Payroll software with everything you need

Ensure a smooth payroll journey for your team

Simplify every stage of the employee lifecycle so your people feel supported and your business runs smoothly.

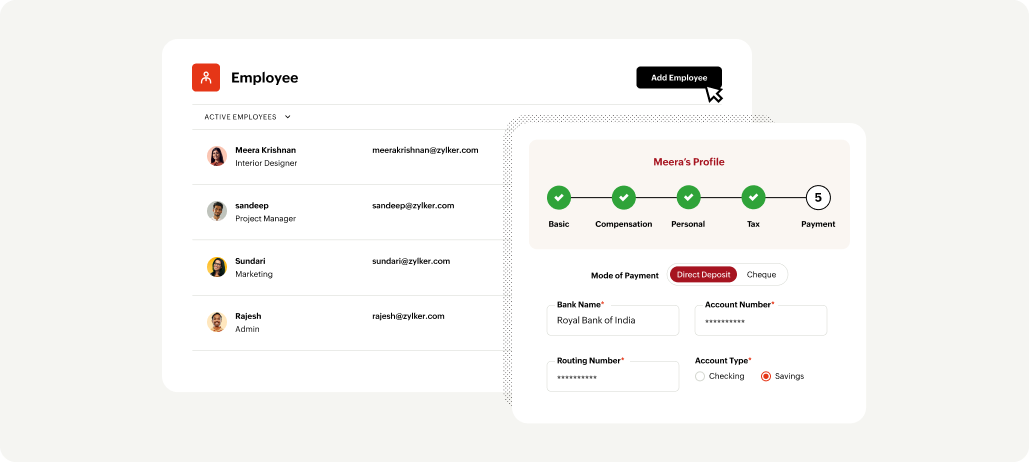

Manage your employees with ease

Help new hires settle in quickly with structured operations so they feel engaged and productive from day one.

Maintain all employee information in one unified place, reducing errors and saving countless hours of yours.

Build customised employee views to quickly filter, group, and review required employee details without navigating multiple screens.

Rehire previously exited employees easily as Zoho Payroll automatically retrieves their details from the previous financial year.

Track leave balances, attendance patterns, and leave trends to manage your workforce more efficiently and responsibly.

Onboard contractors with the same ease as employees and keep their reporting details, contract timelines, and documents organized throughout their tenure.

Explore contractor payrollAutomate resignations and settlements to ensure compliance and provide departing employees with a smooth exit process.

Make every payroll task effortless

Automate key tasks so you can focus less on admin work and more on growing your business.

Payroll administration made easy

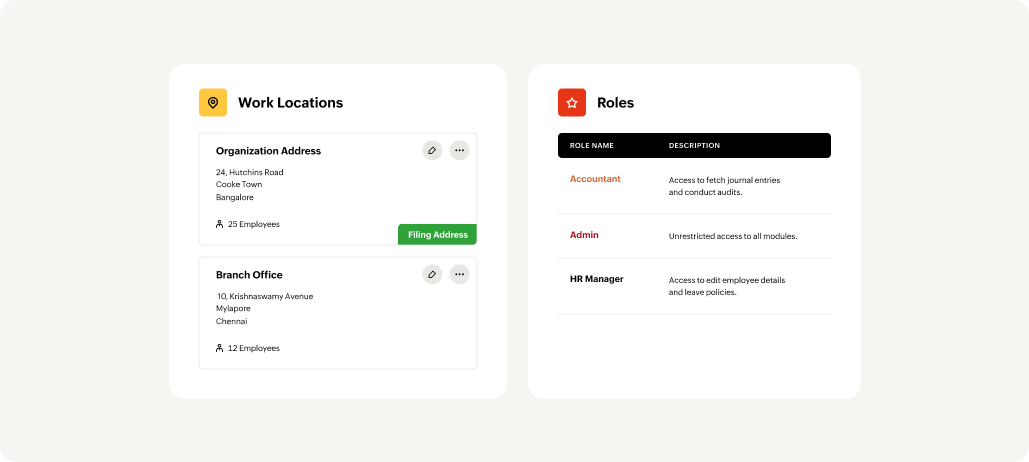

Process compliant and accurate payroll for teams working remotely or across multiple offices, assigning the right work location for every employee.

