GST return for all sales and outward supplies

The GST Council has introduced a new return filing system to help taxpayers file their returns. The new system constitutes of 5 main components:one main return(Form GST RET-1) and four annexures (Form GST ANX-1, Form GST ANX-2, Form GST ANX-1A, and PMT-08). In this guide you will be reading about each of these components in detail:

Form GST ANX-1

GST ANX-1 is an annexure for reporting details of outward and inward supplies that are applicable for reverse-charge, imports of goods and services, and supplies made through e-commerce operators. The information entered in this form will be used to auto-populate some of the fields in the next form, ANX-2. Taxpayers are required to upload this form on a monthly basis, before filing the actual Sahaj return form. Let’s look at the form in detail:

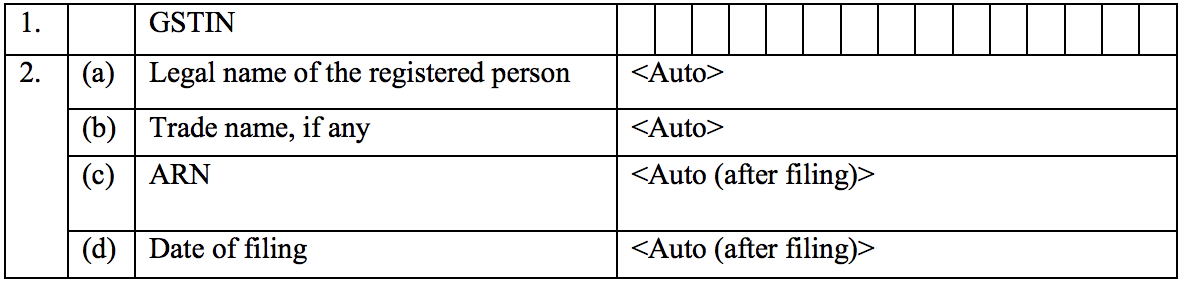

Part 1 and 2: General details

The first two parts of this annexure are for your general details: GSTIN, full legal name, trade name, ARN (Application Reference Number), and the date of filing.

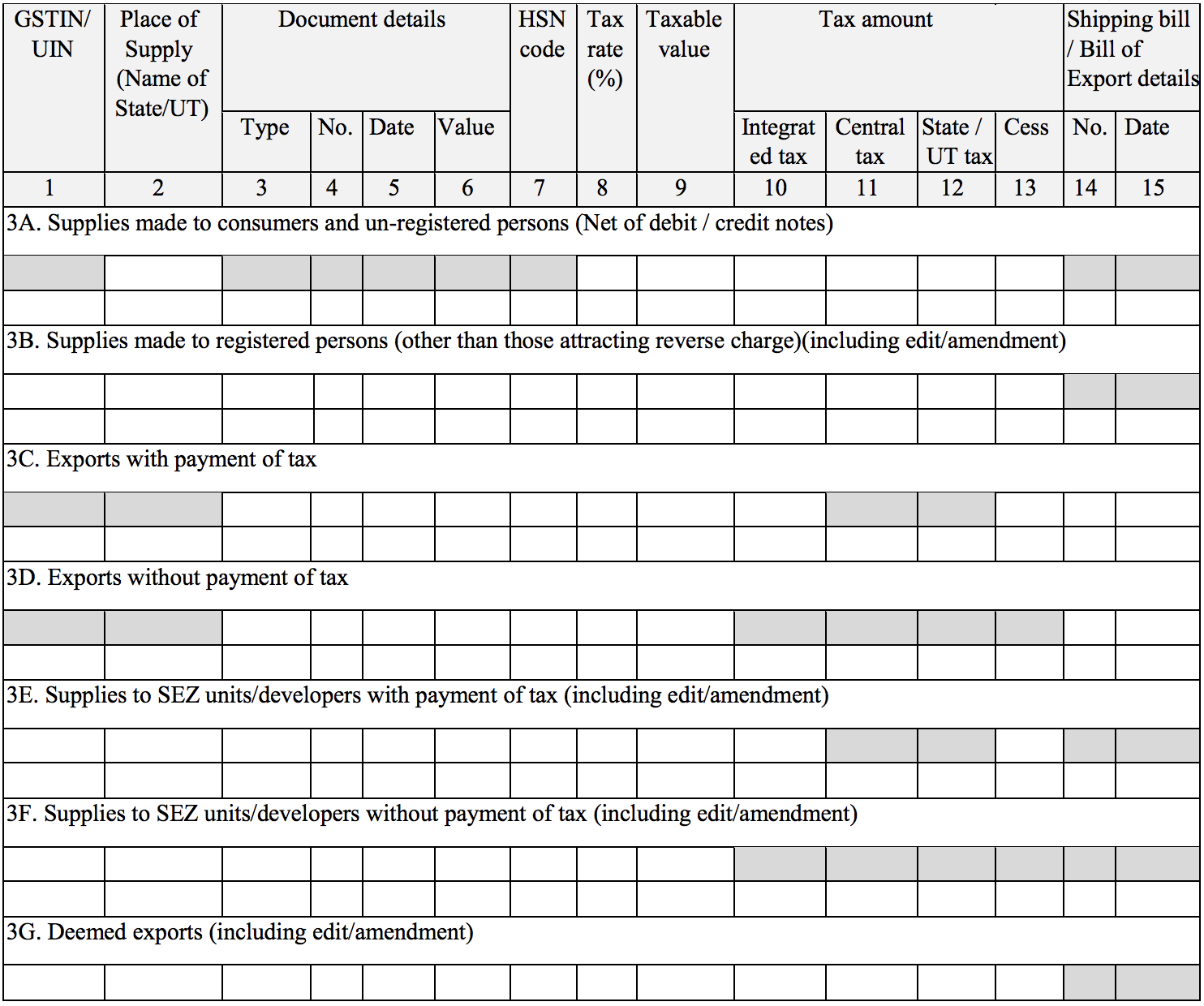

Part 3: Details of outward and inward supplies that attract reverse-charge and imports of goods and services

In this section, you are required to fill in your GSTIN or UIN, place of supply, HSN code, tax rates, taxable value, tax amounts, and details regarding your shipping bill or bill of export for the following:

A. Supplies made to your consumers and other un-registered persons.

B. Supplies made to registered persons, besides those for which reverse charge applies.

C. Exports with payment of tax.

D. Exports without payment of tax.

E. Supplies to SEZ units/developers with payment of tax.

F. Supplies to SEZ units/developers without payment of tax.

G. Deemed exports.

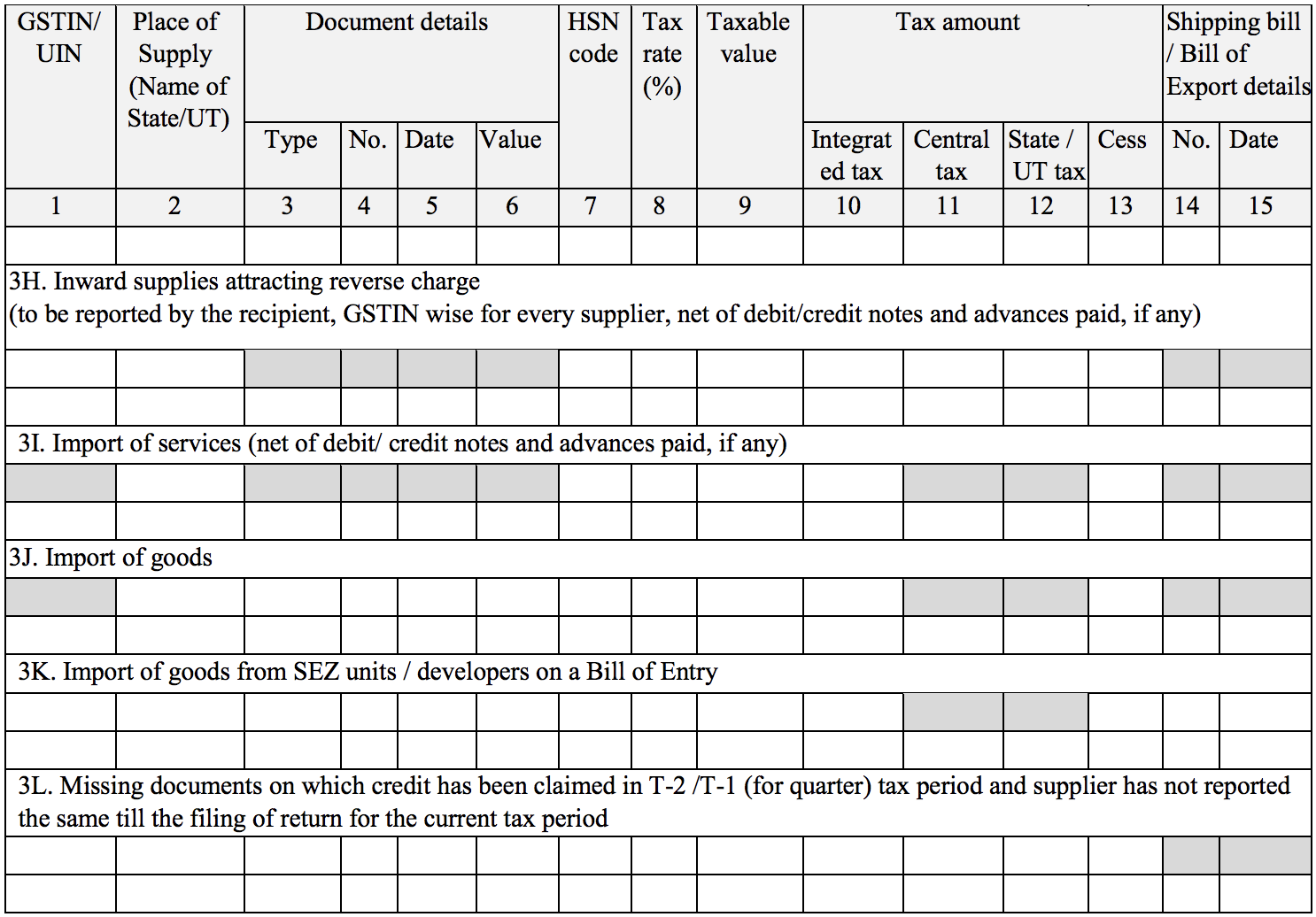

H. Inward supplies attracting reverse charge.

I. Import of services.

J. Import of goods.

K. Import of goods from SEZ units/developers on a Bill of Entry.

L. Missing documents on which credit has been claimed but the supplier has not reported the same prior to filing the return for the current tax period.

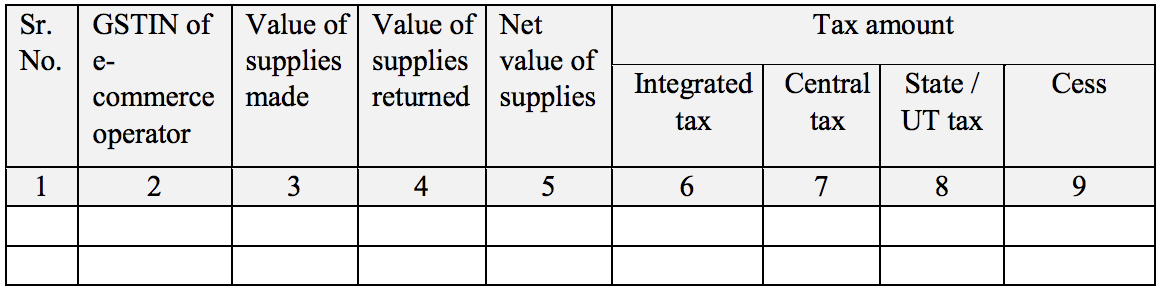

Part 4: Details of supplies made through e-commerce operators liable to collect tax under section 52

Here, you are required to provide details of the supplies made through an e-commerce operator. Enter the GSTIN, value of supplies made, value of supplies returned, net value of supplies, and the amounts of integrated tax, CGST, SGST/UGST, and cess tax.

