Back

How do I update the TDS rate in bulk for vendors?

The Central Board of Direct Taxes (CBDT) had reduced the rate of Tax Deducted at Source (TDS) by 25% from 14 May 2020 to 31 March 2021 to help businesses during the Covid-19 pandemic. On 1 April 2021, the TDS rates will go back to its normal rate. So, you will have to start deducting TDS at normal rates in the relevant transactions.

You can perform an advanced search for the vendors with reduced TDS rates and bulk-update the TDS rates so that all future transactions will have the normal TDS rates. Here’s how:

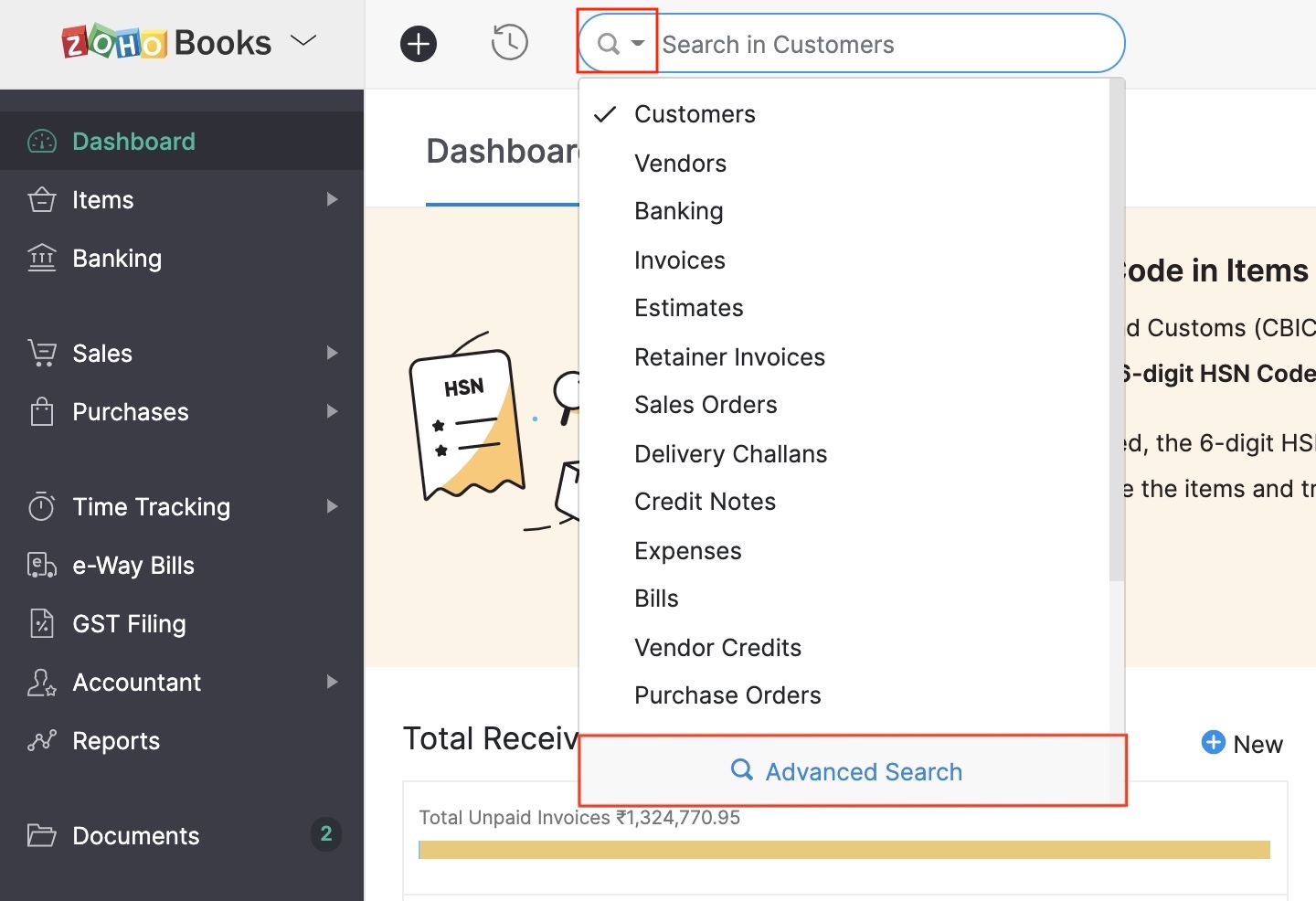

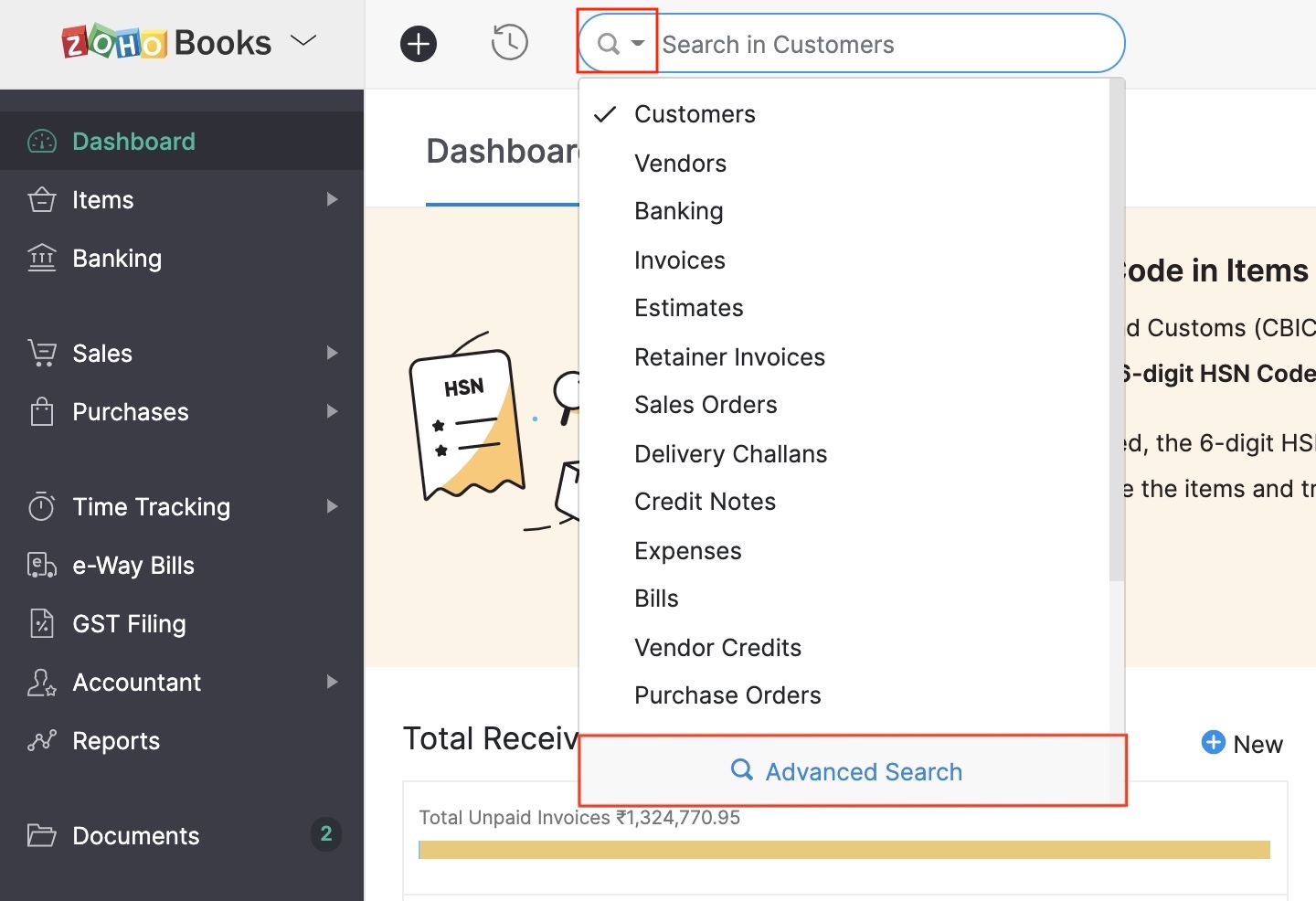

- Click the Search dropdown in the top bar and select Advanced Search.