Import all pay runs you've processed so far when starting Zoho Payroll mid-year to keep your data accurate and ensure a smooth, uninterrupted transition.

Set up FBP structures the way you prefer, allow employees to personalise their allocations, and let the system keep everything accurate and compliant.

Track and approve fuel, telephone, medical, and other reimbursement claims with built-in checks that keep everything fast and compliant.

Collect, verify, and approve IT declarations in one organised flow to ensure error-free tax calculations.

Create and manage tailored roles and permissions, so teams can collaborate securely and efficiently.

Easily handle employee loans by automating salary deductions, defining perquisite rates, and recording any manual repayments.

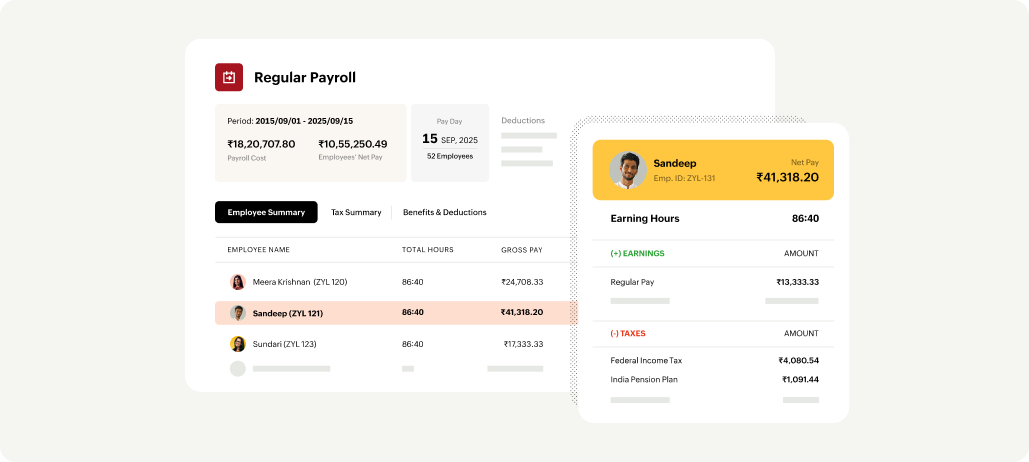

Process your payroll in minutes, not days

Turn payroll into a routine that is fast, accurate, and effortless with automated and compliant processes.

Create payroll schedules that fit your workflow, adjusting for weekends, holidays, and workdays to keep payments accurate and on time.

Easily add salary components, allowances, or deductions to a pay run to ensure accurate payroll processing.

Temporarily skip payroll for employees on extended leave or those ineligible, keeping future payments uninterrupted.

Keep payroll up-to-date after appraisals or mid-year reviews, reflecting employee growth and maintaining accurate tax calculations while boosting your team.

Quickly manage salary revisions, onboarding, and pending payments, and contractor payouts with off-cycle payroll for hassle-free, timely pay.

Manage salary payments through multiple modes, including cash, cheque, or bank transfers, without juggling separate systems or processes.

Pay employees and contractors via direct deposit through HSBC, YES Bank, and ICICI, ensuring accurate, timely, and hassle-free salary transfers.

Settle arrears for new joiners by paying them for work done before their first payroll, making sure no days go unpaid.

