- HOME

- Taxes & compliance

- Kenya VAT: All you need to know to stay VAT compliant

Kenya VAT: All you need to know to stay VAT compliant

Among the taxes administered in Kenya, the value added tax (VAT) is one of the prime taxes impacting business owners. This guide will take you through the basics of Kenya VAT—from its rates to registration and returns—so you can stay compliant and carry your business forward with ease!

VAT in Kenya

The value added tax is a tax that is applicable to the sale or import of taxable goods and services, and is administered by the Kenya Revenue Authority (KRA).

If you sell taxable supplies worth 5,000,000 KES or more within a year, you must register with the KRA for VAT. Once you’ve registered, you are required to file monthly returns and remit the VAT you’ve collected from your customers.

How does VAT work?

This tax is charged at every point in the production chain until it reaches the final consumer. So, if you are selling a box of chocolates, VAT would be applied at every stage, from when the cocoa is sourced to when it is sold to you by a wholesaler. You will then apply VAT when you sell it to the final consumer.

VAT rates in Kenya

There are three tax rates that apply across Kenya:

16% – the standard rate for taxable goods and services, as well as imports

8% – the rate applied to the local supply of fuel, petroleum oils, etc.

0% – the rate applied to exports, international passenger transport, and zero-rated supplies (such as supplies sent to EPZs, diplomats, and governments)

Note: There is a 3% turnover tax on businesses below the VAT registration threshold, between KES 100,000 and 500,000.

Calculating VAT in Kenya

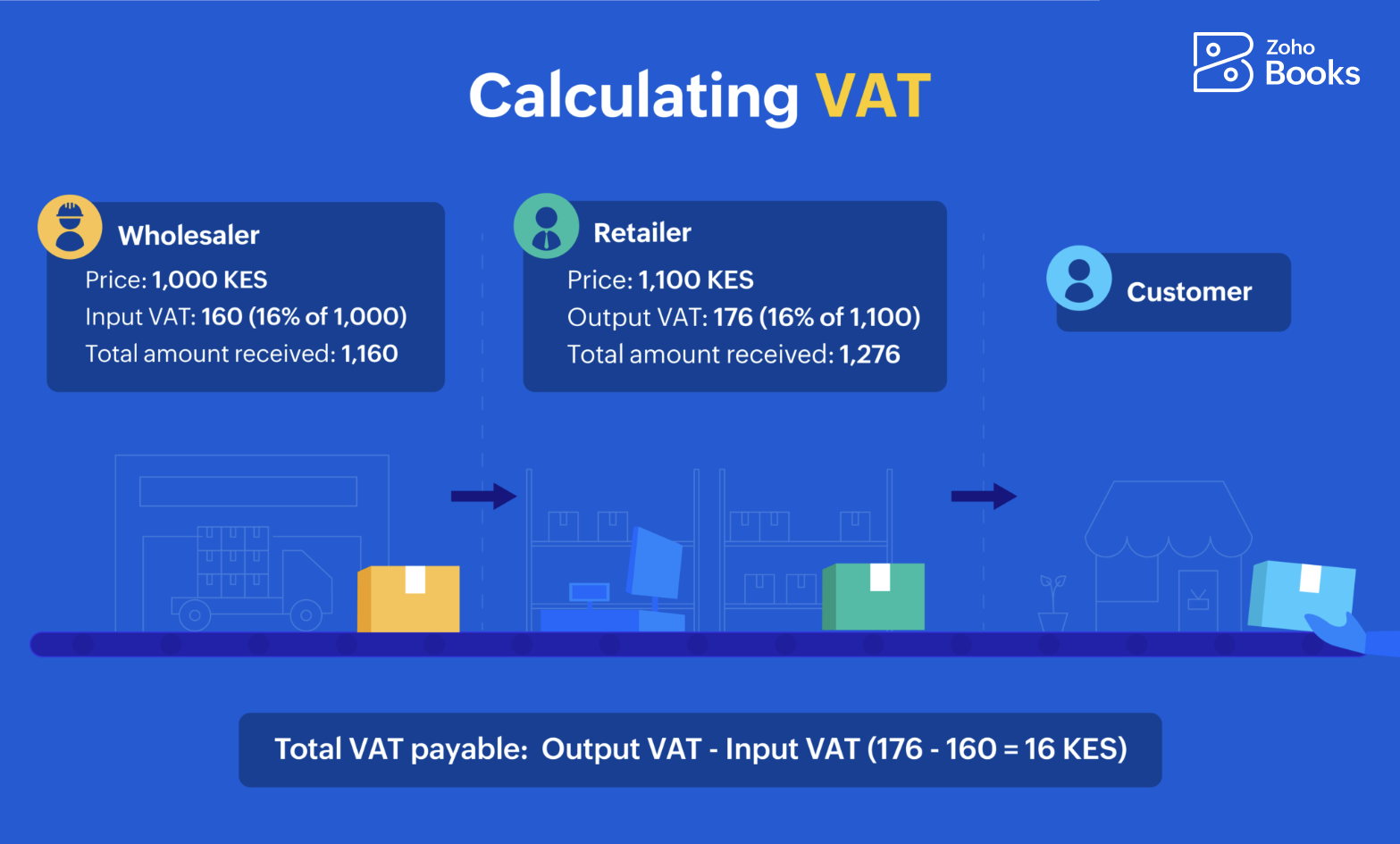

The VAT you pay to your seller when you buy something from them for resale is called input VAT, while the VAT you charge your buyer while making a sale is called output VAT.

