Managing Taxes

Let us have a look at the different modules in which the taxes can be added.

Customers & Vendors

You can configure the tax treatment for your customers and vendors while adding or editing them in Zoho Books.

- Create a new customer/vendor, or edit an existing one.

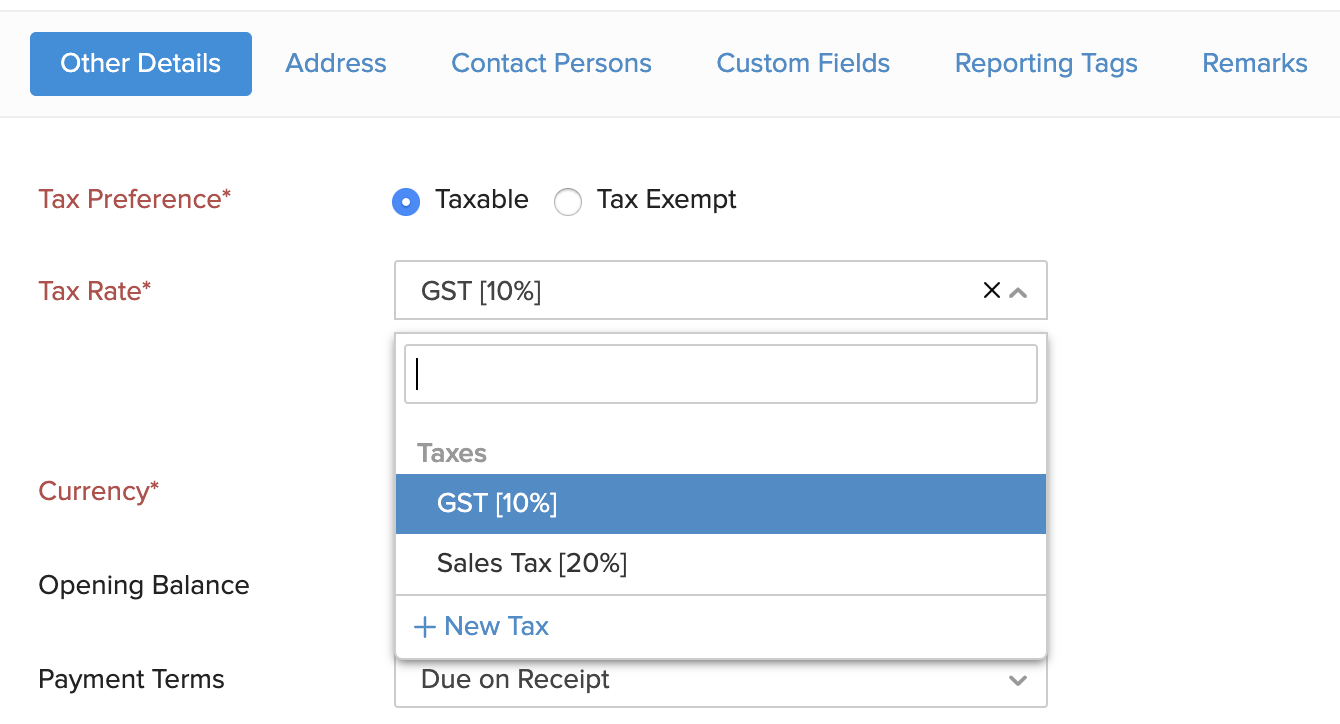

- In the Other Details section, choose the appropriate Tax Preference for your customer or vendor.

Taxable

If your customer or vendor is taxable, choose a Tax Rate from the list of taxes that you have created, or add a new one.

