Manage Employee Profile

Managing your employees’ details is essential, as their tax situation or personal circumstances might change due to life events such as relocation, marriage, or a job promotion.

When you initially add or import employees into Zoho Payroll, you provide their essential details. You can update and manage these details in the Employees module to ensure that your employees’ information remains accurate and up-to-date.

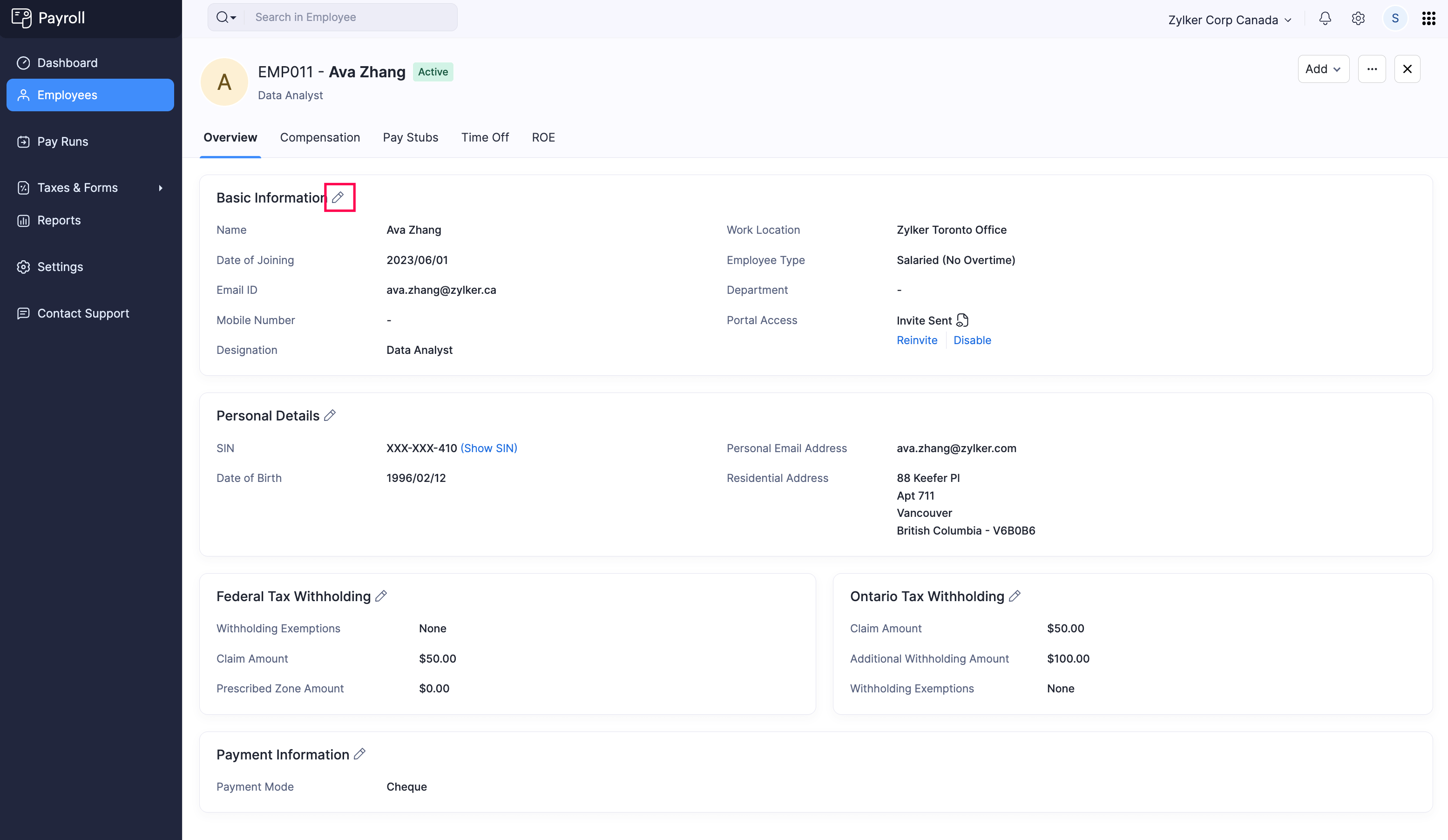

In the Overview section of an employee, you can:

View and Edit Employee Details

You can view and edit the following details of an employee:

Basic Details

To edit the basic details of an employee:

- Go to the Employees module.

