What is a debit note?

Debit notes are usually issued to rectify erroneous values recorded in previous invoices. For example, if a product costs Rs. 450, and the invoice is wrongly recorded as Rs. 400, then a debit note of Rs. 50 is issued by the seller. At times, a debit note may be issued by the vendor to request a credit note from the customer. GST tax invoices cannot be changed once they’re uploaded on the GSTN portal, so if changes need to be made, debit notes are issued.

When is a debit note issued?

A debit note is issued when the recipient owes the supplier. Here are some cases:

- The tax amount shown in an invoice is less than the actual payable amount. Example: When the total tax amount of the invoice adds up to Rs. 500, but it’s wrongly recorded as Rs. 400.

- The taxable value of the supply mentioned in the invoice is less than the actual amount. Example: When a product that should be under the 18% GST tier is wrongly taxed at taxed at 12% instead.

- A registered person may issue a consolidated debit note for multiple invoices issued in throughout a financial year.

When a debit note is issued, it’s accompanied by a supplementary invoice. A supplementary invoice is issued when there are errors in the original tax invoice.

Format of a debit note

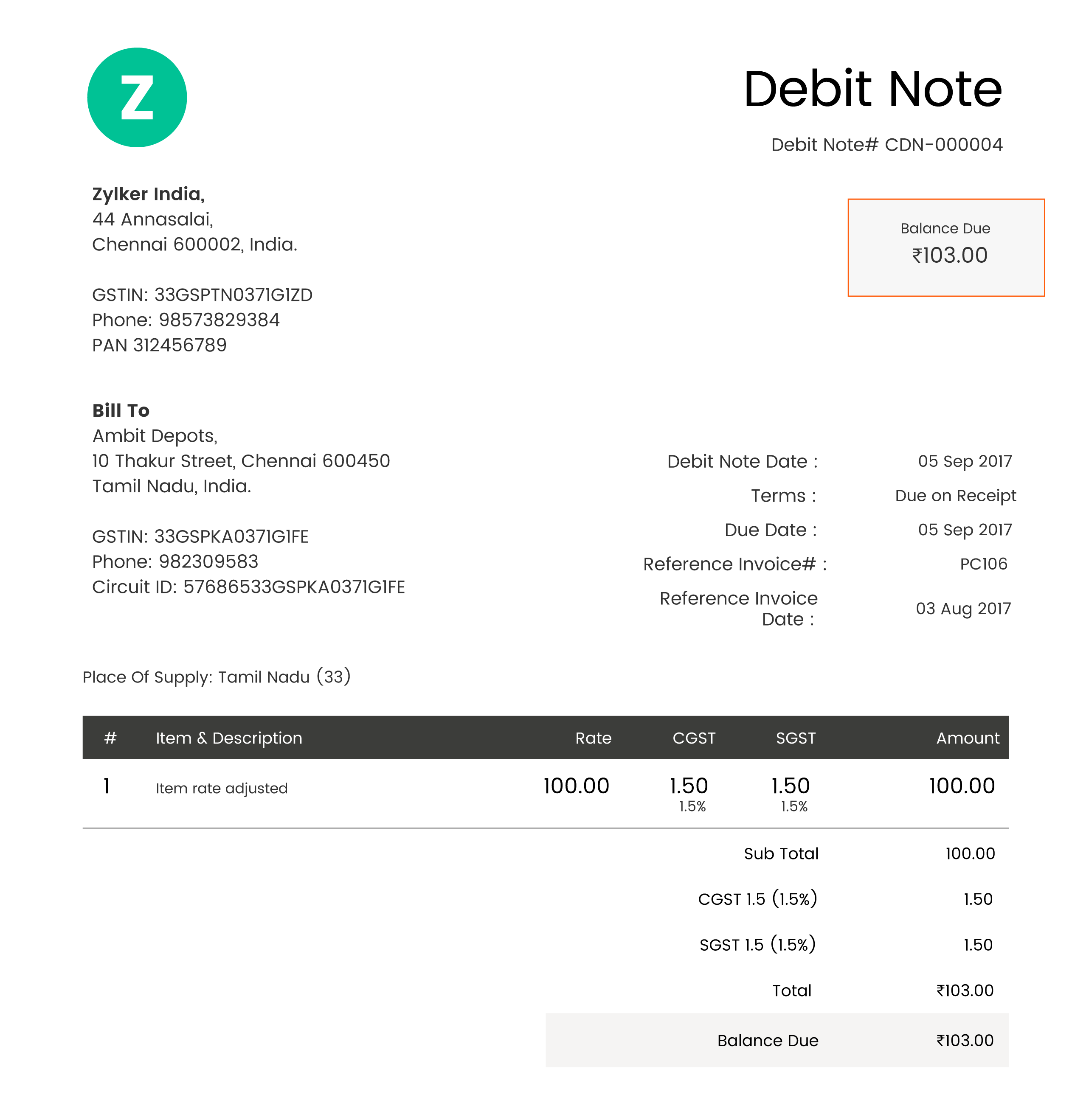

Based on the rules prescribed by the Government, here is what a sample debit note will look like in the GST regime:

- The word “Revised Invoice”, should appear wherever applicable.

- Name, address, and GSTIN of the supplier

- Nature of the document (DEBIT NOTE, in this case), unique serial number (containing only alphabets and/or numerals), and date of issue of the debit note.

- Name and address of the recipient. If the recipient is registered for GST, provide their GSTIN/UIN, and if the recipient is not registered under GST, mention their State and State code.

- Serial number and date of the corresponding tax invoice or the bill of supply (whichever one was originally issued)

- Value of the taxable goods and services involved in the sales transaction

- Tax rate, and the amount of tax to be debited to the recipient

- Signature or digital signature of the authorized supplier

Procedure

The supplier should furnish details of a debit note while filing returns for the month in which the debit note was issued. The tax liability will be adjusted accordingly.

Time limit

There is no time limit to issue a debit note. However, once a debit note is issued, the supplier should declare it to their monthly return no later than the following month.

The debit note details should be furnished either by the September following the financial year in which the sales transaction was carried out, or by the date of filing of the relevant GSTR-9 annual return, whichever is earlier.

If the seller does not adhere to the time limit, the debit note may not be considered for adjusting tax liability.

A debit note should prominently contain the words ‘INPUT TAX CREDIT NOT ADMISSIBLE’, if it’s issued in the following cases:

- In case of unpaid tax, short paid tax, wrong refunds, wrongly availed or fraudulent utilization of ITC, furnishing fake details on purpose, suppression of facts. (SECTION 74).

- Detention or seizure of goods and vehicles involved in transit. (SECTION 129)

- Confiscation of goods or vehicles involved in transit, and levy of penalty. (SECTION 130)