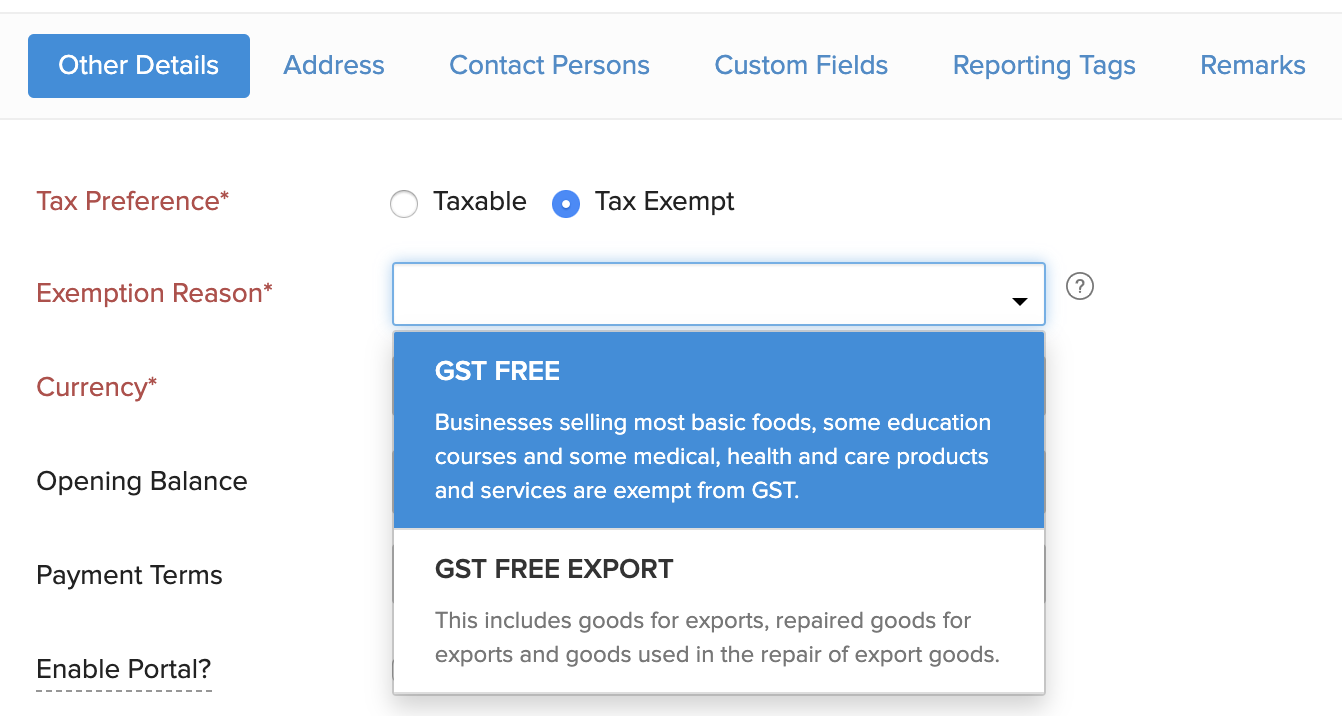

Tax Exempt

If your customer or vendor is exempted from tax, choose this option, and select the Exemption Reason:

GST Free: This is a business that sells most basic foods, some education courses and some medical, health and care products, and services that are exempted from GST.

GST Free Export: This is a business that includes goods for exports, repaired goods for exports, and goods used in the repair of export goods.

After making the necessary changes, click Save.

Items

Items are goods or services that you deal with in your business.