- Click an employee.

- Click the edit icon in the Basic Details section.

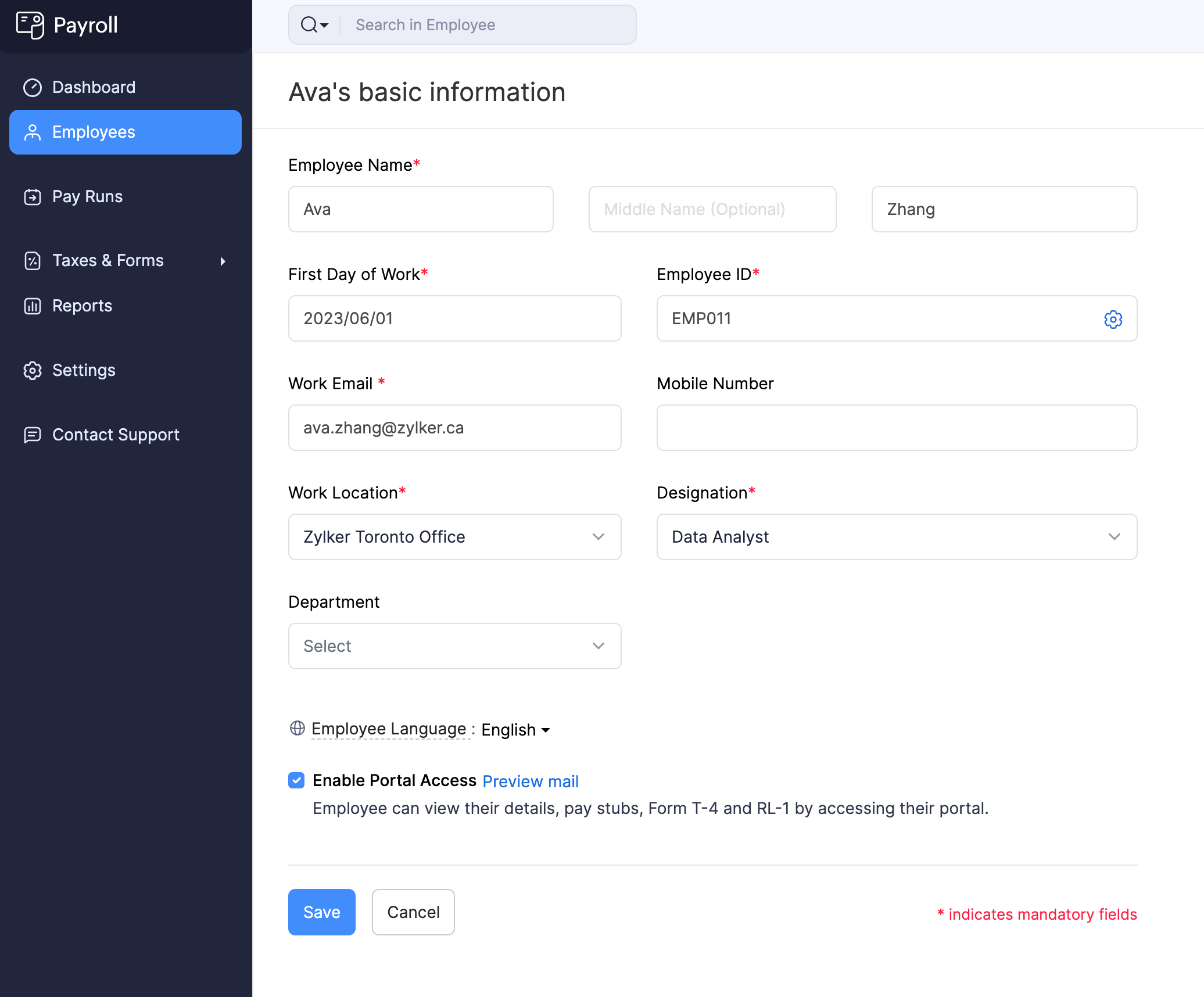

- Make the necessary changes. You can edit the following:

| Field Name | Description |

|---|---|

| Employee Name | Edit the employee’s first name, middle name, and last name. |

| First Day of Work | Edit the employee’s date of joining. |

| Employee ID | Edit the employee’s identification number. |

| Work Email | Edit the employee’s official work email address. Note: You can edit the email address only if you haven’t enabled Portal Access for the employee. |

| Mobile Number | Enter your employee’s mobile number. |

| Work Location | Select the location where the employee primarily works from. PRO TIP: You can add a new work location by clicking New Work Location in the dropdown. Learn more about Work Locations. |

| Designation | Select the employee’s job title. PRO TIP: You can add a new designation by clicking New Designation in the dropdown. |

- Click Save.

