Taxes

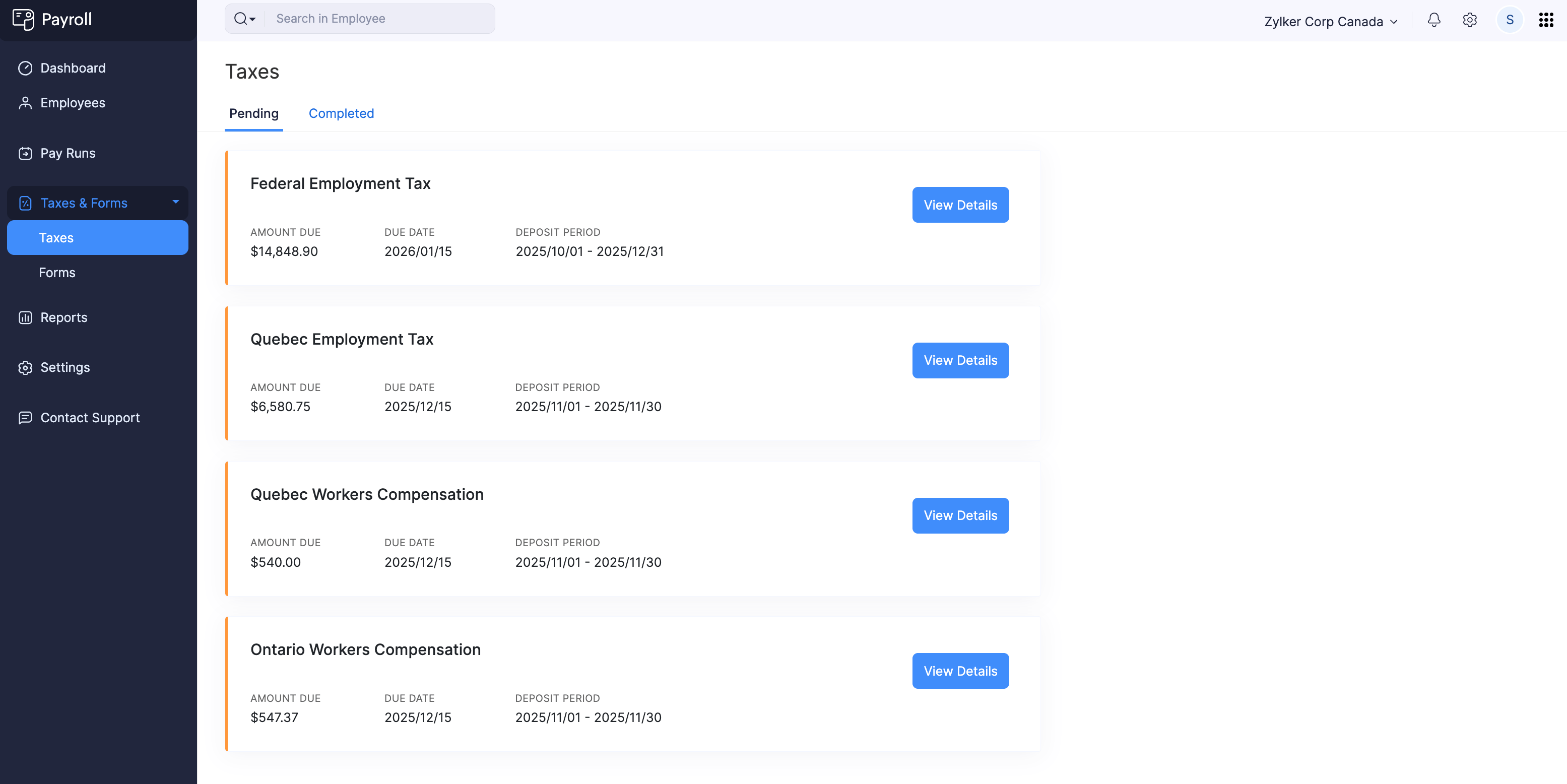

The taxes you withhold from your employees’ paychecks need to be deposited to the appropriate tax authorities according to your deposit schedule. These applicable taxes are listed under Taxes and Forms > Taxes.

Within this section, you’ll find details such as the tax name, deposit period, amount due, and the due date for each tax.

View Tax Details

To view the details of a particular tax:

- Navigate to Taxes under Taxes and Forms on the left sidebar.