Form GST ANX-2

GST ANX-2 is an annexure for all inward supplies received from a registered person and details of the ITC and ISD credits received. Taxpayers are required to upload this form on a monthly basis, before filing the actual Sugam return form. Let’s look at the form in detail:

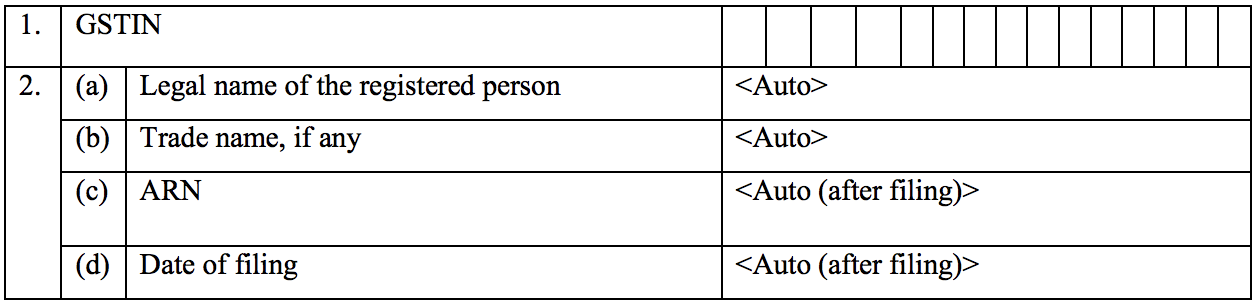

Part 1 and 2: General details

The first two parts of this annexure are for your general details: GSTIN, full legal name, trade name, ARN (Application Reference Number), and the date of filing.

Part 3: Inward supplies received from a registered person besides those for which reverse charge applies

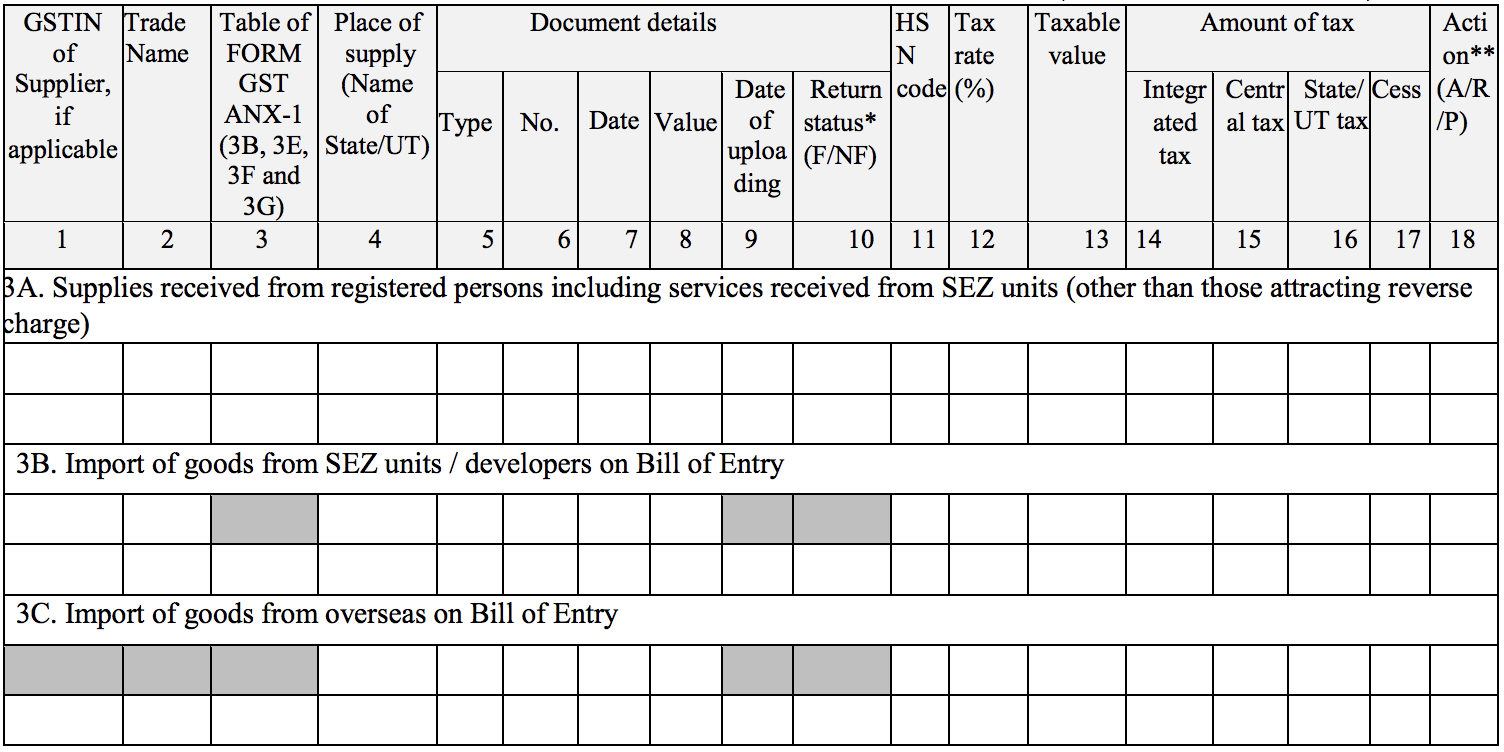

In this form, you are required to enter the GSTIN of your supplier, their trade name, place of supply, HSN code, tax rates, taxable value, tax amounts, and the status of the form for the following:

Supplies received from registered persons, including services from Special Economic Zones, besides those for which reverse charge applies.

Import of goods from SEZ units/developers on a Bill of Entry.

Import of goods from overseas on a Bill of Entry.

Note:

The F in the return status refers to Return Filed and the NF refers to Return Not Filed. In the action column, the A stands for Accepted, R’stands for Rejected, and P stands for Pending.

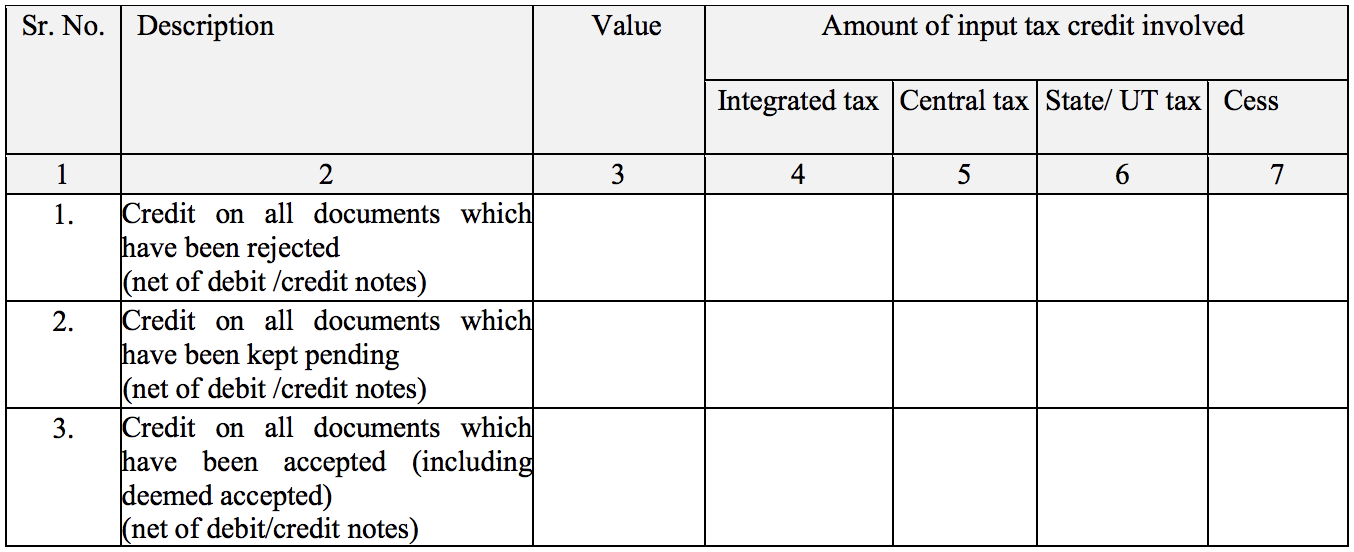

Part 4: Summary of ITC

The last part of Form GST ANX-2 is where you are required to enter the value and amounts of ITC involved under your integrated tax, CGST, SGST or UGST, and cess tax for the following:

The total amount of credit availed from documents that have been rejected.

The total amount of credit availed from documents that have been marked pending.

The total amount of credit availed from documents that have been accepted.

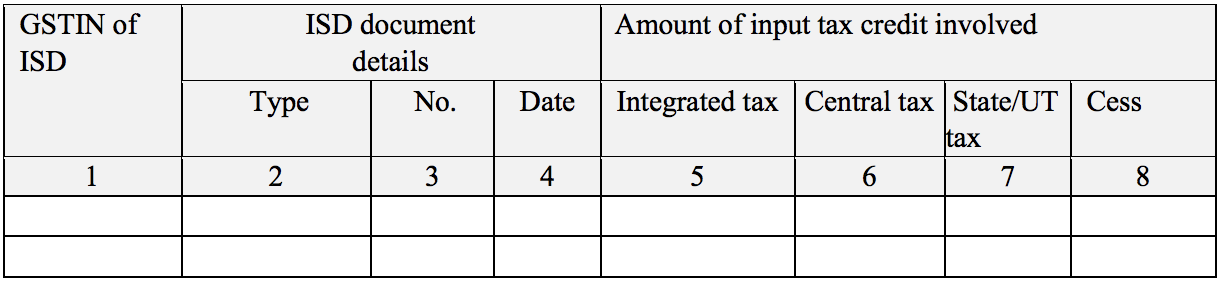

Part 5: ISD credits received

In this section, you are required to enter details regarding the amount of ISD credits you have received from integrated tax, CGST, SGST/UGST, cess tax.

Form GST RET-1

Form GST RET-1, or the normal return, is a return through which taxpayers can declare all their outward and inward supplies and acquire credit for their missing invoices.This return can be filed either monthly or quarterly. Here is a detailed explanation of the form:

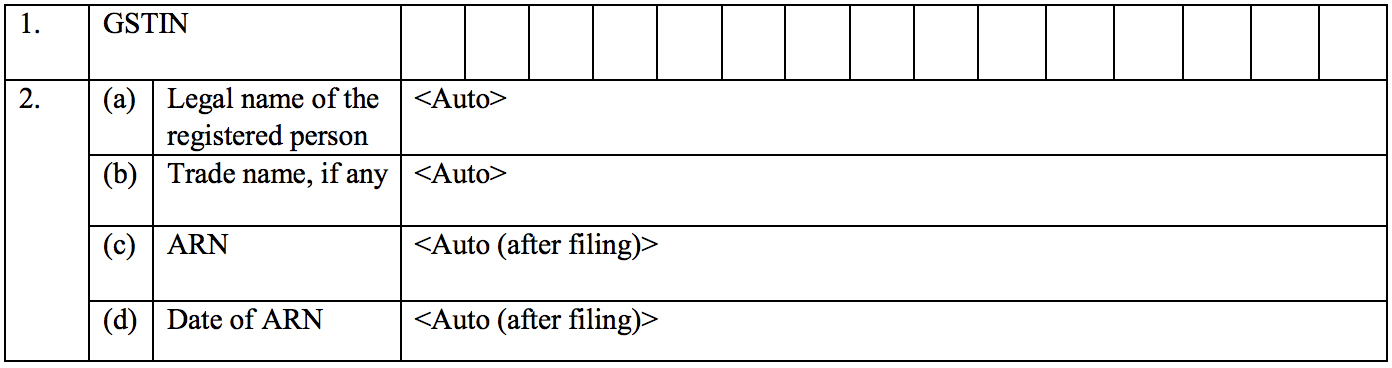

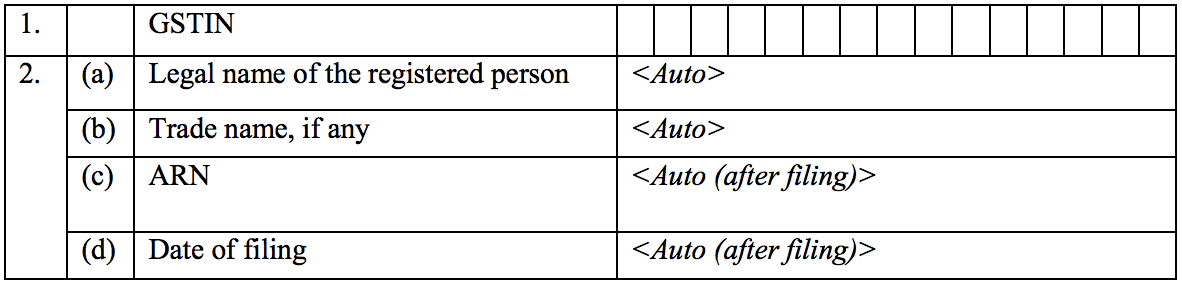

Part 1 and 2: General details

The first two parts of the Sahaj return form are for your general details. Enter your GSTIN, full legal name, trade name, ARN (Application Reference Number), and the date of filing.

