Input Service Distributor

An Input Service Distributor (ISD) is an office of a business (a taxpayer) that receives GST invoices for services used by multiple locations. The input tax credit (ITC) received at the ISD for such services is distributed proportionally to the locations. The ISD issues separate ISD invoices to allocate this credit to each location. The locations of the business may have different GSTINs, but they must all share the same PAN as the ISD.

Scenario: Zylker Corporation has its head office in Delhi and branch offices in Pune, Hyderabad, and Jaipur. The Delhi office pays for annual housekeeping services that cover all four locations. Since the services benefit every office, the input tax credit (ITC) cannot be retained entirely at Delhi. By registering as an ISD, the Delhi office can proportionately distribute the ITC among Delhi, Pune, Hyderabad, and Jaipur based on their turnover.

Why ISD is Needed?

Large businesses usually operate through multiple units, such as a head office, regional offices, locations, warehouses, or sales depots. Often, common services like security, housekeeping, accounting, software licenses, or communication are billed to just one office but benefit the entire organisation.

Without the ISD feature, only the office that receives the invoice could claim the input tax credit (ITC). This would create an imbalance: one location would accumulate ITC it doesn’t fully need, while the other locations would be unable to claim their rightful share. Over time, this leads to inefficient utilisation of credit and cash flow mismatches across different locations of the organization.

The ISD feature resolves this by allowing the ITC on such common services to be pooled at one office (the ISD) and then redistributed among all consuming locations. Distribution is made in proportion to the turnover of each location. The turnover of the previous financial year is used as the basis for this distribution. If a location did not exist or had no turnover in the previous year, then the turnover of the last available quarter is taken for allocation.

How ITC is Distributed

The ISD receives ITC when vendors upload invoices, debit notes or credit notes in their GSTR-1/1A /IFF, which then auto-populates in the ISD’s GSTR-6A. Based on these details, the ISD files GSTR-6 to distribute the credit to its locations. The ISD must distribute the ITC to all its locations within the same month in which it is received.

Add Your Office as an ISD

To claim ITC through an ISD, you must first add the GSTIN of the office you wish to designate as an Input Service Distributor (ISD) in your Zoho Books organization.

Here’s how:

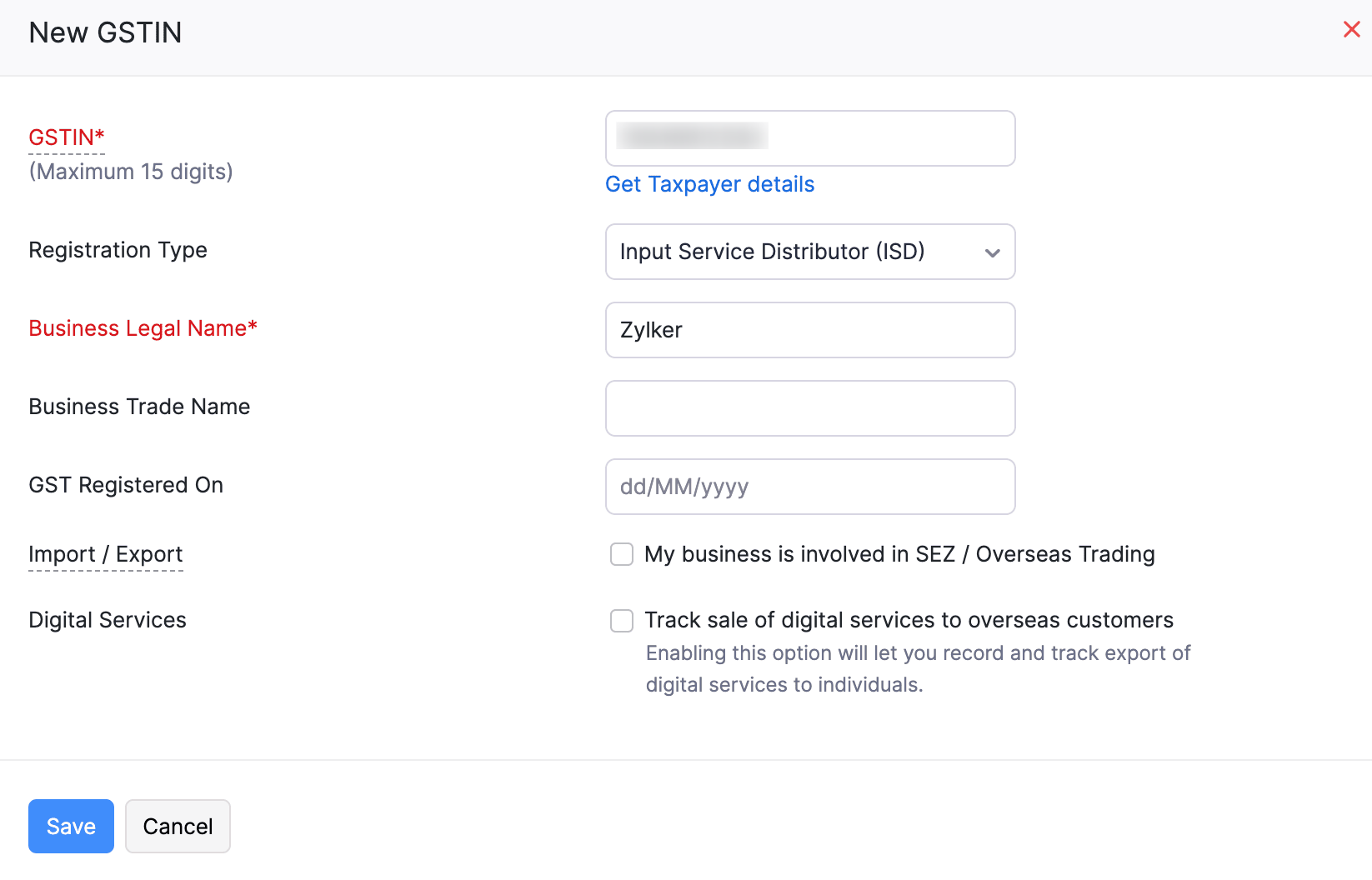

- Go to Settings in the top right corner.

- Select Taxes under Taxes & Compliance.

- Click + New GSTIN.

- Enter the GSTIN and select Input Service Distributor (ISD) in the Registration Type dropdown.

- Enter all the necessary details and click Save.

Once added, this office will act as the central point to receive invoices for common input services and redistribute the input tax credit (ITC) to your other locations.