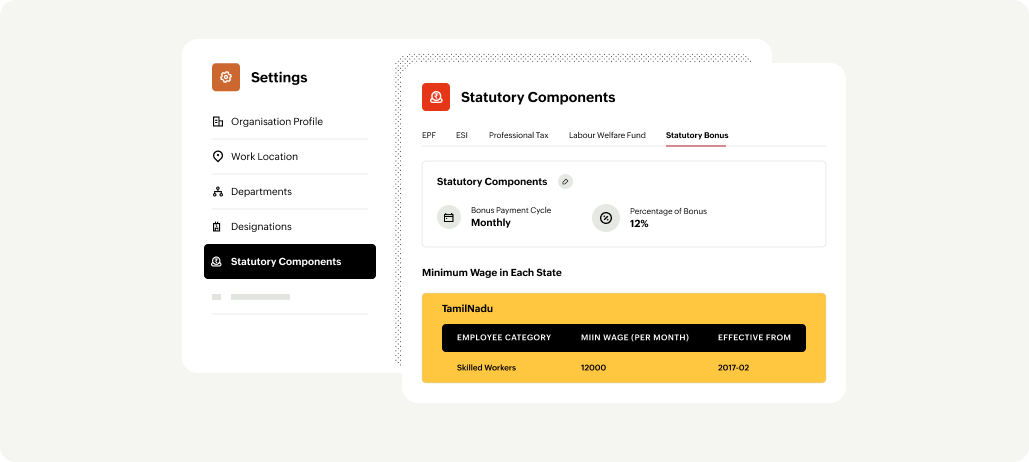

Built-In compliance you can rely on

Stay tax-ready automatically with built-in statutory calculations for EPF, PT, ESI, LWF, and statutory bonuses to maintain compliance and avoid penalties.

Stay ahead with built-in compliance

Stay tax-ready with built-in statutory calculations for EPF, PT, ESI, LWF and statutory bonuses by automated compliance checks to avoid penalties.

Handle contractor payouts smoothly with built-in TDS for 194C and 194J and optional statutory benefits like EPF and ESI.

Configure employee-wise PF contributions to match company policies while staying regulation-compliant.

Provide employees with financial security during unemployment, disability, or health emergencies through automated ESI deductions.

Enhance employee welfare and social security with LWF benefits, including medical care, education support, transport, and recreational facilities.

Get ready-to-file reports for audits, inspections, or internal reviews without scrambling at the last minute.

Keep up-to-date with labour, tax, and social security laws so your business always meets every compliance requirement.

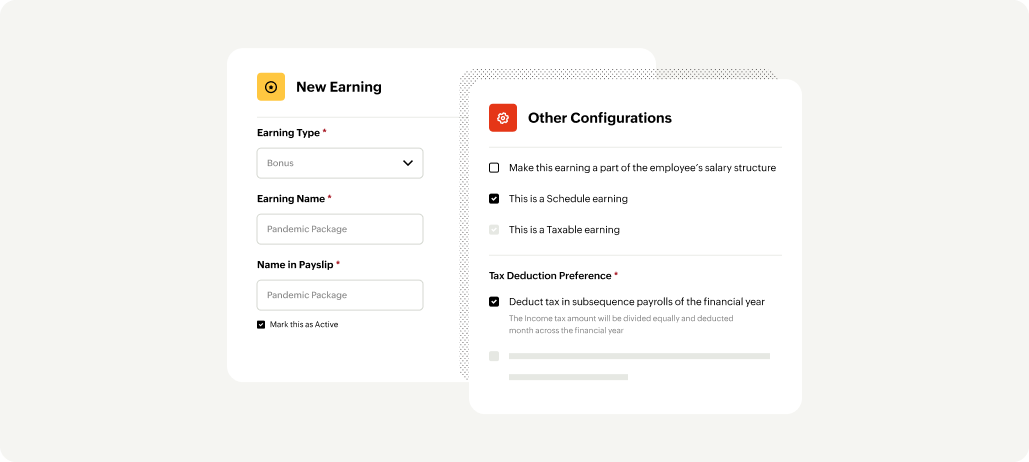

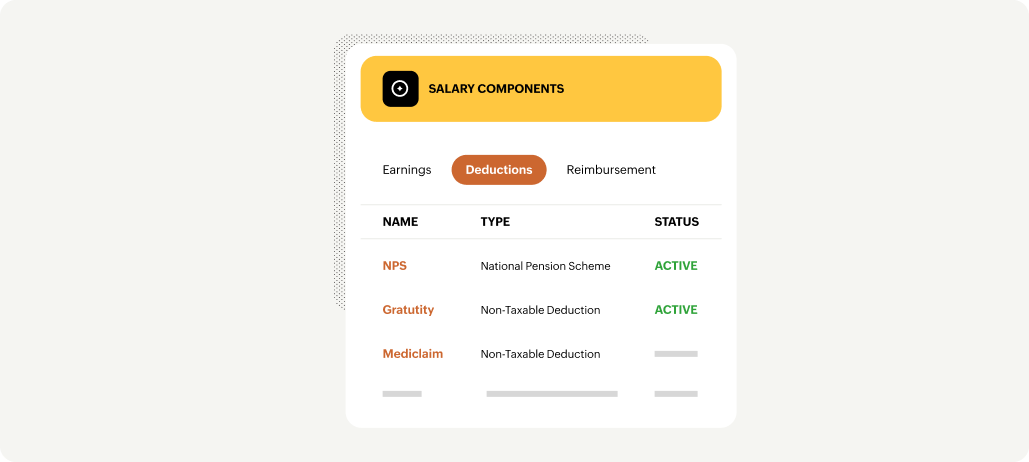

Create flexible pay structures built around your business

Create salary structures using ready-made templates or your own custom setup, and ensure accurate, compliant payouts every month.

