Back

How do I reconcile the transactions (Expenses, Bills, Debit Notes, Credit Notes etc.) with the GSTR-2A transactions?

Before you can match the transactions, you must pull the GSTR-2A data from GSTN into Zoho Books. Once you pull the GSTR-2A transactions, they will be listed under the Missing in Zoho Books, Partially Matched and Matched tabs based on the level of matching. To match the transactions under these tabs with GSTR-2A transactions:

- Go to the Accountant module and select GST Filing.

- Select the GSTR-2 return.

- Select the Reconciliations tab.

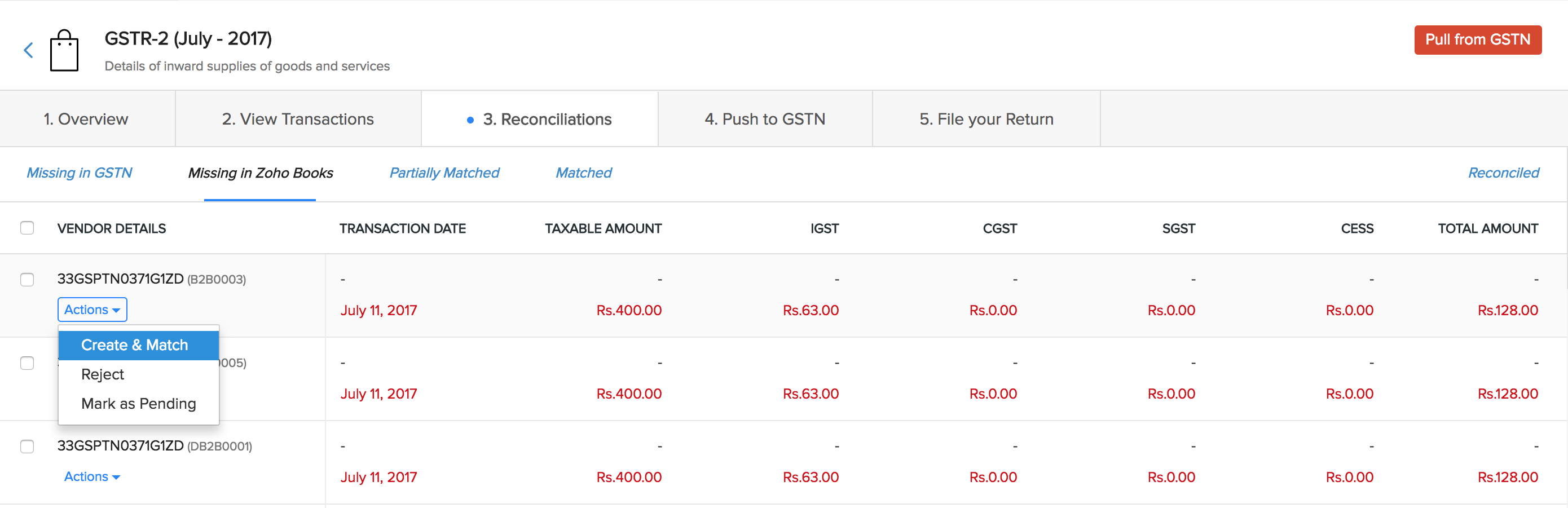

Go to Missing in Zoho Books sub-tab.

- Click the Actions dropdown and select one of the following options to reconcile a transaction:

- Select Create & Match, if the information in the transaction is accurate and you want to create a new transaction in Zoho Books.

- Select Reject if the transaction is a counterfeit or a duplicate copy.

- Select Mark as Pending, if you will be creating the transaction later and do not want the transaction to be matched in this filing period.