VAT is the difference between the Output and Input tax.

VAT payable = Output VAT – Input VAT

For instance, if you bought clothes for 1,000 KES taxed at 16%, you would have to pay 160 as the input VAT. So, the total amount you would have to pay would be 1,160 KES. Then, if you sell the same clothes at a profit of 10% of the price (10% of 1,000) for 1,100 and add the output VAT of 16% (176), the total selling price would be 1,276 KES.

So, the VAT payable = Output VAT – Input VAT (176 – 160 = 16 KES)

VAT registration

If you are making taxable sales (except the sale of capital goods) in Kenya worth KES 5 million annually, you need to register for VAT.

You can register online via iTax, the official portal to register and file returns.

Source: iTax website

Once you’ve registered, you need to start collecting VAT from your customers whenever you make taxable sales or issue invoices. You can start collecting VAT as soon as you receive your Personal Identification Number (PIN). This PIN can also be used to pay the VAT amount after filing your returns. In the case of imports, you need to collect the amount from your customer as soon as the customs clearance for imports has been completed.

Note: There’s a 16% VAT on online services (such as software downloads, movies, e-learning, and more) provided by non-residents via digital marketplaces. So, non-residents have to register for VAT (there is no VAT registration threshold), but there won’t be an option to recover Kenyan input VAT through this registration.

VAT exempt supplies

VAT exempt supplies are those that won’t be subject to VAT, and would not qualify for an input tax deduction.

Some exempt supplies include:

Unprocessed agricultural products and agricultural services

Medical supplies (like physiotherapy accessories, treadmills, and ventilators)

Financial services and insurance

Suppliers of imported digital services will also be exempt from VAT, as they are excluded from meeting the KES 5 million VAT registration threshold.

Filing VAT returns

VAT returns have to be filed on a monthly basis via iTax. For each month, the return should be filed by the 20th of the following month. If you don’t have any VAT to declare, you need to file a nil return.

After filing it online, you have to generate an E-slip (from the same iTax portal) which is used to to physically pay the tax amount at KRA-appointed banks. However, instead of showing up physically, you can also authorize your bank to pay your VAT through a direct credit payment to the Commissioners account at the Central Bank of Kenya.

Input tax credits

You can claim a deduction of the input VAT (paid at the time of making a purchase) while filing returns. While the amount can be regained when you sell the same item to your customer, any additional VAT incurred can be deducted from the tax payable via your return.

Input tax can be deducted within six months of the tax period in which the sale took place.

Note: You can get a VAT refund for any VAT paid on bad debts within four years from the date of sale.

Penalties

If there’s a delay in filing returns or paying your due VAT, penalties and interest will be applied.

For late filing: A penalty of KES 10,000 or 5% of the due tax amount will apply for delayed filing of returns.

For late payment: 5% of the due tax amount and an interest of 1% per month should be paid on the unpaid tax until you pay the whole VAT amount due.

Electronic tax invoice

The electronic tax invoice is an invoice with a QR code, which is generated by a compliant Electronic Tax Register (ETR). Using this QR code, you can ensure the accuracy of your invoice details.

Issuing an electronic tax invoice is necessary for all VAT registered taxpayers. Once you’ve issued the invoice, the online copy (the electronic tax invoice) will be transmitted to KRA.

VAT on imports

Imported goods are subject to import duty at varied rates (0% for raw materials and capital goods, 10% for intermediate goods, and 25% for finished goods).

The following groups are exempt from payment of import duty:

Machinery (excluding motor vehicles) imported into Kenya solely for direct use in oil, gas, or geothermal development

Imports of goods by enterprises established under the Special Economic Zones Act and the Export Processing Zones Act

VAT on imported services is called reverse VAT. These imported services refer to:

Services provided by non-residents who don’t have to register for Kenya VAT

Services provided by export processing zones for use in Kenya

If you are importing a service, irrespective of whether you’ve registered for VAT or not, you should pay VAT on the imported service whenever the service and invoice have been received.

Taxes paid on imported services that will be used in a registered person’s business can be deducted as input tax in future VAT returns.

Withholding VAT

Withholding VAT is a process where government-appointed withholding agents collect a portion of VAT from payments made to local sellers. These withholding agents can’t be final consumers of the product or service. The amount of VAT to be withheld and remitted is 2% of the value of the taxable supplies.

This process was introduced by the government in order to maintain accuracy of details and proper payment of the due VAT amount. As a typical procedure, the agent (also a taxpayer) may have a customer who pays for the goods without paying the VAT amount. In this case, the tax agent can withhold the VAT and issue a certificate to the seller for the amount. The seller can then claim this VAT charged at 2% of the invoice value.

You can pay the withheld VAT amount online via iTax. This payment is remitted by the agent to the Commissioner on the 20th day of the month following the deduction.

If your VAT has been withheld, you still have to submit an online return and account for the VAT balance.

Note: Withheld VAT doesn’t apply to zero-rated supplies and exempt goods or services. If it is withheld, it will be treated as a tax paid in error and will be refunded by the Commissioner. For business to government (B2G) transactions, the agent must withhold 6% of the VAT due to the seller.

Following these steps and filing your VAT returns can be made much simpler if your business is powered by accounting software like Zoho Books. Zoho Books helps you stay VAT compliant while you manage your business needs!