- HOME

- Taxes & compliance

- E-invoicing in Singapore: Everything businesses need to know

E-invoicing in Singapore: Everything businesses need to know

E-invoicing is gaining traction globally, with many countries adopting it in recent times. The widespread adoption is attributed to the enhanced transparency that it brings to the table for tax reporting, besides streamlining the invoicing process.

In Singapore, the IRAS (Inland Revenue Authority of Singapore) announced an official timeline to facilitate the phased adoption of e-invoicing for businesses. According to the timeline, any GST-registered business can voluntarily adopt e-invoicing from May 1, 2025.

This article covers the basics of e-invoicing, its relevance for Singapore businesses, how the system works, compliance requirements, and other necessary information for getting started.

What is e-invoicing?

E-invoicing is the process of exchanging invoice data between businesses in a standard, machine-readable format often through a government-approved electronic system or network. This process may also involve transmitting invoice data to the tax authority—either in real time or at defined intervals—to support tax reporting.

E-invoice vs. traditional invoice

E-invoicing is different from other digital invoices; people often confuse e-invoices with other electronic file formats. Files like PDFs do not have a standardised data structure, which makes them unviable for data interpretation by machines. On the contrary, e-invoicing uses formats like XML or JSON that structure data in a way that can be interpreted by machines. This key feature makes e-invoicing comparatively more efficient than other models, as the invoice data can be instantly read by accounting and finance systems, significantly reducing the time required for data processing. Additionally, e-invoices have comparatively smaller file sizes, making them suitable for large-scale adoption.

E-invoicing in Singapore

Singapore businesses subjected to the e-invoicing mandate or the ones planning to adopt it voluntarily should be aware of the following information to ensure smooth adoption.

Data format and file format

The Singapore e-invoicing framework uses a localised version of the PEPPOL BIS Billing 3.0 data format known as SG PEPPOL BIS Billing 3.0. This version contains additional fields and rules specific to Singapore regulatory requirements. As a result, e-invoices remain globally interoperable while adhering to the reporting and compliance needs of Singapore businesses. The prescribed file format for Singapore e-invoicing is XML.

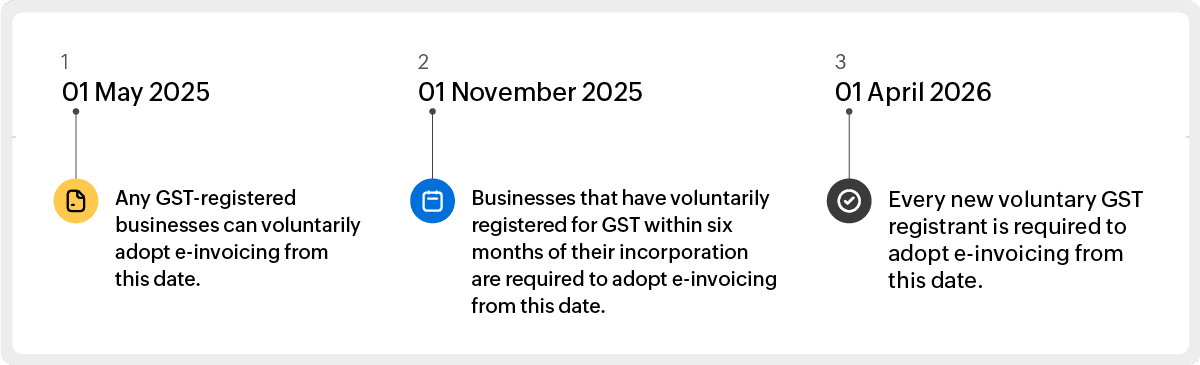

Timeline

The following table presents the official timeline for the phased adoption of e-invoicing for Singapore businesses.

| Date | Applicability |

| 01 May 2025 | Any GST-registered businesses can voluntarily adopt e-invoicing from this date. |

| 01 November 2025 | Businesses that have voluntarily registered for GST within six months of their incorporation are required to adopt e-invoicing from this date. |

| 01 April 2026 | Every new voluntary GST registrant is required to adopt e-invoicing from this date. |