Note: When creating a customer in Zoho Books, you can now set the customer as an ISD by selecting Input Service Distributor under the GST Treatment option.

Reconcile GSTR-6A Returns

GSTR-6A is a read-only, auto-drafted return available to an Input Service Distributor (ISD). It is generated automatically when vendors upload invoices, debit notes, or credit notes in their GSTR-1/1A/IFF for services provided to the different locations of the ISD. These documents are recorded in Zoho Books as follows: invoices are recorded as Bills, debit notes as Vendor Credits, and credit notes as Vendor Credit Notes.

To fetch these transactions from the GSTN portal:

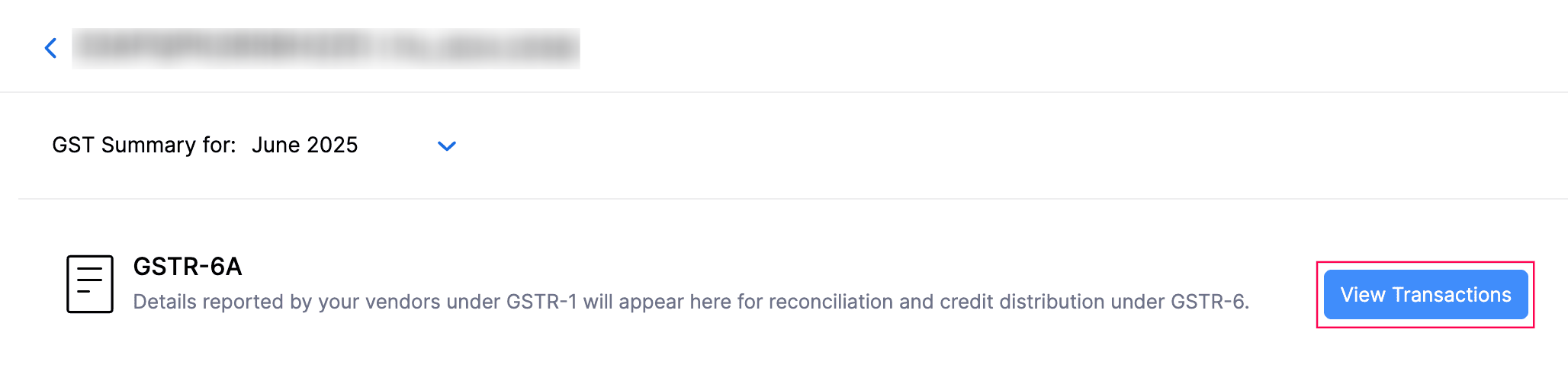

- Go to Filing & Compliance on the left sidebar and select GST Filing.

- Under the GSTIN registered as an ISD, click View Returns.

- Click View Transactions in the GSTR-6A return.

- Click Pull From GSTN in the top right corner of the GSTR-6A page.

The fetched transactions will appear in the GSTR-6A dashboard, where they are automatically matched with the records in Zoho Books and categorised. You can then review and reconcile them to distribute the input tax credit (ITC) to the respective locations under the ISD.

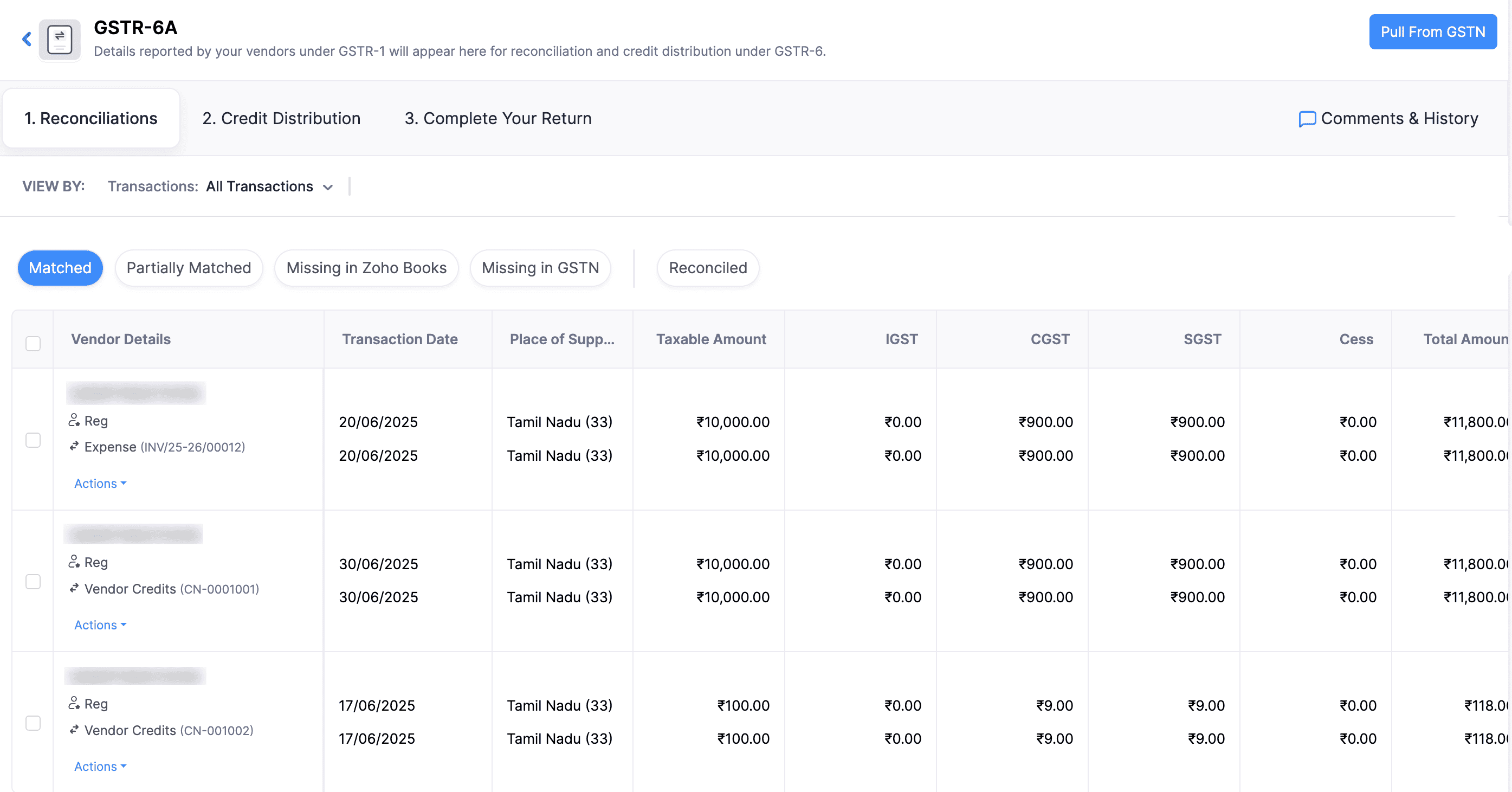

Reconcile Transactions

Under the Reconciliation section, you can view all matched and partially matched transactions, as well as transactions that are missing in Zoho Books, missing in the GSTIN, and the reconciled transactions.