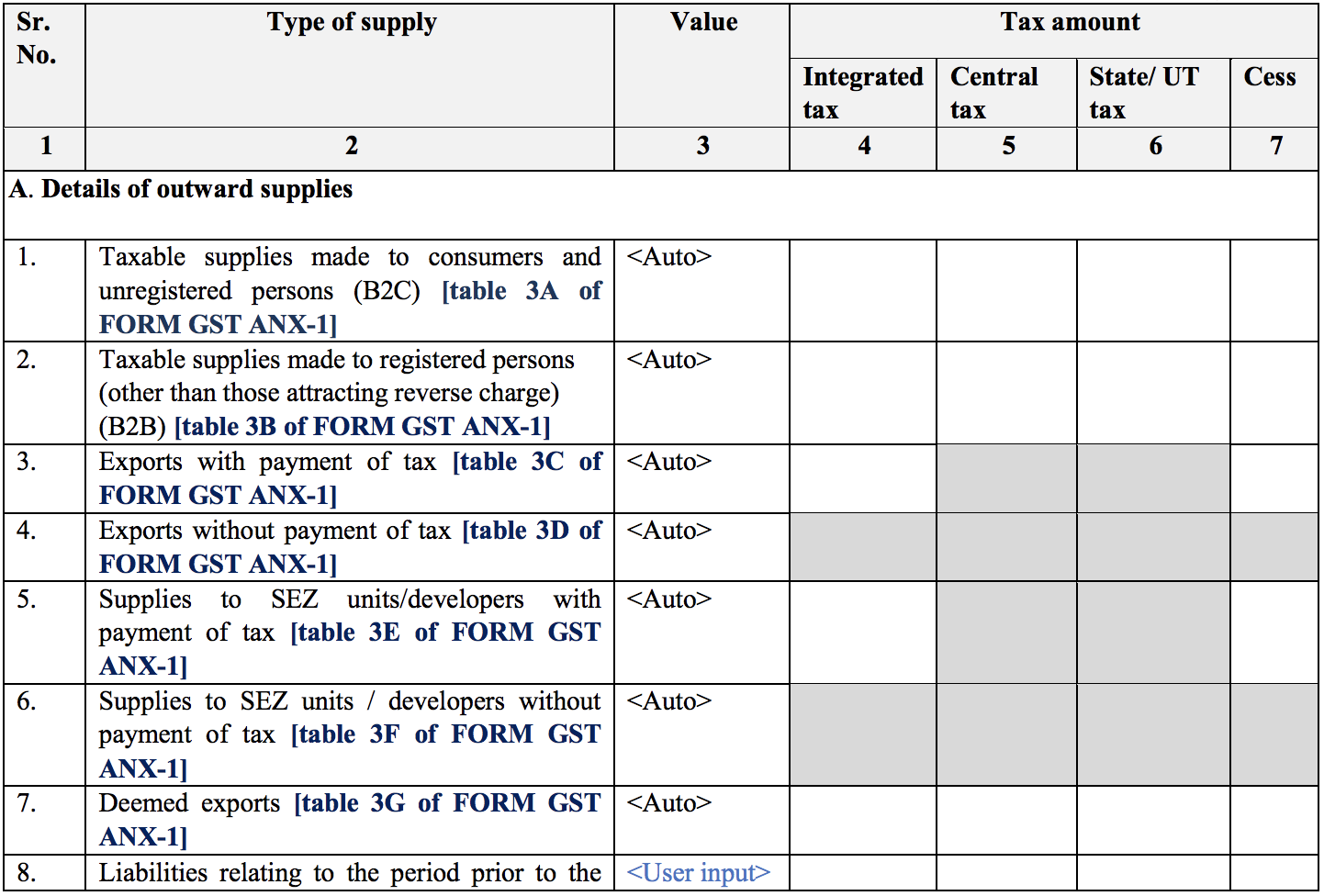

Part 3: Summary of outward and inward supplies for which reverse charge applies

A. Details of outward supplies

This part of the form is where you are required to fill in details of your outward supplies. Enter the value of the supply and the amount of integrated tax, CGST, SGST, and cess tax for:

The taxable B2C supplies made to your consumers and other unregistered persons.

The taxable B2B supplies made to registered persons.

Exports with payment of tax.

Exports without payment of tax.

Supplies to SEZ units/developers with payment of tax.

Supplies to SEZ units/developers without payment of tax.

Deemed exports.

Liabilities acquired during the period before the introduction of GST.

The subtotal of all the above quantities.

B. Details of inward supplies

In this section you are required to fill in details of your inward supplies. Enter the value of the supply and the amount of integrated tax, CGST, SGST, and cess tax for:

The inward supplies for which reverse charge is applicable. This is the net amount of debit/credit notes and advances paid, if any.

Import of services.

The total of the above values.