Tailor salary structures to fit your needs

Use built-in salary components such as basic pay, HRA, allowances, bonuses, reimbursements, and deductions, and quickly assign amounts or percentage-based values.

Create components like performance-based bonuses, travel claims, or team-specific allowances to fit any employee requirement.

Design salary templates that can be reused across employee levels, simplifying setup while keeping your payroll structured and consistent.

Set up formula-based components once, and let the system handle complex salary calculations for every pay cycle.

Process urgent payouts such as corrections, incentives, or reimbursement adjustments outside your regular payroll run.

Let employees distribute their CTC across eligible components such as HRA, LTA, conveyance, fuel, and driver allowance, all within preset organizational limits.

Include occasional payouts like festival allowances or appreciation bonuses in the current pay run without making them recurring.

Apply tax-saving contributions before tax and manage deductions like fines or advances after tax, ensuring accurate payroll calculations.

Set up automatic EMI deductions, follow repayment progress, and apply accurate balances month after month.

Make managing employee benefits feel effortless

Deliver meaningful benefits to your employees while keeping the whole process simple, efficient, and free of administrative hassle.

Manage employee benefits with ease

Set up reimbursement policies in minutes, covering components like fuel, driver, travel, and internet, with customizable eligibility for every employee.

Configure recurring NPS, VPF, and mediclaim deductions easily, ensuring compliance and supporting employees' financial security.

Account for ownership, maintenance costs, cubic capacity, and driver provision to compute precise taxable values and help employees save on taxes.

Empower employees to choose their benefits while payroll accurately excludes eligible amounts from tax during salary processing.

Provide quick financial relief to employees when needed, all while keeping your business expenses under control.

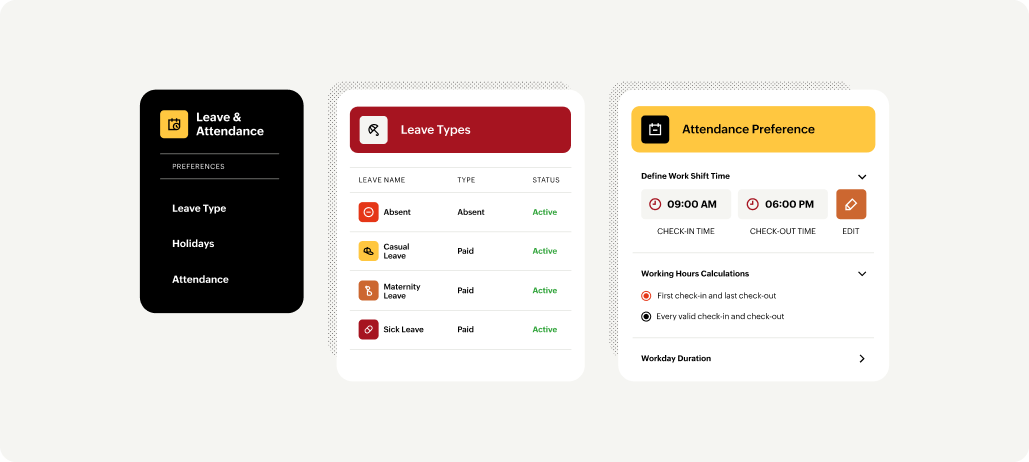

Manage all your leave and attendance needs in one place

Seamlessly manage leave and attendance to streamline HR workflows, reduce administrative effort, and ensure accurate payroll processing every time.

Explore how leave, attendance and payroll work together

Set shift timings and working hours for full and half days to ensure reliable attendance tracking.

Enable employees worldwide to record their check-ins and check-outs easily through the employee portal.

Let employees request corrections for missed check-ins or check-outs whenever needed to keep their records accurate.

Define custom leave types as per your organizational policies and decide whether they're paid or unpaid.