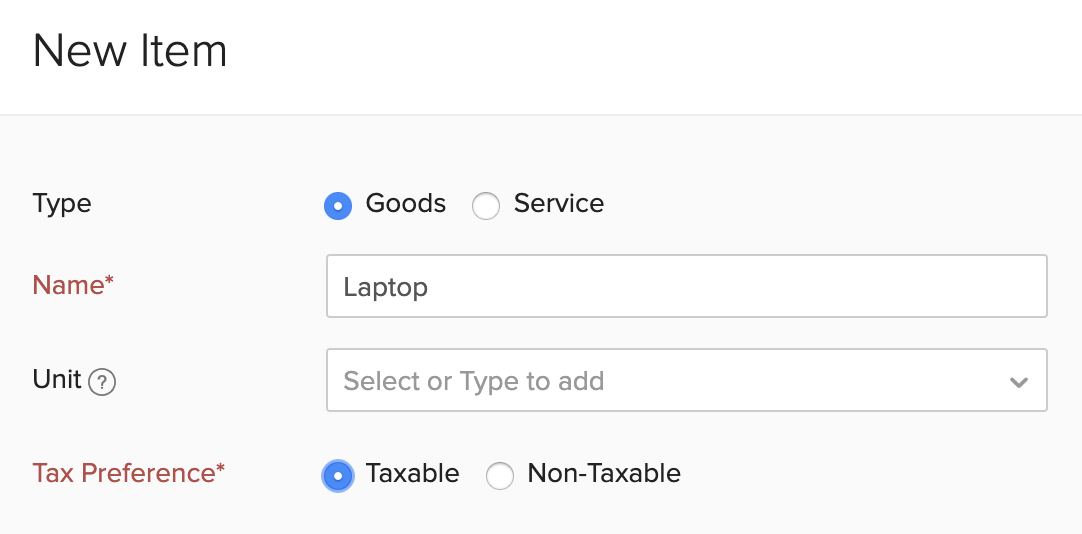

When you add an item in Zoho Books, you can choose whether it is Taxable or Non - Taxable. Here’s how:

- Go to the Items module.

- Create a new item, or edit an existing one.

- Select the Tax Preference of the item.

Taxable

If your item is taxable, choose this option.

