How do I claim the ITC in GSTR-3B for the bills that my vendor has not uploaded to the GST Portal?

Sometimes while trying to claim your ITC, you might have updated all your transactions in Zoho Books which will be available while filing your GSTR-3B but your vendor might not have uploaded all the bills (purchase invoices) in their GSTR-1 yet. This means that you might not be able to claim the full ITC on the bills that the vendor has not uploaded.

A recent update from the CBIC (Central Board of Indirect Taxes & Customs) on Sub-rule (4) of Rule 36 of CGST Rules, 2017, clarifies the restrictions in availing the ITC. This rule allows the tax payer to avail an additional 20% of the eligible ITC available (based on the bills uploaded by the vendors) for the bills that are not yet uploaded while filing their returns. The remaining ITC can be availed later when the vendor uploads the bill.

This is applicable only on:

- The bills that are eligible for ITC.

- The bills that have not been uploaded yet by the vendors.

Here’s an example to explain this better:

Let’s say there are 10 bills that I’ve received from my vendors for the purchases I’ve made for a particular period. The total eligible ITC value is 1Lakh (ITC is 10000 per bill). My vendor has uploaded 8 bills already and 2 are yet to be uploaded in their GSTR-1.

In this case, you can claim 80,000 (for the 8 bills) and 20% on that 80,000 i.e., an additional 16,000 can be claimed even before the vendor uploads the bills. The remaining 4000 can be claimed as and when the vendor uploads the bill.

Pro Tip: The GST council has amended the rule again and now allows the tax payer to avail only 10% of the eligible ITC available for the bills that are not uploaded. This is applicable for all the returns generated from January 2020.

To do this in Zoho Books:

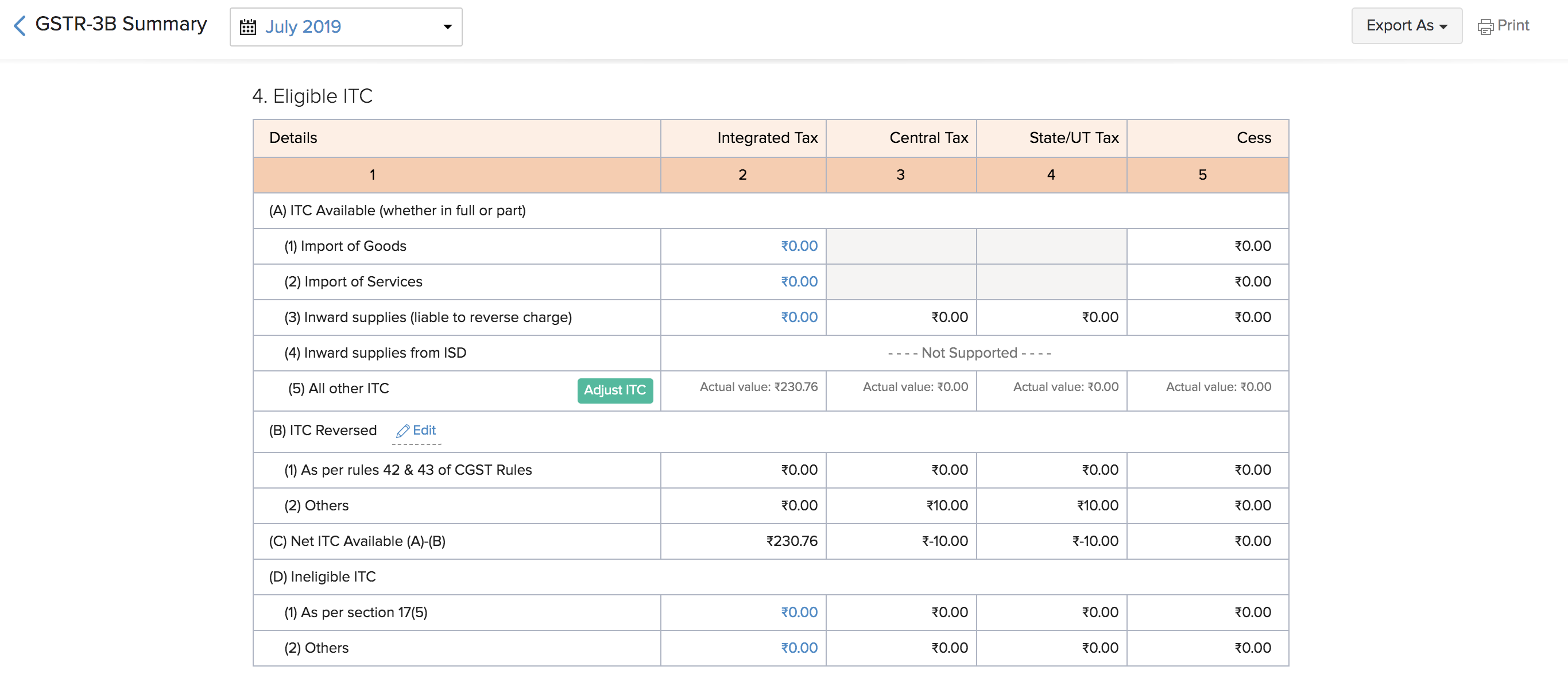

- Go to GST Filing > GSTR-3B summary.

- Navigate to the Eligible ITC section and click Adjust ITC under the Available ITC table.

- Calculate and enter the adjusted ITC value in the pop-up that appears.

- Click Save and proceed to push your returns and claim your ITC.

Note: You will be able to get the list of all the bills that have not been uploaded to the portal by the vendor in the Missing in GSTN section of your GSTR2. You can use them to calculate the value you would like to adjust against your available ITC.

Yes

Yes