The employee’s basic details will be updated.

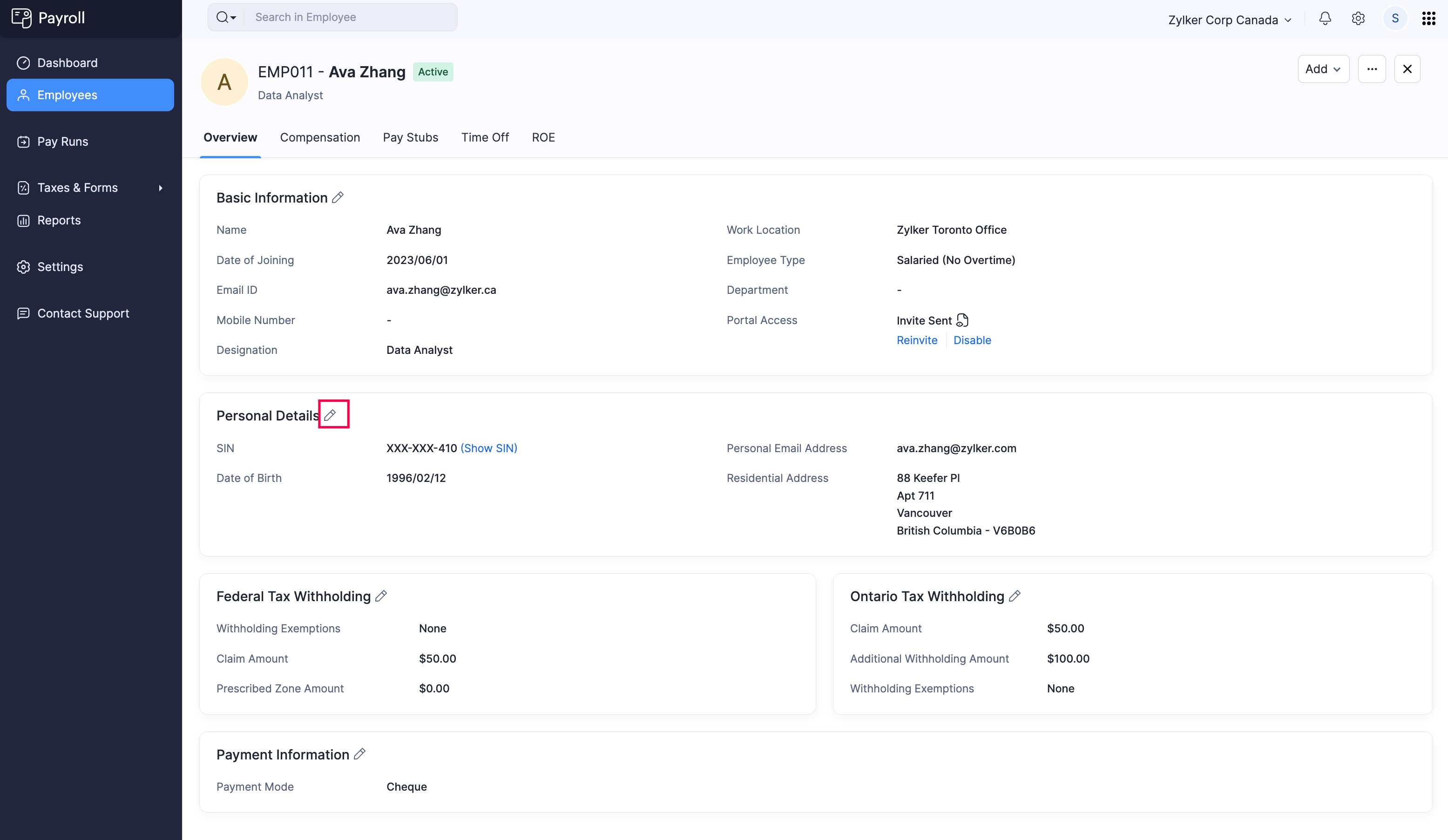

Personal Details

To edit the personal details of an employee:

- Go to the Employees module.