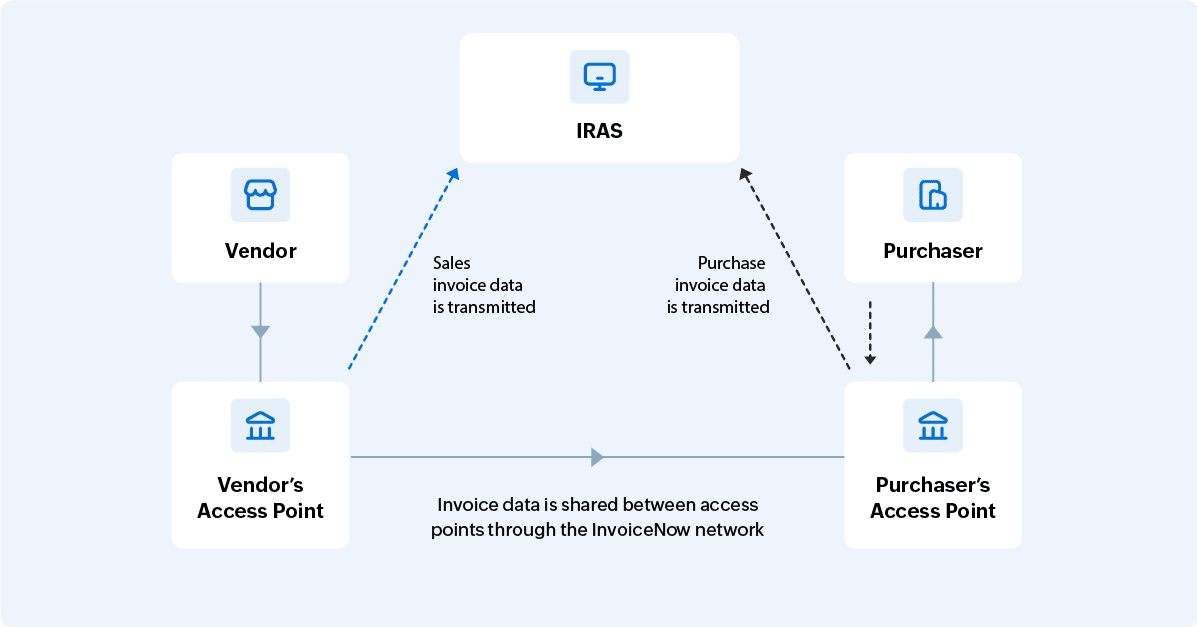

The five-corner model

Singapore follows a five-corner model for e-invoicing that involves five entities—vendor, vendor access point, purchaser access point, purchaser, and IRAS. The five-corner model is implemented via the InvoiceNow network. Here's a quick explanation of the five corners and their function in detail.

Vendor: This is the entity supplying goods or services. The vendor generates and issues invoices through an InvoiceNow-ready solution (IMDA-accredited accounting/finance software). Once the invoice is issued, the invoice data will be automatically routed to the vendor access point.

Vendor's access point: This is an accredited access point that validates the vendor's invoice to ensure it is in line with Peppol standards and GST requirements. Then, the invoice in the standard format will be transferred to the purchaser's access point through the InvoiceNow network.

Purchaser's access point: This access point processes the incoming Peppol e-invoice from the vendor's access point and delivers it to the purchaser in a format that is compatible with their accounting system.

Purchaser: This is the entity purchasing goods or services. In addition to receiving the e-invoice, the purchaser is obliged to transmit the purchase data (invoice data received and recorded) to the receiving access point through its InvoiceNow-ready solution.

IRAS: IRAS is Singapore's tax authority responsible for tax administration, enforcement, and ensuring compliance. In the context of e-invoicing, IRAS is connected to both access points via the InvoiceNow network. It will receive invoice data (sales and purchase data) from both access points whenever the invoices are issued or recorded. The data will be validated to improve compliance, accuracy, and transparency in GST reporting.

Supporting entities

InvoiceNow network: A nationwide network that enables businesses to digitally exchange invoice details in a secure, structured, and efficient manner. The InvoiceNow network is built in accordance with Peppol standards—an international framework designed for secure exchange of electronic business documents.

InvoiceNow Ready Solution Providers (IRSP): IMDA-accredited accounting and finance software that enables businesses to send and receive electronic invoices through the e-invoicing network.

IMDA: The Infocomm Media Development Authority is a statutory body in Singapore under the Ministry of Digital Development and Information. It is responsible for governing the e-invoicing framework and facilitating e-invoicing adoption.

Scope of data collection

Under the GST InvoiceNow requirement, GST-registered businesses in Singapore are required to transmit the invoice data for specific transactions to IRAS. The scope is established to capture key transactions while exempting those that are less relevant for tax reporting.