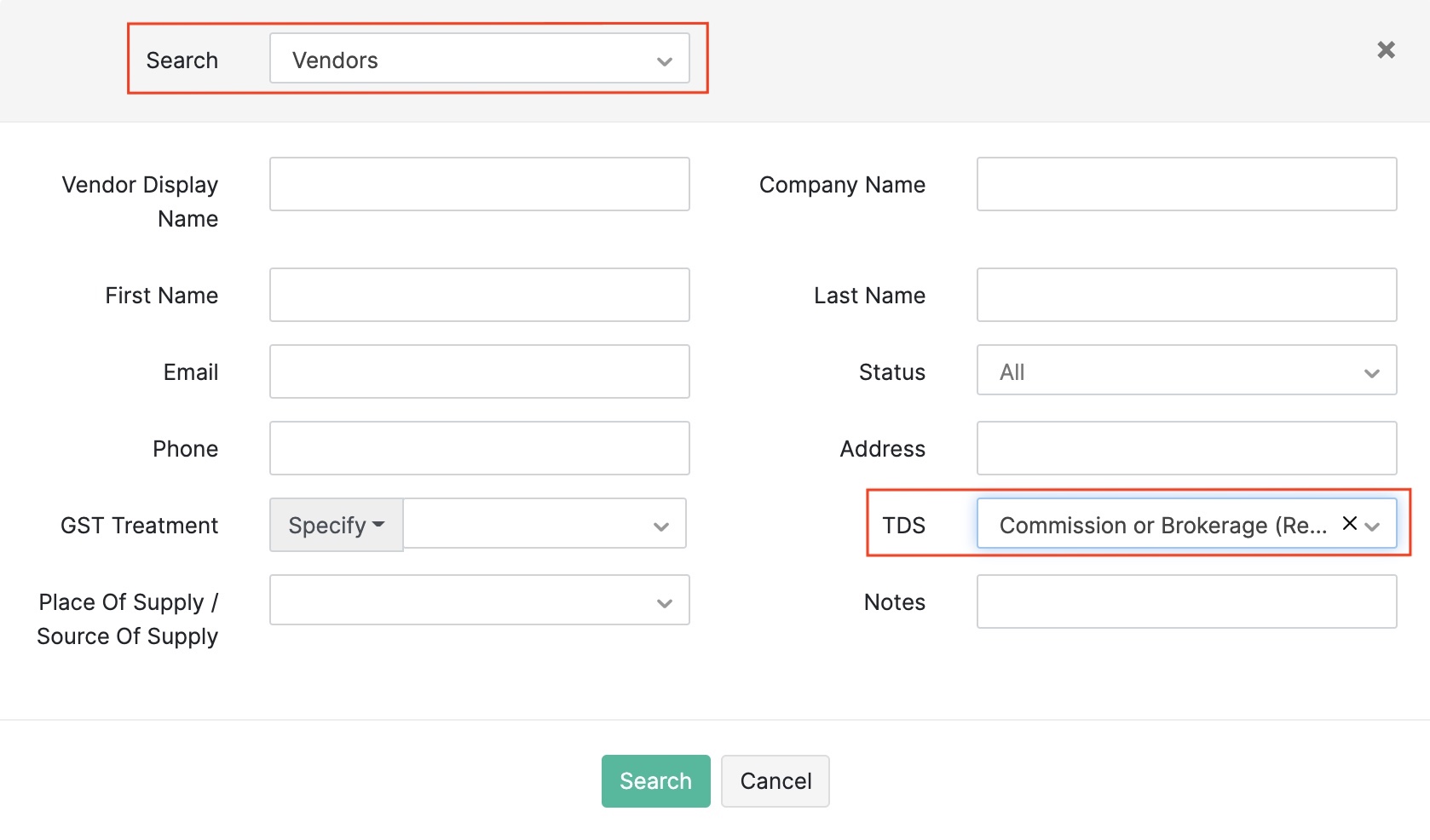

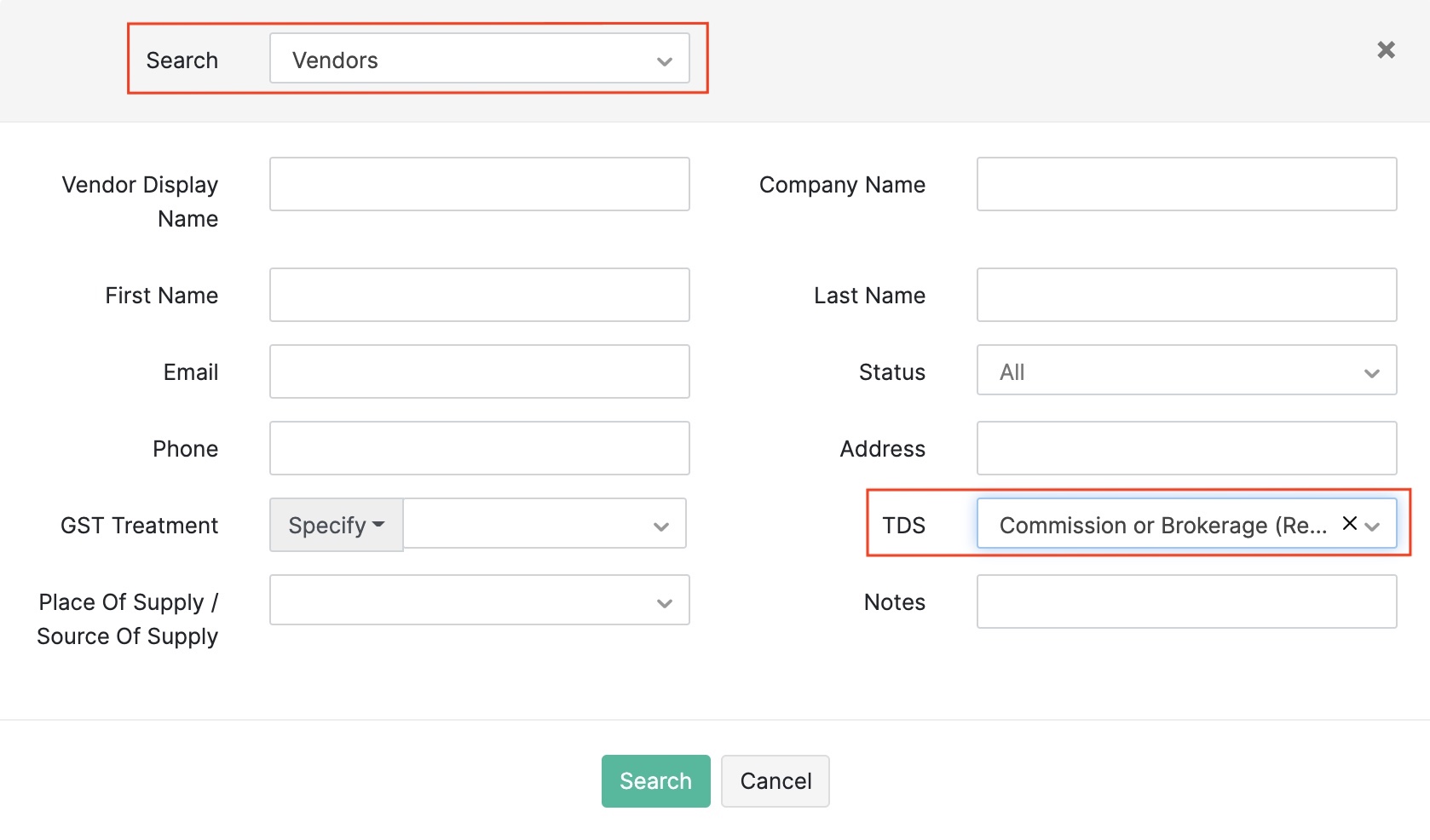

- Select the Vendors module in the Search field.

- In the TDS field, select the reduced TDS rate by which you want to search and filter the vendors.