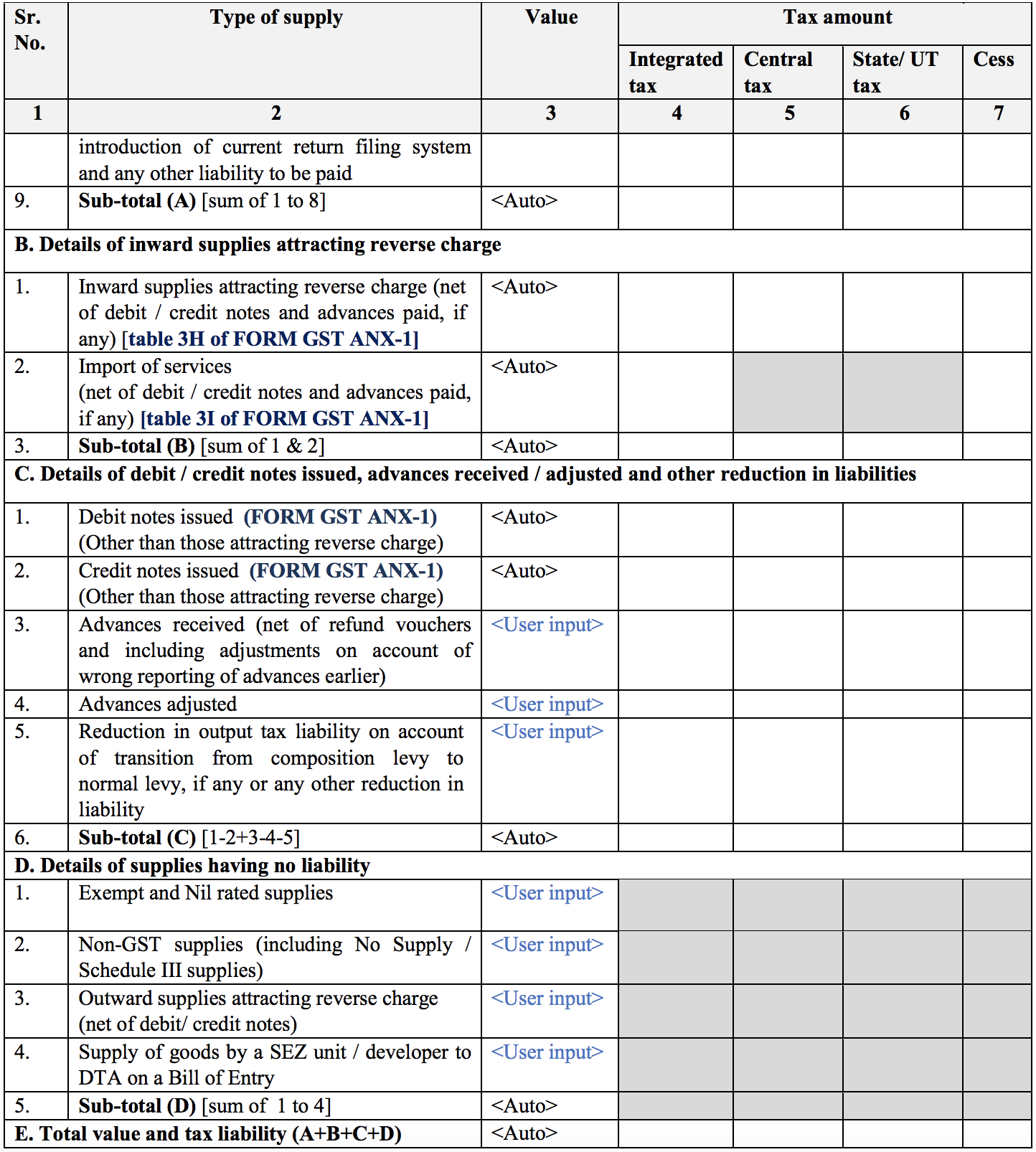

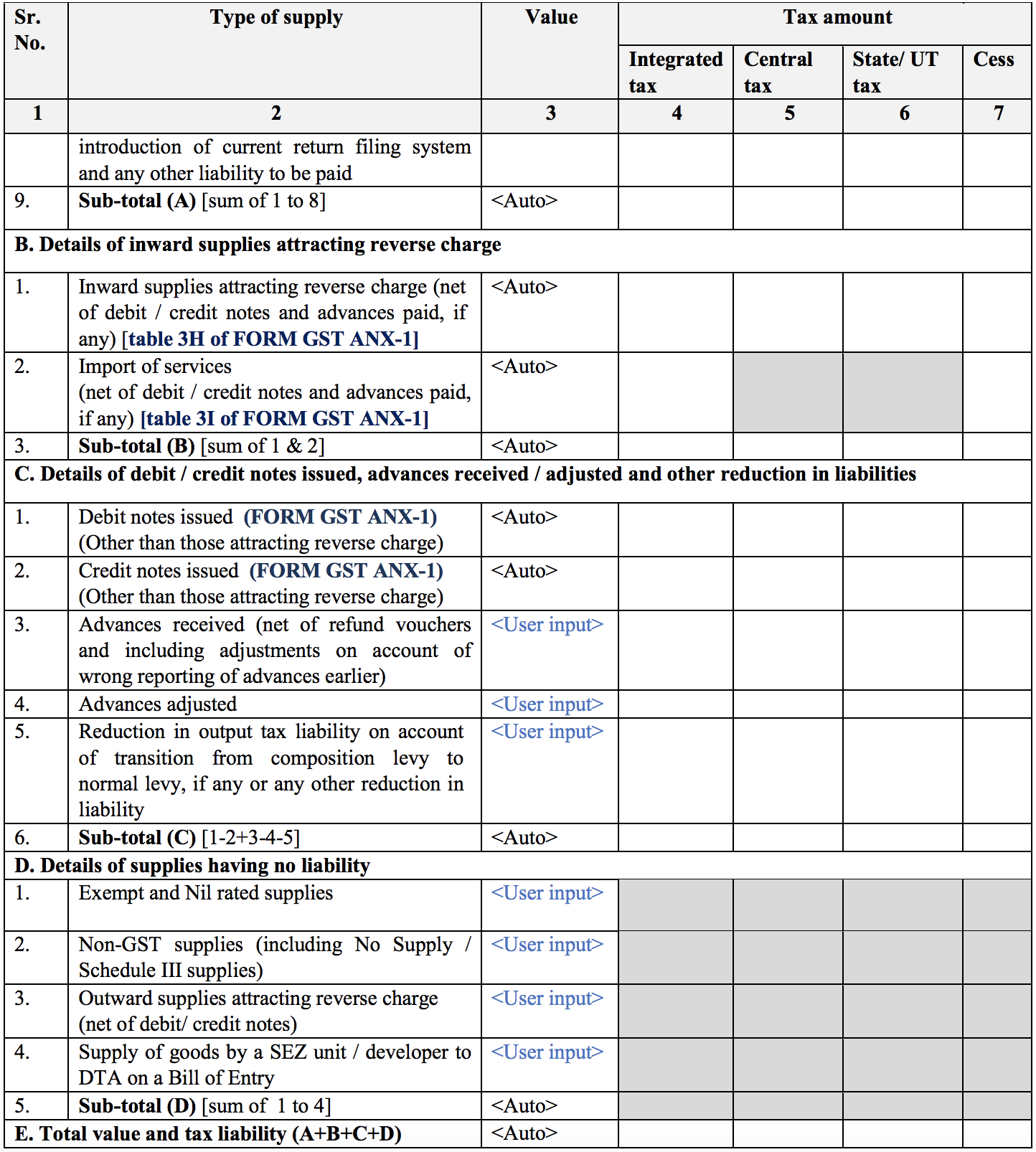

C. Details of debit/credit notes issued, advances received or adjusted, and other reduction in liabilities

Here you are required to fill in details of your integrated tax, CGST, SGST, and cess tax for:

The debit notes that have been issued, besides those for which reverse charge applies.

The credit notes that have been issued, besides those for which reverse charge applies.

Any advances that you have received. This is the net value of refund vouchers and adjustments made due to previous incorrect reporting of advances.

Any adjusted advances.

Any reduction in output tax liability because of the transition from the composition levy to the normal levy, or any other reduction in liability.

The total of all the above values.

D. Details of supplies that have no liability

Here you are required to fill in details of your supplies that have no liability. Enter the value of the supply and the amount of integrated tax, CGST, SGST, and cess tax for:

Exempt and nil-rated supplies.

Non-GST supplies.

Outward supplies for which reverse charge applies.

Any supply of goods made by a SEZ unit/developer to DTA on a Bill of Entry.

The total of the above quantities.

E. The total value and tax liability from A, B, C, and D

Part 4: Summary of inward supplies for claiming ITC

A. Details of ITC based on auto-population from Form GST ANX-1, ANX-2, and other forms

In this section you are required to fill in the value of the supply and the ITC amount for integrated tax, CGST, SGST, and cess tax for:

Credit on all documents that have been rejected.

Credit on all documents that have been kept pending.

Credit on all documents that have been accepted.

The amount of eligible credit that has not been availed before the introduction of GST.

Inward supplies attracting reverse charge.

Import of services.

Import of goods.

Import of goods from SEZ units/developers.

ISD credit.

Provisional ITC on documents that have not been uploaded by the suppliers.

Upward adjustments in ITC due to receipt of credit notes and all other adjustments and reclaims.

The total of the above lines 3 to 11.

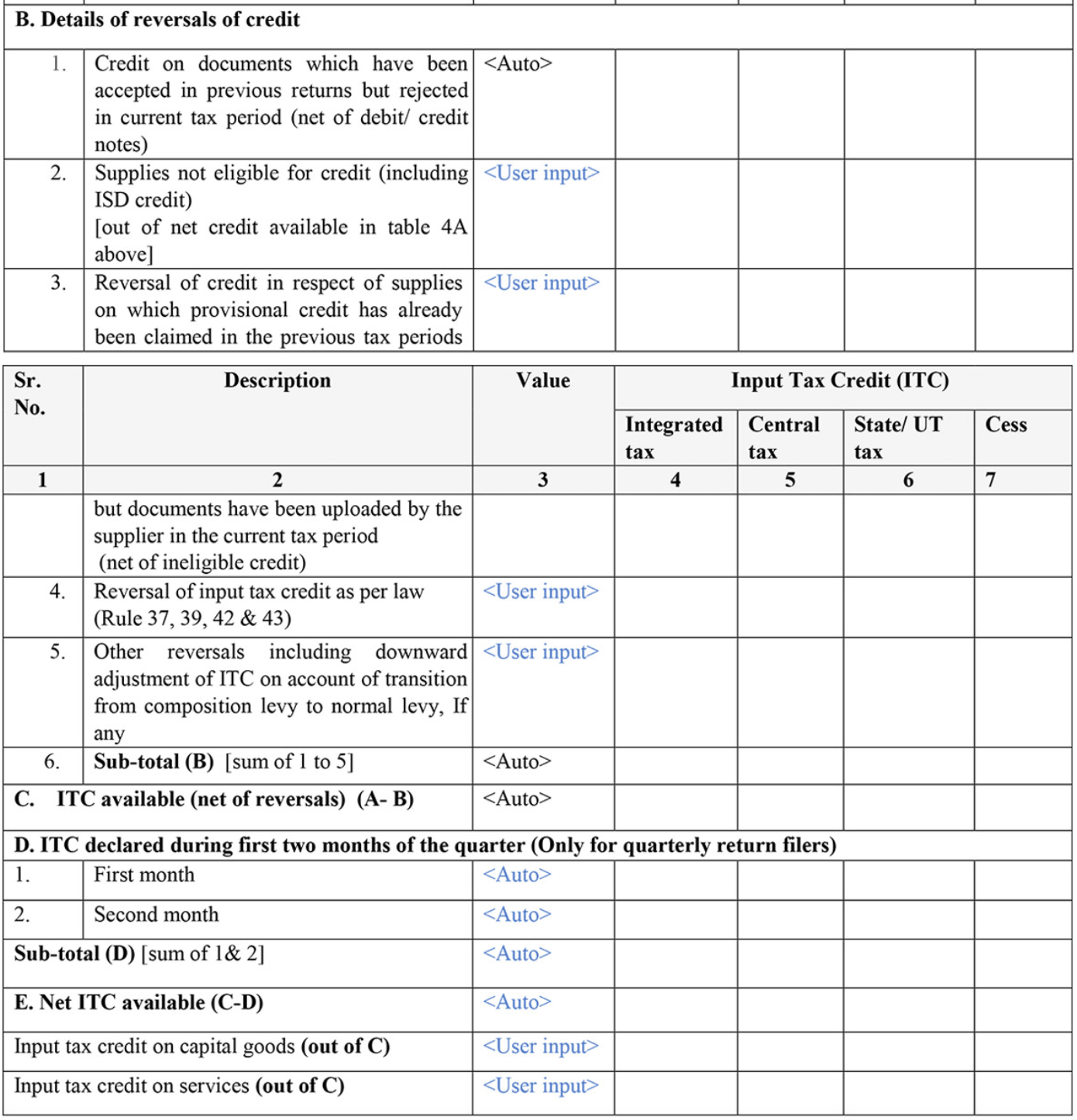

B. Details of reversals of credit

In this section you are required to fill in the value of the supply and the ITC amount for integrated tax, CGST, SGST, and cess tax for:

Credit on documents that have been accepted in previous returns but rejected during the current tax period.

Supplies that are not eligible for credit.

Reversal of credit in respect of supplies for which provisional credit has already been claimed during previous tax periods, and for which documents have been uploaded by the supplier only in the current tax period.

Reversal of ITC.

Other reversals including downward adjustments of ITC on account of transition from the composition scheme to the normal scheme.

The total of all the above quantities.

C. ITC available (A-B)

Compute the difference between sections A and B.

D. ITC declared during the first 2 months of the quarter

Here, you are required to enter the amount of ITC declared during the first and second month of the quarter.

E. The net ITC available

Compute the amount of ITC on capital goods and services out of section C above.

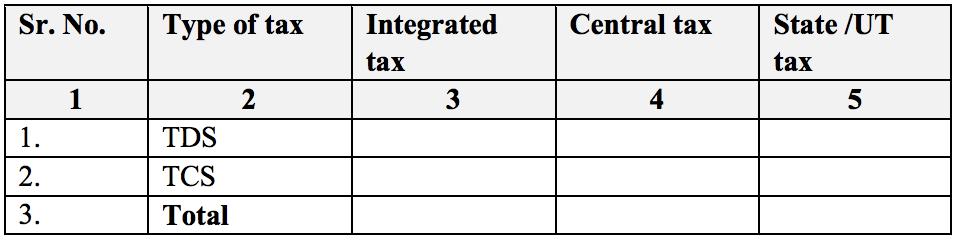

Part 5: Amount of TDS and TCS credit received in electronic cash ledger

In this part, you are required to fill in the amount of integrated tax, CGST, and SGST/UGST received under TDS (Tax Deducted at Source) and TCS (Tax Collected at Source).

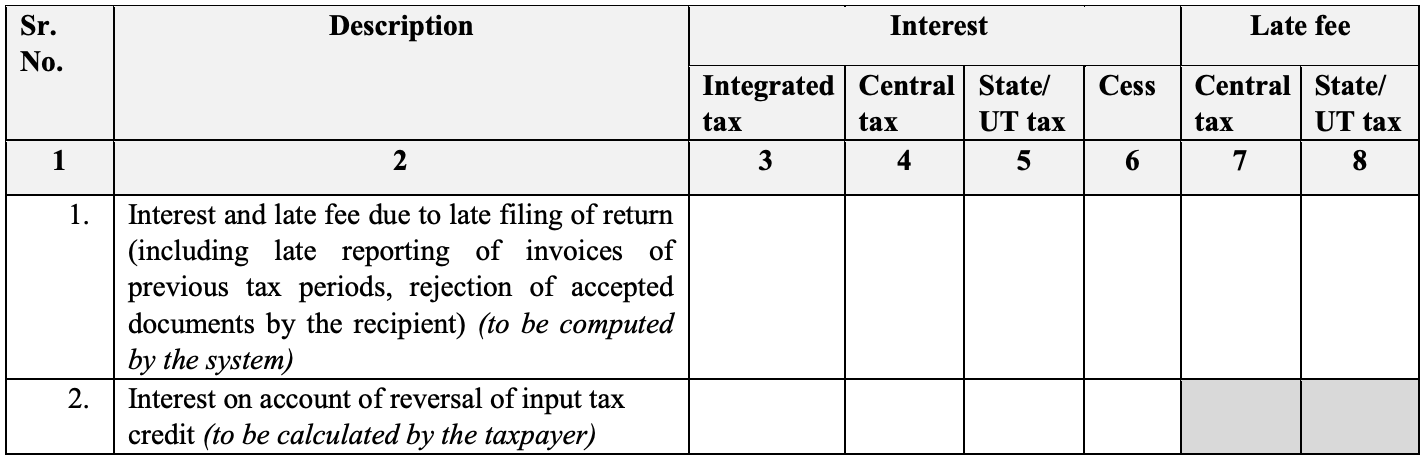

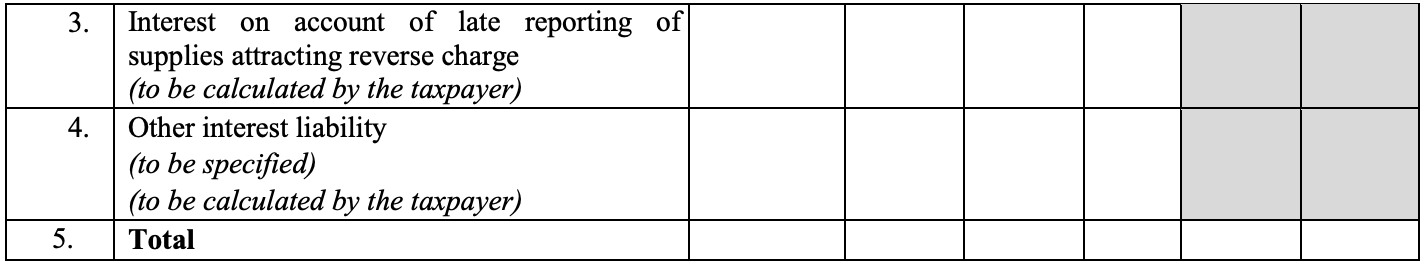

Part 6: Interest and late fee liability details

Here, you are required to enter the amount of interest applicable under integrated tax, CGST, SGST/UGST, and cess tax, and the late fee applicable under CGST and SGST due to the following:

Late filing of returns, including late reporting of invoices from previous tax periods and rejection of accepted documents by recipient.

