What is TDS on purchase of goods according to Section 194Q? How can I manage it in Zoho Books?

The Section 194Q is a tax section pertaining to Tax Deducted at Source (TDS) that has been mandated as a result of the Finance Act, 2021 and is effective from July 1 2021.

As per Section 194Q, when a buyer, whose yearly turnover is greater than 10 crore rupees purchases goods from a domestic vendor for a value that exceeds 50 lakh rupees, the buyer will have to deduct 0.1% of the value during the time of credit or payment as TDS.

Note: This tax deducted at source is applicable only for purchases from domestic sellers and is not applicable for imports.

How is the TDS as per Section 194Q calculated?

Zoho Books allows you to select the Section 194Q as the TDS rate while creating a new bill. Once you’ve selected the Section 194Q as the TDS section, the tax is automatically calculated on the sub-total.

The 194Q is always deducted from the amount that is greater than 50 lakhs. Here’s how you can manually calculate the TDS 194Q for your purchases:

0.1% of [Total value of the purchase of goods - 50 lakhs]

For example, let’s assume you’ve purchased capital goods worth 55 lakhs from a resident vendor. The TDS applicable will be 0.1% of the difference between 55 lakh and 50 lakh rupees (which is equal to 500 rupees).

Note: The TDS rate is 5% and not 0.1% if the vendor has not furnished their PAN card details.

When is the TDS as per 194Q calculated?

The TDS is deducted while making the payment. Here’s how you can configure the Section194Q while creating a bill in Zoho Books:

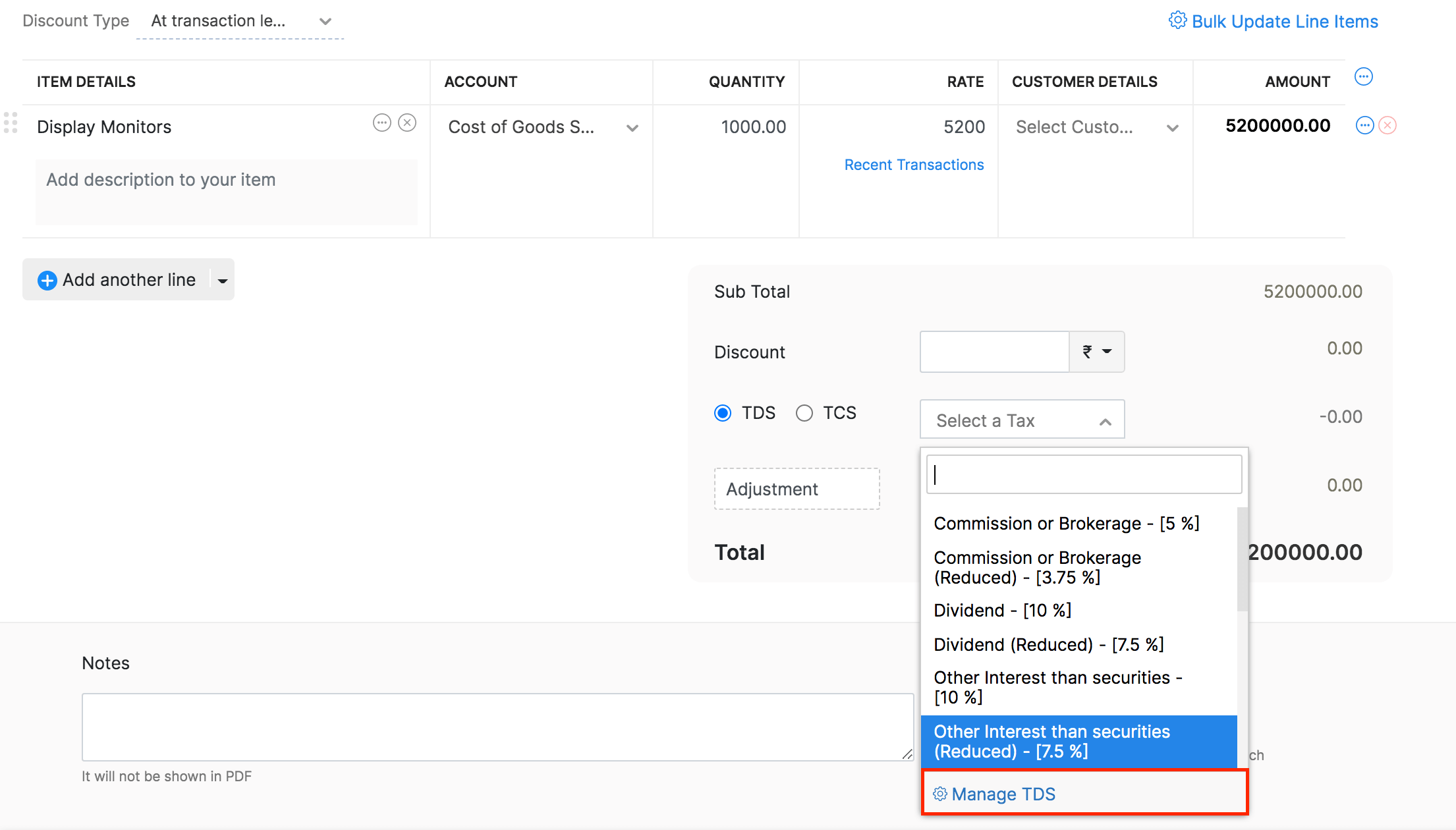

- Click Purchases in the left sidebar and select Bills from the dropdown.