Note: You can filter the transactions to be displayed in this section by All Transactions, Bills, Vendor Credit Notes, and Vendor Credits by clicking the View By filter.

| Tab | Description |

| Matched | Displays transactions uploaded by your vendors in their GSTR-1/1A /IFF that exactly match the bills recorded in Zoho Books. To reconcile the transactions under this tab, click the Actions icon and select Accept. |

| Partially Matched | Displays transactions from vendors that only partially match with the purchase transactions in Zoho Books due to differences in details such as amount, tax, or invoice number. |

| Missing in Zoho Books | Displays vendors transactions that are available in GSTR-6A but have not been recorded in Zoho Books. You can click the missing transaction to create and save the corresponding bill in Zoho Books. |

| Missing in GSTN | Displays purchase transactions recorded in Zoho Books that are not available in GSTR-6A because the vendors have not uploaded them in their GSTR-1/1A/IFF. |

| Reconciled | Displays all the transactions that you have successfully reviewed and reconciled. If needed, you can undo the reconciliation by clicking Actions and selecting Revert Reconciliation from the dropdown. |

Distribute Credits

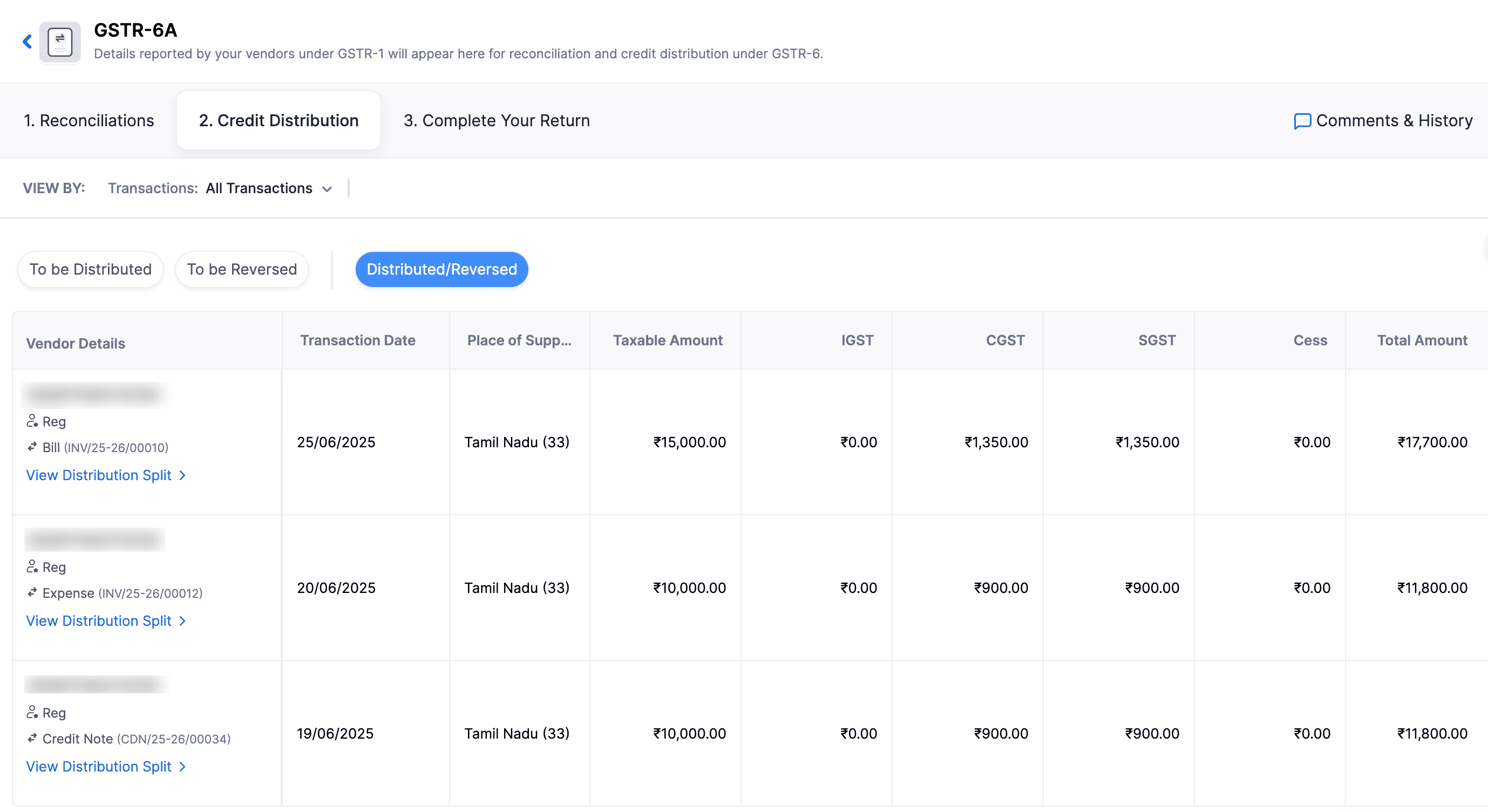

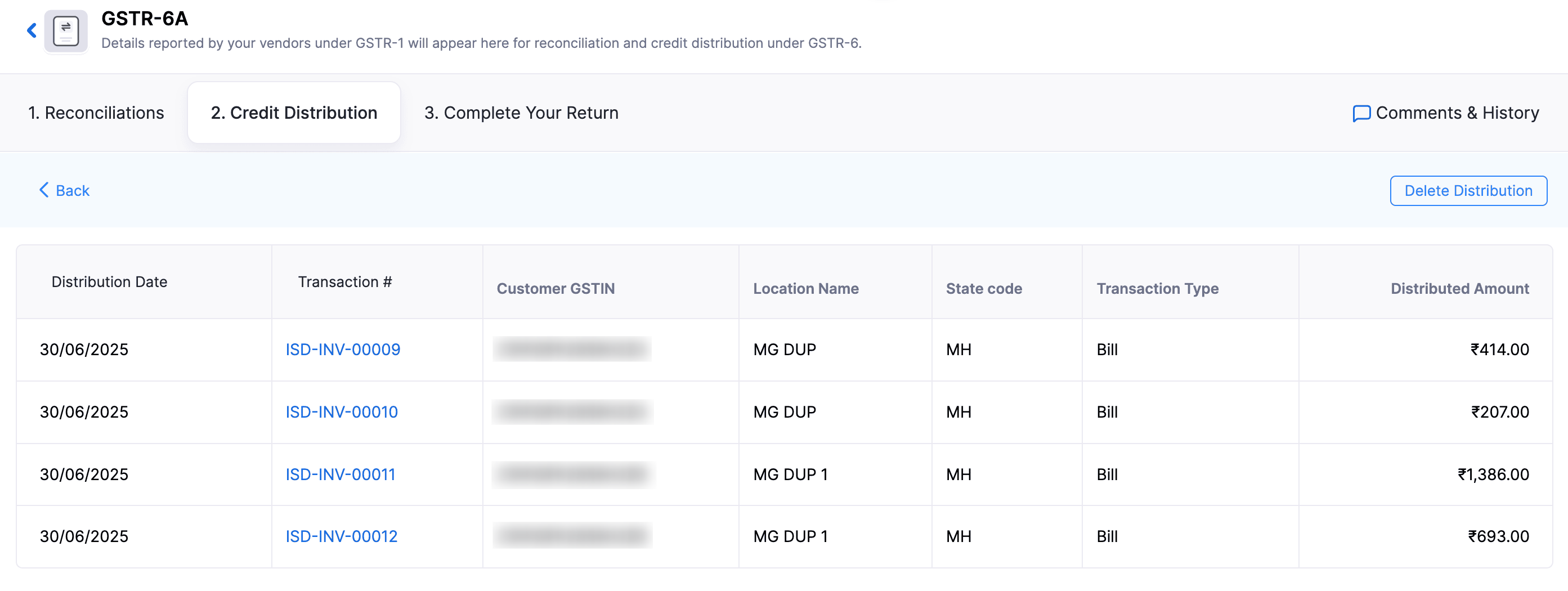

Once you’ve reconciled the transactions in your GSTR-6A return, you can distribute the credit to your locations from the Credit Distribution section.

| Tab | Description |