Interest on account of reversal of ITC.

Interest on account of late reporting of supplies attracting reverse charge.

Any other interest liability.

The total of the above quantities.

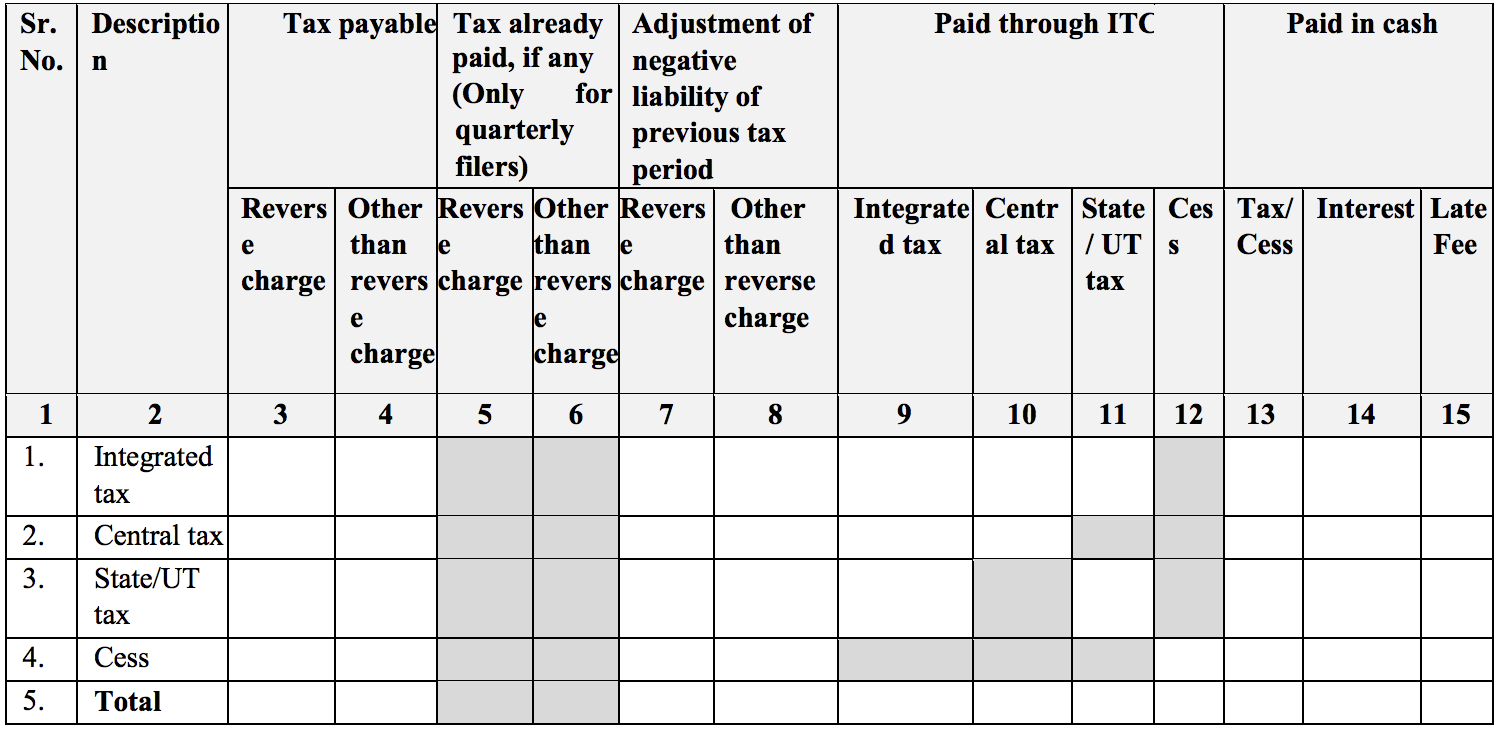

Part 7: Payment of tax

In this part of the form, you are required to enter the values of your payable tax, paid tax, adjustment of negative liability incurred during the previous tax period, payments made through ITC, and payments made in cash for:

Integrated tax

CGST

SGST

Cess

The total of the above quantities.

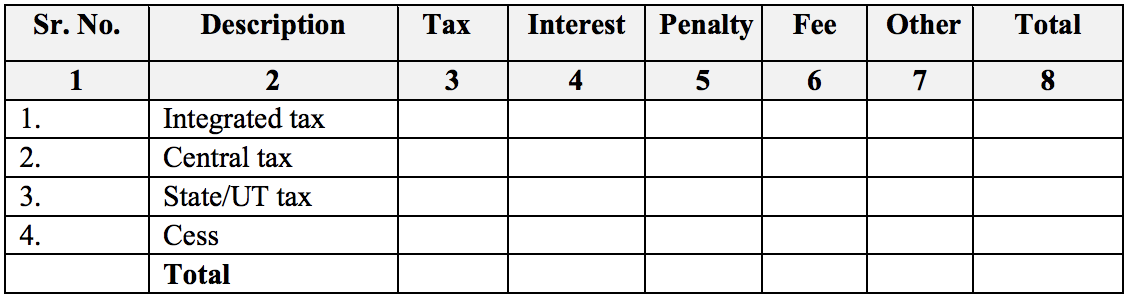

Part 8: Refund claimed from electronic cash ledger

In this section, you are required to enter details related to the refund amounts claimed from the electronic cash ledger. Enter the tax amount, interest, penalty, fee, other amounts and the total amounts.

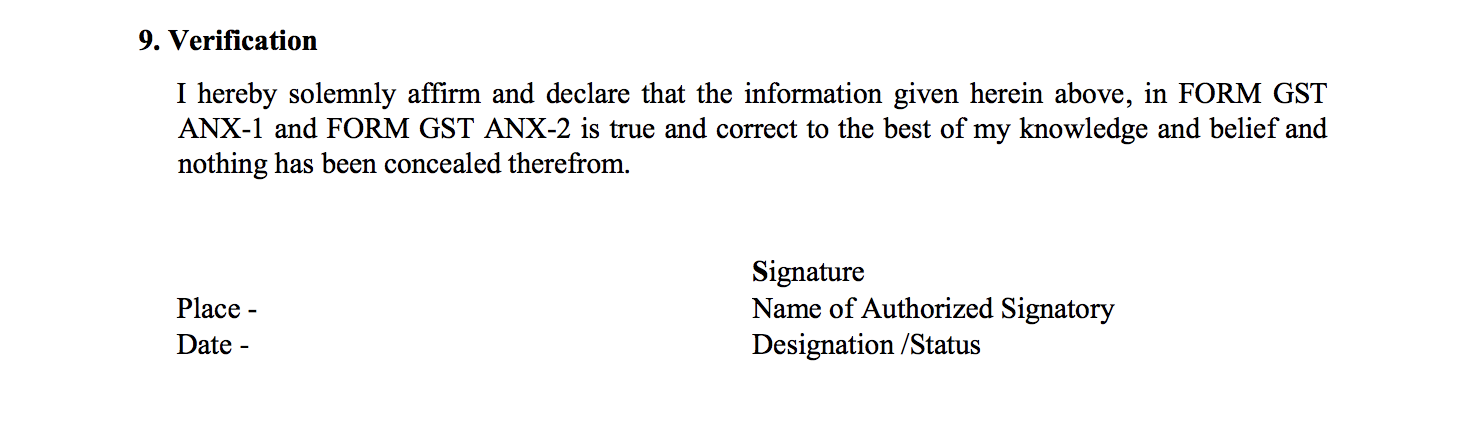

Part 9: Verification

Filling in and signing the final part of the form will verify and authenticate the return either through a digital signature certificate (DSC) or by using an Aadhar-based signature verification mechanism.

Form GST ANX-1A

Form GST ANX-1A is an amendment for details of both your outward and inward supplies that attract reverse charge. Here is a detailed explanation of the form:

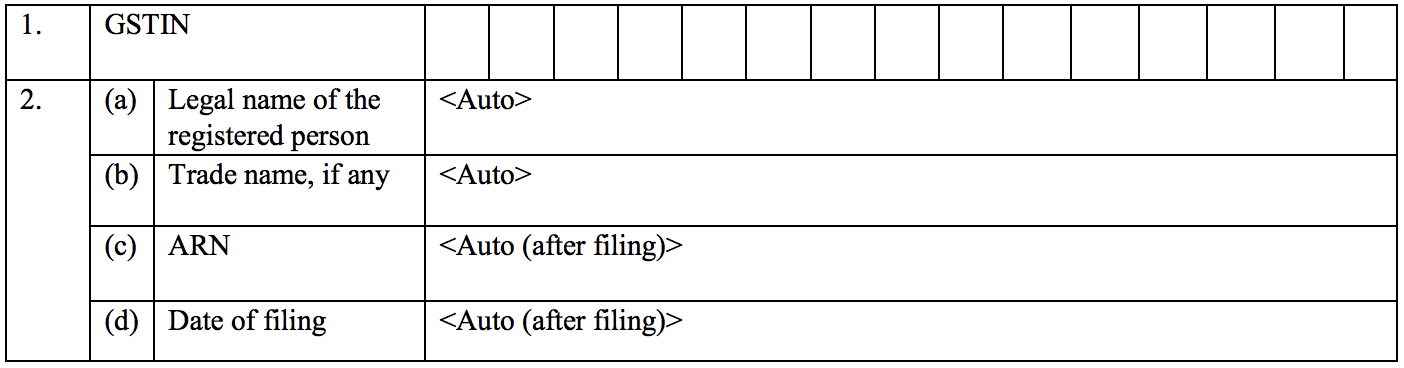

Part 1 and 2: General details

The first two parts of this annexure are for your general details: GSTIN, full legal name, trade name, ARN (Application Reference Number), and the date of filing.