- Click the + New button in the top right corner of the page.

- Fill in the required details.

- Select the TDS button and click the dropdown next to it.

- Click Manage TDS.

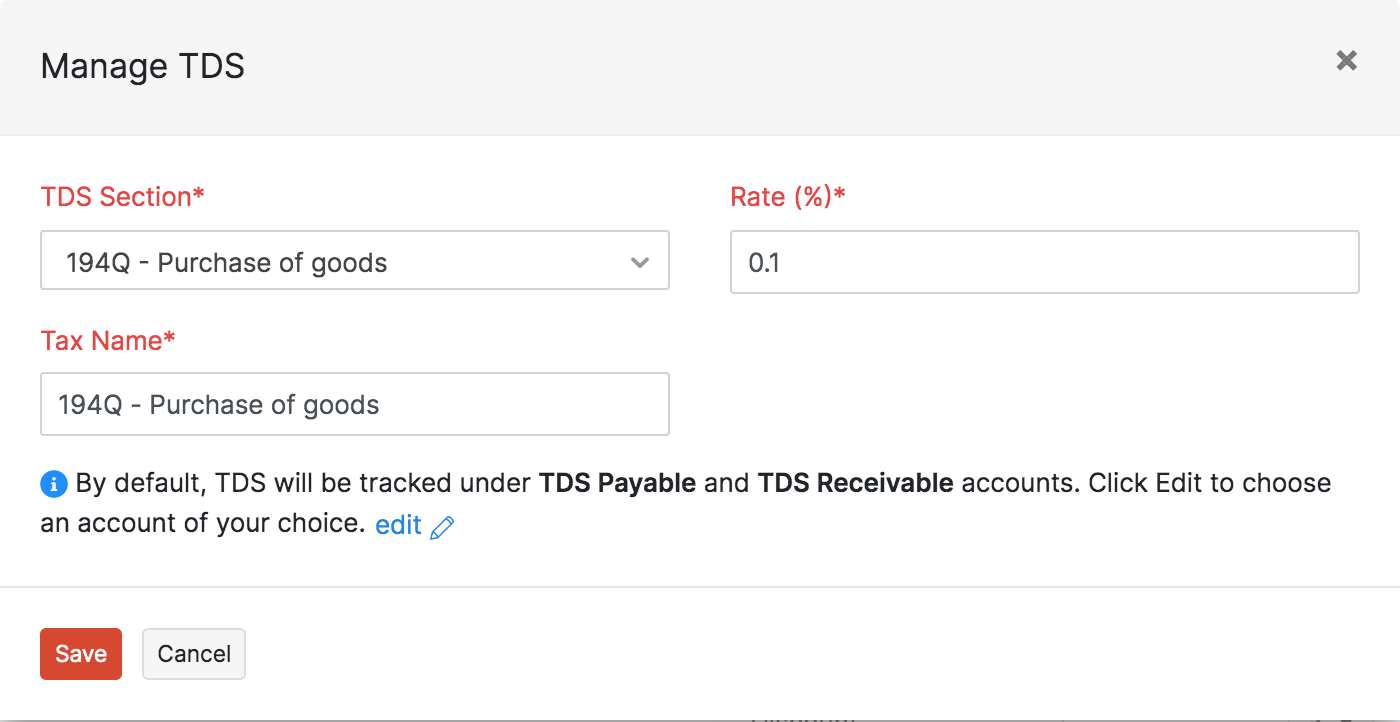

- Next, click +New TDS Tax in the pop-up that appears.

- Select 194Q - Purchase of goods as the TDS tax type.

- Enter the tax rate as 0.1%.

Warning: You’ll have to enter the tax rate as 5% if the vendor has not furnished their PAN details.

Click Save.

You’ll now be able to select the TDS 194Q as the tax while creating a new bill.

When is TDS as per 194Q not applicable?

The TDS as per Section 194Q will not be applicable if:

- goods have been imported

- your turnover does not exceed 10 crores

- TDS is deductible as per any other section

- TDS is collectible as per the the section 206C except for 206C (1H)

Insight: If your purchase falls below the criteria of both TDS 194Q and 206C (1H), you’ll have to consider the provisions in Section 194Q over 206C (1H).

Insight: Your purchase transaction will be applicable to TCS 206C (1H), if you have failed to deduct TDS section194Q.

As an E-commerce operator, should I apply TDS according to Section 194Q after applying TDS according to Section 194O to a transaction?

No, you need not apply TDS according to Section 194Q if the TDS according to Section 194O if the TDS has already been applied to a transaction according to Section 194O.

Yes

Yes