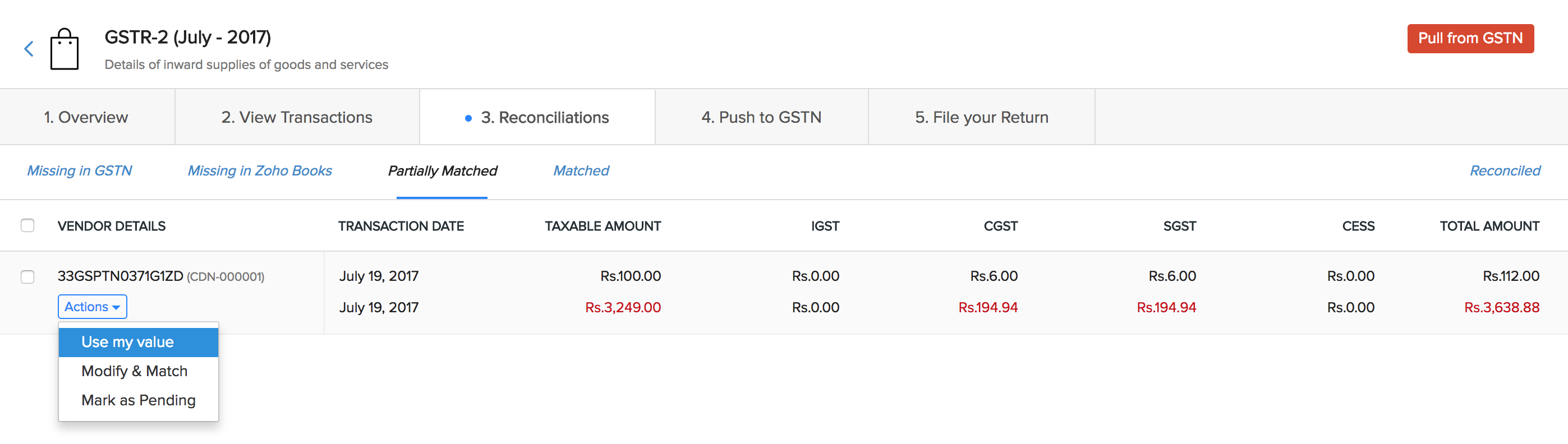

Go to Partially Matched sub-tab.

- Click the Actions dropdown and select one of the following options to reconcile a transaction:

- Select Use my Value, if you want to use the values in the Zoho Books’ transaction instead of the values in the fetched transactions.

- Select Modify & Match, if you want to edit your transaction and match.

- Select Mark as Pending, if you do not want the transaction to be matched in this filing period.

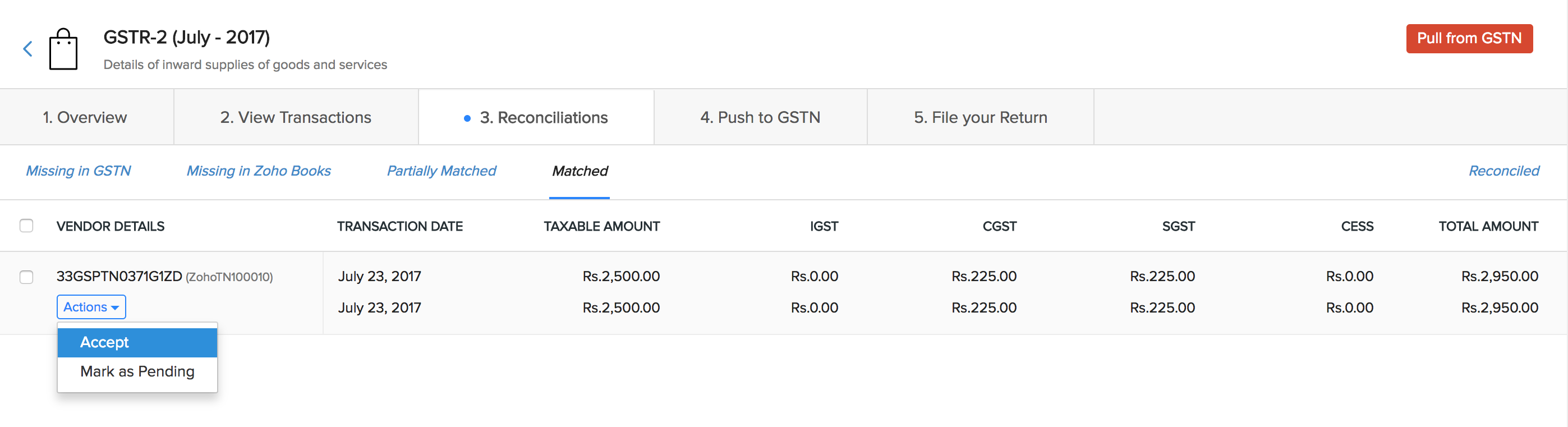

Go to Matched sub-tab.

- Click the Actions dropdown and select one of the following options to reconcile a transaction:

- Select Accept, if you want to confirm the match and include this transaction in this month’s return filing.

- Select Mark as Pending, if you do not want the transaction to be matched in this filing period but later.

Yes

Yes