- Click an employee.

- Click the edit icon in the Personal Details section.

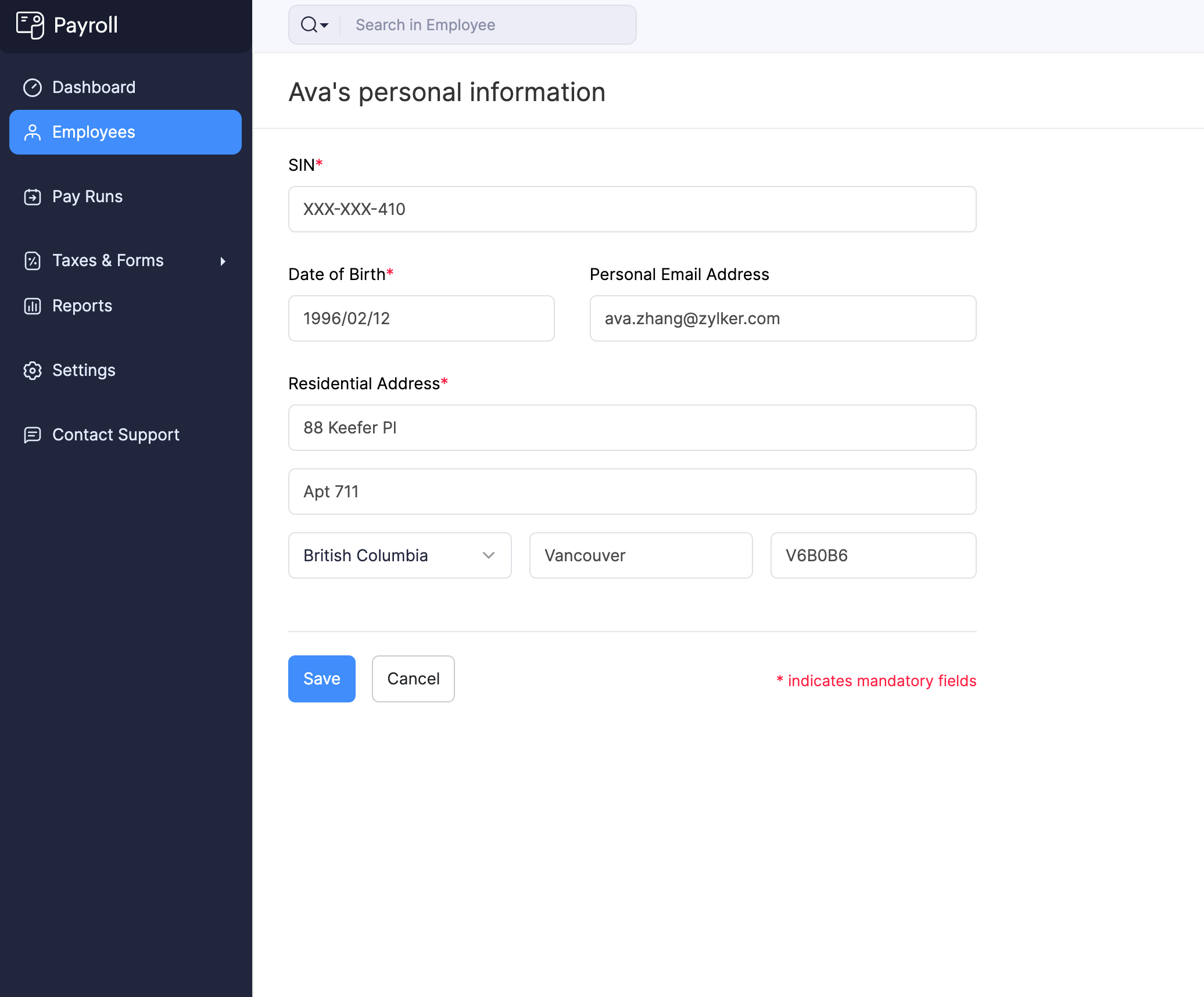

- Make the necessary changes. You can edit the following:

| Field Name | Description |

|---|---|

| SIN | Edit the employee’s 9-digit Social Insurance Number (SIN). |

| Date of Birth | Edit the employee’s date of birth. |

| Personal Email Address | Edit the employee’s personal email address. |

| Residential Address | Edit the employee’s home address. |

- Click Save.

