Social Security Summary

The Social Security Summary Report provides a concise overview of various benefits offered to employees, detailing both employee and employer contributions. For each benefit, the report displays the benefit name, the amount contributed by employees, the corresponding contribution made by the employer, and the total combined contribution.

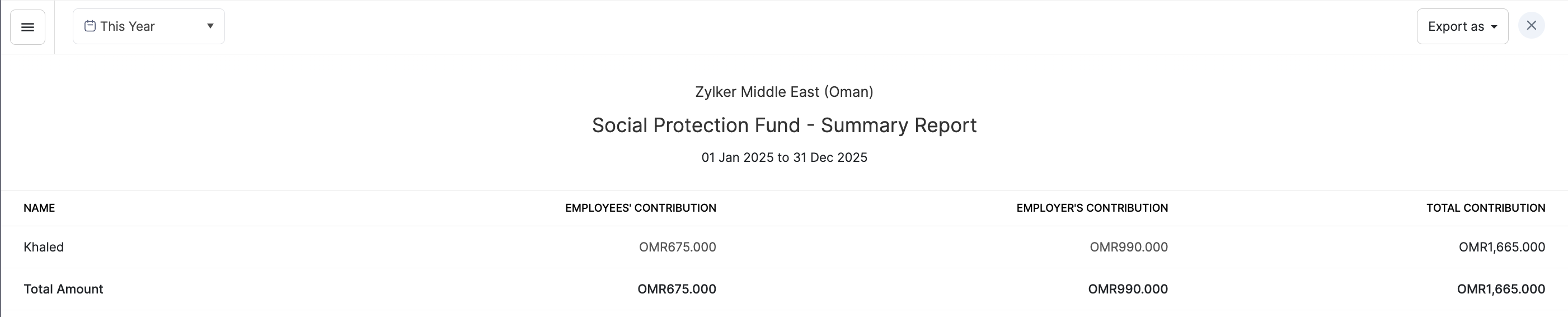

Social Protection Fund (SPF) - Summary Report

The Social Protection Fund (SPF) offers a comprehensive overview of social insurance contributions as mandated by Oman’s social security system.

This report tracks the contributions made by both employees and employers over a specified period, ensuring compliance with local labor regulations. It also helps organizations monitor their social insurance obligations and manage payroll contributions accurately.

Columns in SPF - Summary Report

The columns in this report include:

| Column | Description |

|---|---|

| Name | This column displays the names of employees enrolled in the SPF scheme. |

| Employees’ Contribution | This column reflects the mandatory contribution made by each employee toward their social insurance fund. |

| Employer’s Contribution | This column outlines the employer’s required contribution on behalf of the employee, as per SPF regulations. |

| Total Contribution | This column presents the combined total of both employee and employer contributions toward SPF. |

