Back

How do I apply Reverse Charge on transactions?

Reverse Charge is applied when:

- a registered business owner purchases from an unregistered vendor;

- an e-commerce operator supplies services; and

- certain goods and services as specified by CBEC is purchased or sold. (Goods Transport Agency, Legal agencies etc.).

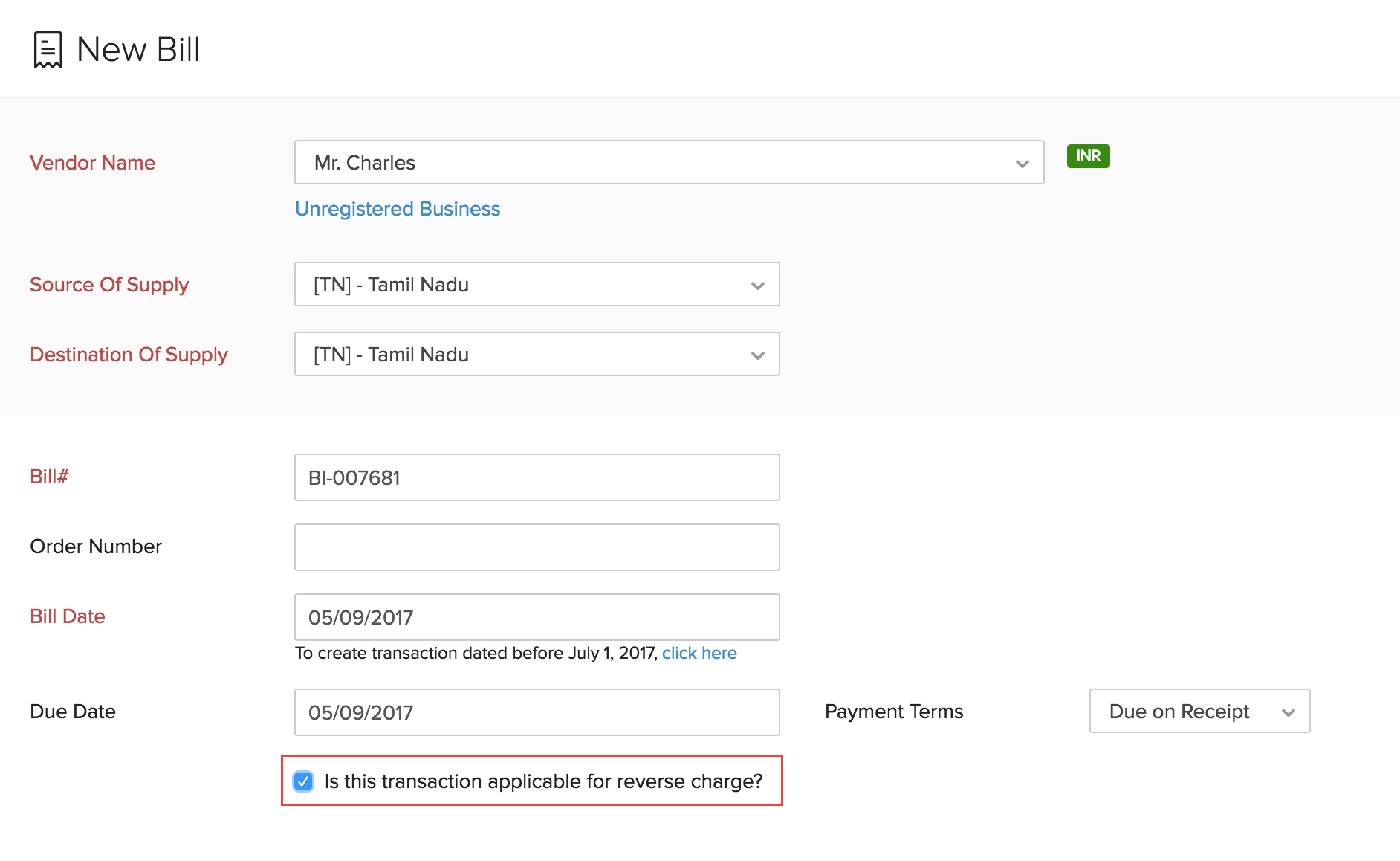

To apply reverse charge on purchase transactions:

Check the Is this transaction applicable for reverse charge? option when you create a purchase transaction.