| To Be Distributed | Displays bills, expenses, and vendor credit notes along with the ITC available for distribution to your locations. To distribute ITC, click the Actions icon and select Distribute. In the pop-up that appears, select the Locations for which you want to allocate the ITC, enter their Credit Distribution %, and then click Distribute. On successful distribution, an ISD invoice will be created. You can calculate the eligible Credit Distribution Percentage using the formula c1=(t1/T)×C, where C is the total credit available for distribution, t1 is the turnover of the specific location, and T is the turnover of all locations. This determines the portion of credit that can be distributed to a particular location. |

| To Be Reversed | This includes transactions such as vendor credits, where excess ITC was claimed earlier and must now be reversed. To reverse the ITC, click the Actions icon and select Distribute. In the pop-up that appears, choose the locationses for which you want to reverse allocate the ITC, select their Eligible Credits Reference Invoice, enter the Credit Distribution %, and then click Distribute. On successful reversal, an ISD credit note will be created. The Credit Reversal Percentage can be calculated using the formula c1=(t1/T)×Cr, where Cr is the total credit to be reversed, t1 is the turnover of the specific location, and T is the turnover of all locations. This determines the portion of credit that needs to be reversed for a particular location. |

| Distributed/Reversed | Displays all ITC that has already been distributed to es or has been reversed. Click View Distribution Split to see the breakdown along with the corresponding ISD invoices/credit notes raised. |

Once you’ve reconciled the purchase transactions in Zoho Books with the transactions pulled from GSTIN, you can navigate to the Complete Your Return section and click Mark as Completed to mark your return as completed.