Allow employees to either cash out or roll over unused leave into the next year as a token of appreciation for their service.

Provide employees the ability to track leave, view attendance, and regularize any missed requests directly from the portal.

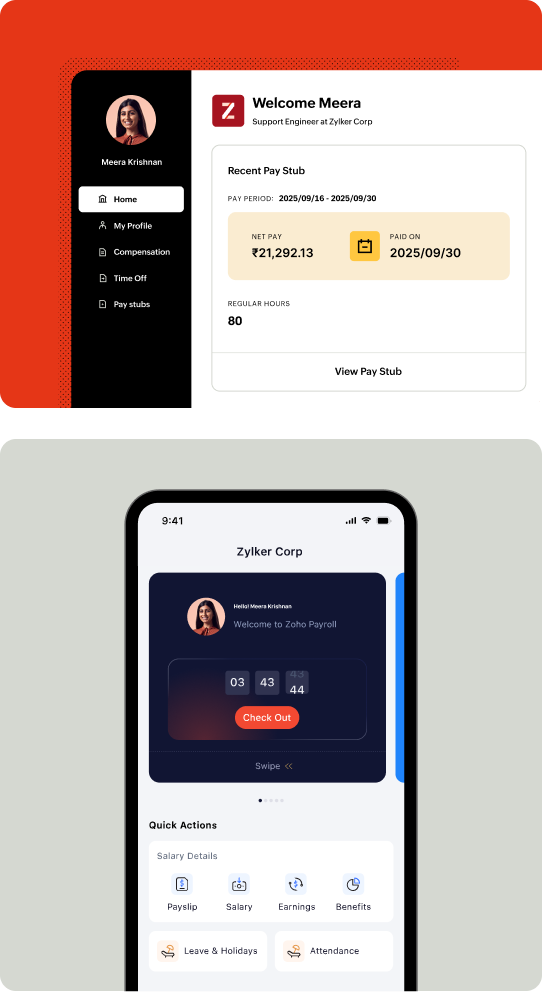

Mark and track attendance, apply for leave, and review your attendance summary and leave balance.

Approve leave requests from your reportees without delays.

Receive timely alerts for proof submission and important updates.

Download your payslips, TDS details, and Form-16 effortlessly.

Submit IT declarations and Proof of Investments digitally.

Monitor your loan details and EMI repayment status.

File reimbursement claims and attach receipts for verification.

View personal or company documents uploaded by the admin.

Get your payroll questions addressed instantly through real-time chats.

Make informed decisions with detailed payroll insights

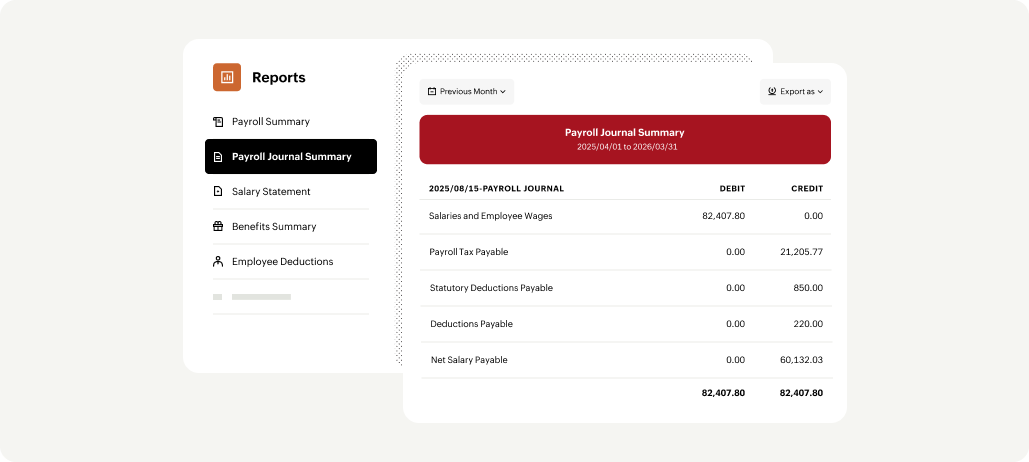

Access comprehensive payroll reports instantly, turning detailed insights into smarter, data-driven business decisions.

See how payroll insights support better decisions

Review overall payroll spending to forecast budgets and fine-tune salary structures, allowances, and periodic adjustments.