The employee’s personal details will be updated.

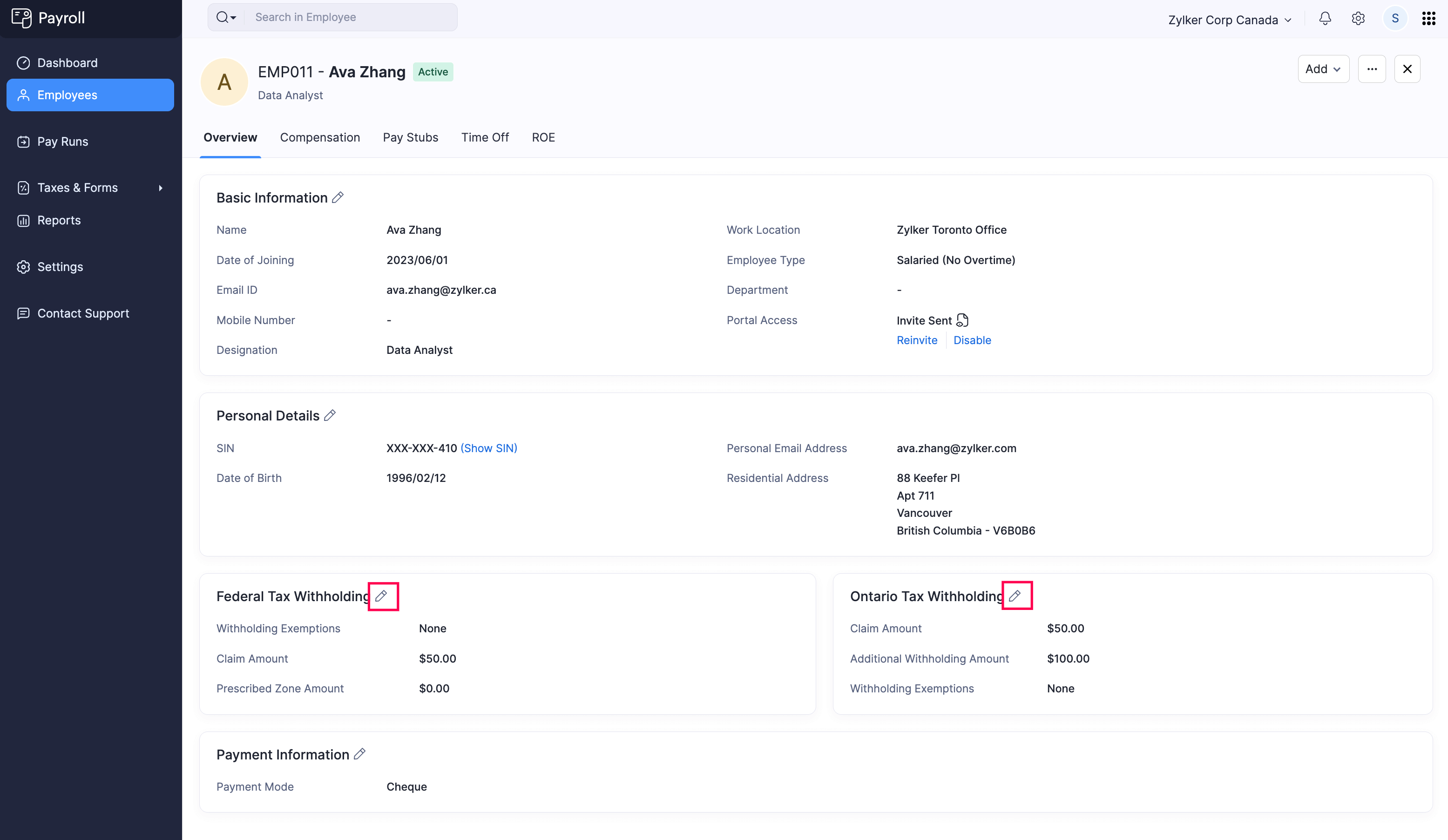

Tax Details

To edit the tax details of an employee:

- Go to the Employees module.

- Click an employee.

- To edit the employee’s federal tax details, click the edit icon in the Federal Tax Withholding section.

- To edit the employee’s provincial tax details, click the edit icon in the Tax Withholding section for the corresponding state.

- Make the necessary changes and click Save.

The employee’s tax details will be updated.