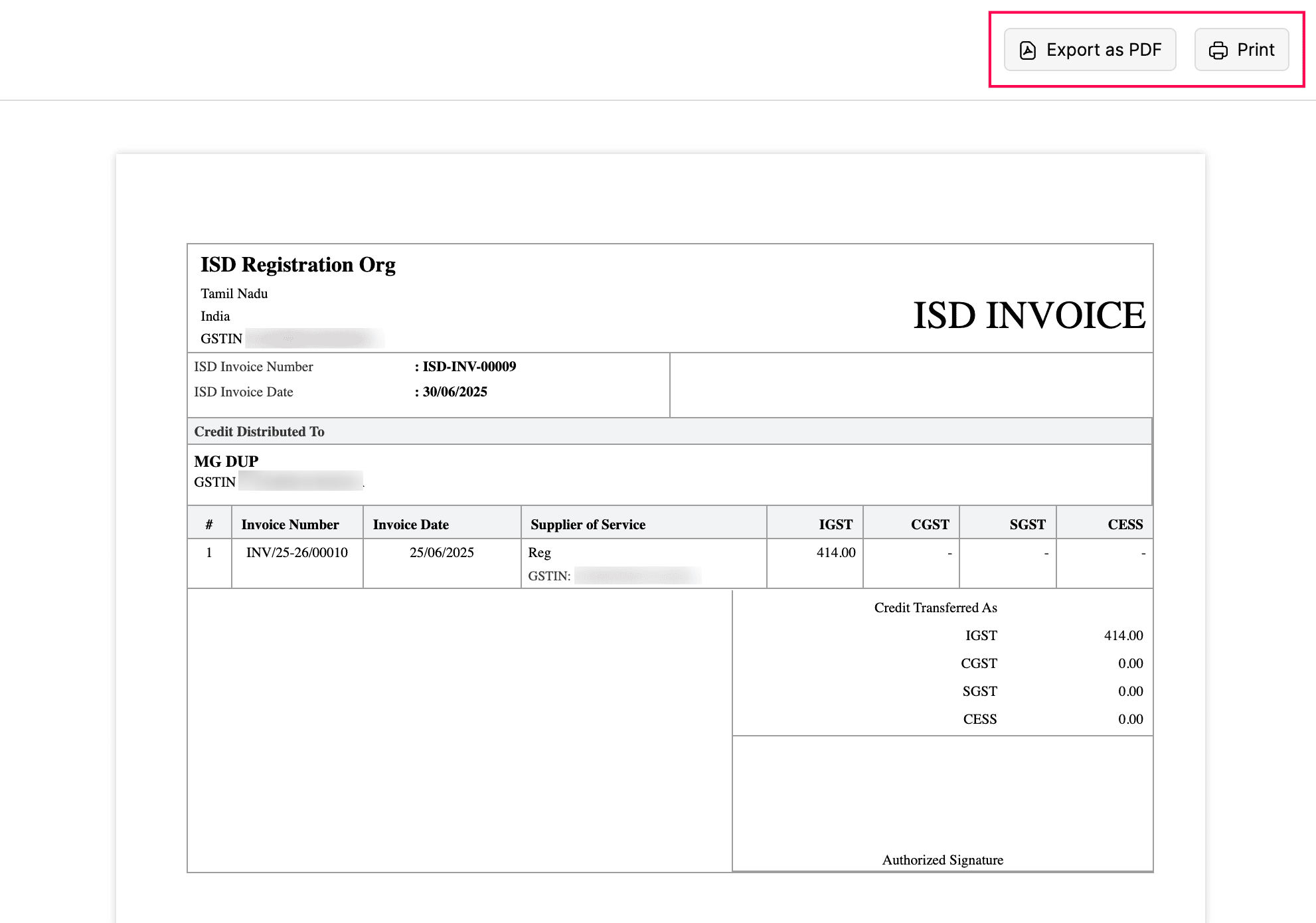

Print / Download ISD Invoices

To print or download your ISD invoices:

- Go to Filing & Compliance on the left sidebar and select GST Filing.

- Under the GSTIN registered as an ISD, click View Returns.

- Click View Transactions in the GSTR-6A return.

- In the GSTR-6A return page, navigate to the Credit Distribution section.

- Under the Distributed/Reversed tab, click View Distribution Split for the ISD invoice or ISD credit note you want to print or download.

- To download the ISD invoice or credit note as a PDF, Click Export as PDF.

- To print the ISD invoice or credit note as a PDF, click Print.

The ISD invoices or credit notes will be printed/downloaded to your device.

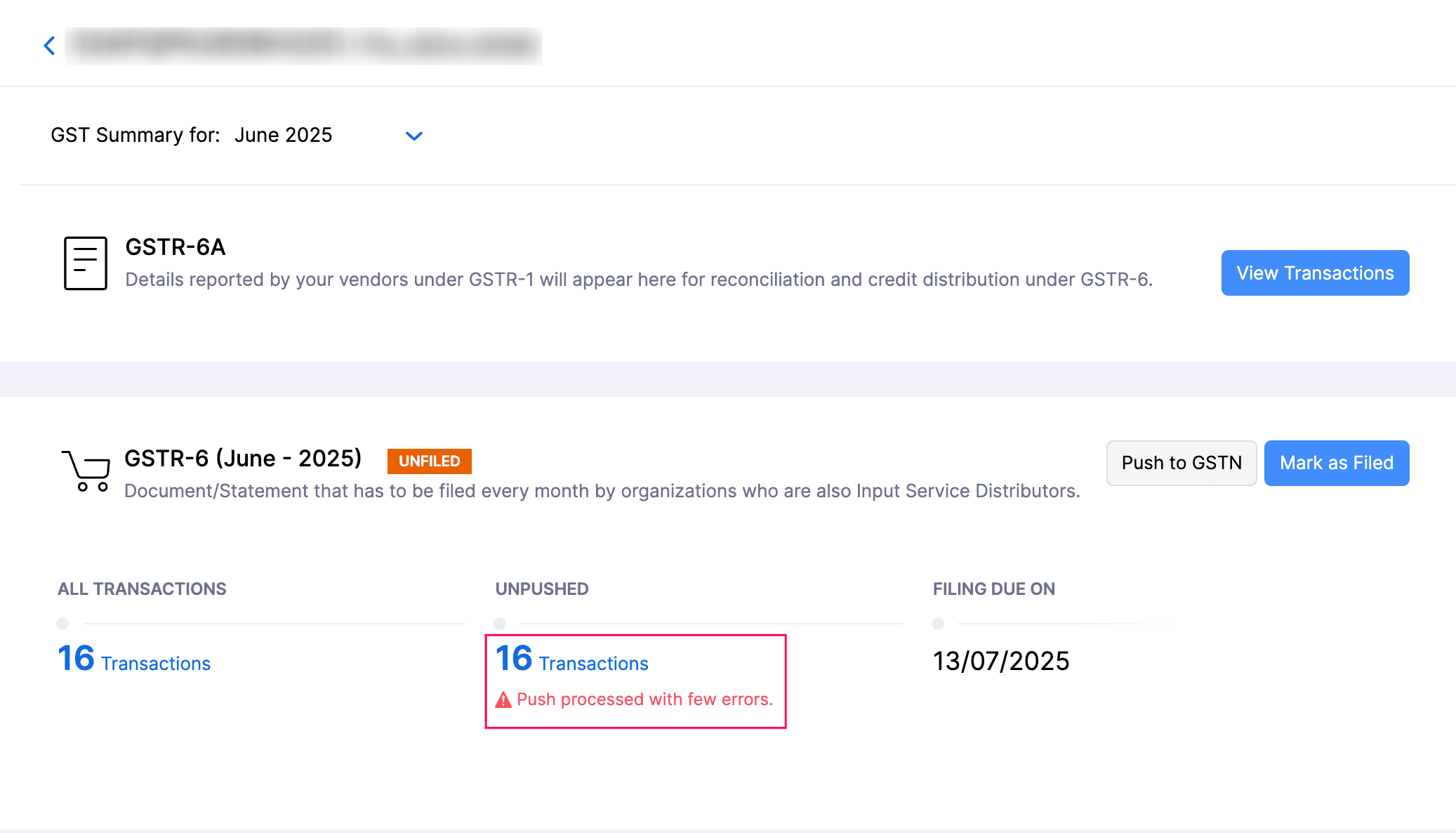

File your GSTR-6 Return

Once you’ve reconciled the transactions in GSTR-6A and distributed the ITC, the next step is to file your GSTR-6 return. This return contains details of all the ITC received by your ISD and how it has been distributed to the respective location. You must file the GSTR-6 return every month. The deadline is the 13th of the following month.