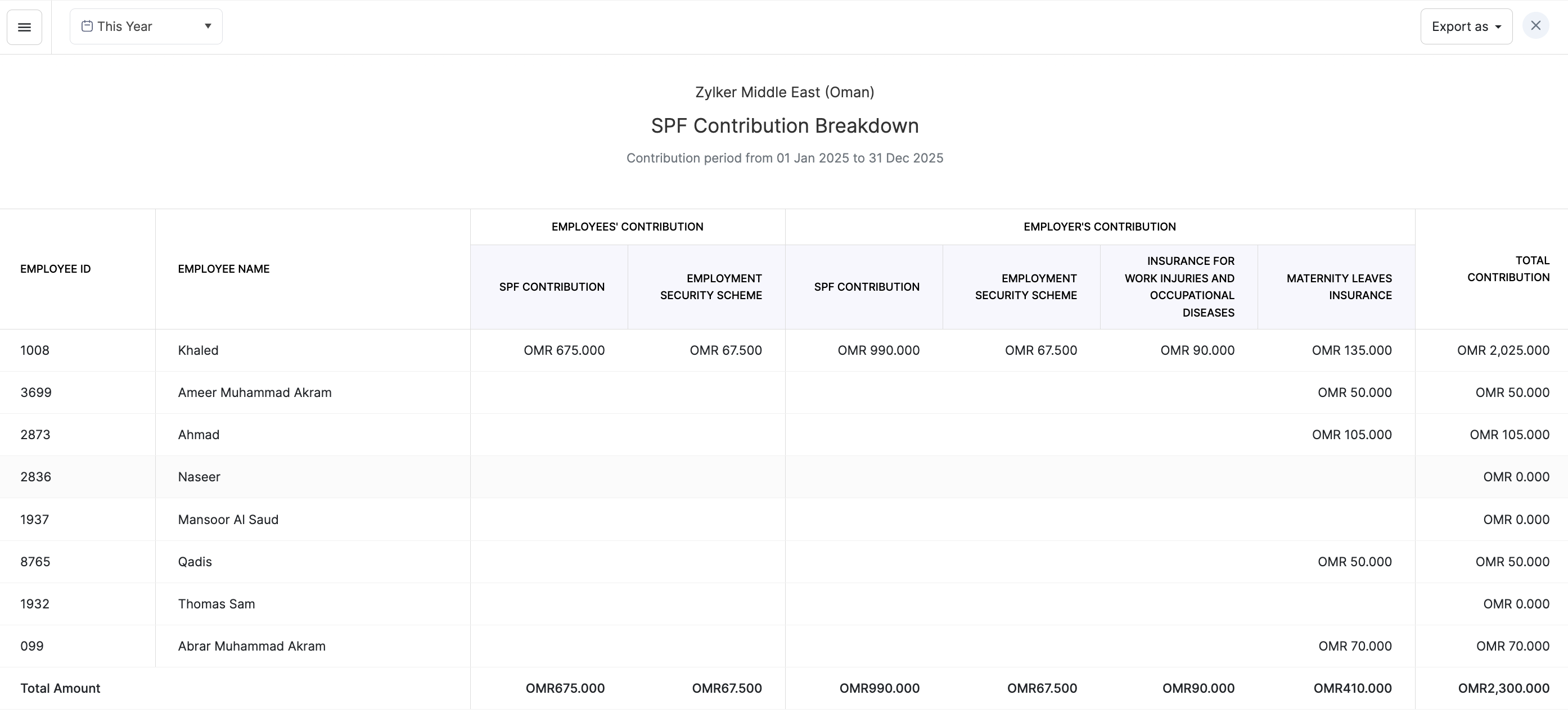

Columns in SPF – Contribution Breakdown Report

This report provides a detailed breakdown of employee and employer contributions to the Social Protection Fund (SPF) and its related schemes, applicable not only to employees in Oman but also to those from other countries. It helps organizations and employees track mandatory contributions across different categories and understand the overall contribution totals.

| Column | Description |

|---|---|

| Employee ID | Displays the unique identification number assigned to each employee in the organization. |

| Employee Name | Shows the name of the employee enrolled in the Social Protection Fund (SPF). |

| Employees’ Contribution – SPF Contribution | Represents the mandatory contribution made by the employee toward their social protection fund. |

| Employees’ Contribution – Employment Security Scheme | Shows the employee’s contribution to the employment security scheme. |

| Employer’s Contribution – SPF Contribution | Reflects the contribution made by the employer on behalf of the employee to the SPF. |

| Employer’s Contribution – Employment Security Scheme | Indicates the employer’s contribution toward the employment security scheme for the employee. |

| Employer’s Contribution – Insurance for Work Injuries and Occupational Diseases | Covers the employer’s contribution for insurance against workplace accidents and occupational illnesses. |

| Employer’s Contribution – Maternity Leaves Insurance | Displays the employer’s contribution toward maternity leave coverage for employees. |

| Total Contribution | Summarizes the total amount contributed by both the employee and the employer under all applicable schemes. |