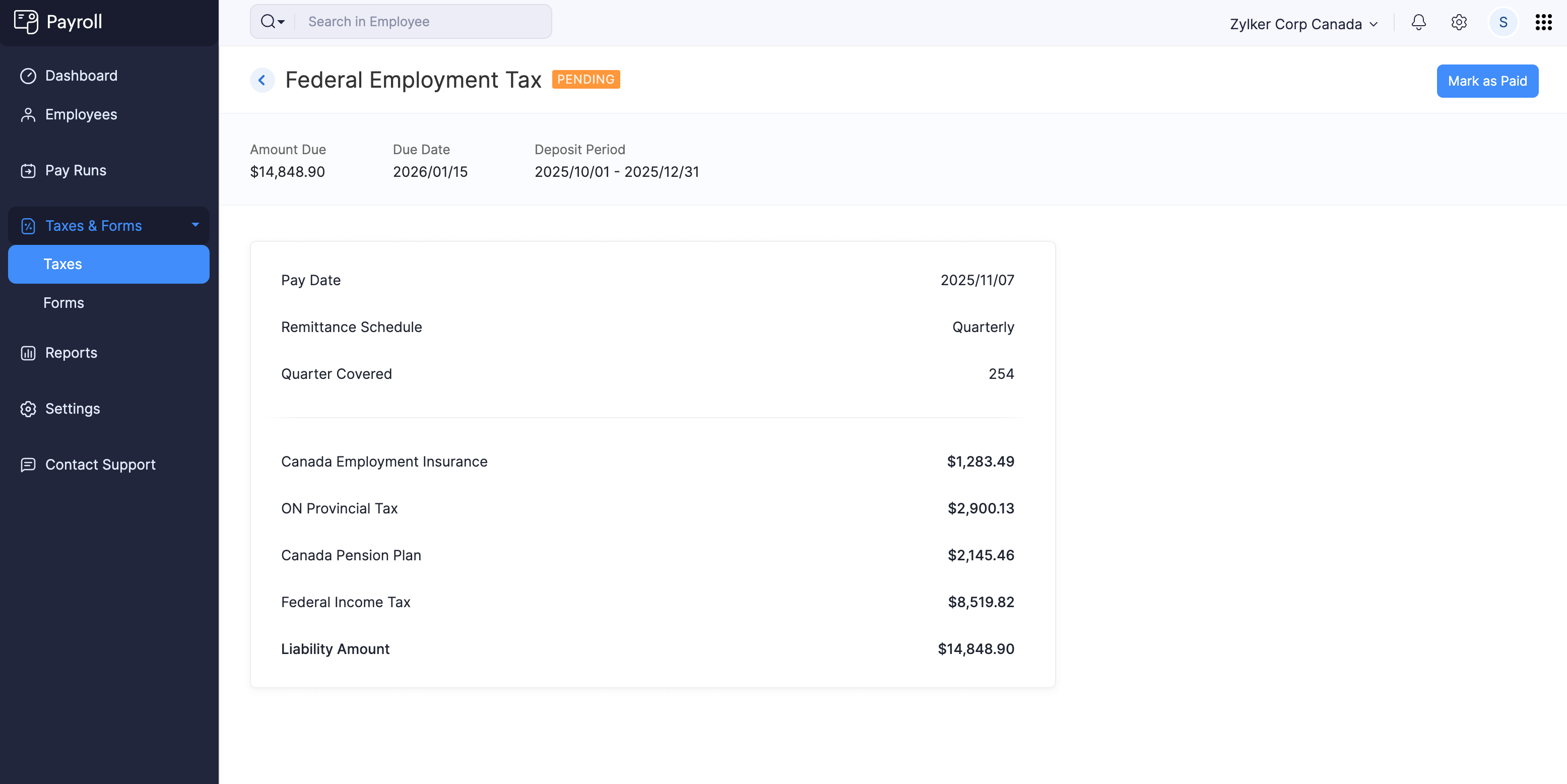

- Click View Details next to the tax you want to examine. A detailed slider will appear, showing the following information for that particular tax:

| Tax Details | Description |

|---|---|

| Deposit Period | The duration for which the tax liability is calculated. |

| Total Tax Amount | The total amount that you are liable to pay for the tax type during the specified deposit period. |

| Due Date | The deadline by which the tax amount must be paid to the corresponding tax authority. |

| Tax Breakdown | A section that provides a breakdown of the tax liability for each pay period within the deposit period. |

Tax Types

Each time you process payroll, Zoho Payroll will generate and list all the applicable taxes in the Taxes module. Some common types of taxes include:

- Federal Income Tax

- Federal Employment Tax

- Canada Pension Plan

- Employment Insurance

- Other Provincial Taxes