Here’s how you can file your GSTR-6 return:

- Go to Filing & compliance on the left sidebar and select GST Filing.

- Under the GSTIN registered as an ISD, click View Returns.

- In the GSTR-6 report, select the transactions listed under the Unpushed column.

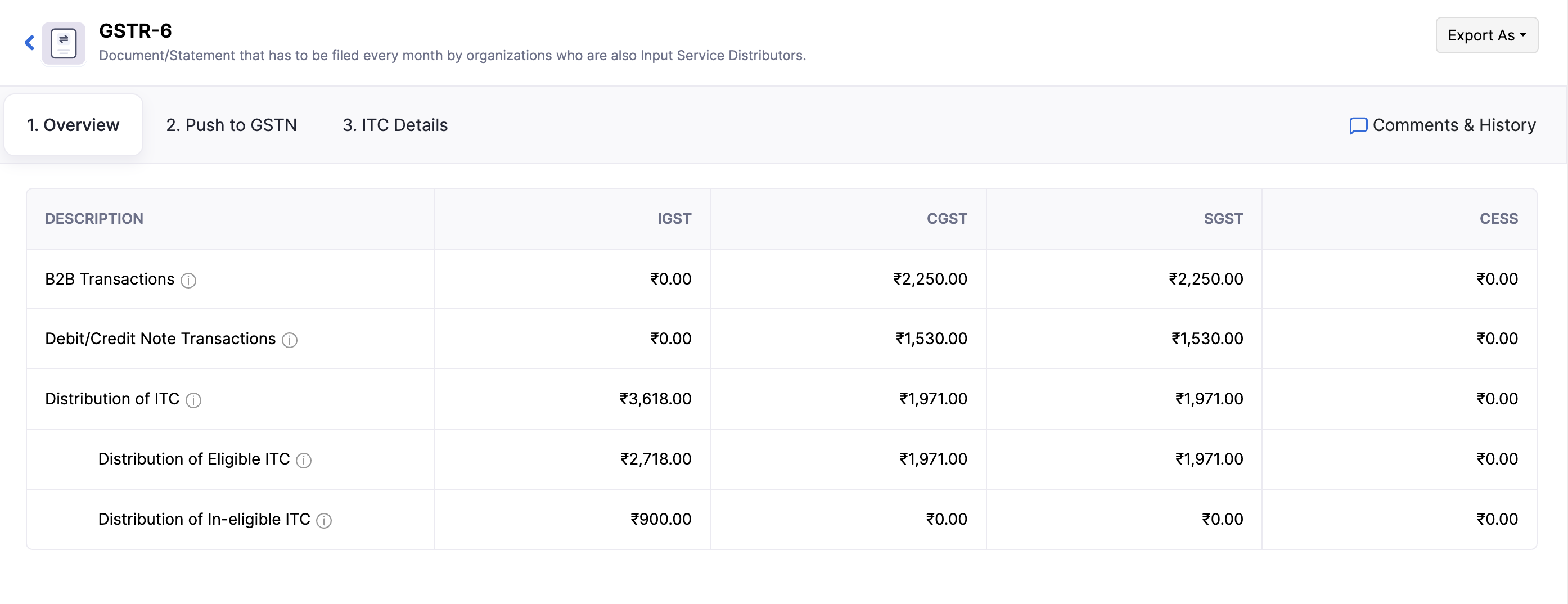

You will be redirected to the Overview section of the GSTR-6 report.

View Transactions to be Filed

In the Overview section, you can view a summary of all B2B transactions, debit note transactions, and the distribution of eligible and ineligible ITC.

Note: To export the transactions from the Overview page in JSON format, click Export As in the top-right corner and select JSON.