All standard-rated supplies except:

Deemed supplies

Supplies under the reverse charge regime, where businesses are required to account for GST

All zero-rated supplies except:

All financial services that are exempt and eligible for zero-rating

All digital payment tokens (DPT) that are exempt and eligible for zero-rating

Export of goods without underlying sales

All exempt supplies except:

All financial services that are exempt

All DPTs that are exempt

All standard- and zero-rated purchases except:

Permits required for importing goods into Singapore

Reverse charge purchases for which the business is eligible to claim input tax

Purchase of goods and services by overseas headquarters/branches of a Singapore branch

The invoice data for the above transactions should be transmitted to IRAS by the earlier of the following two dates.

The due date for filing the respective GST return.

The date on which the return is actually filed.

Why does it matter to Singapore businesses?

E-invoicing is a crucial upgrade in businesses' financial operations. It is not just a compliance mandate but a technological evolution that offers extensive benefits to businesses. Here's why it matters to Singapore businesses both from a compliance standpoint and in terms of the benefits it delivers.

Compliance perspective

As per the IRAS timeline, the mandatory adoption of e-invoicing has begun from 1 November 2025 for a specific group of businesses, and more businesses will be covered in the near future. Therefore, preparing for an early adoption is a practical step towards regulatory readiness.

Singapore's e-invoicing requirement mandates that invoice data must be presented in SG Peppol BIS Billing 3.0 format. This standardised structure allows both businesses and their access point providers to validate the invoice data more effectively, improving the accuracy of GST reporting. Enhanced accuracy reduces errors and minimises unnecessary issues during GST return filing.

Benefits perspective

E-invoices are machine-readable, enabling businesses to automatically capture invoice data in their accounting system. This eliminates the need for manual entry, significantly reducing the processing time while improving the accuracy of the information recorded in the books.

The direct delivery of invoices into the purchaser's accounting system through the InvoiceNow network accelerates invoice approvals and improves cash flow. This results in faster payment cycles, enhancing overall operational efficiency.

Since SG Peppol BIS Billing 3.0 is an international standard, invoices issued via InvoiceNow Ready Solutions are globally compatible, enhancing interoperability for cross-border transactions.

The invoices generated and transmitted through the InvoiceNow network are highly secure, as they go through IMDA-accredited access points. This prevents tampering and significantly reduces the risk of invoice fraud.

In the long run, e-invoicing helps businesses by reducing costs associated with manual data entry, physical storage, printing, and postage. The adoption of e-invoicing will position businesses in line with Singapore's digital tax requirements while streamlining their invoicing process.

Technical and system requirements for adoption of e-invoicing

Businesses must use one of the InvoiceNow-ready solutions—that is, an IMDA-accredited accounting or finance software—to generate and transmit invoices. Businesses with an in-house accounting solution should establish a connection with an accredited access point provider (AP) for transmitting invoices through the InvoiceNow network.

To exchange invoices through the InvoiceNow network, businesses must register in the Peppol directory and obtain a Peppol ID. Businesses can register by providing the required details—UEN (Unique Entity Number), business name, and contact information—to an InvoiceNow Ready Solution provider or an access point provider. After successful registration, the businesses will be added to the Peppol directory with a Peppol ID.

Businesses with InvoiceNow Ready Solutions should enable the InvoiceNow submission feature in their solutions and verify that invoice data can be transmitted directly to IRAS. Businesses with in-house solutions should verify the same with the assistance of the access points.

Internal Preparation

Once the compliance and technical requirements are satisfied, it is critical for the businesses to implement internal checks to avoid disruptions during the e-invoicing process.

E-invoices generated by businesses go through Access Points and are eventually reported to the tax authority. This makes it crucial to ensure that invoices are generated with accurate data, as any corrections in invoice data would cost excess time and resources for the businesses. Therefore, businesses should set up an approvals mechanism to ensure invoices are free from error.

Businesses must set up access control to ensure only the authorised professionals have access to business records. Well-defined access control will prevent unauthorised tampering of the invoices.

Businesses must maintain an audit trail and activity logs to keep track of every accounting activity. This improves transparency and accountability in the e-invoicing process.

Conclusion

E-invoicing marks a significant leap in Singapore's accounting and tax reporting landscape owing to the efficiency, accuracy, and transparency it offers to both businesses and the tax authority. Regardless of the mandate, e-invoicing is an inevitable upgrade that GST-registered businesses have to adopt at some point in the future, given its long-term benefits. Refer to the official IRAS e-tax guide for more detailed information on e-invoicing and prepare your businesses for a smooth transition to e-invoicing.

E-invoicing with Zoho Books

Explore Zoho Books, globally renowned GST accounting software equipped with a Peppol e-invoicing feature that helps your business generate and send e-invoices seamlessly. As a next step in simplifying accounting, Zoho Books is working towards integration with the InvoiceNow network, which will enable your business to transmit invoice data directly to IRAS.