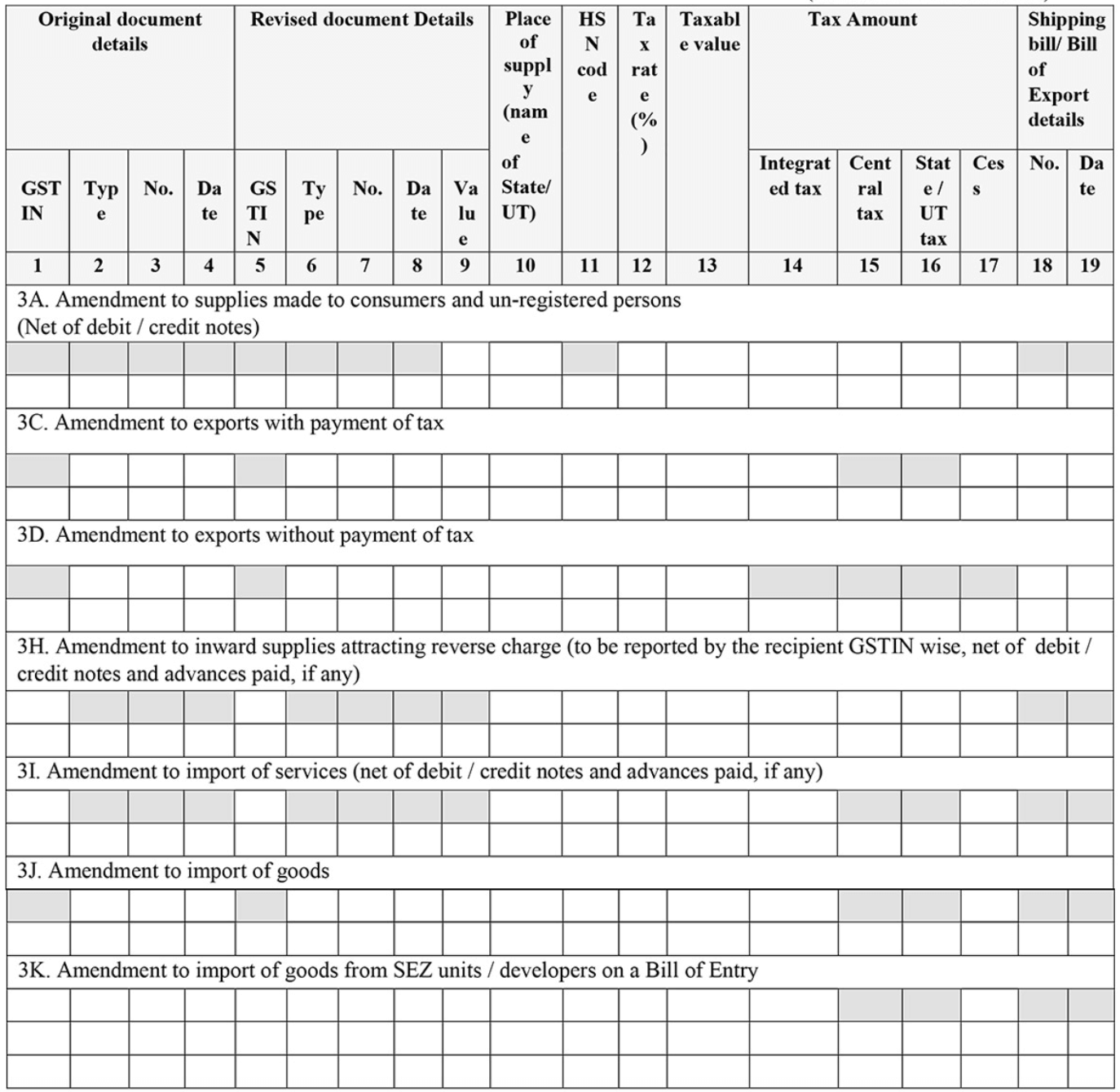

Part 3: Amendement to details of outward and inward supplies for which reverse charge applies

In this section, you are required to enter the changes or amendments of details that were previously entered in Form GST ANX-1. Enter your details related to your original document, revised document, place of supply, HSN code, tax rates, taxable value, tax amounts, and details regarding your shipping bill or bill of export for the following:

Amendment to supplies made to your consumers and other un-registered persons.

Amendment to exports with payment of tax.

Amendment to exports without payment of tax.

Amendment to inward supplies attracting reverse charge. This is the net of debit or credit notes and any advances paid, and it is to be reported by the recipient GSTIN-wise.

Amendment to import of services.

Amendment to import of goods.

Amendment to import of goods from SEZ units/developers on a Bill of Entry.

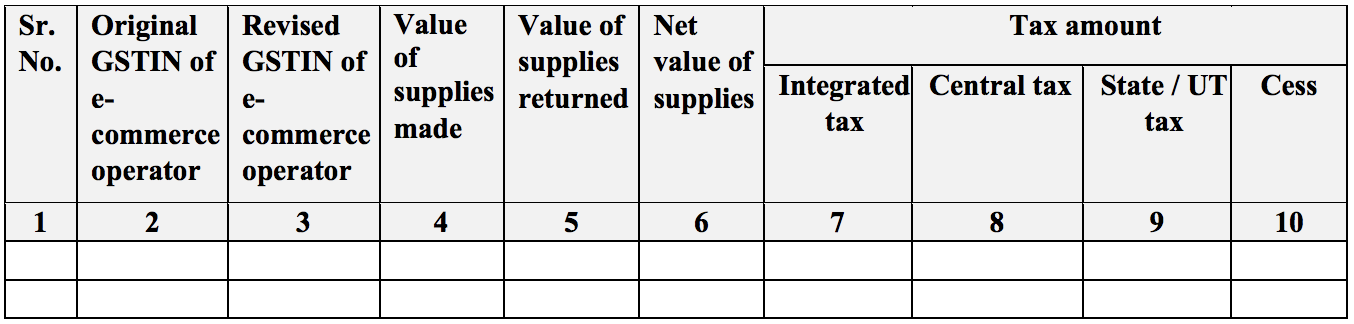

Part 4: Amendment to the details of the supplies made through e-commerce operators liable to collect tax under section 52

This part of the form is for you to make any amendments to the details of the supplies made through e-commerce operators. Enter the original GSTIN of the e-commerce operator, revised GSTIN of the e-commerce operator, value of supplies made, value of supplies returned, net value of supplies, and the amount of integrated tax, CGST, SGST/UGST, cess tax.

FORM GST RET-1A

Form GST RET-1A is an amendment to the quarterly return GST RET-1, also called the normal return. Here is a detailed explanation of each section of the form:

Part 1 and 2: General details

The first two parts of this annexure are for your general details. Enter your GSTIN, full legal name, trade name, ARN (Application Reference Number), and the date of filing.

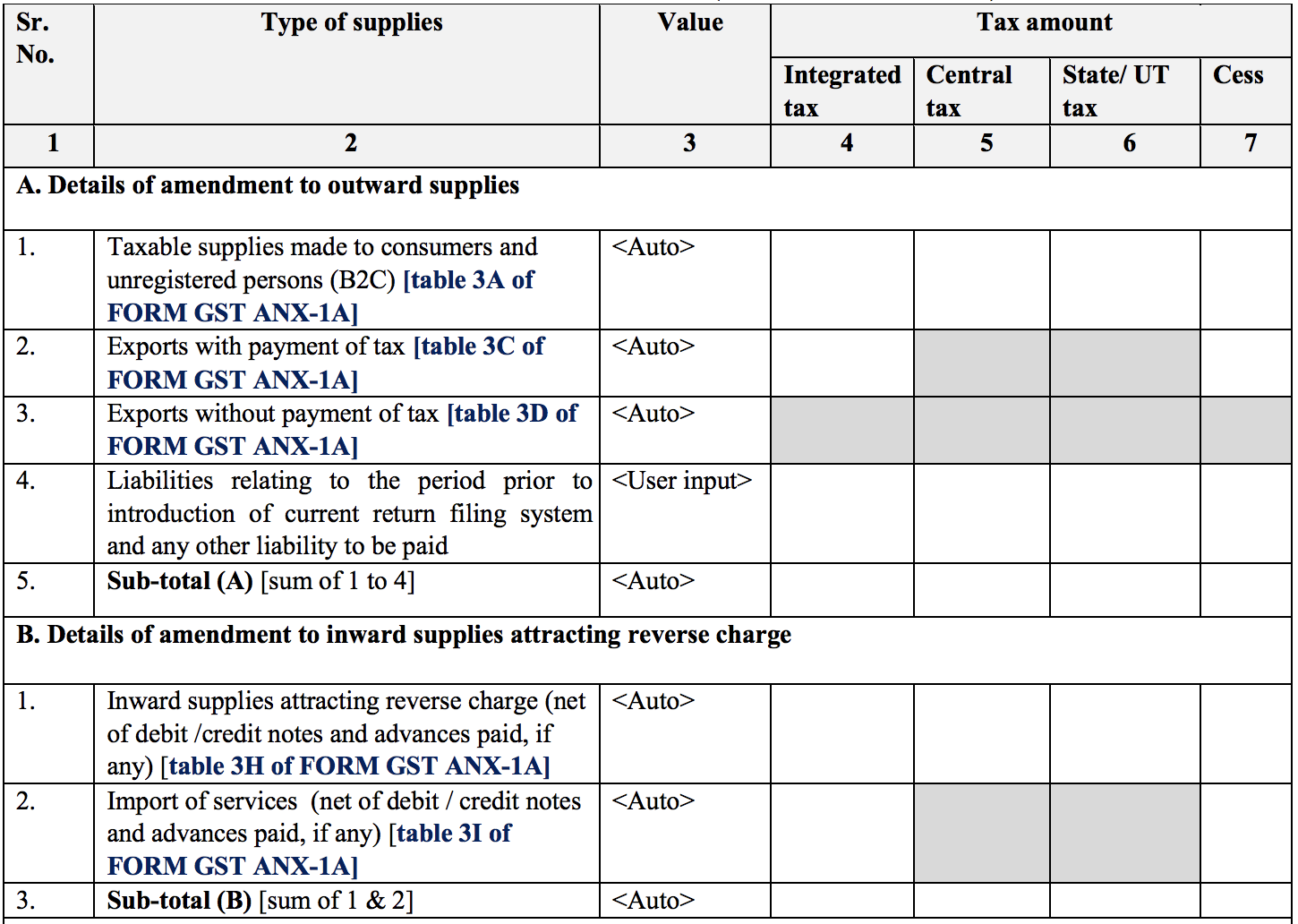

Part 3: Amendment to summary of outward and inward supplies that attract reverse charge and tax liability

A. Details of amendment to outward supplies

This part of the form is where you are required to fill in details of your outward supplies. Enter the integrated tax, CGST, SGST, cess amount, and value of:

The taxable supplies that you have made to your customers and unregistered persons.

Your exports with payment of tax.

Your exports without payment of tax.

The liabilities relating to the period before the introduction of current return filing system and any other liability to be paid.

The total amount of the above quantities.

B. Details of amendment to inward supplies attracting reverse charge

Fill in details of your outward supplies here. Enter the integrated tax, CGST, SGST, cess amount, and value of:

Inward supplies attracting reverse charge.

Import of services.

The total of the above quantities.