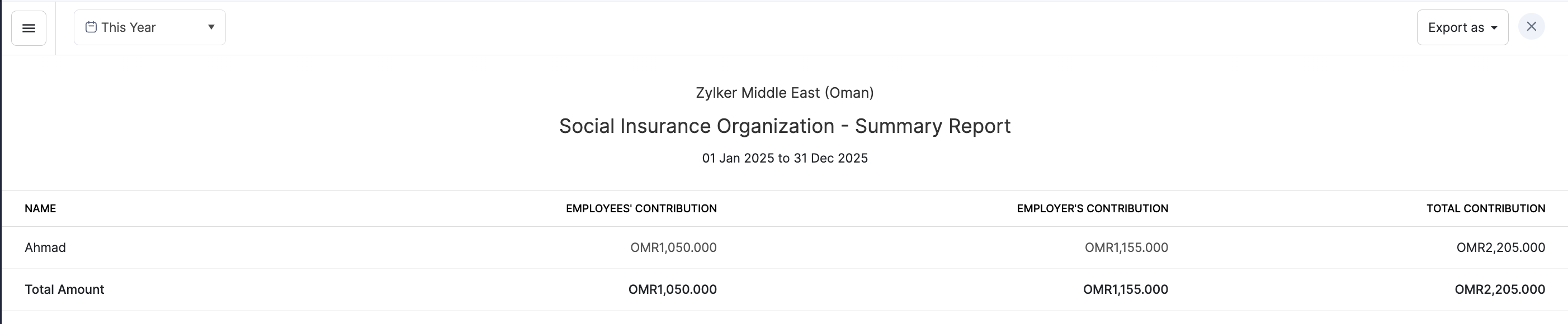

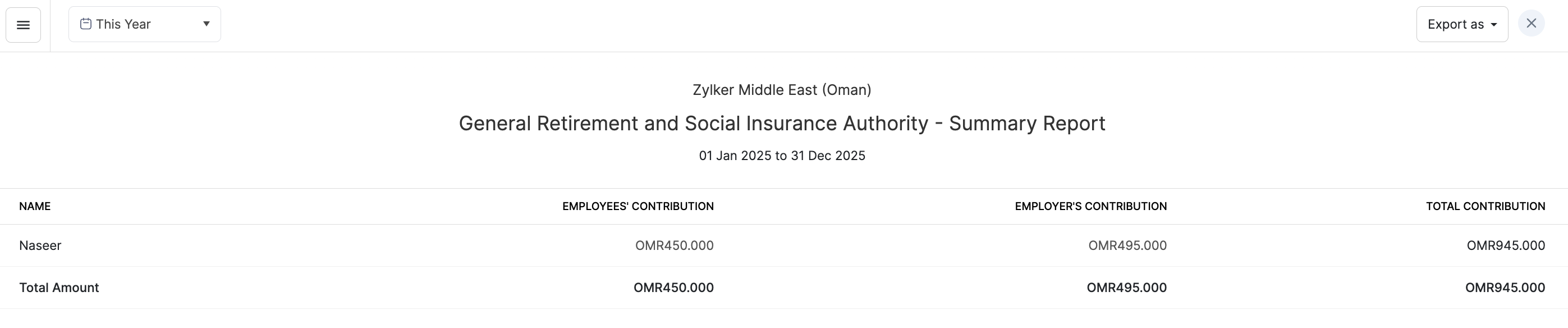

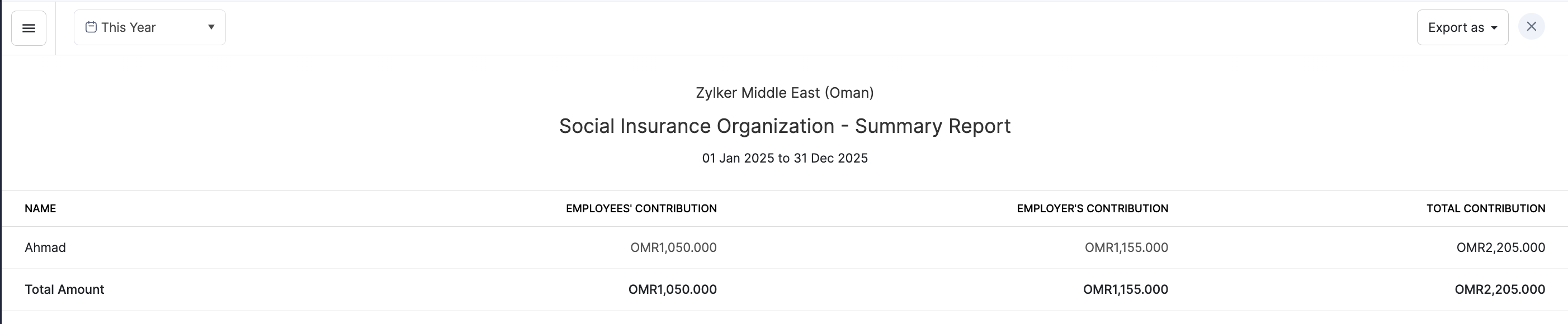

Other Social Security Reports

Similarly, you will be able to generate report summaries for GRSIA, PIFFS, SIO, SIO, and GPSSA summaries based on employees’ origin country.

Columns in other Social Security Benefits

| Column | Description |

|---|---|

| Benefit Name | This column lists the specific social security benefits provided to employees. |

| Employees’ Contribution | This field indicates the monetary amount deducted from employees’ salaries for a particular benefit, showcasing the individual financial responsibility of each employee. |

| Employer’s Contribution | This column displays the corresponding amount contributed by the employer towards the specified benefit. |

| Total Contribution | The total contribution is the sum of both the employees’ and employers’ contributions. It provides a comprehensive view of the overall financial investment in each benefit. |