Apply custom filters for time periods, departments, locations, roles, and pay run status to view exactly the payroll details you need.

Distribute payroll reports digitally in PDF, XLS, or XLSX formats with password protection to ensure data privacy and compliance.

Compare historical reports or import data from other sources to generate insights exactly the way you need with advanced analytics integration.

Track salary components, expenses, and compensation entries seamlessly, ensuring every financial record stays clean and compliant.

Get complete visibility into employee time off with reports that track absences, leave balances, and encashments without manual effort.

Check employee loan balances and payment schedules to streamline repayments and maintain financial clarity.

Assess individual expense behaviour to improve flexible benefit policies that reflect practical employee priorities.

Connect payroll with core business systems

Unify payroll with your key business functions by integrating Zoho Payroll with other Zoho apps, WhatsApp Business, and banking systems for seamless data flow across operations.

Sync payroll with accounting to auto-record expenses and journal entries, keeping your books accurate and tax-ready.

Connect Zoho Payroll and Zoho People to bring real-time employee, attendance, and LOP data together for accurate and effortless payroll management.

Bring approved reimbursements into payroll for seamless processing and clear, auditable expense management.

Enable instant chat support to resolve payroll questions faster and strengthen employee or client communication.

Visualize payroll data through detailed dashboards and reports for deeper financial and workforce insights.

Manage multiple clients' payroll, compliance, and reports effortlessly within your centralized practice workspace.

Enable WhatsApp Business integration in Zoho Payroll to share payslips and salary letters instantly while keeping your employees informed and engaged.

Effortlessly transfer salaries on time through ICICI, YES Bank, or HSBC, right from Zoho Payroll.

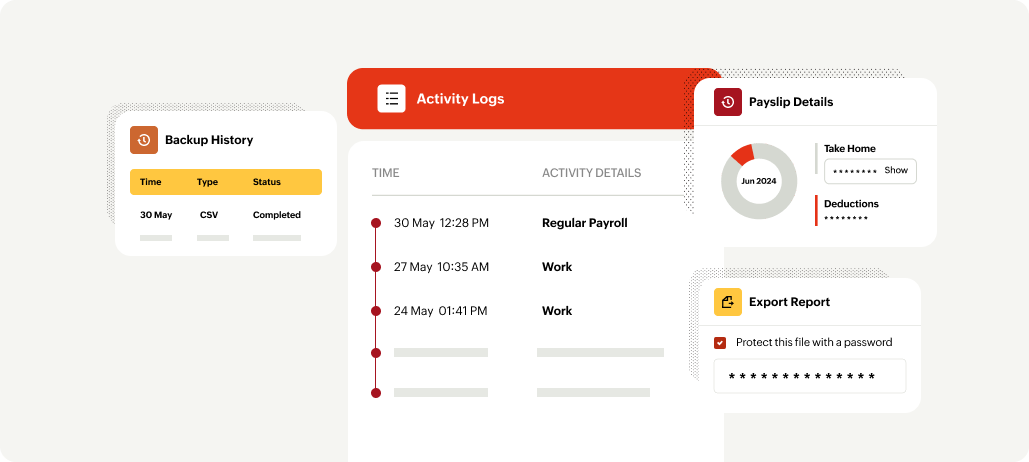

Your payroll data, always safe and private

Experience robust privacy and security for all your payroll operations with first-grade features.

Explore how your payroll data stays only yours

Store sensitive information safely and privately, backed by our independent infrastructure without external dependencies.

Use two-factor authentication to strengthen access control and maintain robust data security.

Assign precise roles and permissions to let team members access only what they need, keeping sensitive payroll data protected.

Securely back up your payroll information to maintain functional continuity and easy recovery.

Centralize all vital payroll documents including payslips, TDS sheets and more in one place with password protection for reliable data safety.

Monitor every payroll update with timestamps and user information to stay informed, wherever you are.