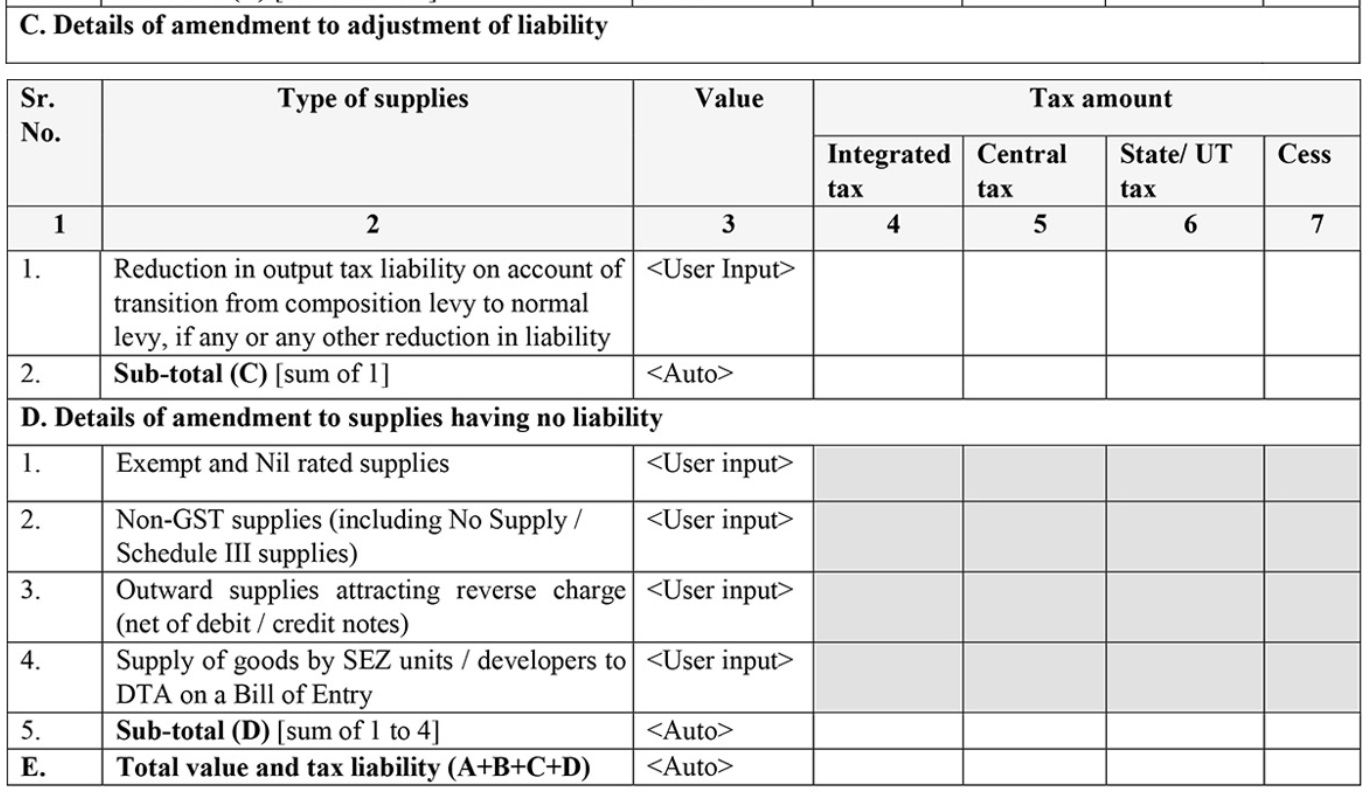

C. Details of amendment to adjustment of liability

Here, fill in details of your outward supplies. Enter the integrated tax, CGST, SGST, cess amount, and value of:

The amount of reduction in output tax liability on account of the transition from the composition scheme to the normal scheme.

The subtotal of the above quantities.

D. Details of amendment to supplies having no liability

Here, fill in details of your outward supplies. Enter the integrated tax, CGST, SGST, cess amount, and value of:

Exempt and nil-rated supplies.

Non-GST supplies.

Outward supplies for which reverse charge applies.

Supply of goods by SEZ units/developers to DTA on a Bill of Entry.

The total of the above quantities.

E. Total value and tax liability (A+B+C+D)

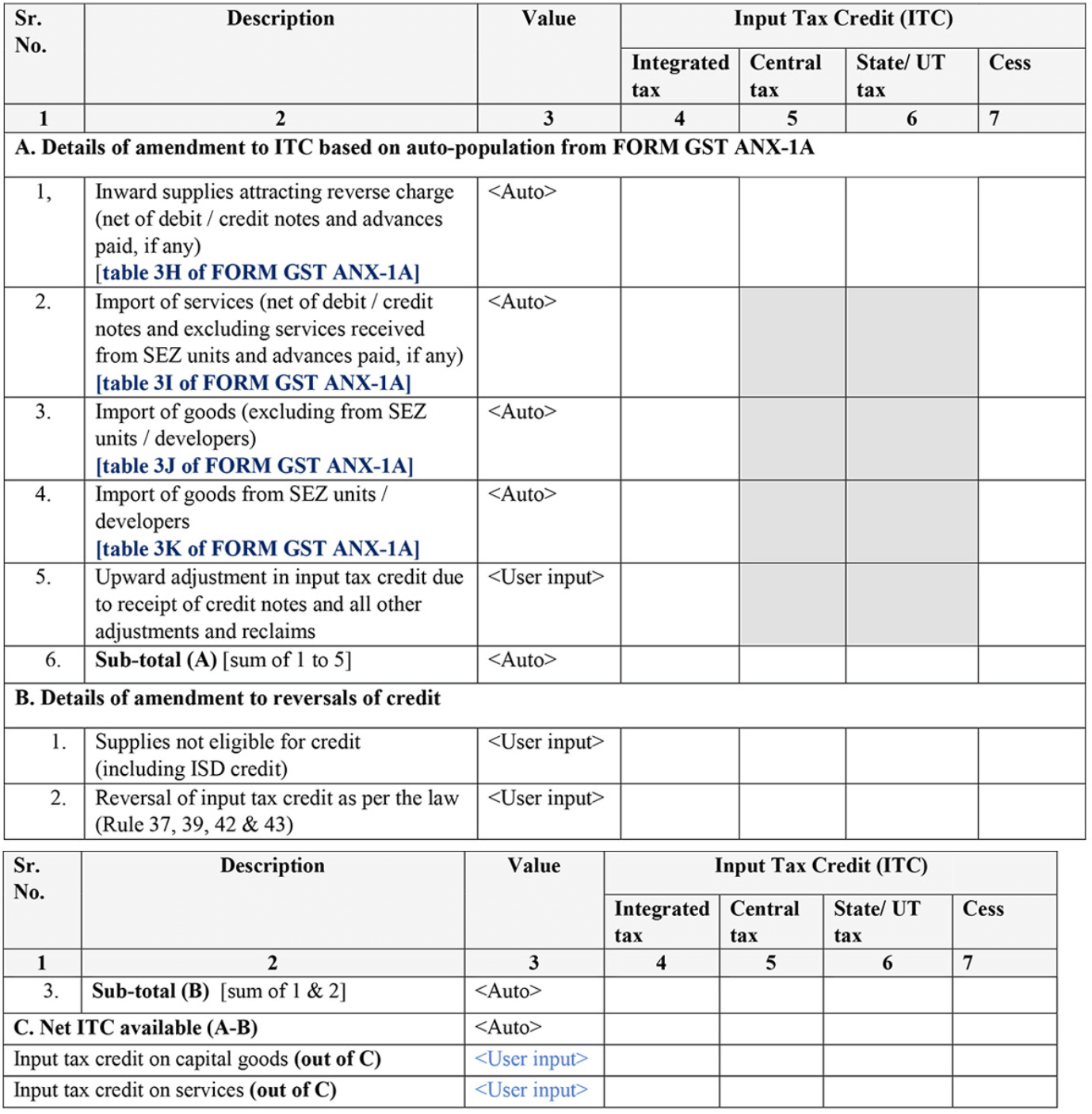

Part 4: Amendment to summary of inward supplies for claiming ITC

A. Details of amendment to ITC based on auto-population from Form GST ANX-1A

This is where you are required to fill in details of your inward supplies. Enter the ITC value of your integrated tax, CGST, SGST, cess amount, and value of:

The inward supplies for which reverse charges are applicable and advances have been paid, if any apply.

The import of services.

The import of goods.

The import of goods from SEZ units/developers.

Upward adjustment in the ITC due to receipt of credit notes and all other adjustments and reclaims.

The total of the above quantities.

B. Details of amendment to reversals of credit

This is where you are required to fill in details of your inward supplies. Enter the ITC value of your integrated tax, central tax, and cess amount, CGST, SGST, and value of:

The supplies that are not eligible for credit.

The reversal on ITC as per the law.

The total of the above 2 quantities.

C. Net ITC available (A-B)

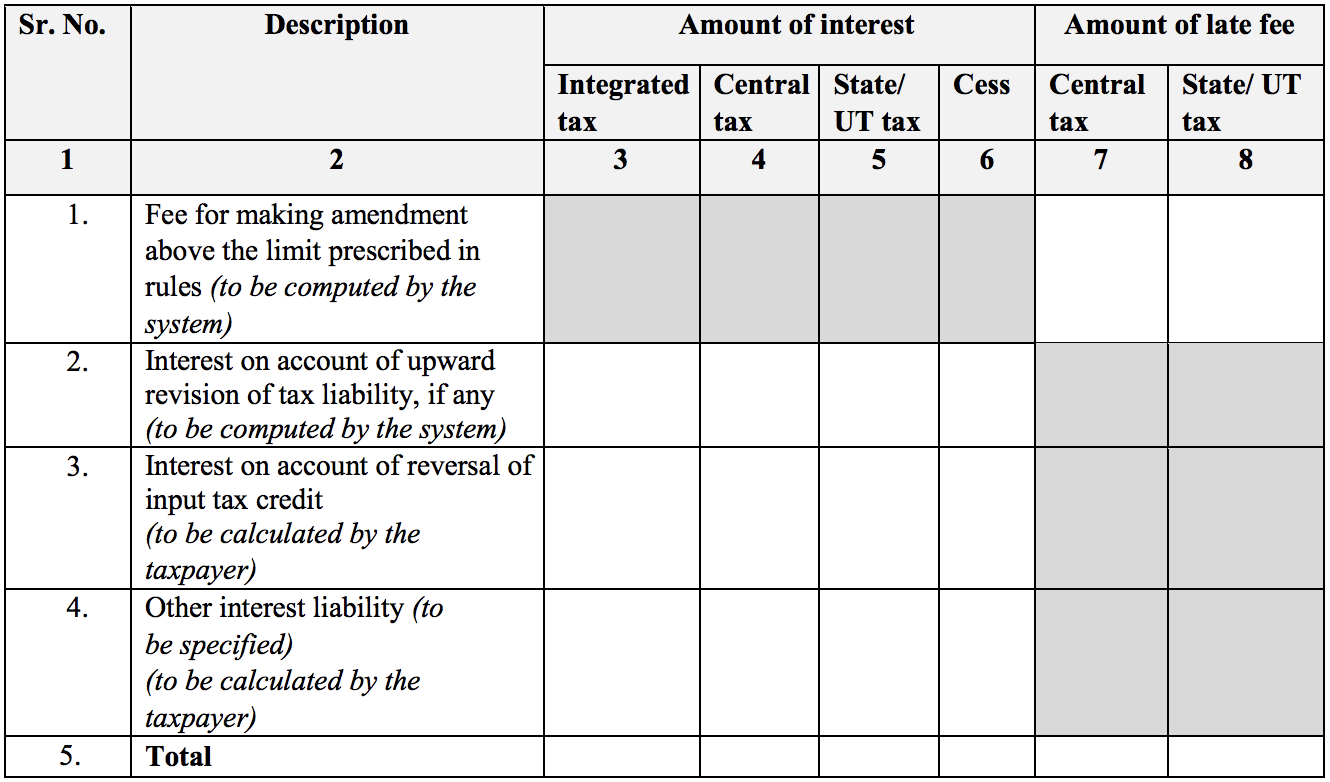

Part 5: Interest and late fee details

In this section, you are required to fill in details of your interest and late fees for:

Making amendments higher than prescribed by GST rules.

Any upward revisions of tax liability.

Any reversal of ITC.

Other interest liabilities that have not been mentioned above.

The total of all the above quantities.