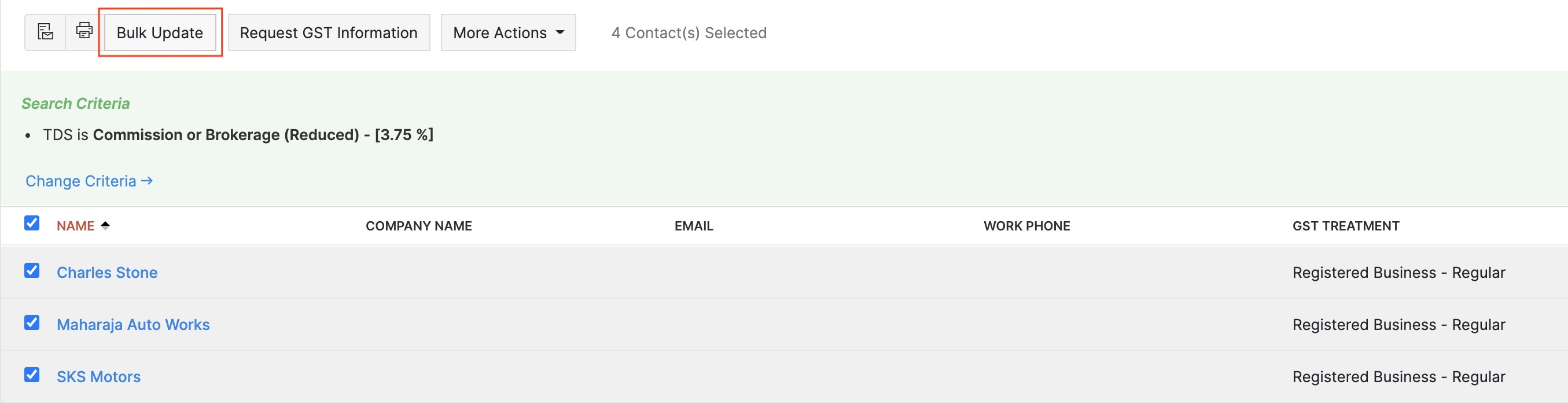

- Click Search. All the vendors who have the reduced TDS rate will be filtered and shown to you.

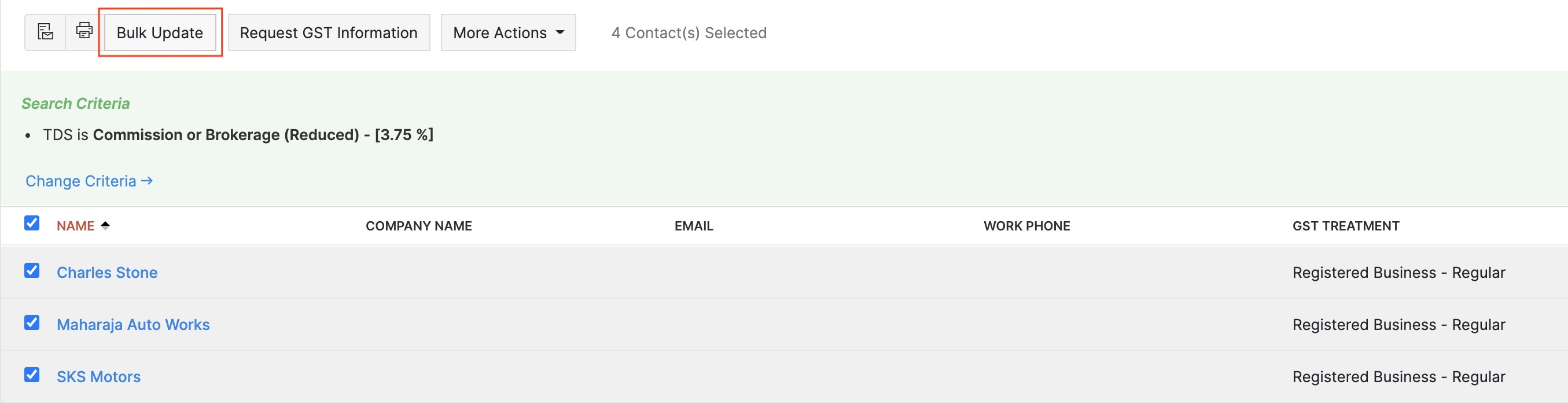

- Check the vendors whose TDS rates that you want to update with new rates and click Bulk Update.