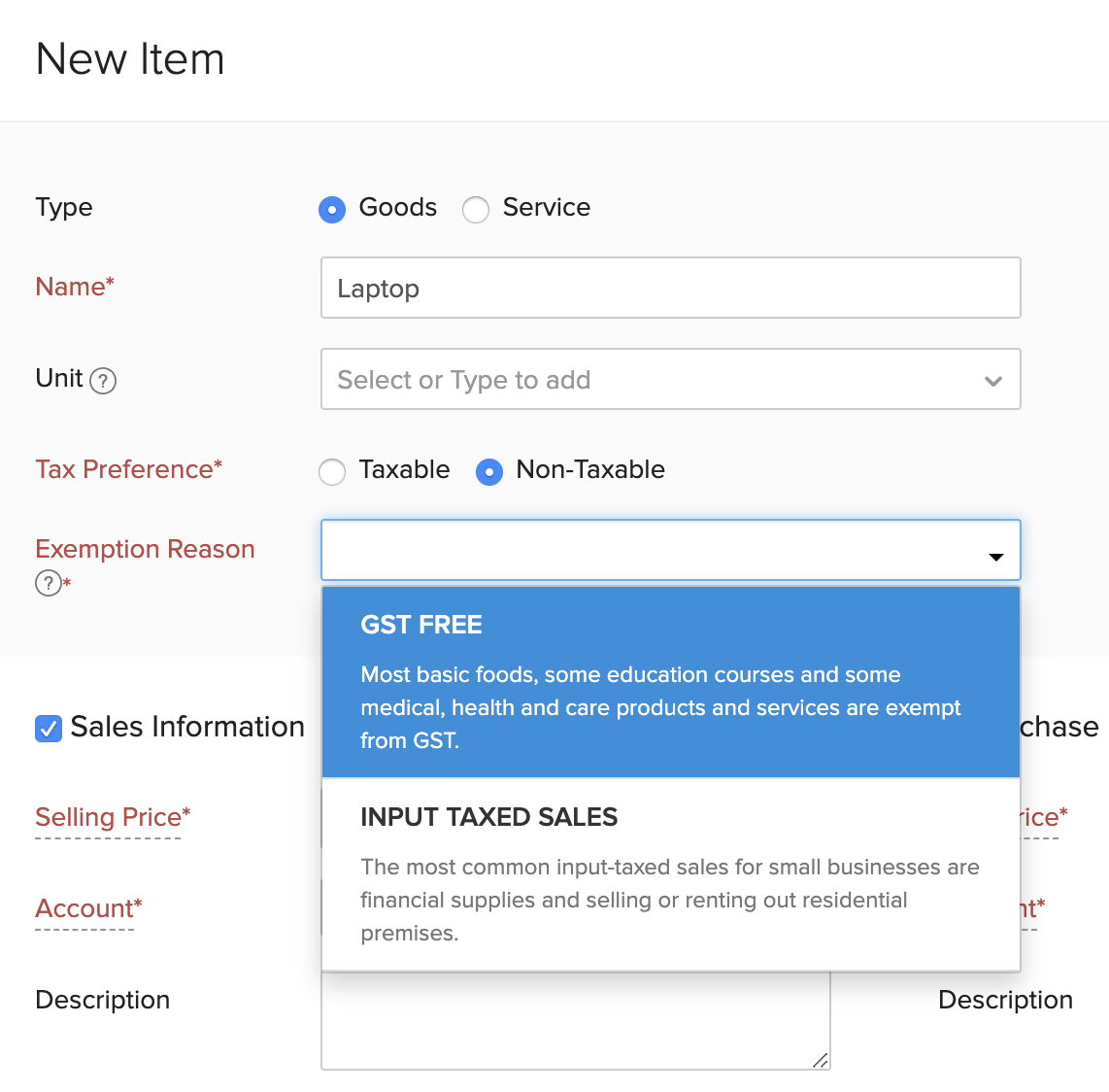

Non - Taxable

If your item is not taxable, choose this option and select the Exemption Reason:

GST Free: This is a business that sells most basic foods, some education courses and some medical, health and care products, and services that are exempted from GST.

GST Free Export: This is a business that includes goods for exports, repaired goods for exports, and goods used in the repair of export goods.

After making the necessary changes, click Save.

Transactions

Zoho Books has a wide range of sales and purchase transactions. You can create GST transaction for any of the following modules:

Sales Transactions

- Quotes

- Sales Orders

- Invoices

- Recurring Invoices

- Credit Notes

Purchase Transactions

- Expenses

- Recurring Expenses

- Purchase Orders

- Bills

- Recurring Bills

- Vendor Credits

Once you have set up the taxes, customers, vendors, and items in your Zoho Books account, you can start creating transactions and adding the tax rates in them.

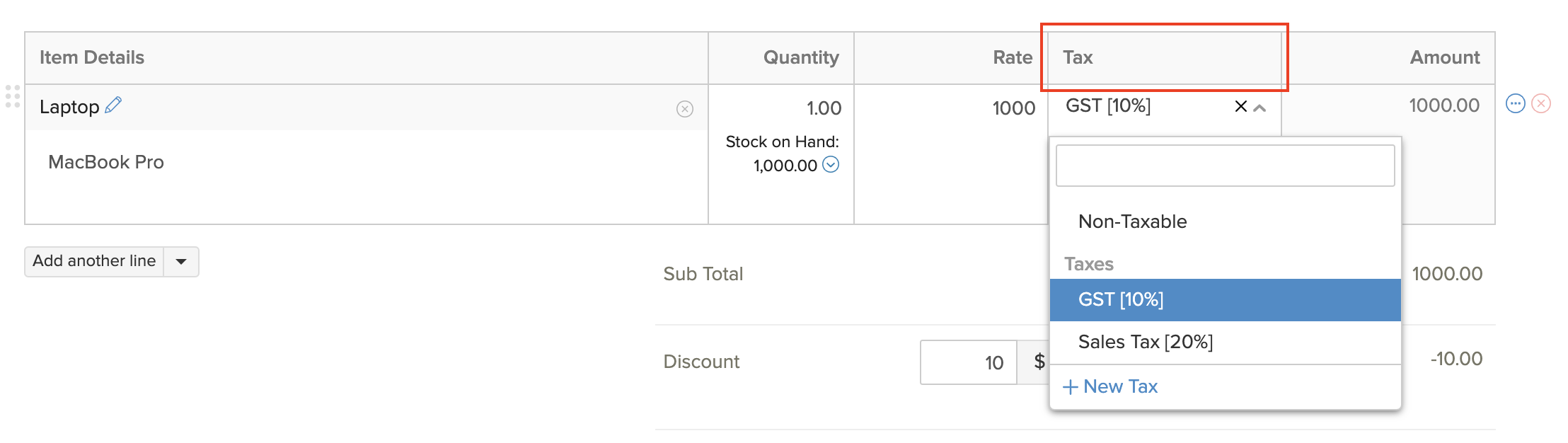

Let us take the example of an invoice and see how the different taxes can be applied on it.

- Go to Sales > Invoices.

- Click the + New button in the top right corner of the page.

- Enter the customer details.

- In the Item Details, select an item and select the appropriate tax applicable on it.

- Save the invoice.

With this, you have successfully added tax in your invoice.

Next >

BAS Report

Related

Yes

Yes