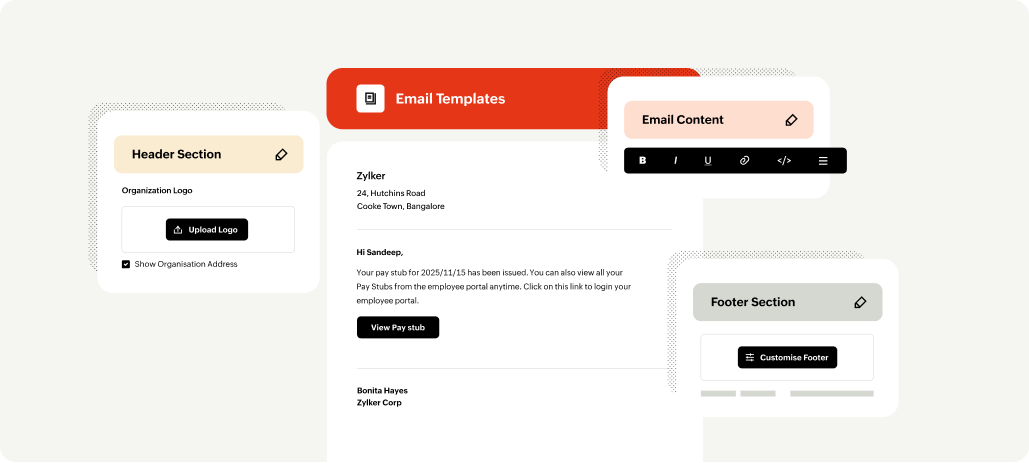

Tailor payroll to match your unique workflows

Customize every part of your payroll from payslip formats to notifications and manage payroll exactly the way your business works.

Build salaries your way by configuring earnings, deductions, in a way that it aligns perfectly with your team and compliance needs.

Adjust formats, add your logo, edit headers and footers, and decide exactly what details appear on each payslip.

Add employee records that hold every essential detail that are custom-built to meet your organization's requirements.

Create personalized employee lists using filters like department, job role, or payroll eligibility for faster, targeted access.

Create custom fields to track extra loan details such as approval status, reference numbers, disbursement dates, and more to help you in better tracking.

Send real-time alerts to your team about payroll updates, salary changes, and approvals through email or in-app notifications.

Establish multi-level checks for pay runs, reimbursements, and salary updates to maintain accuracy and accountability.

Pick sidebar and accent colour themes that echo your organization's identity throughout.

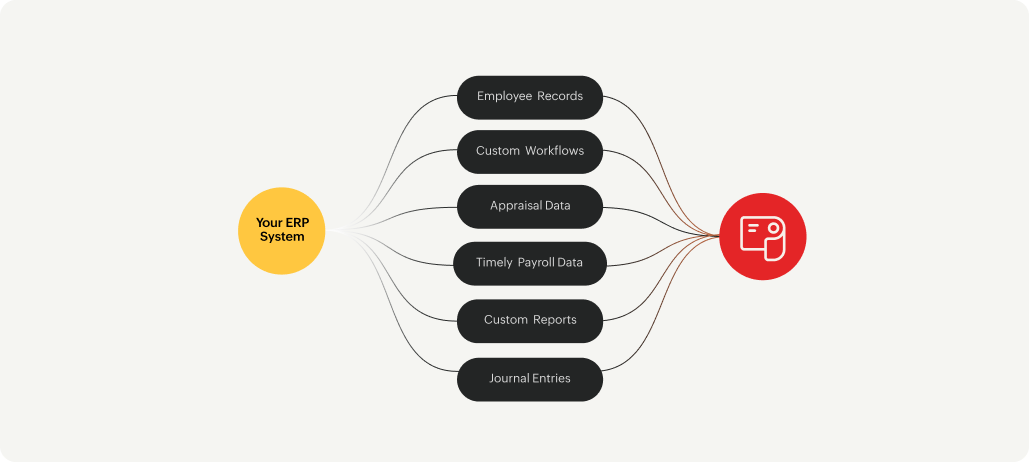

Seamlessly connect with systems you already use

Integrate Zoho Payroll with existing platforms like Workday, SAP, Oracle, UKG, and Microsoft to unify your workflows without disrupting your current processes.

Bring employee, attendance, leave, payroll, and other HR data into a single system automatically, ensuring accuracy and saving time.

Customize connections to fit your workflows, allowing payroll to work effortlessly alongside your existing ERP and business systems.

Build tailored payroll solutions with platform capabilities

Extend payroll beyond routine tasks with platform capabilities that automate complex workflows, trigger event-driven actions, schedule recurring processes, and more to align payroll with your organization's unique requirements.