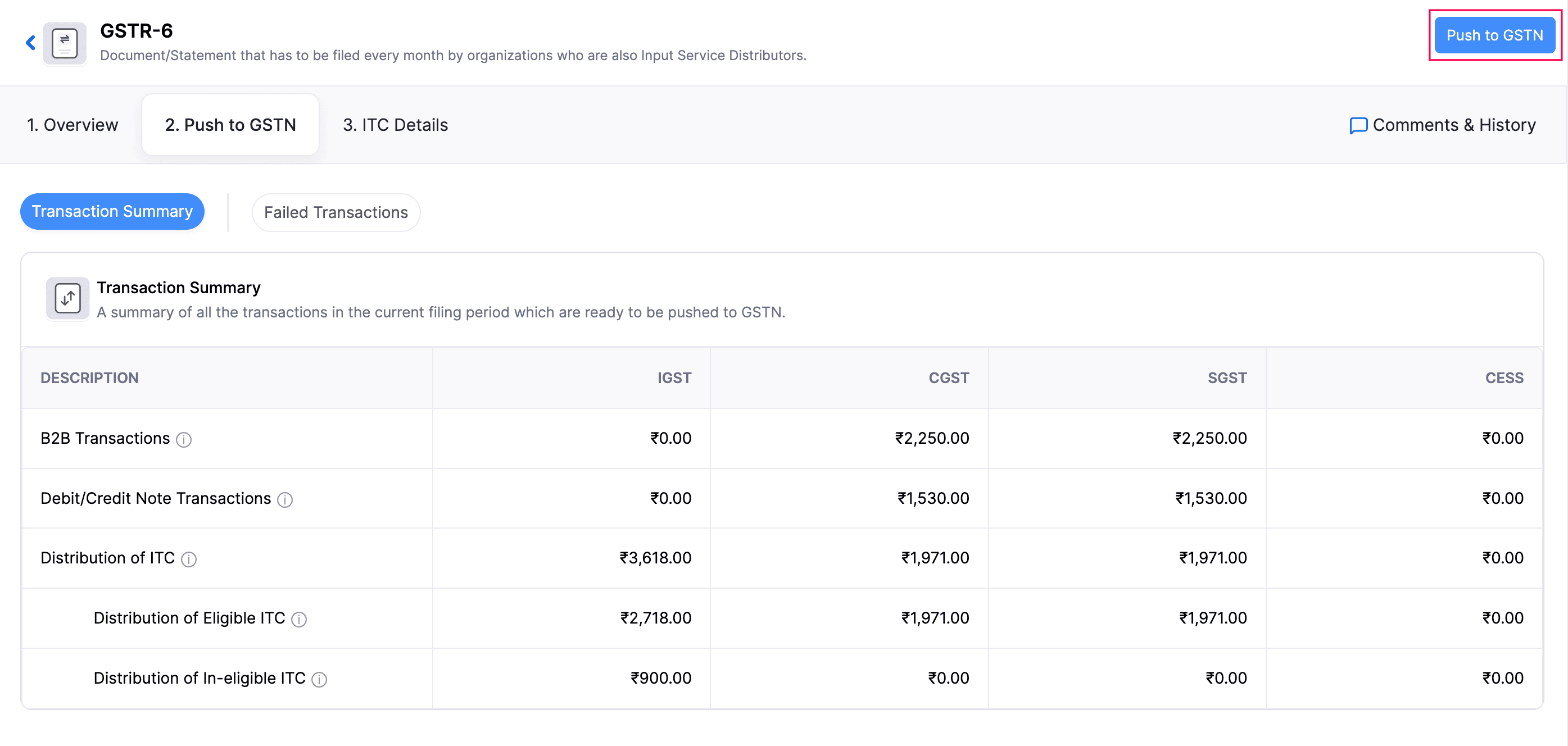

Push to GSTN

In this section, you can view a summary of all the transactions that are ready to be pushed.

| Tab | Description |

| Transaction Summary | Displays a summary of all the transactions included in the GSTR-6 return, such as B2B transactions, debit notes, and ITC distribution. |

| Failed Transactions | Displays the list of transactions that could not be pushed to the GSTN. You can edit them and push them again. |

Once you’ve verified the transactions, click Push to GSTN in the top right corner.

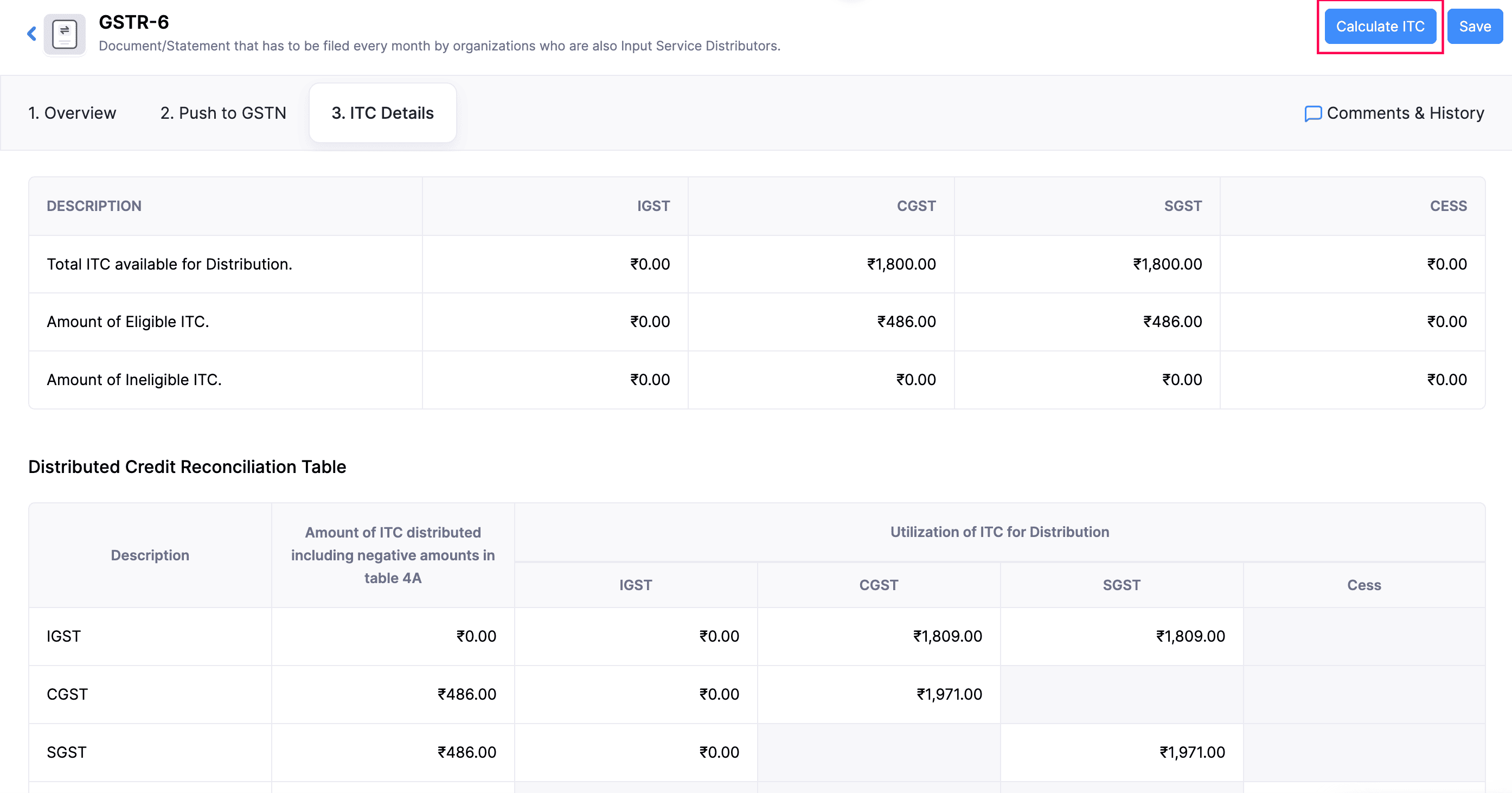

Calculate ITC

In the ITC Details section, you can view the total ITC available for distribution, as well as the amounts eligible and ineligible for ITC.

To calculate ITC:

- Go to Filing & compliance on the left sidebar and select GST Filing.

- Under the GSTIN registered as an ISD, click View Returns.

- Click View Transactions in the GSTR-6 return and select the return.

- Navigate to the ITC Details section.

Note: The ITC details are fetched from the GST Portal. If the session expires, you can reconnect by generating an OTP. To do this, go to the ITC Details section, click Generate OTP in the Session Expired pop-up, enter the OTP sent to the mobile number or email address, and click Verify OTP.

- Click Calculate ITC.

- After reviewing, click Save ITC.