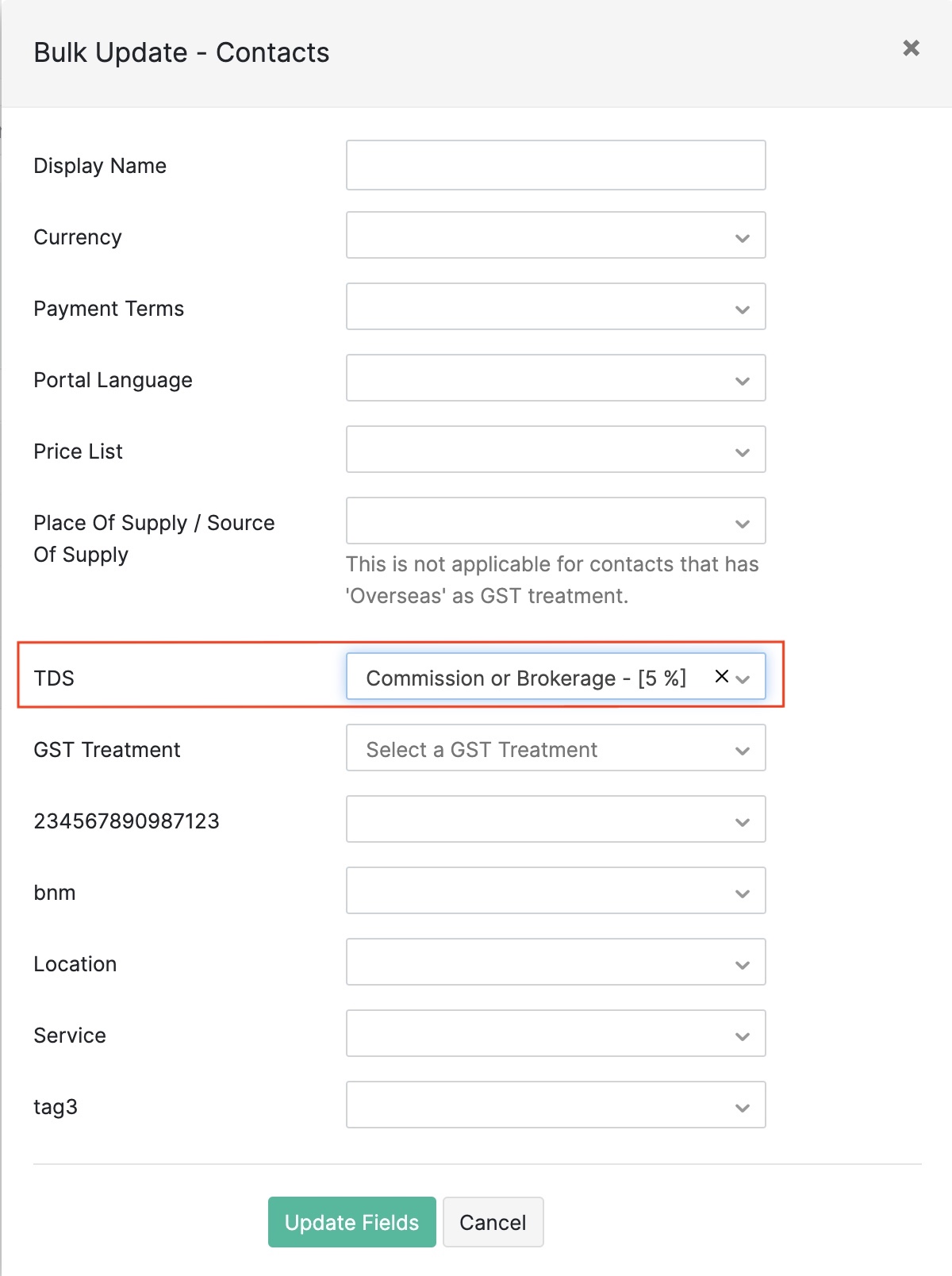

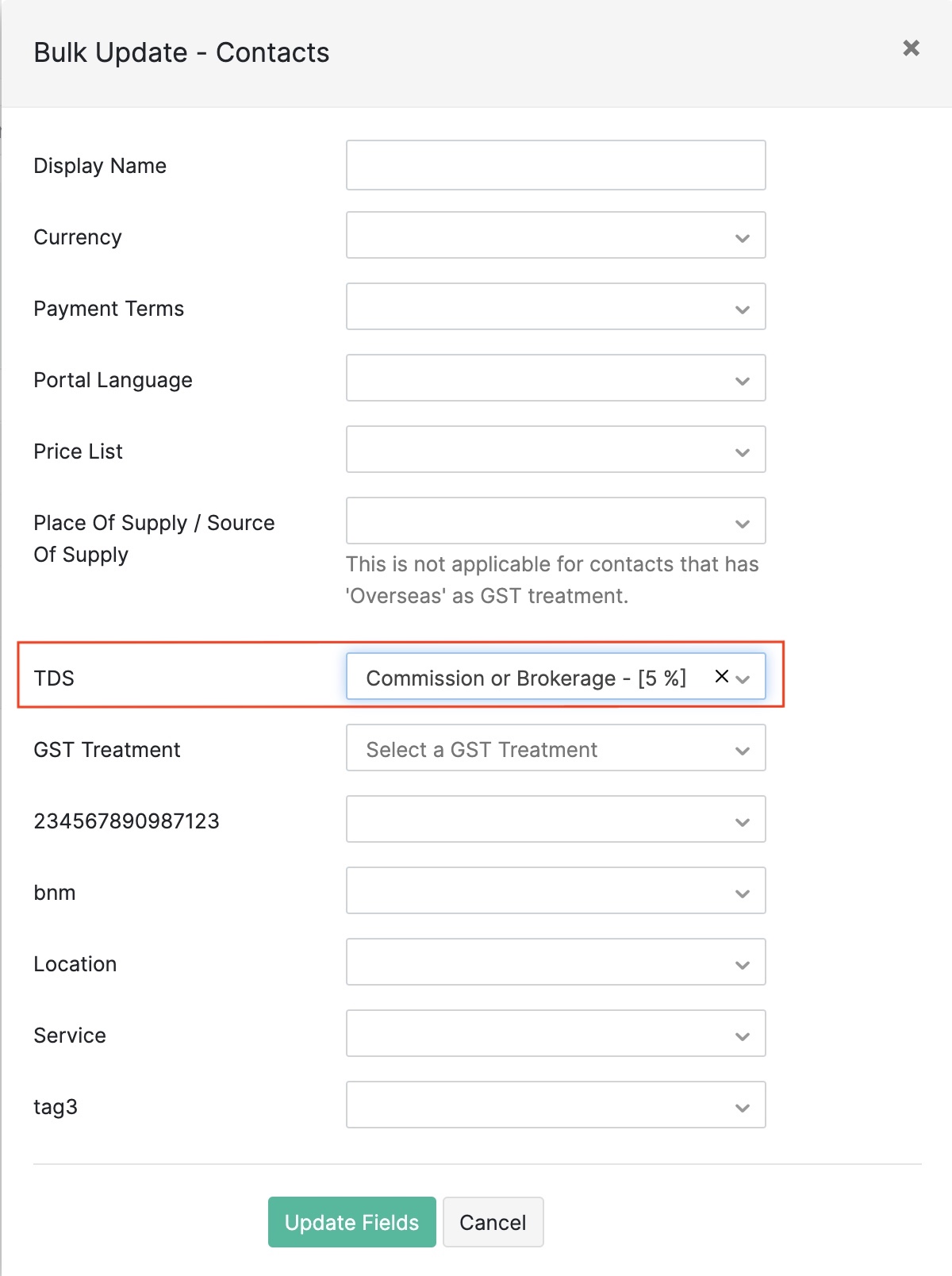

- Select the new tax rate in the TDS field.

- Click Update Fields and the vendors will be updated with the new TDS rate.

Yes

Yes