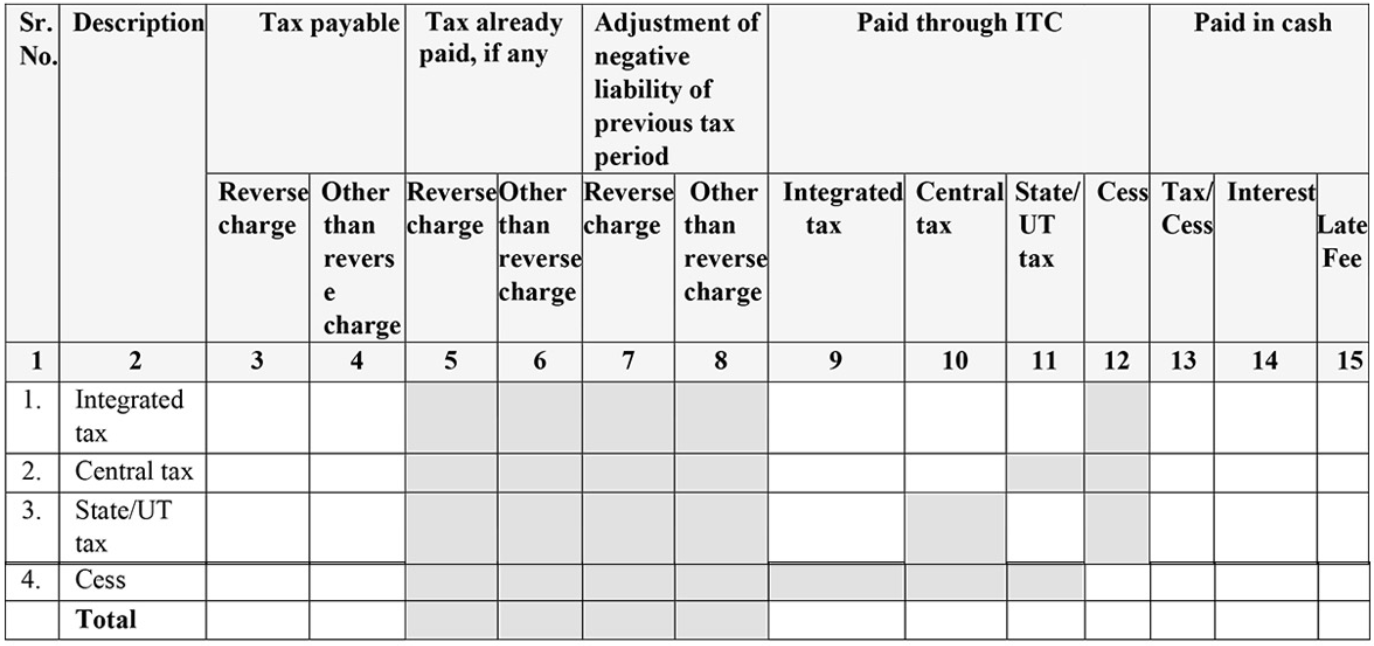

Part 6: Payment of tax

In this part of the form, you are required to enter the values of your payable tax, paid tax, adjustment of negative liability incurred during the previous tax period, payments made through ITC, and payments made in cash for:

Integrated tax

CGST

SGST

Cess

The total of the above quantities.

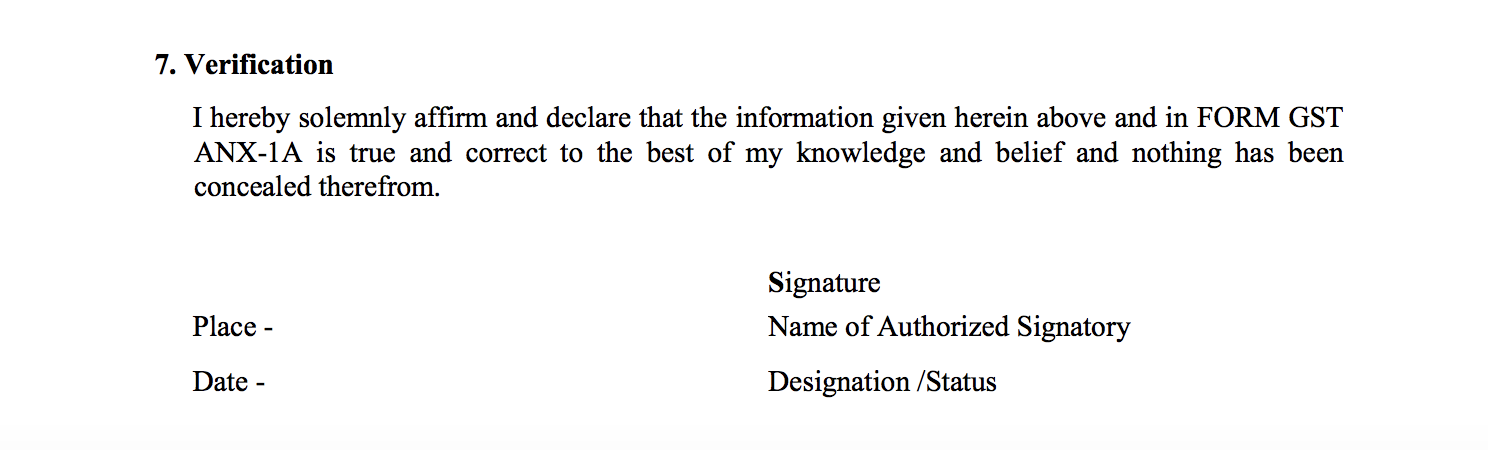

Part 7: Verification

Filling in and signing the final part of the form will verify and authenticate the return either through a digital signature certificate (DSC) or by using an Aadhar-based signature verification mechanism.

Form GST PMT-08

GST PMT-08 is the form that must be filed on a monthly basis, when making payments of self-assessed tax. Here is a detailed explanation of each section of the form:

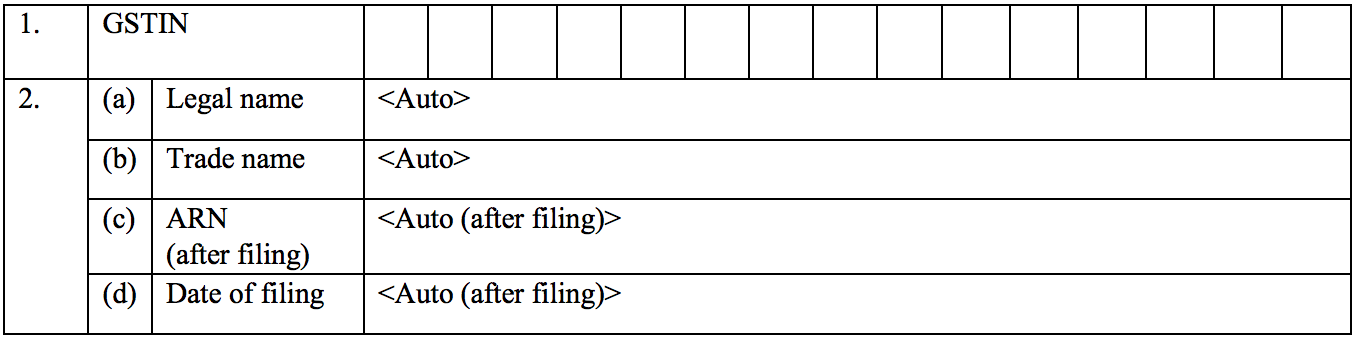

Part1 and 2: General details

The first two parts of this annexure are for your general details: GSTIN, full legal name, trade name, ARN (Application Reference Number), and the date of filing.

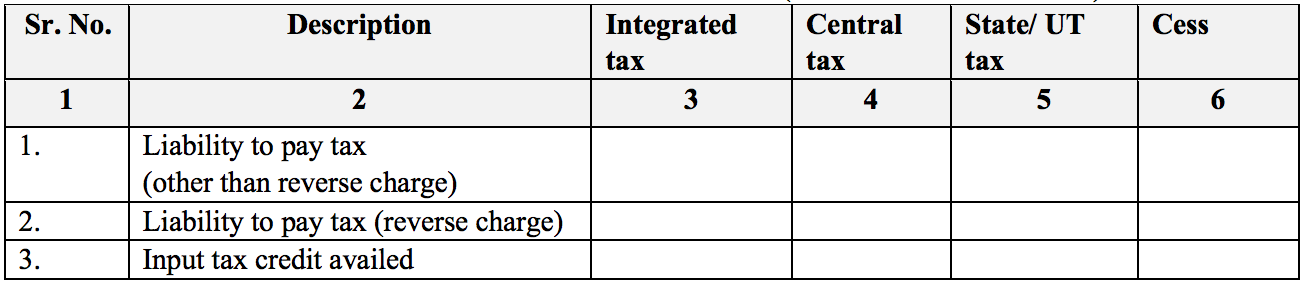

Part 3: Summary of self-assessed liability and ITC availed

In this section, you are required to enter the relevant amount of integrated tax, CGST, SGST/UGST, and cess tax for the following:

Any liability to pay taxes besides those under reverse-charge.

Any liability to pay tax under reverse-charge.

The amount of ITC that you have availed.

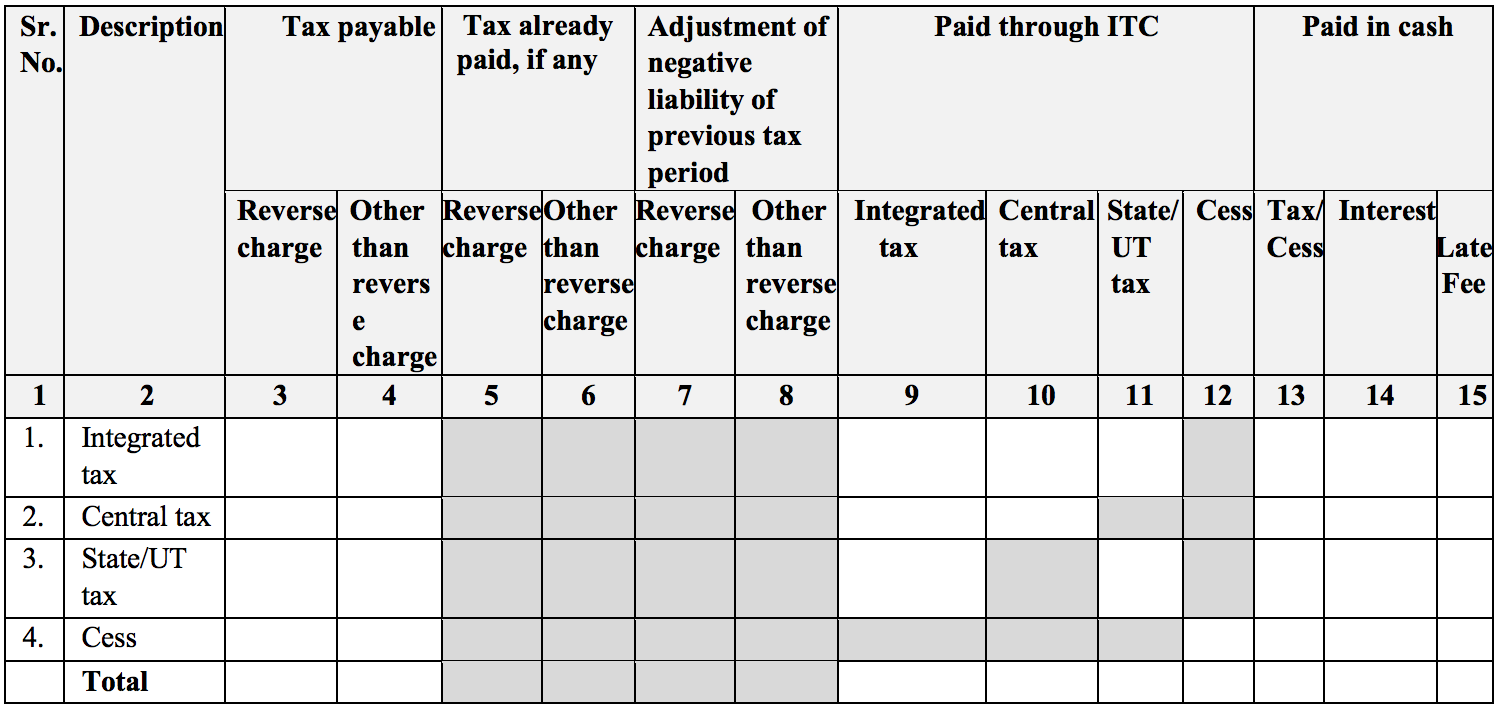

Part 4: Payment of tax

This part of the form is for details related to your tax payments. You are required to enter the amounts of tax payable, tax paid, adjustment of negative tax liability accumulated during the previous tax period, tax paid through ITC, and tax paid in cash for the following:

Integrated tax

CGST

SGST/UGST

Cess tax

Part 5: Verification

The final part of this form is verification. Filling in and signing the final part of the form will verify and authenticate the return either through a digital signature certificate (DSC) or by using an Aadhar-based signature verification mechanism.