What is a shipping bill and when is it issued?

When certain goods are exported out of India, or supplies are provided to SEZ, they need to be taxed under GST and approved by the Customs department. The shipping bill contains information about the exported supplies, their value, and the custom duty and IGST paid on them. This also allows the supplier to claim a refund for the IGST paid on the supplies.

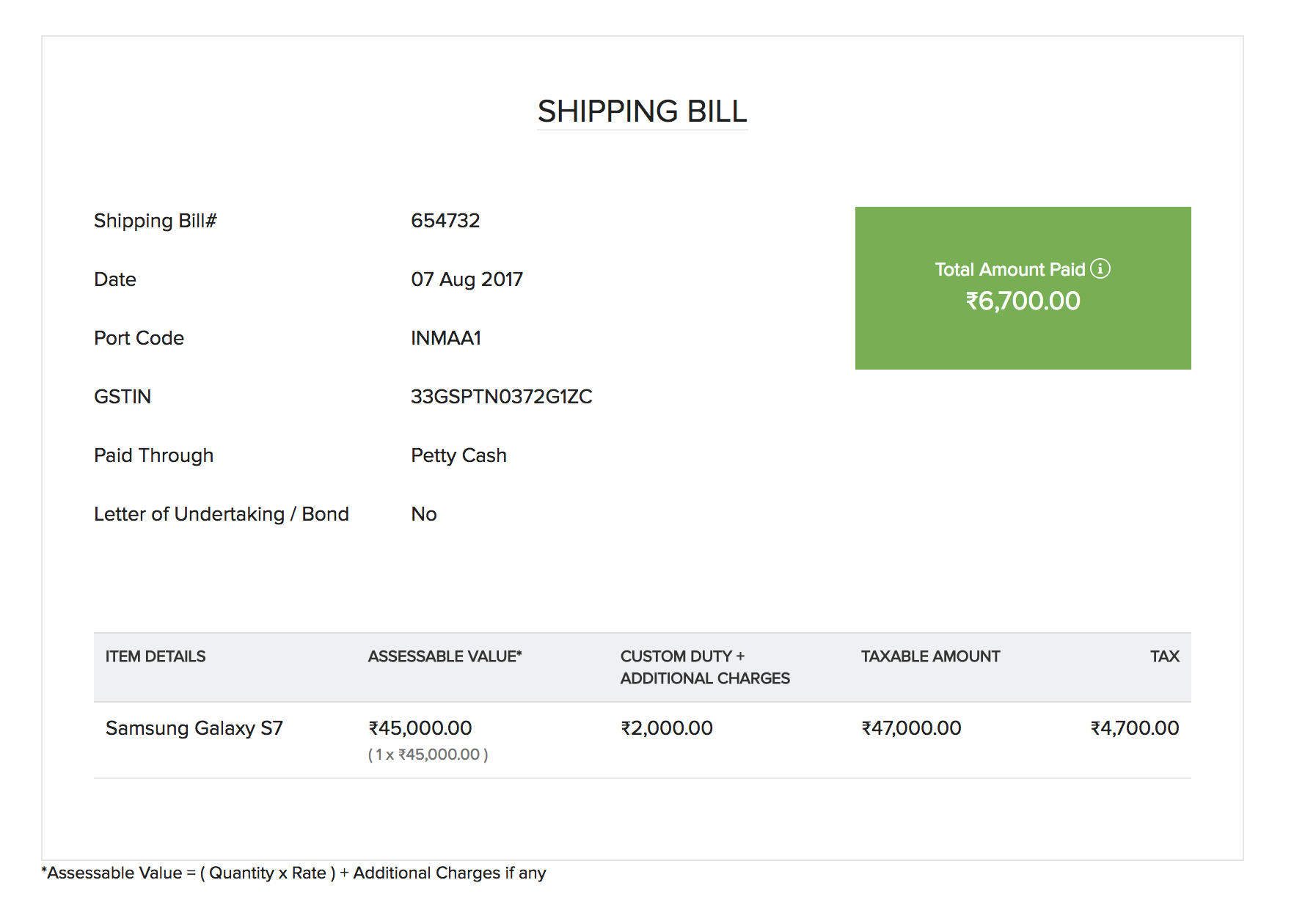

Format of a shipping bill:

Based on the rules prescribed by the Government, here is what a sample shipping bill will look like in the GST regime:

- Port code along with the date on which the bill is issued.

- Shipping bill number (a unique number assigned to every shipping bill by the Indian Customs Electronic Data Interchange System).

- GSTIN is mandatory if GST is levied on the supplies for domestic clearance. For exempt goods, the supplier can enter PAN instead. If the exports are made by United Nations or Multilateral Financial Institutions, or Embassies/Consulates, the exporters should provide their UIN (Unique Identity Number).

- Place of receipt of cargo, port of loading, port of discharge, final destination of the supplies, and lorry or goods train number. In the State of Origin field, include the State code for the state where the export of goods originated.

- Commercial invoice number, invoice value (in Rupees), currency in which invoice was issued, exchange rate, total value of invoice (in Rupees), and nature of payment.

- Cargo details including the nature of the cargo, number and kind of packages, gross weight, and net weight.

- Additional charges including customs duty and IGST.

- Taxable value and the total tax amount for every item on which a refund will be processed. A single GSTIN holder can issue multiple tax invoices in one shipping bill, if it’s being issued for the same consignee.

Note: A taxpayer cannot claim a refund on the IGST paid, or ITC on the inputs involved in the exports, unless they furnish their GSTIN and GST invoice details in the shipping bill.

The customs broker will authorize the document with a stamp of approval as specified by the customs authorities.