Back

How do I record a payment in Zoho Books for the tax paid in the GST portal?

Once you’ve paid your taxes and cleared all your liabilities in the GST portal, you will have to record the payment in Zoho Books. Here’s how:

- Go to the GST Filing module in the left sidebar.

- If you’ve enabled the Branches feature, you’ll be redirected to the List of GSTINs page. Click View Summary next to the required GSTIN.

- If you have only one GSTIN, you’ll be redirected to the GSTIN’s page.

- Switch to the GST Payments tab at the top.

(Or)

- Click View Summary next to the GSTR-3B.

- In the following page, switch to the GST Payments tab at the top.

- Click Record Payment.

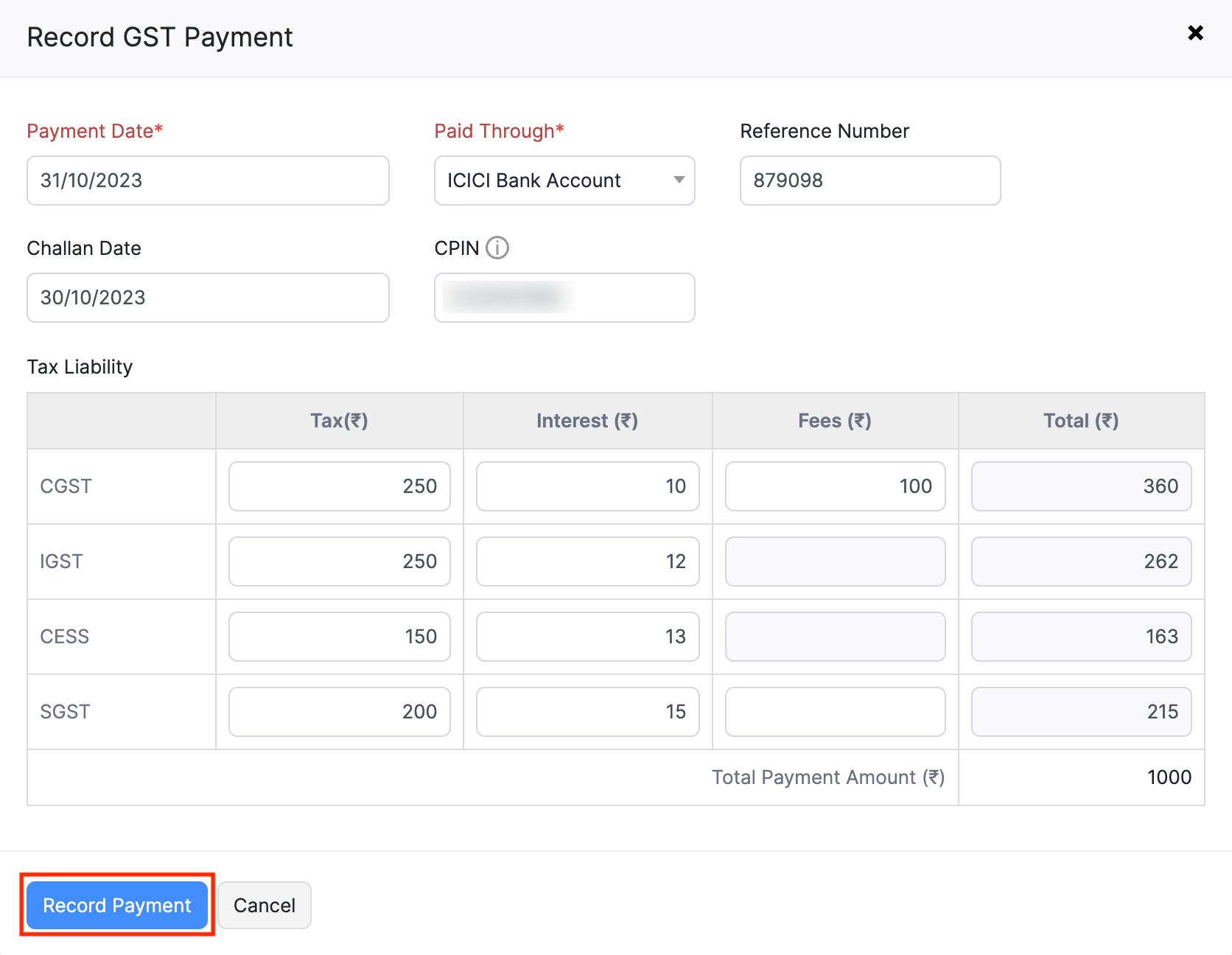

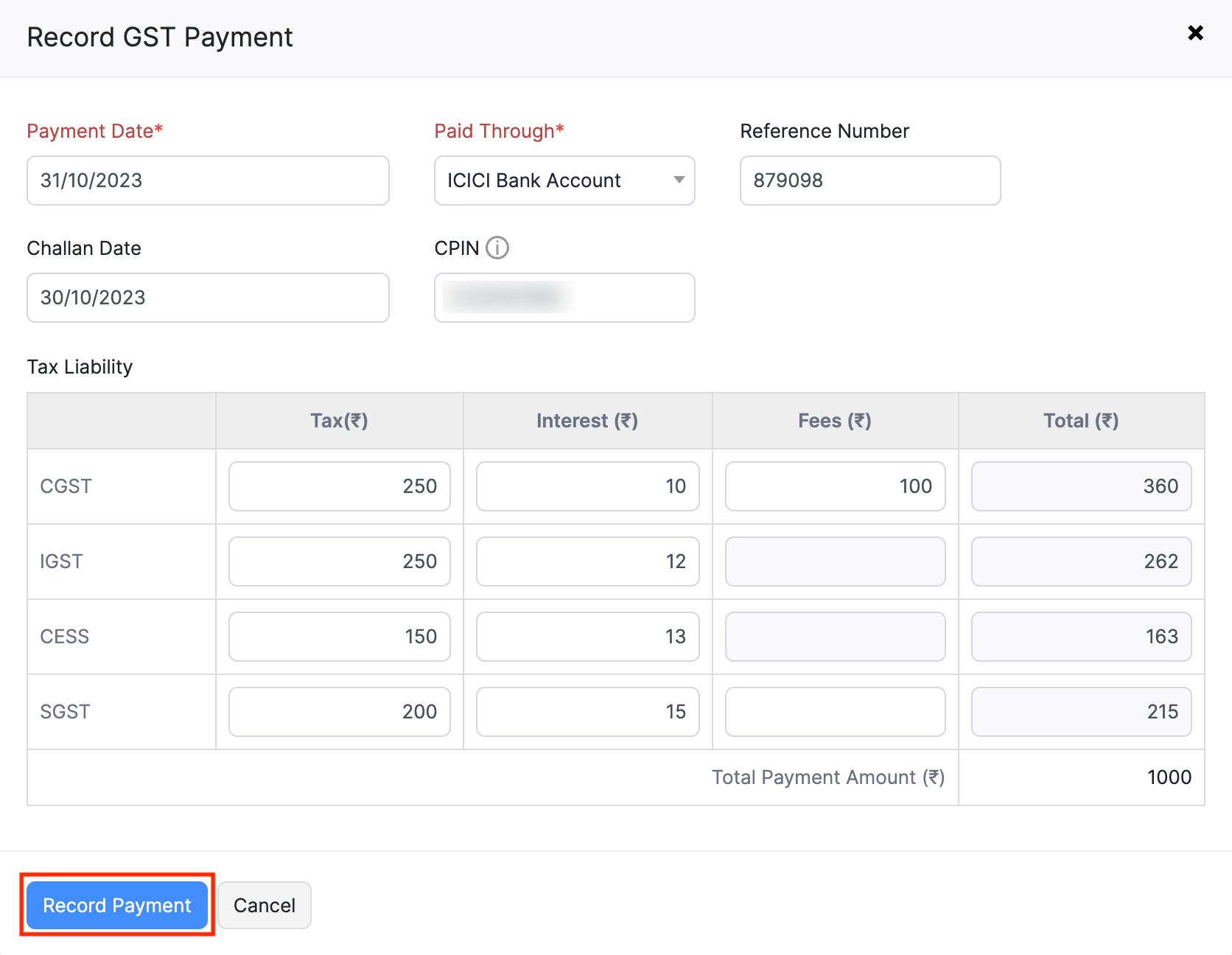

- On the pop-up that appears:

- Enter the Payment Date.

- Select the Paid Through account. This is the bank account through which the payment was made.

- Enter the Reference Number of the payment made.

- Enter the Challan Date and CPIN(Common Portal Identification Number) that’s available in the challan you had generated.

- Enter the details of the Tax Liability such as CGST, SGST, IGST, and CESS.

- Click Record Payment.

If your organisation is in the India data center (www.books.zoho.in) and it’s integrated with ICICI bank or HSBC bank, you can make the tax payment directly from Zoho Books. Read our help document on making payment from Zoho Books to learn more.

To learn more about recording payment for your taxes, read our help document on recording payment for taxes in Zoho Books.

Yes

Yes