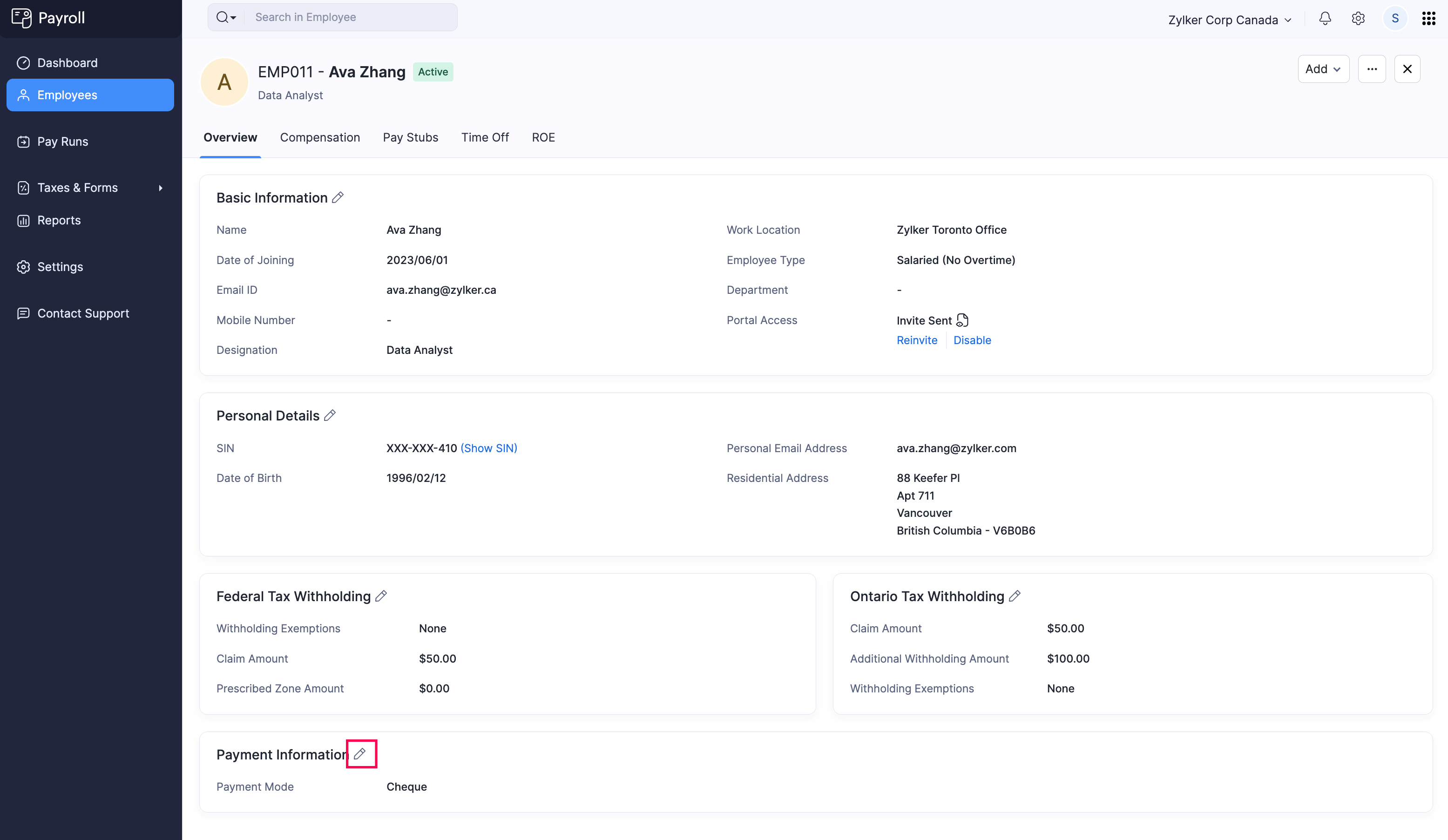

Payment Details

To edit the payment details of an employee:

- Go to the Employees module.

- Click an employee.

- Click the edit icon in the Payment Details section.

- Change the Payment Mode.

Payment Mode | Description |

|---|---|

| Direct Deposit | Provide the employee’s Bank Information to make direct deposit payments to them. |

| Cheque | You’ll need to pay your employees via cheque and then record payments manually for each payroll. |

- Click Save.

The employee’s payment mode will be updated.

