Why should I create an expense for the challan amount in GSTR-3B? How do I do it?

In the process of filing your GSTR-3B in GSTN, you would need to create a challan in the GSTN portal for the total tax liability that you have to pay. As you create a challan in the GSTN portal, it is necessary to record it as an expense in Zoho Books. This cannot be done automatically as the GSTN has not provided the API (Application Programming Interface) access to GSP Providers yet. Until then, it is required that you record it as an expense to keep your books intact.

To record the expense:

- Go to the Expenses module in the left sidebar.

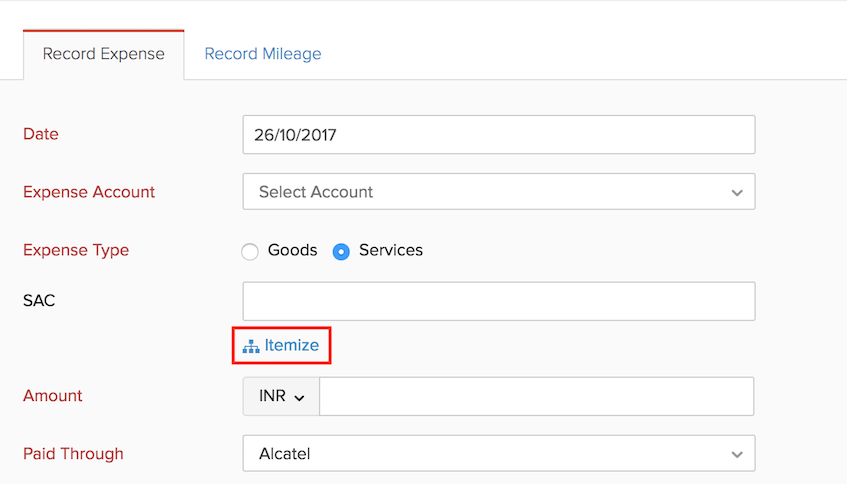

- Click the + New button to create an itemised expense.

- Select the Expense Type as Services.

- Click the Itemize option to enter multiple expenses.

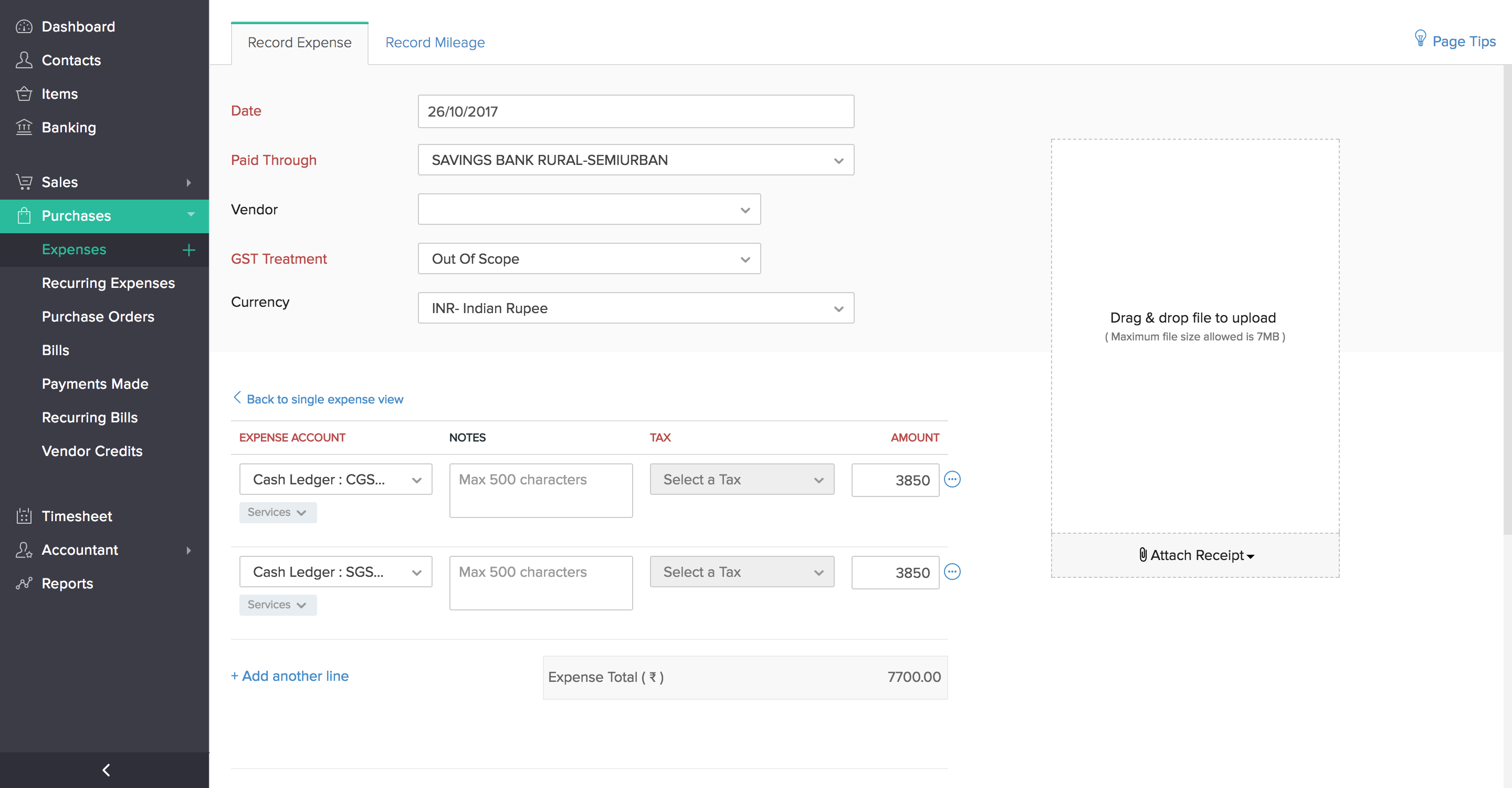

- Select the Paid Through dropdown and select an account through which you made the payment in GSTN.

- Select the GST Treatment as Out of Scope.

- Based on the tax payment that you’ve made, select the respective Cash Ledger account as the Expense Account and enter the respective tax amount that you’ve paid. Make sure you enter all the taxes you’ve paid and their corresponding cash ledger accounts.

All the cash ledger accounts that will be available for you to choose from is displayed below. Choose the appropriate account and enter the corresponding amount while recording an expense.

- Cash Ledger : CESS Tax

- Cash Ledger : CGST Tax

- Cash Ledger : SGST Tax

- Cash Ledger : IGST Tax

- Cash Ledger : CESS Interest and Latefee

- Cash Ledger : CGST Interest and Latefee

- Cash Ledger : IGST Interest and Latefee

- Cash Ledger : SGST Interest and Latefee

As soon as you mark your return as filed in Zoho Books, all the expense accounts mentioned above are generated automatically. Also, a manual journal is created automatically to record the cash flow from Cash Ledger account to the Output Tax account.

- Click Save to record the expense.

Note: If your ITC is equal or greater than the tax liability, then you don’t need to create a challan in GSTN or record it as an expense.

Yes

Yes