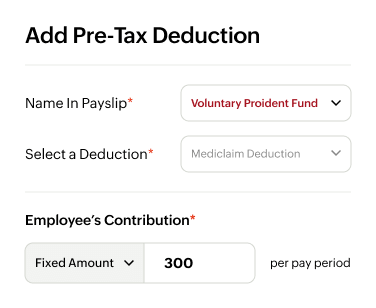

Support pre-tax deductions for different categories

Add recurring pre-tax deductions for NPS, VPF, and mediclaim premiums to stay compliant while helping employees save for the future.

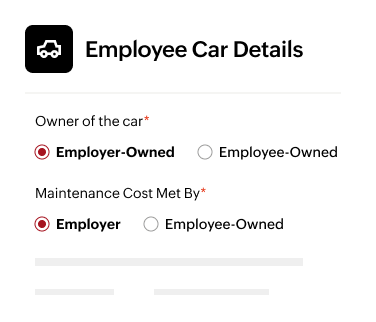

Automate vehicle perquisite calculations

Factor in ownership, maintenance costs, cubic capacity, and driver provision to ensure precise tax inclusion and offer potential tax relief for employees

Keep tabs on salary advances

Provide timely financial support with salary advances to your employees in need without adding costs to your business.

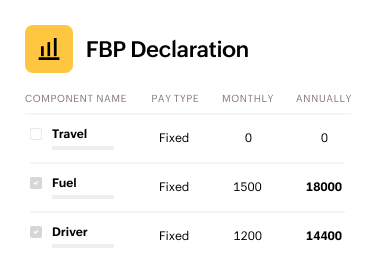

Maximize tax savings for employees

Allow employees to choose the flexible benefit plans of their choice, and stay compliant by automatically excluding the benefits from taxes during every payrun.

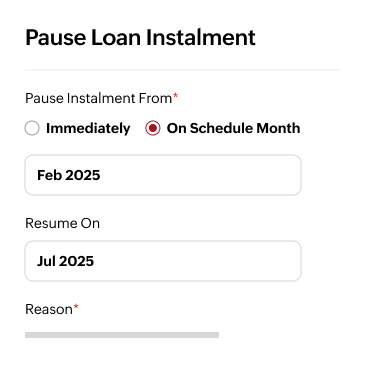

Simplify employee loan management

Record loans, set perquisite rates, automate deductions, track repayments, and manage installments, pause or resume actions while supporting employees financially.

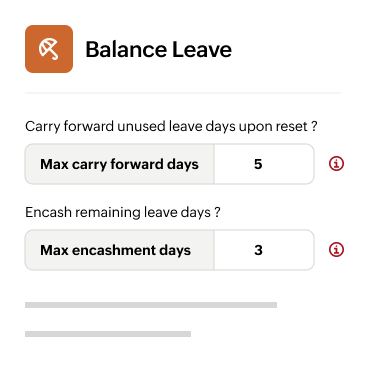

Automate leave encashment & carry forward

Easily manage leave encashment and carry forward, ensuring employees get accurate, timely payouts without extra work for you.

Flexible benefit plans that fit your team

Create reimbursement policies in a few clicks. We support components like driver, fuel, travel, and internet reimbursements with custom applicability for every employee.

Handle compliance

Streamline IT declaration process

Allow employees to easily submit tax-saving declarations, ensuring precise deductions and timely compliance with minimal administrative effort.

Stay ahead with benefits reports

Get clear insights on contributions, deductions, and liabilities through detailed reports that help you stay compliant without extra effort.