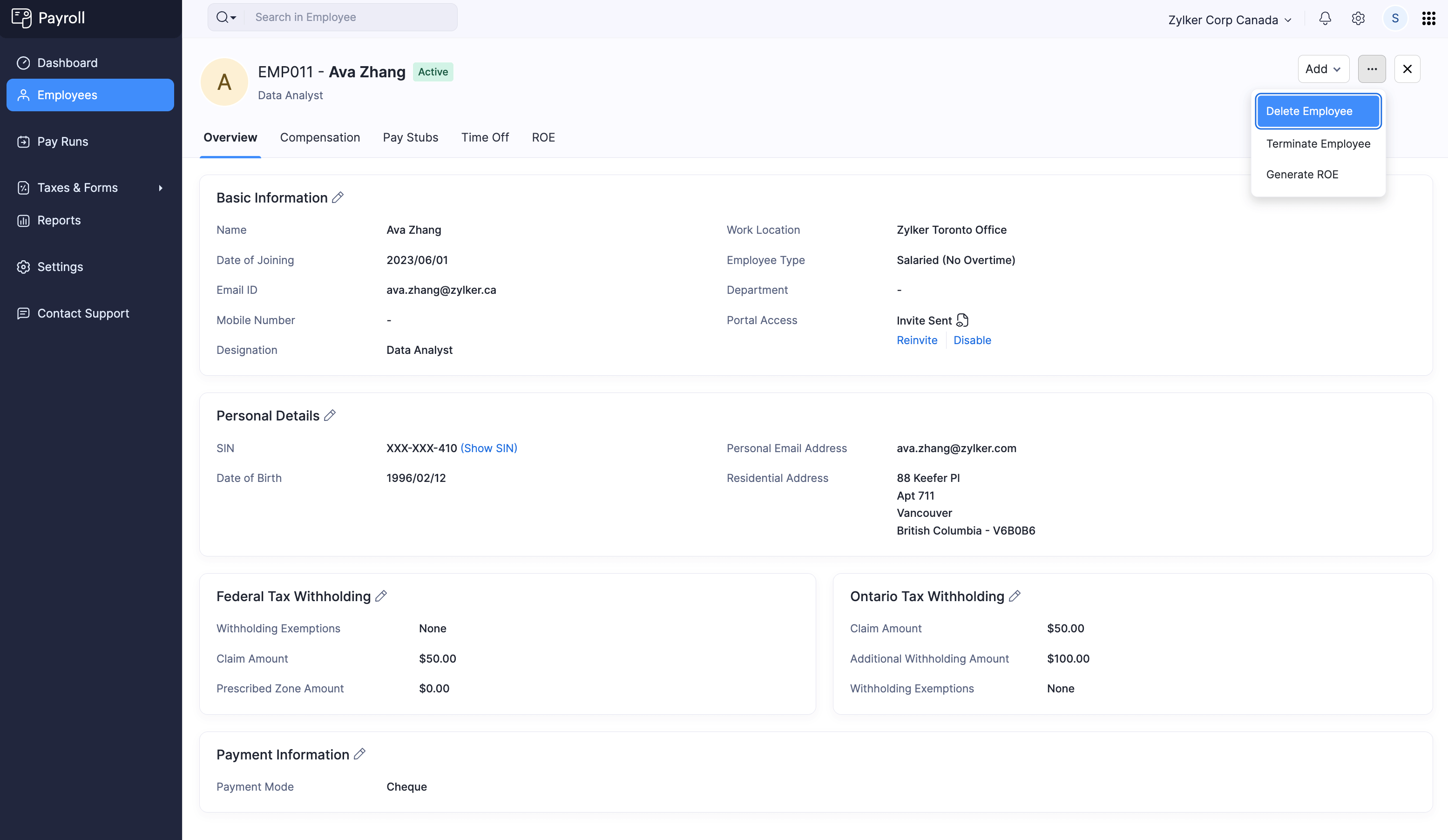

Delete Employee Profile

In Zoho Payroll, deleting an employee is a permanent action that removes the employee’s profile and data from your organization.

PREREQUISITE The employee must not be a part of any payroll.

WARNING Deleting an employee cannot be undone.

To delete an employee:

- Go to the Employees module.

- Click the employee you want to delete.

- Click the More dropdown.

- Select Delete Employee.

- In the popup that appears, click Yes.

The employee will be permanently deleted from your organization.