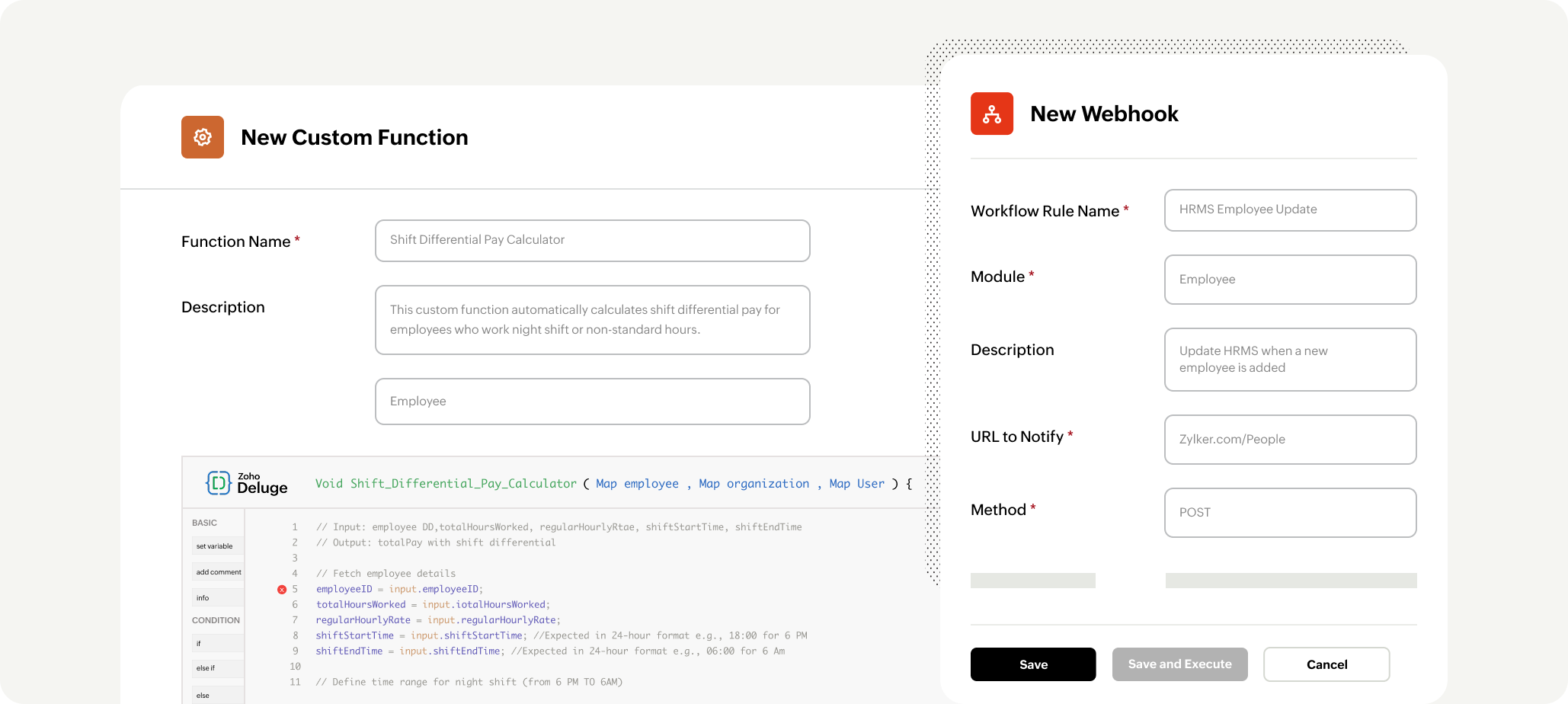

Compute allowances, deductions, and payroll components automatically using Custom Functions. Retrieve data via APIs, apply business logic, and update pay runs seamlessly.

Send or receive real-time data between Zoho Payroll and external systems using Webhooks. Execute updates instantly whenever specific events occur.

Run recurring jobs like calculations, reports, or data synchronizations automatically with custom schedulers to ensure each tasks complete on time without manual effort.

Modify key employee fields automatically through employee field Updates to keep payroll data accurate, current, and aligned with your business requirements.

Send alerts to employees or admins for loans, approvals, or payroll adjustments using email & in-App Alerts to keep employees informed and prevent delays in action.