What is a delivery challan?

Most supplies of goods and services involve the creation of a tax invoice. However, in some cases where no actual sale of goods/services takes place, a delivery challan is generated instead. For example, during the transportation of goods from one warehouse to another, a tax invoice is not needed.

When is a delivery challan issued under GST?

A delivery challan is issued in the following cases:

- When the quantity of the goods delivered is not known. Example: a supply of liquid gas where the exact quantity is not known at the time of dispatch from the place of business.

- Supply of goods for job work (when goods are dispatched for further processing). The delivery challan is required whether it’s an interstate or an intrastate sale.

- Transportation of goods for reasons other than sale. Example: transferring goods from one warehouse to another.

- Certain other transactions as specified by the Central Board of Excise and Customs(CBEC).

Three copies of the delivery challan must be created: an original for the consignee (the buyer who is financially responsible for the receipt of goods), a duplicate for the transporter, and a third copy or triplicate for the consignor (the seller).

Format of a delivery challan:

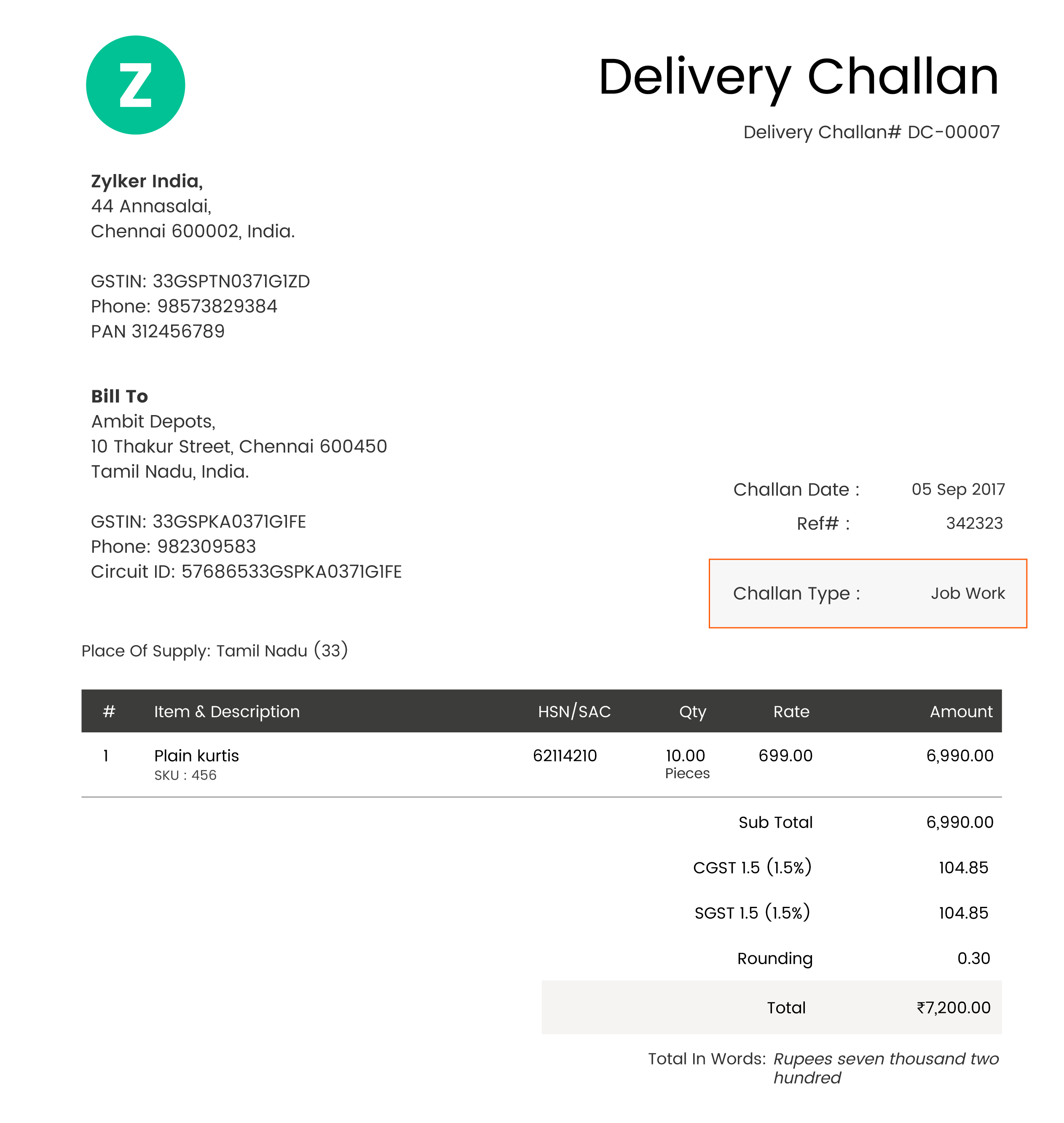

Based on the rules prescribed by the Government, here is what a sample delivery challan will look like in the GST regime:

- The header of the delivery challan should contain the logo, name, address, GSTIN, and CIN (Challan Identification Number) of the consignor’s organization.

- In the next section, mention the date and the challan number.

- Place of supply, state of issue, state code (first 2 digits of the GSTIN), mode of transportation, and vehicle number of the consignor.

- State, state code, and GSTIN of the consignee.

- Description and HSN code of the product.

- Unit of measurement (UOM) such as kilograms, liters or pieces, and quantity of the product involved in this transaction.

- Rate per unit of the product, total amount (calculated by multiplying the rate by the quantity), discount offered (if any), and the total taxable value.

- GST amount (IGST value for intrastate transactions, and CGST and SGST values for interstate transactions).

- Calculated total.

Note: The above mentioned values are not for sale, they are usually mentioned in case of goods supply for job work.

- Total taxable amount and total GST; the sum of these is the Invoice Total.

- Terms and conditions that are regulated by the firm.

- The delivery challan should be authorized by the consignor, after certifying that the particulars provided in the form are true and correct. When goods are transported with a delivery challan instead of a tax invoice, the same details should be furnished in the form (waybill). If a tax invoice could not be issued at the time goods were dispatched for sale, the seller should issue the tax invoice after the goods have been delivered.

When goods are being transported in batches (for example, a large order delivered in several smaller shipments over a period of time), the following steps should be carried out:

- The supplier should issue a complete invoice before dispatching the first batch of goods.

- The supplier should issue a delivery challan for every subsequent batch and along reference the original invoice.

- Each batch of goods should be accompanied by copies of the corresponding delivery challan and an authorized copy of the invoice.

- The last batch should be dispatched along with the original invoice.