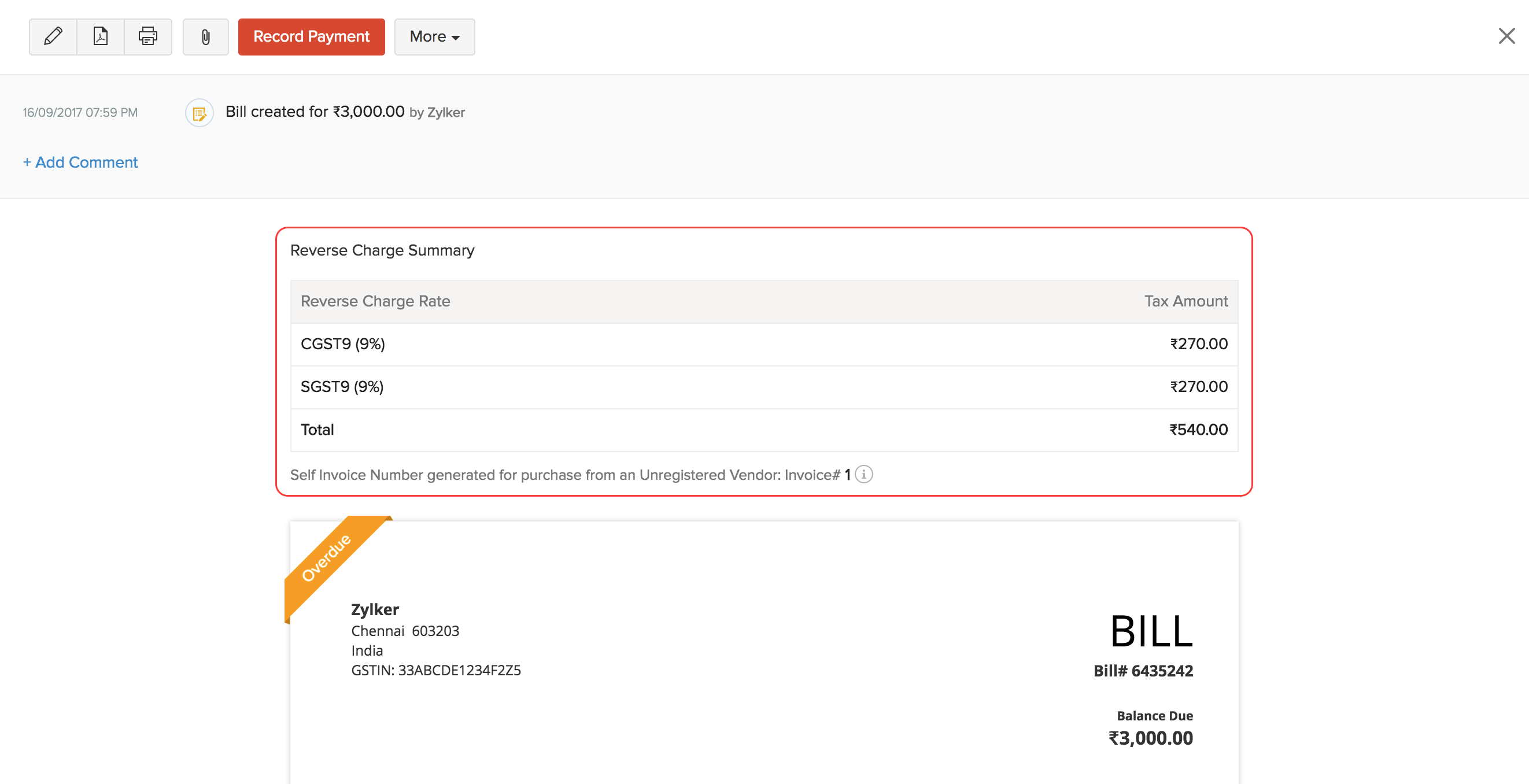

The reverse charge is displayed above the bill in Zoho Books.

Yes

Yes