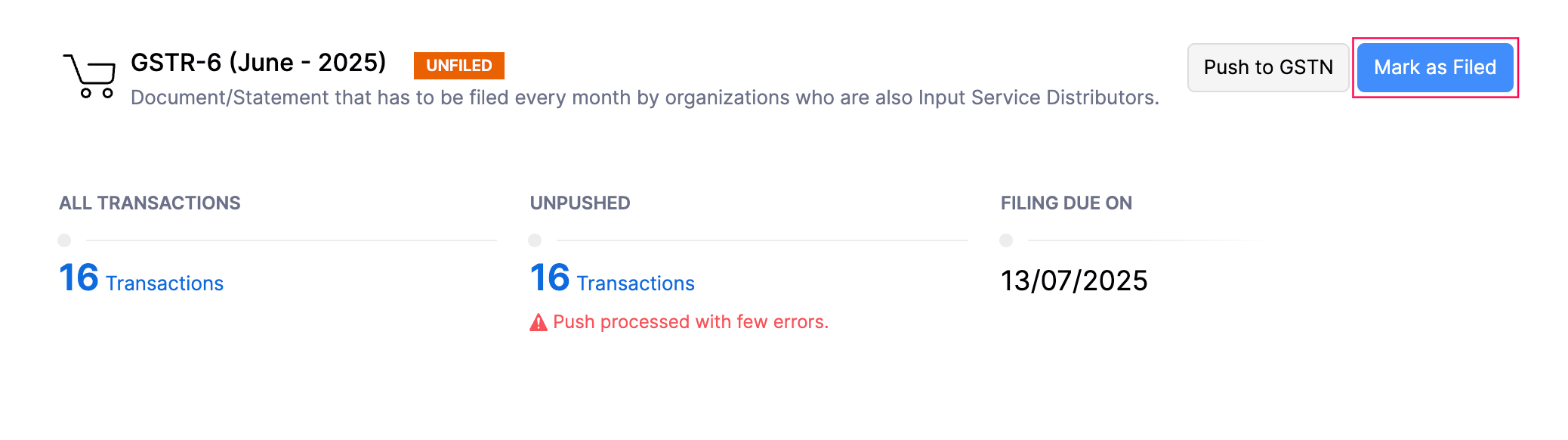

Mark as Filed

Once you have reviewed and verified all the details in your GSTR-6 return and ensured that the ITC distribution is correct, you cam mark the return as filed. Here’s how:

- Go to Filing & compliance on the left sidebar and select GST Filing.

- Under the GSTIN registered as an ISD, click View Returns.

- Navigate to the GSTR-6 return, and click Mark as Filed.

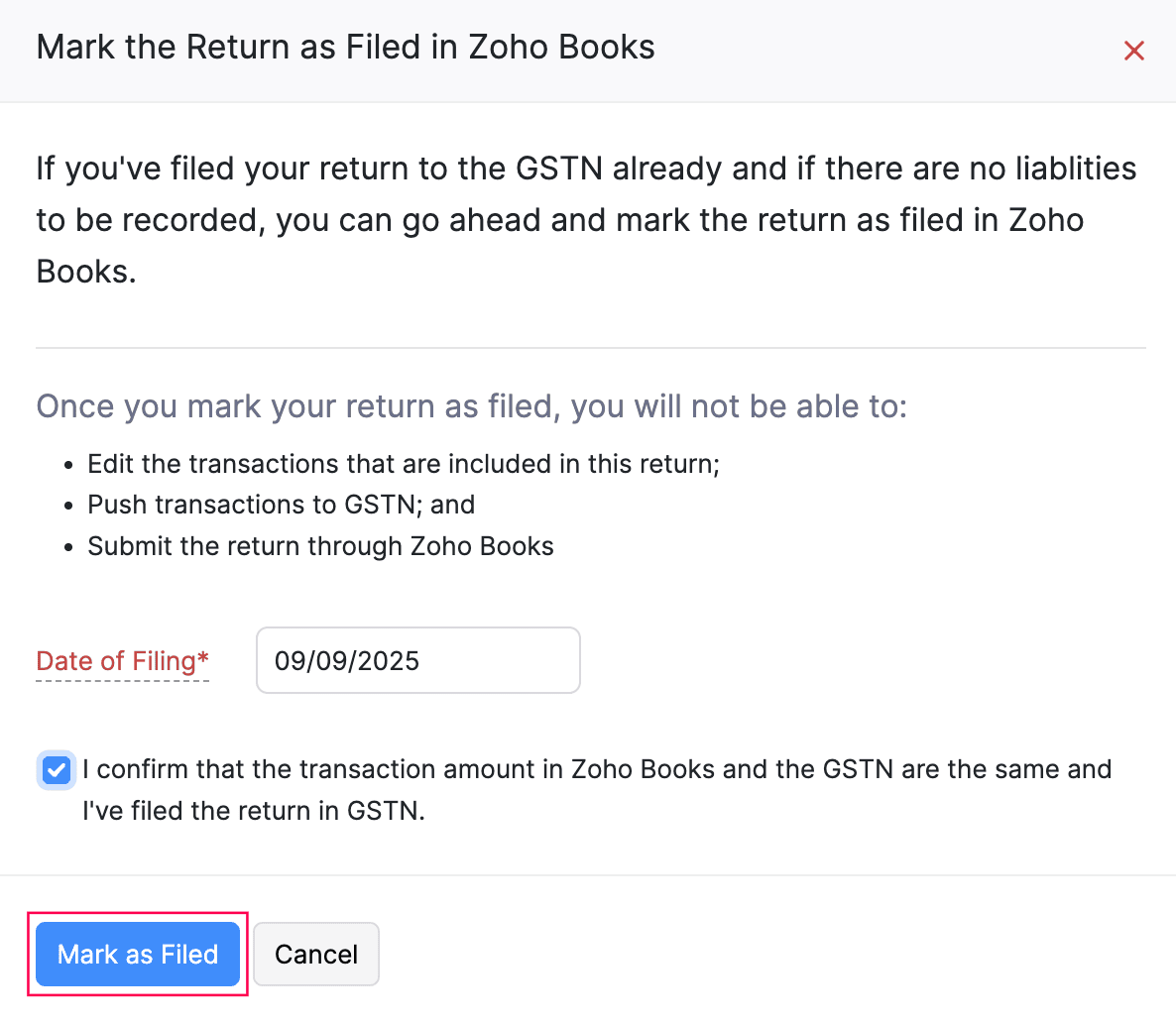

- In the Mark the Return as Filed in Zoho Books pop-up:

- Select the Date of Filing.

- Check the I confirm that the transaction amount in Zoho Books and the GSTN are the same and I’ve filed the return in GSTN option.

- Click Mark as Filed.

After marking the return as filed, you can generate the next return for the following period.

Note: You can mark the return as unfiled by clicking Mark as Unfiled to make any corrections in the return.