One platform to pay every

Teams today are a mix of full-timers, interns, freelancers, and contractors and each one helps your business move faster. Zoho Payroll brings all of them into one organised payroll flow, so salary payments stay accurate and compliance stays simple.

See everything Zoho Payroll can doAdd contractors and get them work-ready in minutes

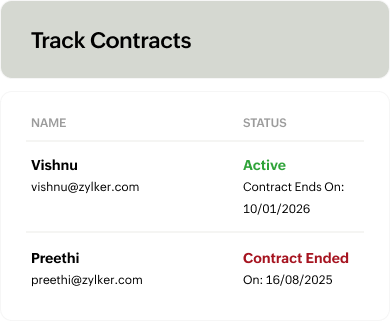

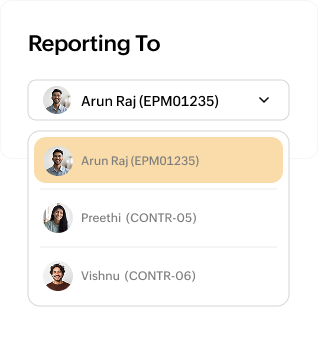

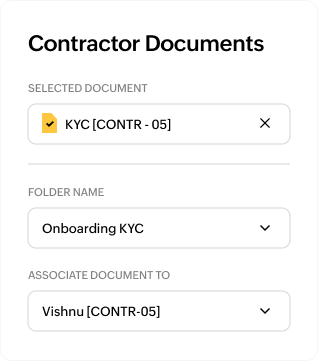

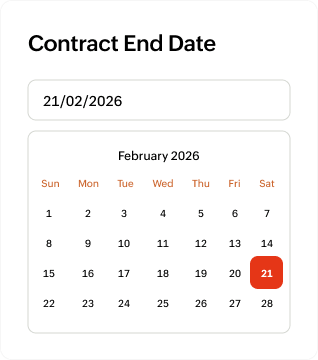

Onboard contractors, assign reporting managers, upload documents, and track contract end dates in one place. Everything stays organised from day one, so you always know who’s working with you and for how long.

All your contractor compliance,

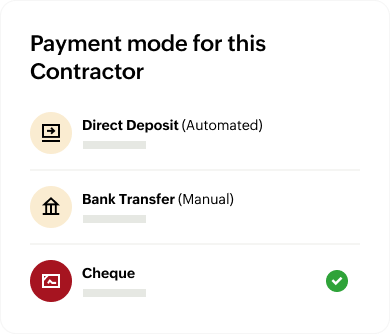

Ready to pay your contractors

Run unified pay runs

Process contractors and employees together in one streamlined run. Clear summaries and a simple review flow make each cycle quick to check, approve, and finish.

Handle mid-cycle payments with ease

Need to pay for a milestone, invoice, or urgent project task? Run an off-cycle payout just for your contractors, without touching your main payroll run.

More ways Zoho Payroll simplifies

Self service your contractors will love

Contractors can access payslips, review past payments, and stay informed through a secure self-service portal.

Clear, ready-to-use reports

See contractor payouts, project costs, and overall spend through reports that are easy to read and simple to filter.

Consistent data across your systems

Contractor details stay in sync with Zoho Books, Zoho People, and Zoho Expense, keeping records and payouts aligned.

Contractor payroll, made truly effortless

Get set up in minutes and start paying contractors the simple, accurate way.

Try Zoho Payroll for freeFrequently asked questions

- What is considered a "contractor" for payroll purposes in India?

- A contractor is defined as a freelancer, consultant, or project-based worker who provides services independently, not as a permanent employee. Payments made to them are subject to Tax Deducted at Source (TDS) as mandated by the Income Tax Department.

- Is contractor payroll different from employee payroll?

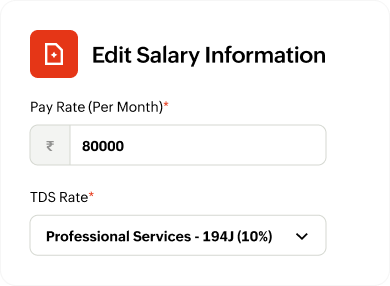

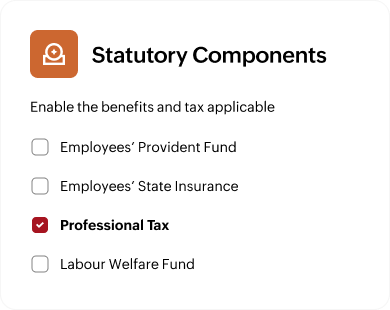

- Yes. Employee payroll involves calculating taxes based on salary slabs and managing benefits like PF (Provident Fund) and ESI (Employee State Insurance). Contractor payroll, however, relies on flat TDS rates determined by the nature of work, specifically under Section 194C (for work contracts) and Section 194J (for professional services). Zoho Payroll handles both distinct workflows within a unified system.

- Can Zoho Payroll help if I work with only contractors and no employees?

- Yes. Zoho Payroll supports businesses that onboard only contractors, allowing them to run contractor-only pay runs without requiring employee profiles.

- How does TDS work for contractors?

- Zoho Payroll automatically applies the correct TDS percentage based on the contractor's category, aiming to ensure compliance without manual calculations.

- Can I track contract end dates and extensions?

- Yes. Zoho Payroll enables users to record contract end dates for each contractor and sends reminders for renewal, extension, or contract closure.

- Is Zoho Payroll compliant with the latest TDS rules?

- Yes. The TDS rules under sections 194C and 194J are automatically applied and updated in Zoho Payroll as per Income Tax regulations.

- Can I assign reporting managers to contractors?

- Yes. Contractors can be assigned to report to any employee or even another contractor, depending on how your organisation works.

- Can contractors access their payment details?

- Yes. Contractors get their own self-service portal to view payslips and payment history.

- Is this feature available on all plans?

- Yes, Contractor Payroll is available from the Standard plan at no additional cost.